naphtalina/iStock via Getty Images

Near the peak of the coronavirus crisis, just before the announcement of the positive results of studies related to vaccines, Holly Energy Partners (NYSE:HEP) had plunged nearly 50% over the preceding 12 months and thus it was offering an abnormally high distribution yield of 11.0%. At that point, most investors were probably considering the distribution of the stock highly risky but I stated that it was safe. Since my article, the MLP has kept its distribution constant. Even better, it has rallied 47%, and thus it has greatly rewarded its unitholders. Nevertheless, Holly Energy Partners is still offering an above-average yield of 7.5% while it is now facing the headwinds of inflation and a potential upcoming recession. Therefore, many investors probably still consider the distribution of the stock risky. However, in this article, I will discuss why the distribution remains safe.

Business overview

Holly Energy Partners owns and operates all the pipelines of crude oil and refined products as well as the storage tanks and terminals that are located at or near the refineries of HF Sinclair (DINO). These assets are located in attractive growth areas in the Mid-Continent, Southwest and Northwest regions of the U.S.

The oil industry is infamous for its high cyclicality, which is caused by the dramatic swings of the prices of oil and refined products. Due to the cyclicality of this industry, most oil companies are characterized by extremely volatile and unreliable earnings. Holly Energy Partners is a bright exception in the energy sector.

Nearly all the revenues of the MLP are fee-based, with little correlation with commodity prices. More importantly, the MLP generates approximately 70% of its fees from minimum-volume contracts. This means that the customers of the company have to pay minimum amounts every year even if they actually transport and store much lower volumes than normal.

Thanks to its exceptionally defensive business model, Holly Energy Partners has repeatedly proved resilient to recessions and downturns of the energy sector. In the downturn caused by the collapse of the oil price from $100 in mid-2014 to $27 in early 2016, the MLP continued growing its distributable cash flow per unit. It also kept raising its distribution in every single quarter. As a result, its unitholders did not feel the impact of that severe downturn.

Moreover, Holly Energy Partners has proved resilient throughout the coronavirus crisis as well. While all the oil producers and refiners incurred excessive losses due to the collapse of global oil consumption in 2020, Holly Energy Partners maintained essentially flat distributable cash flow [DCF] per unit. Unfortunately, due to the uncertainty caused by the pandemic, management cut the distribution by 48% at the onset of the pandemic. The MLP had a distribution coverage ratio slightly above 100% before the pandemic and hence it did not need to cut its distribution so drastically. However, it decided to implement a 48% cut due to the uncertainty caused by the unprecedented lockdowns, in order to have a wide margin of safety.

Thanks to the recovery of global consumption of oil and refined products, Holly Energy Partners has fully recovered from the pandemic. To be sure, it posted DCF per unit of $2.56 in 2021, just 1% below its pre-pandemic level of $2.58.

Moreover, Holly Energy Partners has greatly benefited from the sanctions imposed by the U.S. and Europe on Russia for its invasion in Ukraine. Before the Ukrainian crisis, Russia was producing approximately 10% of global oil output. Due to the sanctions imposed by western countries on Russia, the latter has significantly reduced its production. Given the pent-up demand for oil and refined products and the inability of the vast majority of OPEC members to increase their production, the lost barrels of Russia have been replaced primarily by increased output from the U.S. and Canada. This is undoubtedly a great development for Holly Energy Partners.

Even better, OPEC recently announced that it will reduce its production by 2 million barrels per day in an effort to support the price of oil. Thanks to this support, U.S. oil producers will have a great incentive to enhance their production, as they are essentially the only producers outside the cartel that have meaningful spare production capacity.

The latest report of the Energy Information Administration [EIA] is a testament to the strong tailwind that U.S. oil producers are enjoying thanks to the tight production quotas of OPEC and Russia. According to this report, U.S. shale oil production is expected to reach an all-time high next month while total U.S. oil production has returned to the level it was in March-2020, just before the collapse triggered by the pandemic. It is also important to note that the recently announced production cuts of OPEC have not materialized yet and hence the situation is likely to improve further for U.S. oil producers.

It is also worth noting that Holly Energy Partners is resilient in the highly inflationary environment prevailing right now. Nearly all the revenues it generates from minimum-volume commitments are linked to the producer price index. This feature of its contracts provides a significant hedge against the exceptionally high inflation, which has persisted much longer than initially expected.

To sum up, Holly Energy Partners is not likely to see the volumes transported and stored through its network decline anytime soon thanks to the declining production of OPEC and Russia, which is providing a tailwind to the U.S. oil producers. In addition, the MLP has repeatedly proved resilient to fierce downturns and hence it is likely to remain solid in the event of a recession, which has become more likely lately.

Distribution

Holly Energy Partners had an enviable distribution growth record until the onset of the pandemic. To be sure, the MLP had grown its distribution for 58 consecutive quarters until early 2020. As this period includes the aforementioned downturn of the oil industry in 2014-2016 and the Great Recession, it is a testament to the defensive business model of the MLP.

Holly Energy Partners ended its distribution growth streak in early 2020, with a 48% cut, and has kept its distribution constant since then. The MLP is currently offering a 7.5% distribution yield, with a healthy distribution coverage ratio of 55% (=$1.40/$2.56).

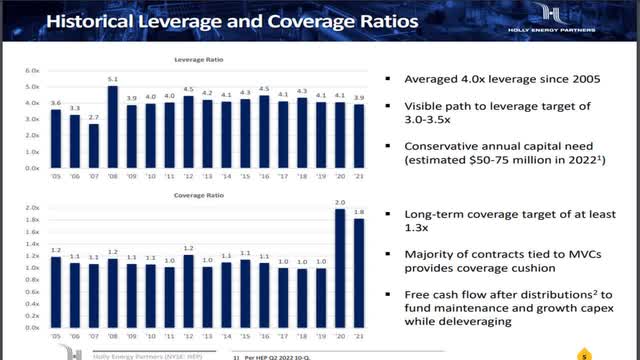

In addition, the company has a solid balance sheet. Its leverage ratio (net debt to EBITDA) is expected to reach 3.5 by the end of this year, with its credit rating standing at BB+ (S&P) and Ba2 (Moody’s).

Holly Energy Partners Distribution Coverage (Investor Presentation)

It is also important to note that the net interest expense of Holly Energy Partners consumes only 3% of its operating income and hence it is negligible. In addition, its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $1.7 billion. This amount is less than 5 times the annual DCF of the MLP and hence it is easily manageable. Overall, thanks to its healthy payout ratio, its solid balance sheet and its defensive business model, Holly Energy Partners offers an attractive distribution yield of 7.5% with a wide margin of safety.

Risk

While Holly Energy Partners is one of the most resilient oil companies in the investing universe, it is not immune to recessions. Due to the aggressive interest rate hikes implemented by the Fed, the risk of an imminent recession has significantly increased. In such a case, the volumes transported and stored through the network of the MLP are likely to decrease. Nevertheless, thanks to its defensive business model, which includes minimum-volume contracts, and its healthy payout ratio, the MLP is likely to maintain its distribution without any problem.

Investors should also realize that the scenario of a prolonged, severe recession is highly unlikely. As soon as a recession shows up, inflation will probably subside and thus the Fed is likely to shift to a more accommodative policy.

Final thoughts

When a stock offers an exceptionally high yield, it usually sends a signal that the distribution is at the risk of being cut. However, Holly Energy Partners is a bright exception to this rule. The MLP is resilient to high inflation thanks to the adjustment of its fees in tandem with the producer price index. In addition, given its resilient business model, its financial strength and its solid payout ratio, its distribution has a wide margin of safety.

Be the first to comment