Christopher Furlong

Investment Thesis

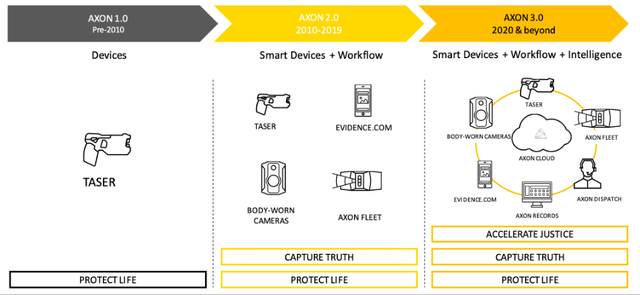

Axon (NASDAQ:AXON) has been transforming law enforcement in the United States for decades, initially with its non-lethal TASER products and more recently with its expansion into body cameras, in-car systems, and even cloud-based software for the entire justice system. Axon already had a monopoly with its TASERs, and it has used this existing network to build a monopoly across multiple law enforcement verticals, with additional opportunities to expand beyond the U.S.

The basis of my investment thesis for Axon is the following: the company benefits from an existing network of virtually all law enforcement agencies in the U.S. to which it can upsell its newer products and solutions, with the SaaS offering integrating with Axon’s body cameras and other products creating a very sticky ecosystem. To ensure this is on track, I would look for fast growth within Axon’s SaaS solutions, consistent growth among its other products and new products being rolled out and adopted.

Axon August Investor Deck

As a quick side note, my personal investing style looks to find leaders in fast-growing, important industries; it probably won’t shock you that it hasn’t been my most enjoyable twelve months. So, I hope you’ll forgive me for celebrating the performance of Axon since I first gave it a ‘Strong Buy’ recommendation in a previous article, because this stock has been fantastic.

Seeking Alpha

But it’s not just the stock; this company has executed phenomenally well in an environment where virtually every other company (unless they sell oil) is being whacked. Axon had previously raised its full year revenue guidance when it reported Q2 earnings, so investors had plenty to be optimistic about heading into Q3.

Well, Axon just reported Q3 earnings, so how did it do? Let’s take a look.

Axon Q3 Earnings Overview

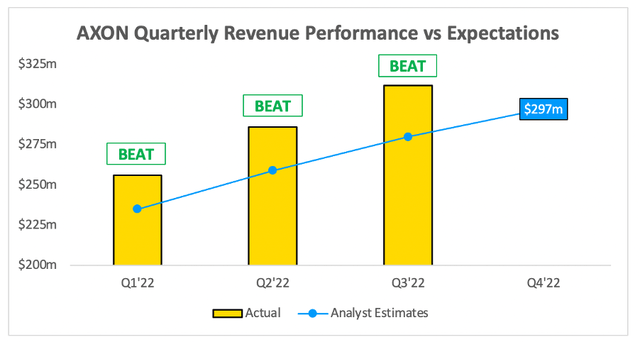

Starting from the top, Axon’s Q3 revenue grew 34% YoY to $312m, coming in well ahead of analysts’ estimates of $280m. This strong quarter continued Axon’s impressive record this year of smashing analysts’ expectations, and it gets better.

Seeking Alpha / Author’s Work

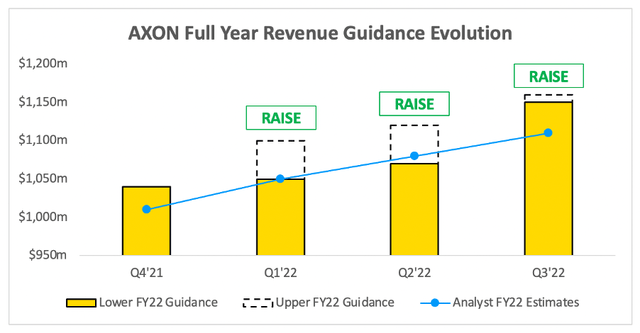

Axon also raised its full year revenue guidance from $1.07-$1.12B previously to $1.15-$1.16B. This is very much a substantial raise, and now implies YoY revenue growth of 34% at the midpoint, compared to 27% in management’s previous guide. This once again blew past analysts’ expectations of $1.11B, and doubled up as a solid beat on Q4 revenues; the FY22 guidance implies Q4 revenues of $300-$310m, whereas analysts were expecting $297m.

Seeking Alpha / Author’s Work

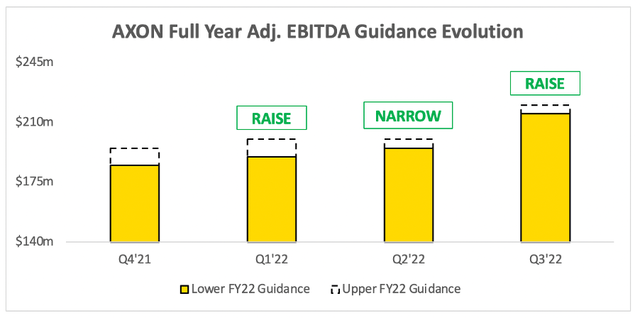

Moving further down the income statement, and Axon continues to paint a very pretty picture. It narrowed its expectations for FY22 adjusted EBITDA in Q2, but went on and raised this full year guidance from $195-$200m to $215-$220m, thanks to increased revenue growth driving higher operating leverage.

Author’s Work

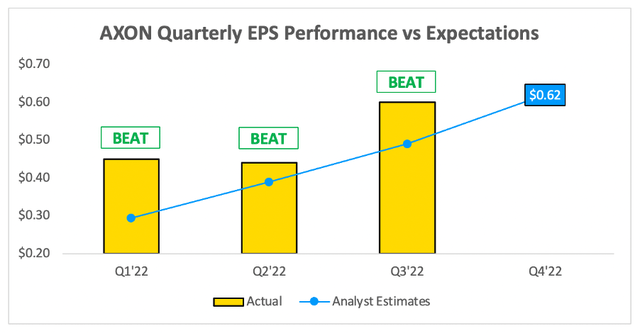

What’s that you say? Surely there can’t be more good news? Well, we’re not done yet, as Axon also comfortably beat analysts’ EPS expectations, coming in at $0.60 compared to the consensus estimate of $0.49.

Seeking Alpha / Author’s Work

I think these graphs tell the story of a company that is continually delivering for shareholders, by executing extremely well and regularly exceeding expectations. That is exactly what any investor should want from their investments, and Axon is showing itself to be one of the highest-quality businesses around.

Demand Remains Extremely Robust

One of my reasons for investing in Axon was my belief that it operates in a fairly recession-proof industry, and this quarter has helped to solidify that belief. Chief Operating Officer Josh Isner told investors in the Q3 earnings call that Axon is seeing a strengthening of demand across all product lines – which is something that investors haven’t been hearing on many earnings calls over the past few weeks.

One of the most promising extracts from Axon’s Q3 shareholder letter refers to the number of customers that are taking up its premium bundle:

We are especially pleased that our highest tier integrated bundle is demonstrating the highest adoption rates this year. Year to date, more than half of customers who chose Officer Safety Plan selected Officer Safety Plan 7+ Premium, which is listed at $249 per officer per month and includes the TASER 7, Axon Body 3 camera, and more software features than any other bundle.

This further solidifies my belief that Axon is building a sticky ecosystem of hardware and software products that work harmoniously together. Seeing so many customers opting for bundles full of multiple Axon products only strengthens this company’s network effects, switching costs, and brand.

There were plenty of other positive signs in this quarter too: Axon is seeing very strong performance with the federal government, it added more software solutions to its ecosystem with Axon Investigate (a tool that improves the video investigation process), and management highlighted that there is still a massive runway for growth ahead, even within its core TASER business. As Founder and CEO Rick Smith said on the earnings call:

We believe the majority of TASER adoption remains in front of us. We’re still under 10% penetrated in terms of our global TAM.

Not only has Axon delivered some really impressive results in 2022, but this is still only a $10 billion business with plenty of room for growth ahead.

Incredible Momentum Beyond TASERs

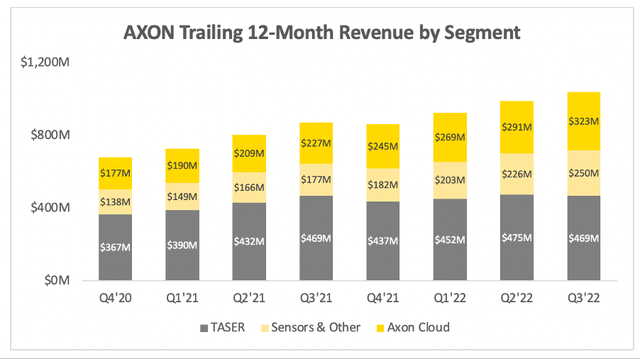

Taking a look at some of the numbers behind the numbers, Axon saw a substantial amount of growth thanks to its non-TASER segments. Axon Cloud, which is probably my top reason for investing in this business, grew revenue by an extremely impressive 51%. But that wasn’t the only positive surprise, as Axon’s Sensors and Other segment grew by an equally staggering 51% YoY.

Author’s Work

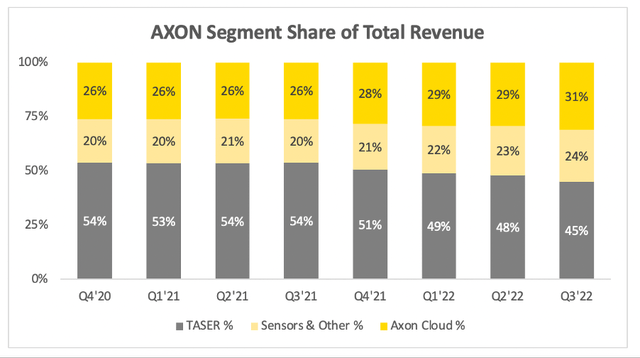

As per the below graph, these two fast growing segments are making up more and more of Axon’s overall revenue. Back in Q4 of 2020, TASER made up 54% of Axon’s total revenue, but in the latest quarter it only made up 45%.

Author’s Work

Whilst it’s great to see momentum with the Sensors and Other segment, I am particularly excited to see Axon Cloud growing from 26% of overall revenue in Q4’20 to 31% in Q3’22, its highest ever share of total revenue.

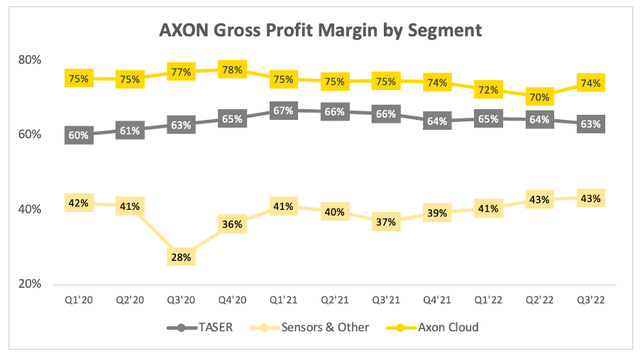

The excitement is mainly due to the margins that Axon can generate through Axon Cloud, with impressive gross margins of 74% in Q3’22.

Author’s Work

Margins for Axon Cloud had been struggling over the past couple of quarters, but Axon’s recently agreed upon long-term contract with Microsoft Azure helped to boost these margins back up to 74%. However, this isn’t peak profitability for Axon Cloud, and management expects gross margins for Axon Cloud to exceed 80% in the long run.

Quick Take: Axon’s Core Financials

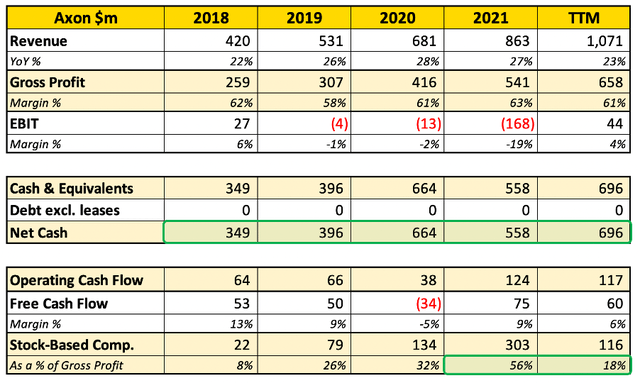

It’s also worth taking a quick look at Axon’s financials, as these continue to tell the story of an extremely healthy business.

Starting with a view on Axon’s trailing-twelve-month trends, and revenue growth over this period has been stable, in the high 20-percents; I’ll speak to the fall to 23% over the past twelve months shortly.

One of the most attractive financial aspects of Axon is its net cash trends, with the company building out that position and now holding almost $700m in cash, short-term, and long-term investments. Combine this with zero debt, and it’s clear that Axon is arguably one of the most financially stable companies out there.

Author’s Work

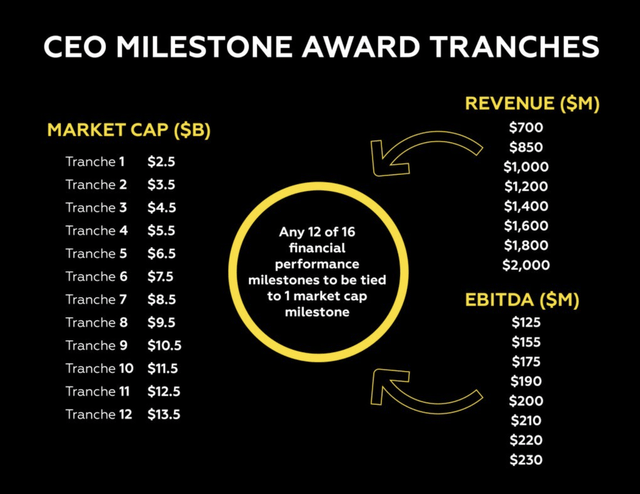

Looking down at the stock-based compensation, and investors have kicked up a bit of a fuss over this in the past. I outlined in a previous article that I didn’t have a huge issue with these temporarily excessive levels, as the SBC related to a CEO Performance Award that Founder Rick Smith took in 2018.

He relinquished his salary, and instead his compensation was linked almost entirely to future company performance and market capitalisation milestones – the only reason for such a huge jump in 2020 and 2021 SBC was because Axon achieved these milestones incredibly quickly! Investors can also see SBC drop down again over the past twelve months, which should calm anyone down who still takes issue with this.

Axon February 2018 Press Release

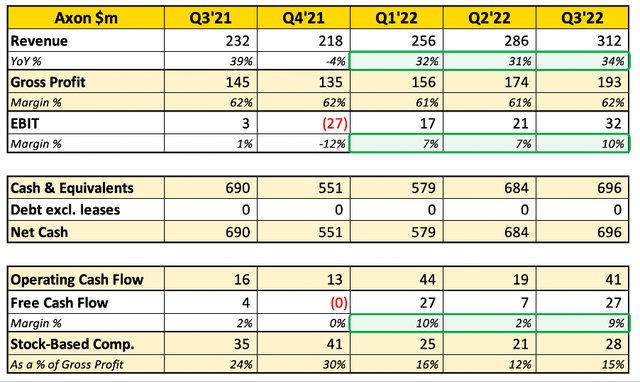

Moving onto quarterly performance, and it’s clear to see what an incredible growth story Axon has shown so far in 2022, growing revenue by over 30% YoY in each quarter.

The only reason for that no-so-great 23% TTM growth in the previous table was because of Axon’s Q4’21, where the company’s revenue declined by 4% YoY. This is in the past now, but it was due to a combination of difficult YoY comparisons combined with supply chain disruptions and chip shortages, which caused some revenues to be shifted to Q1’22.

Author’s Work

The other item I think investors should focus on is Axon’s EBIT and free cash flow margins, both of which have been impressive in 2022. In the current environment, growth-at-any-cost has been thrown out of the window, so I’m extremely pleased to see Axon not only growing revenues rapidly, but also expanding margins at the same time.

In short, this is one of the most financially healthy, recession resistant growth companies that I’ve seen, and it’s no surprise that Axon has excelled in recent months where other business have struggled.

AXON Stock Appears Reasonably Valued

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Axon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

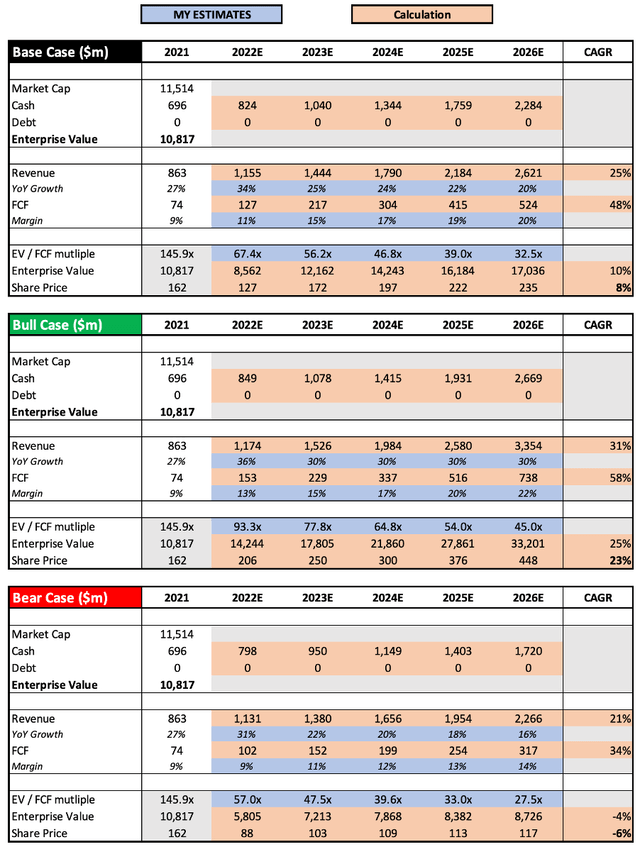

Author’s Work

I have made a couple of changes in assumptions compared to my previous article, in order to reflect the new information available from Axon’s latest earnings, however most assumptions remain the same. The most substantial change I’ve made is an increase to Axon’s revenue expectations in 2022, following management’s increased revenue outlook for the year.

Put all this together, and I can see shares of Axon achieving a CAGR through to 2026 of (6%), 8%, and 23% in my respective bear, base, and bull case scenarios. Whereas I thought shares of Axon looked cheap a few months ago, I would now consider them to be fairly valued.

Bottom Line

I don’t think I need to add much more into this summary; Axon has shown itself to be an incredibly strong business that continues to execute, exceed expectations, and deliver for shareholders. The company still has plenty of growth ahead across all segments, and the continued rise in Axon Cloud’s contribution to this business should be a substantial tailwind for margin expansion.

Given everything I’ve seen, I will be changing my rating on Axon from ‘Strong Buy’ to ‘Buy’. Whilst it may seem strange to downgrade my view on Axon following such a staggering quarter, I am doing so purely on the basis of valuation.

But Axon remains an extremely strong company, and recently made its way to the top holding in my personal portfolio. So, despite the valuation looking less attractive than it did a few months ago, I believe that Axon will continue to deliver impressive results for investors from this point onward, over the next decade and beyond.

Be the first to comment