trait2lumiere

U.S. equities fell more than 9% in September, pushing year-to-date losses to roughly 24%. Only five calendar years have been worse, and three of those were during the Depression. Given the depth and breadth of the bear market, investors are asking a simple question: Have we bottomed? Last August, I suggested caution before chasing the summer really. At the time I cited three factors working against stocks: the Federal Reserve, the calendar, and the likelihood for softer earnings. Today I’d say the first issue is less of a threat, the second is turning positive and the third remains a question mark. The net effect is a still volatile market but one where downside and upside are becoming more balanced.

Valuations

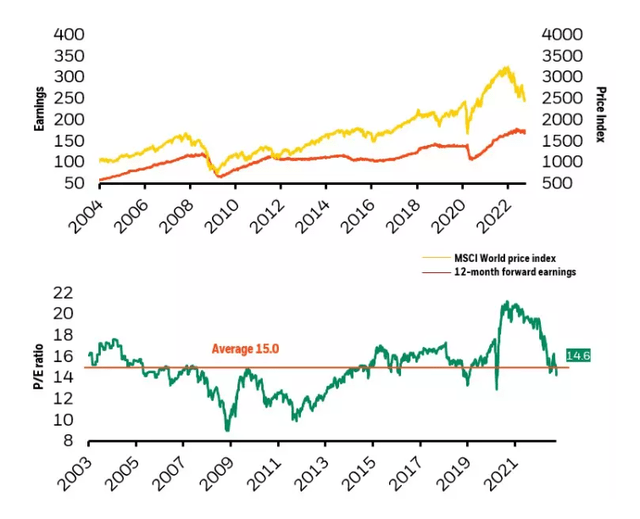

September’s losses brought stock valuations back to the year’s lows, with the S&P 500 trading down to approximately 15x next year’s earnings. While valuations dipped below these levels in early 2020 and late 2018, the post-COVID market premium has been eliminated. On a global basis, valuations have also mean-reverted and are now slightly below the long-term average (see Chart 1). Sticky inflation and an aggressive Fed can result in more multiple compression, but most of the adjustment has probably taken place.

Global equity price and earnings

Closer to restrictive territory

By the time the Fed completes its November meeting, monetary policy will be firmly in restrictive territory. In barely six months, real (i.e. inflation-adjusted) two-year yields have surged from -3% to 2%, the highest level since the 2008 financial crisis. The 500 bps swing represents one of the fastest tightening campaigns in history. While November is unlikely to be the last hike, nor will the central bank quickly pivot to lower rates, by year’s end much of the Fed’s work will be done.

Seasonality turning positive

Seasonality’s impact is often exaggerated but it is not irrelevant. This year September more than lived up to its poor reputation. While October can be volatile, the final quarter of the year is generally supportive for stocks. Since 1987 Q4 has been the best periods for equities, with the S&P 500 posting an average monthly price gain of approximately 1.5%.

Earnings will be key

With the calendar turning positive and rates having already staged a massive adjustment, the key for the market going forward will be earnings. Despite a historic tightening campaign and surging prices, the U.S. economy has proved remarkably resilient. While investors are realistic enough to discount some additional slowing, it’s not clear that earnings estimates reflect a full-blown recession. Under this scenario, even with steady valuations markets can move lower. To my mind, this is the big outstanding question. That said, assuming continued resilience and a modest slowdown or brief contraction, much of the carnage is probably behind us. This suggests more of a two-way market rather than a relentless grind lower. It’s probably too soon to aggressively add, but it’s also likely past the time to cut.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment