DenisTangneyJr

Old school is back in session. Value and cyclical stocks have powered the market higher in the last five weeks.

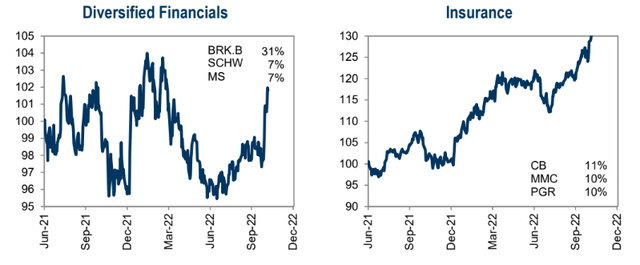

Diversified financials and insurance equities are climbing. The latter group notched fresh cycle relative highs. One of its members issued a positive earnings report while hiking its dividend. I see more upside to come.

Financials in Focus

Goldman Sachs Investment Research

According to Bank of America Global Research, The Hartford (NYSE:HIG) is a diversified financial services/insurance company with businesses in commercial P&C, personal lines, disability lines, and mutual fund distribution. HIG has been undergoing a long-term transformation after having been weakened by the financial crisis. Having excised many of its most volatile businesses, HIG’s earnings have stabilized. The acquisition of Navigators aims to expand it as a broad carrier for independent agents. HIG sells personal lines insurance co-branded with AARP.

The Connecticut-based $23.5 billion market cap Insurance industry company within the Financials sector trades at a below-market GAAP price-to-earnings ratio of 12.8 and pays a 2.3% dividend yield, according to The Wall Street Journal.

HIG has historically been valued slightly higher than its peers, and Chubb’s (CB) recent bid for the firm only improves the valuation outlook. There are risks, though, from smaller personal lines business and litigation concerns. Still, its earnings power and a potential acquisition are upside catalysts. Other downside risks include cost inflation regarding Covid-19, but we should get more clarity about that situation soon. Catastrophe risk is always a concern, and recent jumps in car accidents increase possible payouts and hits to margins.

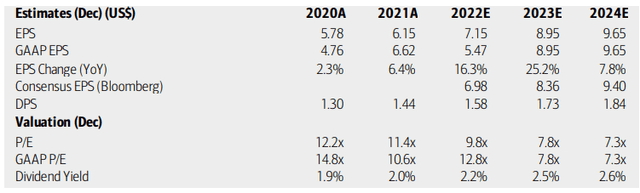

On valuation, analysts at BofA see earnings growing at a solid rate in 2022 with even better growth in 2023 before a moderation in 2024. The Bloomberg consensus forecast is about in-line with BofA’s outlook. Dividends are seen as increasing through 2024 while both the GAAP and operating P/Es should remain attractive. Overall, I like the valuation here, particularly given its strong EPS growth forecast.

The Hartford: Earnings, Valuation, Dividend Forecasts

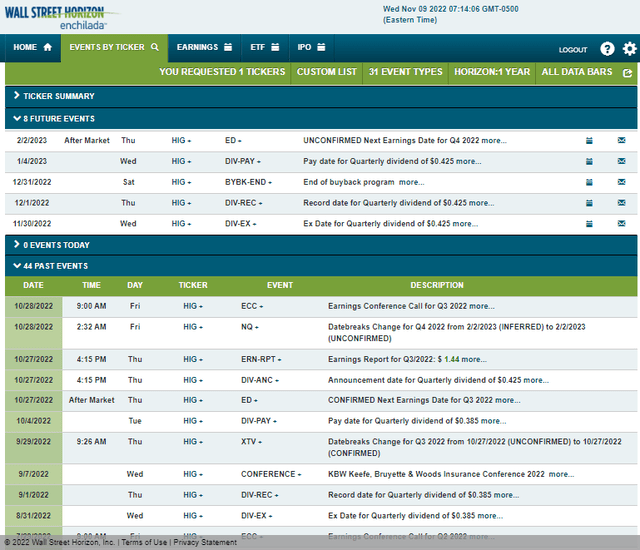

Looking ahead, data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 2, after market close. Before that, though, Hartford has an ex-dividend date of Wednesday, November 30. Finally, its stock buyback program is scheduled to end on December 31.

Corporate Event Calendar

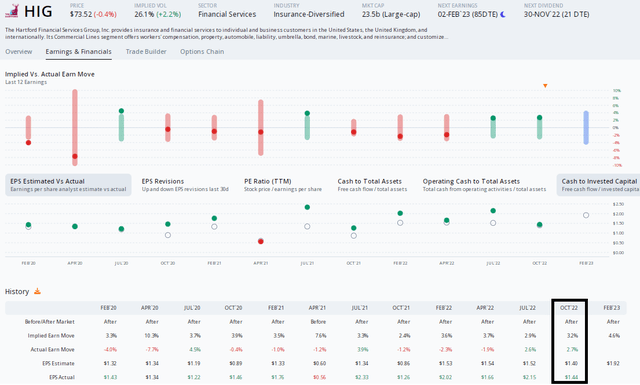

The Options Angle

Reviewing the earnings report and reaction, Option Research & Technology Services (ORATS) data show a solid EPS beat in its Q3 report. HIG beat the $1.40 EPS consensus by $0.04 and shares rose 2.7% post-earnings, slightly less than what the options market has priced in. Traders also see a 4.6% implied stock price move following its Q4 report due out in February with a $1.92 per-share profit consensus. Importantly for investors, the company hiked its dividend by 10% in late October around its earnings report.

An Earnings Beat, Options Traders See Slightly Higher Volatility Ahead

The Technical Take

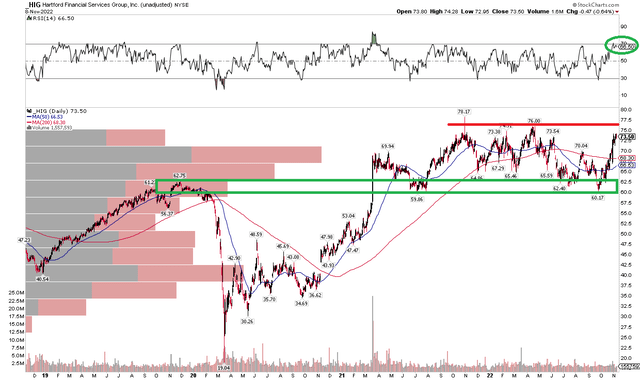

HIG has been a relative winner in 2022. Shares have traded in a range between about $60 and $76 since rising above their pre-Covid peak of $63 in early 2021. While other stocks have given back post-pandemic gains, HIG appears poised for new highs soon.

Notice that the volume-by-price feature in the chart below shows that the stock has rallied above a key supply/demand area, which is bullish. I also assert that a jump in RSI is also conducive to a continued rally. It hit oversold conditions in September but then broke into a bullish momentum zone lately.

Still, the stock must close above $76 to confirm a new uptrend. Should it do so, the measured move price target would be about $92 based on the prior $60 to $76 range.

HIG: A Trading Range With Upside Potential

The Bottom Line

HIG looks good here on valuation and the chart is constructive. I think the stock will ultimately break out, but traders should wait for a move above $76. Long-term investors, though, can buy now on valuation and enjoy a solid and increasing yield.

Be the first to comment