Astrid Stawiarz

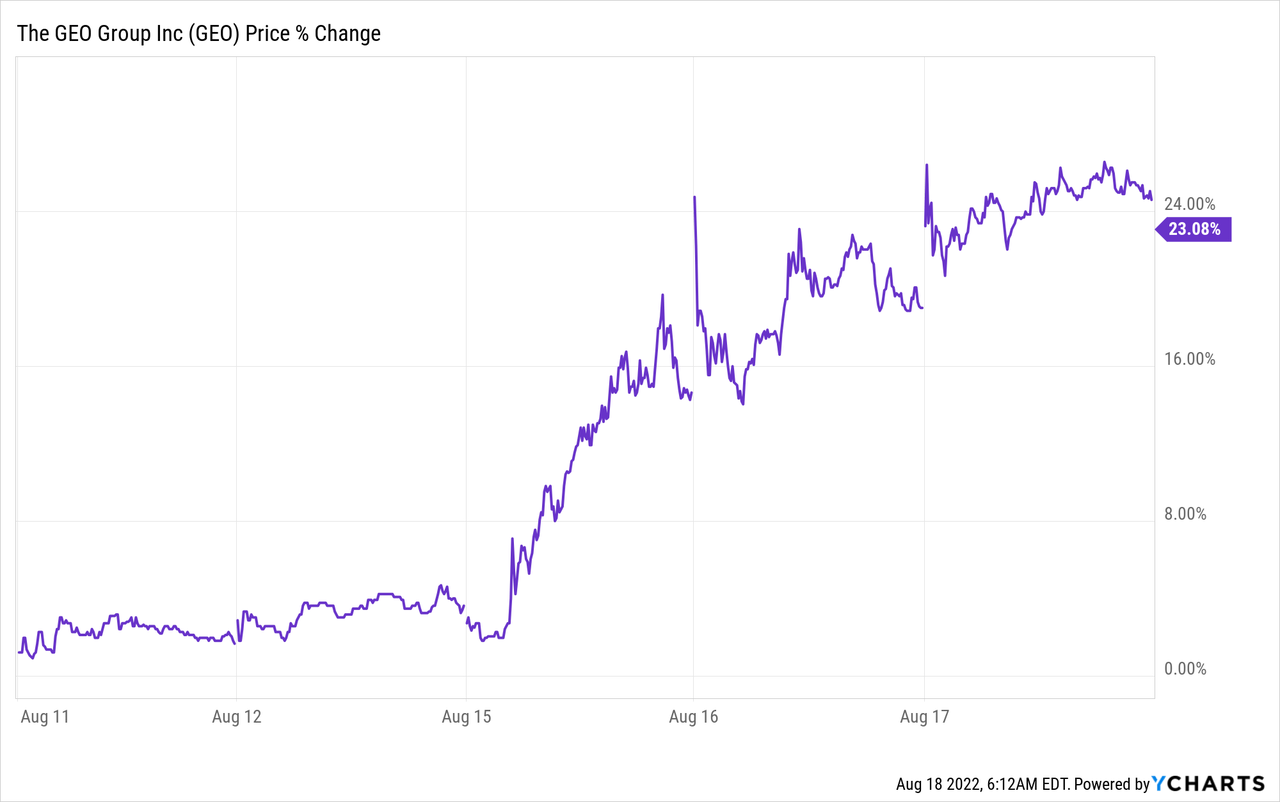

Recent disclosures for Scion Asset Management show that the investment fund sold all of its previous stock holdings. The fund also only added one new stock: The GEO Group (NYSE:GEO). Michael Burry likely made those portfolio changes in anticipation of a major down-turn in the economy or in the stock market. The GEO Group’s shares soared after the disclosure was made, but shares remain cheap and have potential to revalue higher.

Michael Burry, Scion Asset Management and latest 13F disclosure report

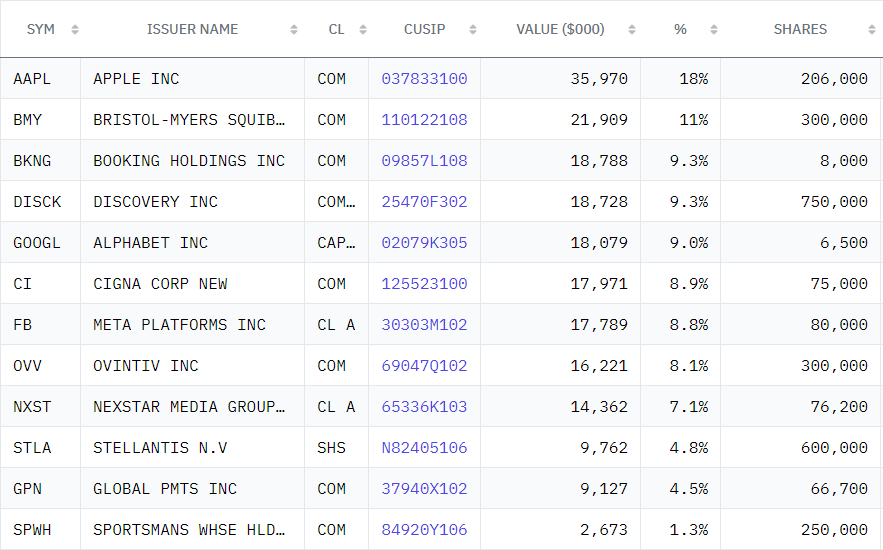

Michael Burry, a physician-turned-investor who rose to prominence 15 years ago by placing timely short bets on the US housing market, has made major portfolio changes in his investment fund in the second-quarter. According to the latest 13F disclosure report, Scion Asset Management sold all of its previous holdings including Apple (AAPL), Alphabet (GOOG), Meta Platforms (META), Bristol-Myers Squibb (BMY), Cigna Corp (CI) and seven other positions. The screen below shows Scion Asset Management’s portfolio holdings before the latest change.

Source: 13f.info

While the fund sold all of its previous holdings, Michael Burry purchased 501,360 shares of The GEO Group in the second-quarter which is now the only position in the fund.

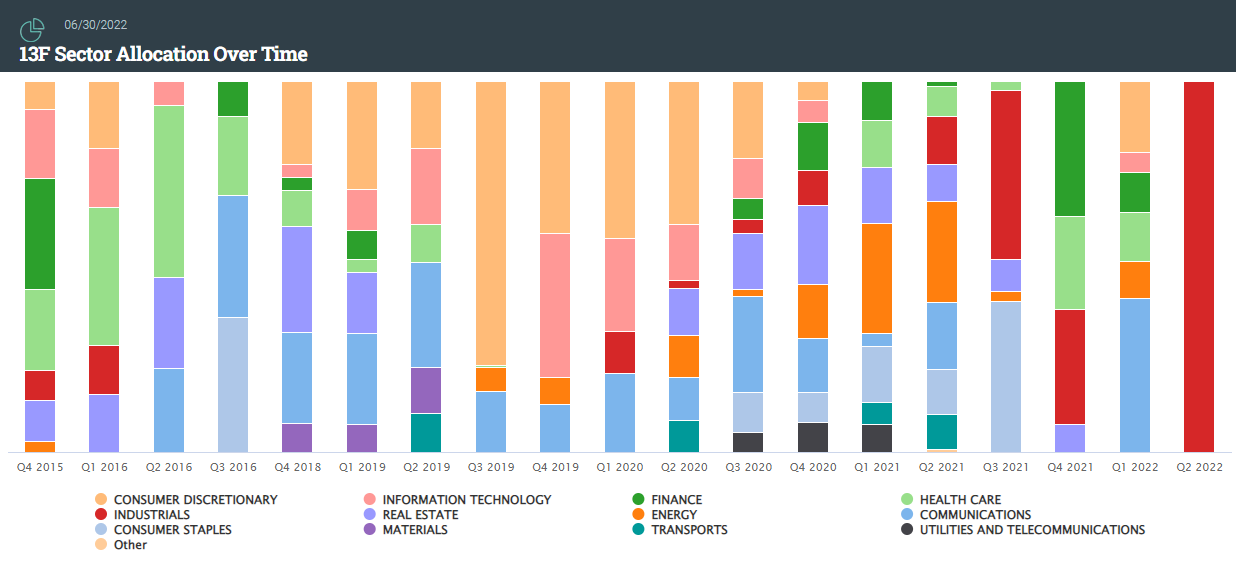

Scion Asset Management’s asset composition has therefore also changed dramatically. The fund was overweight in the communications industry with a total investment allocation of 36% to just three major technology companies: Apple, Alphabet and Meta Platforms.

Source: whalewisdom.com

What are the implications of recent portfolio changes?

Portfolio changes could have two profound implications for investors that track the portfolio actions of infamous investors such as Scion Asset Management:

- Michael Burry is seeing growing macroeconomic risk factors and preemptively sold all of its holdings in anticipation of a major down-turn in the stock market.

- Scion Asset Management may see the market generally as overvalued and raised cash in a bid to take advantage of another down-leg in the stock market.

Macro risks are clearly growing

I believe macro risks have clearly grown a lot in FY 2022 and a large number of technology companies have warned of growing headwinds in the digital advertising industry due to inflation impacting consumer spending. Snap (SNAP), Meta Platforms and Alphabet all warned of top line headwinds in the second half of the year as the digital advertising market goes through a reset.

Additionally, clouds are gathering over the global economy elsewhere. Residential housing sales in China fell 32% in the first six months of 2022, indicating that China’s real estate market is already in the midst of a major correction… which is set to be made worse by the fact that Chinese property developers are currently seeing plunging cash flows as home buyers stop making prepayments for delayed real estate developments.

Why did Scion Asset Management buy The GEO Group?

Likely because of the company’s government-secured cash flows, recession-resistant business model and an incredibly cheap valuation.

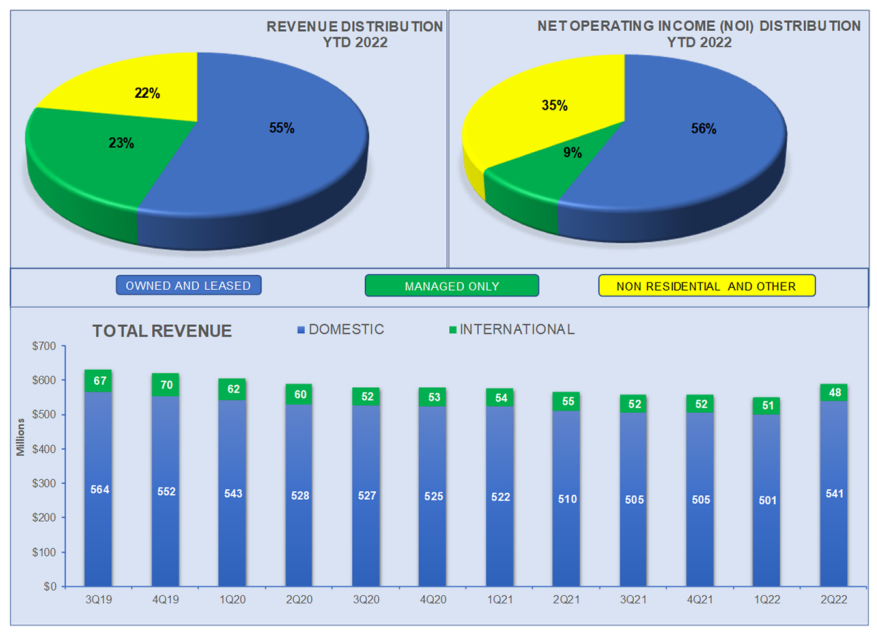

The GEO Group makes its money from leasing facilities to government agencies (and managing some of them), with the majority of revenues coming from the leasing business. The company’s real estate assets generated $588M in revenues in Q2’22, showing an increase of 4% year over year. While The GEO Group has international operations in Australia, South Africa and the United Kingdom, the US is the firm’s main market with a revenue share of 92%.

The GEO Group: Q2’22 Revenue Breakdown

Even during a recession, demand for prison and detention space doesn’t decline, meaning prison operators like The GEO Group are in the most recession-proof business one can think of, especially if one expects a major market down-turn and growing economic headwinds.

And The GEO Group’s business is incredibly cheap, despite shares soaring 11% just on Monday after Scion Asset Management’s disclosure was made.

The company’s guidance for FY 2022 calls for AFFO of $2.40-2.46 implying an AFFO valuation factor of just 3.4 X. The prison operator is cheap in large part because it cut its dividend last year which has hurt a lot of income investors. The GEO Group cut its dividend in order to free up cash to pay down debt which the company is doing: the company repaid $375M in debt since the start of FY 2020, $130M of which was paid just this year. The company ended Q2’22 with $2.0B in net (recourse) debt and will continue to prioritize debt repayments.

Two potential catalysts for The GEO Group

I see continual progress in the repayment of debt as well as a potential reinstatement of the dividend as potential catalysts for The GEO Group.

Risks with The GEO Group

The GEO Group is so cheap that the valuation itself does not represent a risk factor. The company’s largest risk factor, as I see it, is likely of political nature. US governments may be less inclined to outsource the building and managing of secure facilities to contractors and investors, which may create headwinds for The GEO Group’s business.

Final thoughts

Scion Asset Management disclosed major portfolio changes in the second-quarter, likely due to expectations of a deeper market correction and, perhaps, a global recession. The fund sold all stocks and added just one which indicates that Michael Burry may expect a major down-turn in the stock market.

Many technology companies have already lowered revenue expectations due to a down-turn in the digital advertising business (a previous investment focus of Scion Asset Management) and the Chinese economy appears to be headed for more trouble, but prison operator The GEO Group may not be affected by a recession at all. The company’s recession-resistant business model, government-contracted cash flows and the incredibly low valuation should make the stock attractive, not just for Michael Burry!

Be the first to comment