Bet_Noire

In a speech at the Brookings Institution on Wednesday Fed Chairman Powell hinted that interest rate hikes may be smaller starting in December. The financial markets interpreted this statement as a positive sign of the much awaited Fed pivot. The S&P 500 rallied by 2.97% and 10 year bond yields fell by 11 basis points on the day.

While all eyes were on Chairman Powell’s comments regarding monetary policy, few were looking at what is actually happening at the Fed.

Fed Net Income To Turn Negative

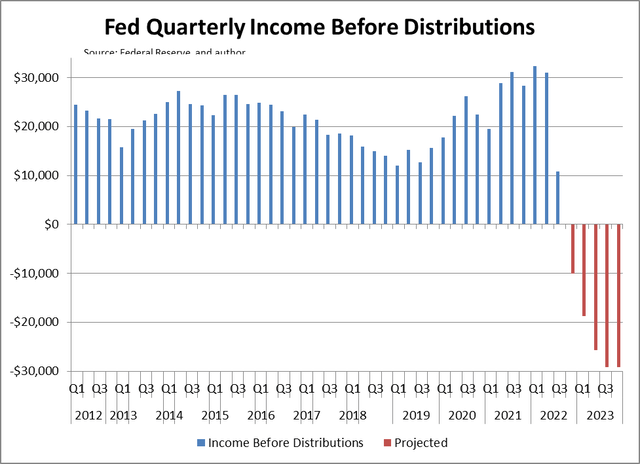

Just released financial results for the third quarter ending September 30, 2022 show that the Fed’s Net Income fell to $10.8 billion from $31 billion in the second quarter, a 65% decline. The primary culprit for the drop in earnings was the sharp increase in interest expense.

As we’ve written previously, when the Fed embarked upon its Quantitative Easing (QE) program in 2009 it committed the cardinal banking sin of funding fixed rate assets with variable rate liabilities. The consequences of this error were either not understood or ignored. The results, though, were totally predictable. As interest rates have risen with the Fed tightening to fight inflation, the higher rates have created havoc on the Fed’s income statement.

In short, the asset/ liability mismatch the Fed has created leaves the Fed’s huge System Open Market Account (SOMA) portfolio earning a fixed rate of approximately 2.0% on its $8.5 trillion SOMA holdings while the cost of its variable rate liabilities, namely $5.6 trillion in bank reserves and reverse repurchase agreements, keeps rising.

In the minutes from the July 26-27, 2022 FOMC meeting the Fed acknowledged “that net income would likely turn negative in coming months.” That time is now.

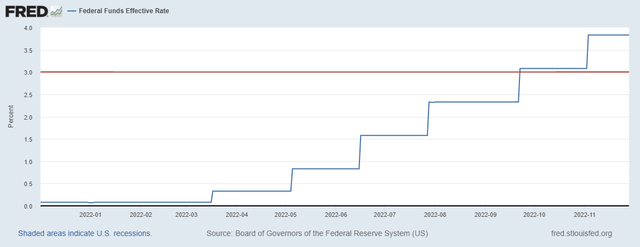

A back of the envelope calculation suggests the breakeven rate for the cost of the liabilities is 3.0%.

The September Fed rate hike moved the Fed Funds rate above the breakeven rate as seen in the above chart. There was an additional rate hike in November. The expected 50 basis point hike at the upcoming FOMC meeting on December 14th will push up the Fed Funds target rate even further to 4.25% to 4.50%.

This means that the Fed could lose an estimated $10 billion in the current quarter.

The Fed has not lost money in 107 years!

Based on forward guidance, we project that the Fed will continue to generate a net loss from operations through 2025.

The market didn’t focus on Chairman Powell’s comments that “the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting” and “restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy.”

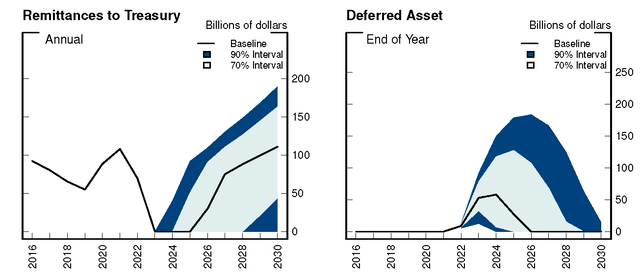

Starting in 2023, for the first time ever, the Fed will have zero remittances to the Treasury since they will incur an estimated net loss of more than $100 billion for the year. This will negatively impact the federal budget as the Treasury will no longer receive these remittances, which have been used to reduce the deficit.

The cumulative losses will greatly exceed the Fed’s capital of $41.8 billion.

However, since the Fed uses accounting rules determined by the Federal Reserve Board of Governors and not rules formulated by accounting standard-setting bodies, these operating losses will not affect the Fed’s capital. Instead, operating losses will be carried on the balance sheet in a new account called “deferred asset,” which is a negative liability.

The Fed’s own conservative estimate shows the deferred asset remaining on the Fed’s balance sheet at least through 2026, and their more realistic assessment shows it remaining through 2029.

Unrealized SOMA Losses Grow

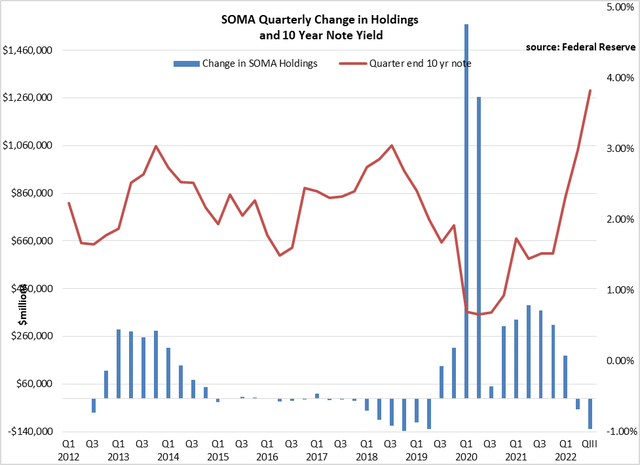

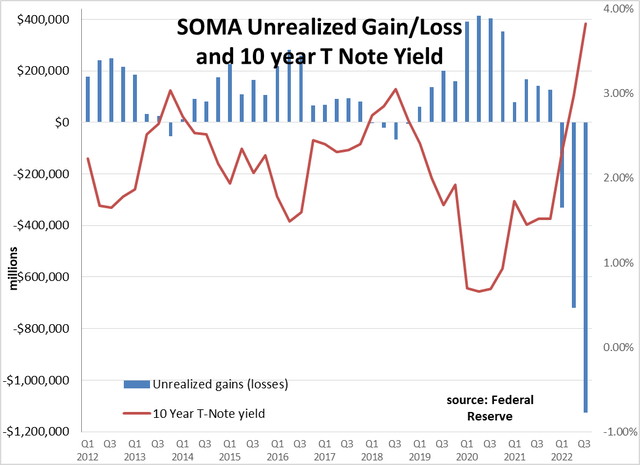

Under QE the Fed deviated from their historical practice of only buying short term Treasury securities for its SOMA portfolio and began accumulating Treasury bonds and Mortgage Backed Securities (MBS.) In doing so, they took on significant interest rate risk.

The SOMA portfolio grew from $900 billion pre-QE to its peak of $8.8 trillion in March 2022.

As can be seen in the chart below, one third of the SOMA portfolio was purchased with yields below 1%, and another one quarter of the portfolio was purchased with yields between 1%- 2%. In fact, during the COVID pandemic, when Treasury yields were their lowest on record, the Fed was practically the only buyer of Treasury securities, as they purchased 57% of the increase in Treasury securities over the past two and a half years. Rates started rising when the Fed’s purchases slowed.

One hundred percent of the SOMA portfolio was purchased when yields were lower than they are today. As a result, the entire SOMA portfolio is underwater. That is, every single security in the SOMA portfolio was purchased at a higher price than its market price today.

As reported for the quarter ending September 30, 2022, the unrealized loss of the SOMA portfolio has grown to -$1.1 trillion.

This unrealized loss is greater than the entire Fed balance sheet pre-QE!

Due to another convenient feature of the Federal Reserve Board of Governors accounting policies, these SOMA losses are unrealized, as the Fed carries its securities at amortized cost. Their market value only shows up in a footnote on their financial statements.

If the Fed were to sell securities from their SOMA portfolio they would have to report the difference between their purchase price and the market price, thereby recognizing the loss. It is most likely for this reason that the Fed is reducing their balance sheet through security roll-offs, so they don’t record any losses.

Balance Sheet Reduction Has Not Met Projections

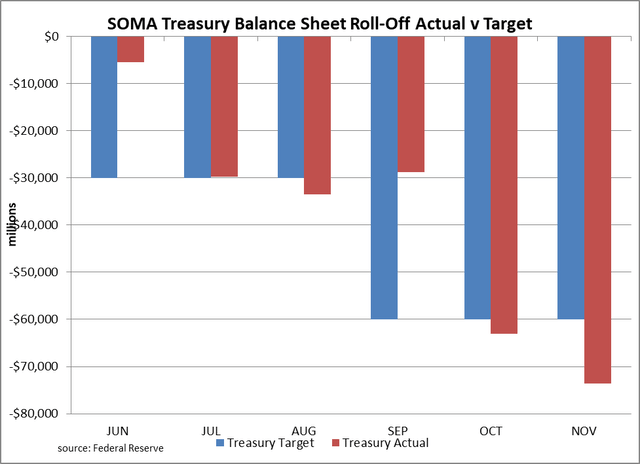

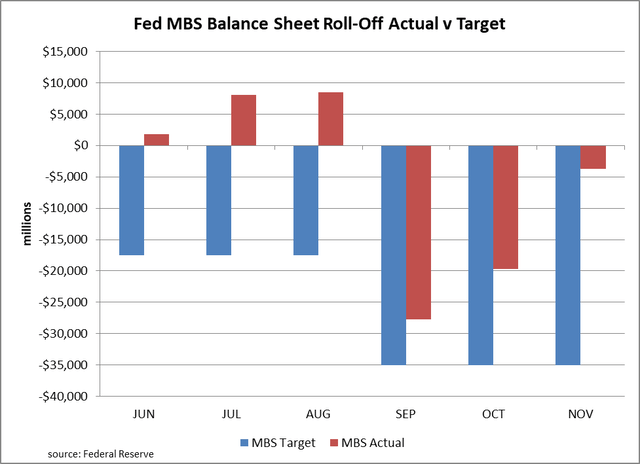

The Fed began their policy normalization through balance sheet roll-offs beginning in June. The goal was to shrink the Fed’s balance sheet. The normalization program was gradually phased in over three months. The first three months would see roll-offs of $47.5 billion per month, comprised of $30 billion in Treasuries and $17.5 billion in MBS. Starting in September the full normalization program of $95 billion per month in roll-offs was started. The Treasury target was doubled to $60 billion per month and the MBS target was doubled to $35 billion per month.

Results are in for the first six months of the balance sheet reduction program and they have not met the Fed’s original projections.

Treasuries have matched their target in only 3 of the 6 months, and cumulatively have been reduced by $234 billion of the targeted $270 billion, or by 86% of target.

The Fed has had an even more difficult time with reducing their MBS holdings. The main reason for this is that the monthly principal and interest payments on MBS are less predictable. When interest rates were lower, a significant portion of the monthly cash flow on the MBS holdings was from extra principal payments due to refinancings. As mortgage rates have risen, refinancings have ground to a halt, thereby hampering the Fed’s ability to reduce their MBS position through roll-offs.

Consequently, the Fed has yet to hit their monthly target on reducing their MBS, and the monthly misses have been quite large. Altogether, the Fed has only reduced their MBS position by $33 billion of the targeted $158 billion, or by 21% of target.

Since the policy normalization plan of balance sheet reduction was implemented, the SOMA portfolio has only declined by $267 billion of the targeted $428 billion, or by only 62% of the plan.

Implications

The Fed continues to insist that any operating losses or unrealized SOMA losses will not affect the Fed’s ability to implement monetary policy.

The operating losses and unrealized SOMA losses, however, are real. No amount of lenient and favorable accounting treatment can hide the significant deterioration in the Fed’s financial position.

This weakness can affect the Fed in three ways. The first is political. If congress focuses on the Fed losing money for the first time in 107 years, thereby costing the taxpayers billions of dollars, they may pressure the administration to institute controls to limit the Fed’s independence. The second area of concern is market confidence. In many ways the stability of our financial system is due to its confidence that the central bank is strong and in control. Continued financial weakness may erode that confidence. The final area of concern is more practical. If losses continue to mount, the Fed may be forced to create new reserves to meet their obligations. This would be inflationary, which would exacerbate the problem they are trying to solve.

Despite their protestations, the Fed’s financial health is the weakest it’s been in its history. Based on their own conservative forecasts, the financial deterioration of the Fed will continue for a few years. This is not a place the world’s most important central bank wants to be.

Be the first to comment