Anna Linda Knoll/iStock Editorial via Getty Images

Following our deep-dive analysis of the Russian impact on the European banks, we clearly emphasized Raiffeisen Bank International AG’s implications (OTCPK:RAIFF). Just as a reminder, Russia has been for years the largest cash cow for the bank and the biggest single market in Eastern Europe. In the previous year alone, the subsidiary bank contributed around a third to the consolidated profit of €1.4 billion. With Moscow’s war of aggression against Ukraine and the sanctions imposed by the West, these days seem to be over. A red line under the Russia chapter has now become very likely. “We are consistently pushing ahead with the evaluation of our strategic options, which also include an orderly withdrawal” said the bank boss Johann Strobl interviewed by a local media agency.

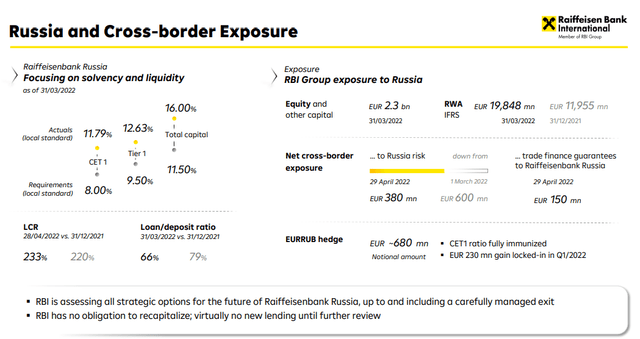

Raiffeisen Russia exposure

Source: Raiffeisen Bank Q1 Results

In terms of its credit volume in Russia, the major bank in Vienna currently recorded a decline from €11.6 billion (end of 2021) to €10.6 billion. However, this amount may have increased again due to the recent stabilization of the ruble. Meanwhile, RBI remains committed to maintaining banking operations in Ukraine despite the war. “Despite the extremely difficult framework conditions, our bank in Ukraine never had to interrupt its operations” reported RBI CEO. “As the market leader in the agricultural sector, it has been instrumental in financing the grain sector” that is important for the country and for the whole world. However, Raiffeisen in Ukraine faced a loss of €41 million in the first quarter (while the business in neighboring Belarus posted a profit of €23 million).

Looking at the overall results, the RBI Group, which is active in all of Eastern Europe in addition to Austria and has around 1,800 branches and almost 18 million customers, was able to significantly increase its Q1 earnings. At €442 million, net profit was more than twice as high as in the same period of the previous year – thanks to growth in net interest and commission income and trading income.

Nevertheless, the bank was forced to form higher provisions (impairments on financial assets), primarily due to the ongoing war. In total, these had more than quadrupled from €76 to €319 million. At the same time, asset write-downs were €209 million. This has pushed the CET1 capital ratio, which bank supervisors consider to be the most important indicator of equity capital, down – from 13.1 to 12.3% in a year-on-year comparison. However, CET stated that, “it will strengthen again in the course of the year and will be very close to our target rate of around 13 percent towards the end of the year.”

Conclusion

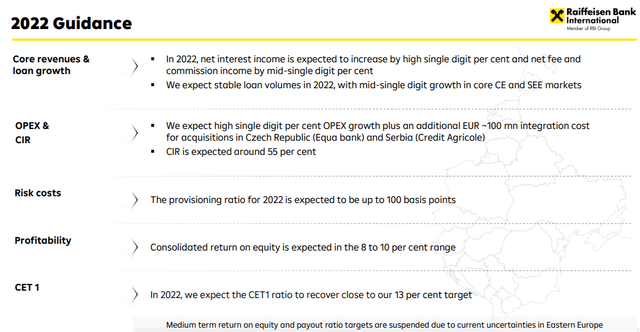

Despite rising risk costs, the RBI boss sees his company’s return on equity this year in the range of 8 to 10%. However, due to the war, the outlook for the year as a whole has been adjusted. For the above reason, we confirm our neutral rating even in considering downside risks, which are equally important. We prefer other names in the banking & diversified financial sector, such as Unicredit (OTCPK:UNCFF) and Euronext (OTCPK:EUXTF).

Raiffeisen Guidance

Source: Raiffeisen Bank Q1 Results

Be the first to comment