FotografieLink

The Goodyear Tire & Rubber Company (NASDAQ:NASDAQ:GT) is one of the world’s largest operators of commercial truck service and tire retreading centers. The company develops, manufactures, and sells tires through 1000 retail outlets to consumers and commercial customers. Along with that, it provides repair and maintenance-related services through its outlets. The company manufactures merchandise through 57 manufacturing facilities in over 23 counties.

Approximately 85% of total sales comes from the tire unit. The company’s presence in the undifferentiated and highly competitive tire industry gives the business a very much commoditized nature because vehicle manufacturers use these products as privately labeled; therefore, price remains the primary factor for the manufacturer.

Also, due to its dependency on the automotive sector, Goodyear faces significant fluctuations in revenue and profitability; the company’s profitability is very much dependent on the average selling price of its tires. During the cyclical downturn of the automotive industry, the company couldn’t produce considerable profits. These facts make the Goodyear business model very much unpredictable and utterly dependent on the cyclicality of the automotive sector. Hence, investors cannot predict the profitability of the business for a short period, such as 2 to 3 years.

Although the company enjoys high brand recognition and has a reputation for performance and product design, the company faces significant pricing pressure due to intense competition from international players such as Bridgestone and Michelin.

History

In 2011, the company’s revenue touched its all-time high levels, but then onward continuously declined until 2020. However, from last year, revenue has seen unusual growth. In contrast, in the last ten years, it has been dropping consistently. Over the same period, net profits have remained very much volatile and have seen sharp rises and falls year over year, ranging from $365 million to over $2.5 billion; in 2021, the company turned significantly towards profitability after significant losses during the pandemic period.

Also, management has kept debt levels at reasonably moderate levels. Still, in the last year, due to the acquisition of Cooper to strengthen the business model, debt levels increased to $6.6 billion but are manageable as a percentage of total assets. The company has been financially stable with over $7 billion in current assets and about $8.3 billion in property plant and equipment.

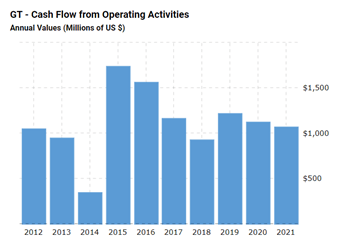

Also, despite consistently decreasing revenues and volatile profit margins, cash flow from operations remained substantially attractive due to the higher cost of depreciation added back into the cash flows.

Furthermore, from 2014 till 2018, the company had been investing its free cash flows for share buybacks but due to the higher share price, those buybacks could only produce a little value for the investors.

Note that the company has considerably low gross margins, which fluctuate significantly year-over-year basis, which gives the businesses a commoditized nature where the seller doesn’t have considerable pricing power over its customers; that is why net profits fluctuate drastically.

Strength in the business model

The company enjoys a strong presence in the tire industry along with brand recognition, which has developed over the period due to the consistent improvement in its product along with the high-quality services provided by the company.

Note that the company has a strong presence in European and Asian markets, which has been bringing significant revenue for the company.

CFO (macrotrends.net)

Also, the cash flow generation history of the business seems very attractive, despite significant volatility in the net profits, the company has produced substantial cash flow over a very long period, and having such a strong cash flow generating business model provides the company with a significant strength to its financial position.

Risk

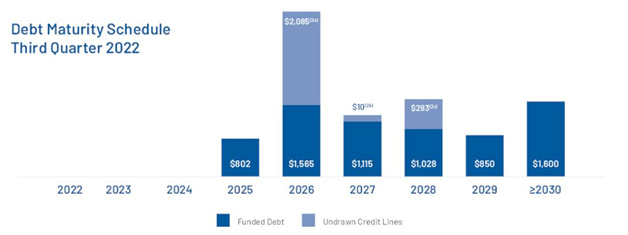

Debt maturity (investor presentation)

Due to the acquisition of Cooper, the overall debt levels have increased significantly; currently, there is no major due of debt obligations for the next two years, but significant debt obligations are due in 2025 and 2026. This, along with the commoditized nature of the business, might result in substantial value destruction for the long-term investors.

During the cyclical downturn, it becomes significantly difficult to refinance debt obligations. If the company has significant debt maturity during its downturn when its profitability gets hampered, it becomes so much more difficult and expensive to refinance debt, the condition affects the stock price which leads to a significant correction, which might take a very long time to recover. Hence, I believe it is better to avoid commodity stocks with significant debt.

Also, operating costs have been rising significantly from the last few quarters, which has been impacting the company’s overall profitability. If the condition lasts for longer, the profitability might get hampered, which might affect the stock price in the upcoming quarters.

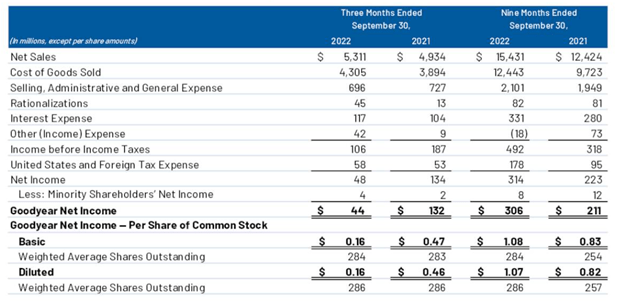

Quarterly results

quarterly result (investors presentation)

In the latest quarter, revenue has grown considerably with significantly attractive growth in net profits. By looking at the overall quarterly results, it seems that the company has been growing quarter-over-quarter, but the investor must understand that the recent increase in profitability is attributed to the cyclical uptrend in the vehicle industry and as we have seen, the company has a long history where revenue dropped consistently and net profits remained very much volatile.

As per the management, the operating cost has increased, primarily as a result of increased raw material costs along with the hiked cost of energy, transportation, and labor which have been affecting the net profit margins. However, management is pretty optimistic about the growth of the industry and expects that going ahead the overall cost might go down as a result margins might recover from the current situation.

Goodyear is currently in a cyclical uptrend, and the current growth might not sustain for a long time, because of high pricing pressure from the competitors and its dependence on the auto sector.

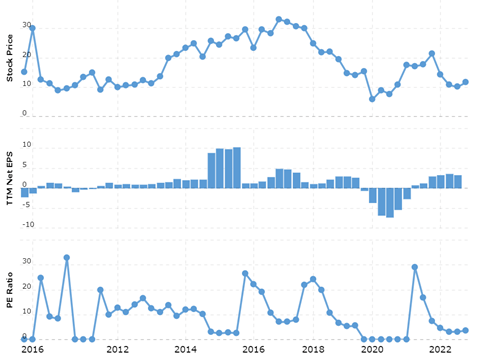

Stock price (macrotrends.net)

Over the period shown, the Goodyear stock price has remained at a significantly higher valuation, and due to the sharp fluctuations in earnings, the company’s price-to-earnings ratio has remained volatile.

Although there has been a sharp drop in the Goodyear share price, I cannot see any margin of safety in the underlying business model; therefore, The Goodyear Tire & Rubber Company is a hold.

Be the first to comment