Maskot/DigitalVision via Getty Images

Thesis highlight

I believe SIGNA Sports United (NYSE:SSU) is undervalued as of today. It is currently undergoing transformation into a future industry powerhouse by becoming an online sports retail specialist. The firm has been expanding well while operating in a very cutthroat industry. Some of the primary elements that are expected to set SSU apart from all competitors in the industry include its data-driven commerce and technology platform, its valuable services, and its differentiated sports specialist websites.

Company overview

With dedicated sports specialty webshops in the fast-growing product categories of bike, tennis, outdoor, and team sports, as well as athleisure, the SSU group has established itself as one of the leading online sports groups in the industry. In this fast-growing digital world, where online shopping has become part and parcel of the daily life of almost everyone around the globe, SIGNA Sports United is selling products through various online webshops. With its presence in prime locations like Europe, Norway, the UK, and the US, SSU has made its services available to a major portion of these countries. Signa’s specialty in the online world market is Bikes, followed by Tennis, Outdoor, Team sports, and Athleisure.

Investments merits

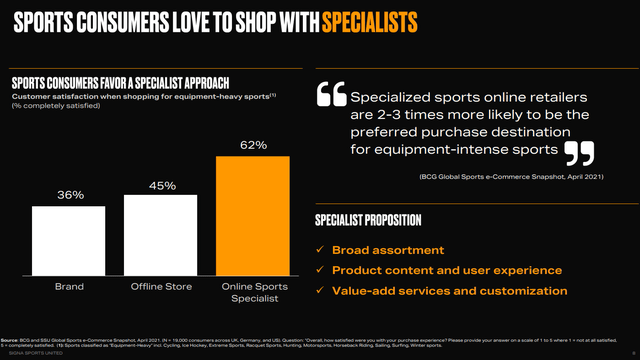

Leading player with dedicated focus as an online sports retailer

With high brand awareness, SIGNA Sports United operates iconic sports specialists’ e-commerce shops in the most appealing industries and regions. When it comes to equipment-intensive sports such as biking, tennis, or winter sports, specialized sports retailers are more likely to be preferred shopping destinations than general online retailers. Further, as per SSU prospectus reports, online shoppers spend more per order than normal while shopping with sports specialists like Signa.

SSU has become the leader of the fast-growing online market in categories like Bikes, Tennis, Outdoor, and Team sports. With approximately €840 million in revenues in FY2021, SIGNA Sports United’s bike category is the largest online bike specialist globally on a pro forma basis, including the Wiggle Group. SSU prospectus states that the second largest competitor only generated approximately €250 million in FY2021. Also, SSU is the only competitor that serves major international markets in continental and northern Europe, North America, Southeast Asia, the Far East, and Australia.

Additionally, SSU topped the global market in other categories as well. On a pro forma basis, they are the world’s largest online tennis retailers by revenue, including Midwest Sports and Tennis-Express. With approximately €180 million in revenues for FY2021, the Outdoor category is the second largest globally by revenue as compared to the second biggest competitor in the market with an estimated revenue of approximately €110 million for CY2020. The volume of the difference speaks for itself.

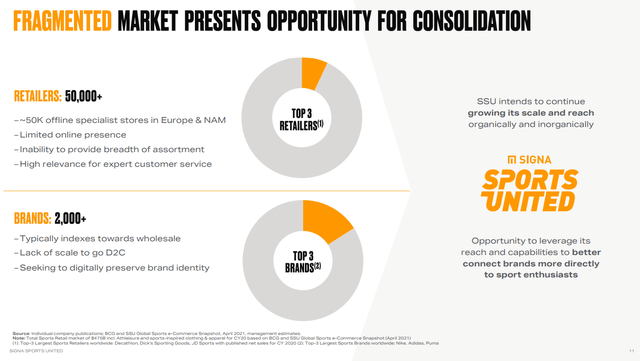

Since the top three sports retailers worldwide-Decathlon, Dick’s Sporting Goods (DKS), and JD Sports-only make up about 7% of total market revenues (source: SSU prospectus), SSU is in a good position to take advantage of the current market conditions to further consolidate the market.

To summarize, SSU is a giant in the global online sports specialty retailer industry. The global sports retail market is a highly competitive one where, apart from leading sporting goods brands, there are traditional offline sports retailers; offline specialist sports retailers, e-commerce generalists; and online sports specialists. Among these competitors, online sports specialist retailers offers a wide range of sports products primarily through online distribution networks and generate the vast majority of their sales through these channels.

Within such a highly diversified and competitive market, a major competitive advantage of Signa Sports, as an online sports specialist retailer, is due to its differentiated sports specialist web shops that cater to both expert and mainstream consumers with category-specific customer propositions, and its scalable, data-driven, and synergistic commerce and technology platforms, which are used to support both its own web shops and third-party enterprise customers.

Strong brand awareness in targeted verticals

SIGNA Sports United operates with some of the most iconic sports specialist webshop brands, such as Addnature, Outfitter, Bikester, Fahrrad.de, Probikeshop, and Tennis-Point, where high brand awareness is important to ensure top-of-mind awareness. In January 2021, SSU conducted a brand awareness study in four different markets; France, Germany, the US, and the UK. According to the results, its own brands have an aided brand awareness, when aggregated together, of 35% across the market, ranging from 12% in the US to 70% in the German market. Also, in the core verticals of SSU, bikes, and tennis, brand awareness peaked at 49% in all markets and 54% in the European market, which includes Wiggle and Chain Reaction Cycles.

In the same way, SSU has put its webshop brands in markets that don’t overlap so that they can serve different, but very large, groups of sports fans. A more consumer-friendly, distinguished but comprehensive specialist webshop brand architecture is one of the main reasons for Signa’s higher market approaches.

Broad range of offerings and personalized touch appeal to customers

There are a variety of reasons for someone to buy sports-related equipment from an online specialist shop. These may be curation and recommendation across the product range, value-added services, and customization. There are two ways that SSU’s customer proposition sets them apart from other specialist websites.

- Better e-commerce basics, such as broad selection, the right price, and a convenient delivery system.

- Category-specific differentiators to inspire, guide, serve, and engage customers.

Apart from the variety of products amongst more than 1000 third-party brands, SSU’s specialist webshops offer its own brands, namely; Votec, Ortler, Fixie Inc., and Serious. Again, as per SSU reports, around 2/3rd of its products are not even on Amazon (AMZN), and in the Bike business, the figures go up to around 89%. Furthermore, the dynamic pricing engine helps on a daily basis in determining the right price in accordance with other factors such as competitors’ prices, supply situations, seasonal factors, and overall growth and profitability targets.

Similarly, SSU web shops facilitate payment options and convenient delivery options, including home delivery, click & collect, and premium concierge delivery, which are subject to local customer preferences by category.

Furthermore, the websites are configured in a way to inspire, guide, serve, and engage specific customers throughout their journey of online shopping. This includes helping customers find the right product for their body type and skill level by using online tools like racket finder apps, digital bike size fitting tools, and web-based jersey configurators.

Scalable data platform

SSU is working on a commerce and technology platform that powers some of the top e-commerce functions for many online clients across all categories. SSU is different from its competitors because it offers three levels of e-commerce and technology services: data and technology solutions, global fulfillment services, and shared business functions and central services.

Furthermore, there are economic benefits of such an easily accessible e-commerce and technology platform, which are mainly of three kinds.

- Higher levels of productivity and cost-efficiency.

- For both internal and external customers, higher quality services and business function output.

- A higher degree of innovation and best practice exchange.

Additionally, there are e-commerce and omnichannel solutions for third-party brands, associations, retailers, and sports apps, provided by SSU’s e-commerce and technology platform. Similarly, SSU provides full-service, direct-to-consumer e-commerce solutions for mid-to large-scale enterprise customers or standalone e-commerce services, including global fulfillment, content creation, retail media, and data services.

Valuation

Price target

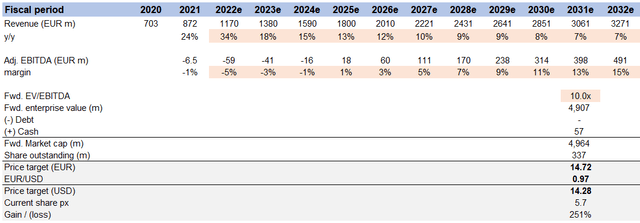

My model suggests a price target of ~$14.28 or ~250% upside in FY31 from today’s share price of $5.7. This assumes revenue will grow at a low-teens CAGR until 2032e, EBITDA margins will improve to 15%, and the forward EV/EBITDA multiple will be 10x in FY31e.

For FY22e, I used the mid-point of management guidance during 2Q22. Moving forward from FY22e to FY31e, I assumed revenue would hit management’s initial guidance (in the SPAC presentation) 6 years later than expected from FY25 to FY31, given the current macroeconomic climate. EBITDA margins would increase over time to management’s long-term financial guidance of 15%, which I expect will happen due to fixed cost leverage.

As for a valuation, I expect SSU to trade in the same range as other mature e-commerce businesses. The easiest example would be eBay (EBAY). I assumed SSU would trade at the same historical levels that eBay had traded at (10x EBITDA).

Image created by author using data from SSU’s filings and own estimates

Risks

Competitive industry with several well-known players

As discussed earlier, the sports retail industry is highly competitive. In such a complex market, SSU’s regional brands face tough competition, both online and offline. Similarly, international and local players affect their growth, profits, and market share as well. Also, other factors that impact the business’s growth negatively are the new and strong growing independent players in the market who are expanding their reach in SSU’s current and future geographies.

Recession

In the contemporary global post-pandemic economic crisis, the online retail market is also severely impacted. This is the reality of today’s world, and SSU is no exception. The global situation has its own outcomes, but one has to bite the bullet of global economic reality until the recovery.

Heavy dependence on SEO

Online retail businesses are mostly dependent on search engines to attract more traffic to their sites. Such dependency has its own disadvantages. A business can be hurt by an increase in costs, a heavy reliance on search engine marketing, or a decrease in how well search engine marketing works.

Conclusion

I believe SSU is undervalued as of today. The company is growing steadily in a highly competitive market. The differentiated sports specialist websites, different indigenous and third-party brands, its valuable services, and data-driven commerce and technology platform are some of the main features that are most likely going to make SSU unique amongst all competitors in the market.

Be the first to comment