cemagraphics

I don’t own Planet 13 Holdings (OTCQX:PLNHF) right now in my model portfolios, but I like it and I’m watching it closely here near $1. I owned it in my long-term focused model portfolios, but I sold the last of the position, which I had last bought at $1.29 in June, at $1.97 in late July. The stock is now $1.15, which is down 61.3% year-to-date. This is slightly better than the overall cannabis sector, which, as measured by the New Cannabis Ventures Global Cannabis Stock Index, is down 62.9% in 2022.

Planet 13 is a Tier 3 multi-state operator – MSO, and it has performed worse than direct peers. The New Cannabis Ventures American Cannabis Operator Index has dropped much less than the Global Cannabis Stock Index, falling 49.3%.

While I don’t include it among the holding currently in my model portfolios at 420 Investor, I really like the stock. In this piece, I discuss the company’s operations, financials and outlook, I weigh in on the valuation, and I assess the chart.

The Company Has Grown Substantially

Planet 13 was formed in 2015 and began trading in Canada on the Canadian Securities Exchange in mid-2018. The price has increased just a bit since then, but, as I display below, it has come down a lot over the past 21 months. The stock price is down, but business is up substantially since the company went public.

Planet 13 is run by two Co-CEOs, both of whom are real business people and not financial types. Both men, Robert Groesbeck and Larry Scheffler, have been entrepreneurs in Southern Nevada for many years. Groesbeck, who has lived in the Las Vegas area the majority of his life, practiced law for more than two decades and was the Mayor of the City of Henderson from 1993 to 1997. Scheffler too has spent the majority of his life in Nevada and founded Las Vegas Color Graphics in 1978.

The company started out focused on Las Vegas, where it owns a very tourist-friendly dispensary and production factory near the Strip:

Planet 13 Las Vegas (Planet 13)

The store is a leader in Nevada with about 10% of the sales there, and the company has done a great job in the state since the pandemic hit in 2020. Note that it has gotten into wholesale distribution of its products. Recall that in early 2020, there was a risk of Nevada shutting down its adult-use cannabis sales. While this never happened, the pandemic has weighed on the industry as tourism fell sharply. Looking ahead, it will soon offer a cannabis consumption lounge at its store in Las Vegas.

Planet 13 has evolved recently in a big way. It’s no longer just a Nevada-focused company. It already opened a store in Orange County, Calif., and purchased another company there, Next Green Wave, to boost its own production capabilities. It’s developing a retail store near Chicago, but perhaps the biggest part of the expansion beyond Nevada will be in Florida, where it bought a license (from Harvest) and is rapidly developing medical dispensaries and building production.

So, the company is more than just a single-state operator, but it also isn’t yet that big compared to other MSOs. It’s small in California, a large state that could become a big source of revenue for the company. The Florida market too should be big for Planet 13 beginning next year and even larger if the state adopts adult use. In addition to Illinois, where there’s just a single store being planned near the Wisconsin border, the company is looking at other states, including Arizona, Colorado, Oregon and Washington in the West and Georgia, Massachusetts, Michigan, Minnesota (not yet legal for adult-use, but this could change), New York and Washington, DC in the east. The company also has its eyes on Texas, my home state and what I think will one day (not soon!) be the best cannabis market in the country.

The Financials Are Strong

Planet 13 is quite unique among publicly-traded cannabis companies: The company has no debt. It ended Q3 with cash of $50.88 million. In an interview at New Cannabis Ventures recently, the Co-CEOs described their businesses and talked about their desire to remain debt free.

Sales in 2022 are down 11% in the first three quarters to $79.7 million. In Q3, revenue was a bit short of expectations at $25.6 million, down 22% from a year ago. Adjusted EBITDA fell too, but it was positive at $400K. Analysts had projected $3 million. The company has generated $2.3 million from its operations in 2022, and more than $1.1 million was generated in Q3.

While the numbers have been weak recently, especially considering that the company was solely in Nevada a year ago, I think the company is performing well. It remains profitable despite the decline in revenue and the ramping up in expenditures in parts of its business. Overall expenses for the company are down 12% year-to-date, in line with the revenue decline, and the real hit has been in gross profits, which are down 25%. The gross margin in Q3 was 41.2%, and year-to-date it’s 46.8%. The decline from a year ago is due, according to the company, to its more frequent use of sales incentives as well as the expansion of wholesale sales in Nevada. Additionally, the move into California is having a negative impact. The company is also generating cash from its operations.

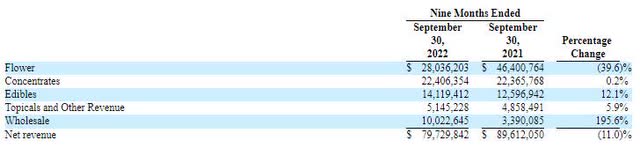

The 10-Q breaks out sales by product category, and flower has been very weak, while other categories have performed better or even risen in 2022:

Planet 13 Sales by Category YTD (Planet 13 10-Q)

On its conference call, Scheffler indicated that Q3 sales in Nevada were about $21 million. The rest of the revenue was from California at approximately $4.6 million. This suggests that organic growth in Q3 was about -36%. Data from BDSA suggests that Nevada revenue of $193.5 million in Q3 fell 25% from a year ago.

I think that the company has faced a lot of challenges this year and is performing reasonably well.

The Near-Term Growth Is Expected to Be Weak

Analysts are projecting Planet 13 revenue will grow 14%in 2023 to $117 million, which is strong but below the average of the larger MSOs. In fact, this would still be below 2021 revenue of $119 million. I think that this is turning some investors off, especially given the expansion that the company has made beyond Nevada. Additionally, adjusted EBITDA is projected to increase 150% to just $15 million, a margin of 12.8%, which is below its peers.

The Valuation Is Cheap But Not As Cheap As Some Peers

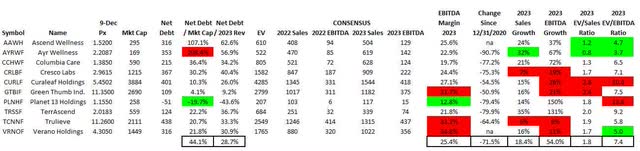

I find many cannabis stocks to be extremely attractive, including Planet 13, which trades at 2X tangible book value, which is rather low for MSOs. The stock looks expensive relative to peers by valuation compared to the 2023 estimates. Here I compare it to the Tier 1 and Tier 2 MSOs using data from Sentieo:

Planet 13 2023 Valuation (Alan Brochstein, CFA)

I think that Planet 13 looks expensive looking at the 2013 revenue and adjusted EBITDA projections relative to peers. The margin is lower, by far, than all of the others, and the projected growth in revenue is below average. The enterprise value of the company relative to projected sales at 1.8X is in line with the average of peers, but relative to projected adjusted EBITDA is much higher than peers at 13.8X.

Before the Q3 report, I shared with my 420 Investor subscribers a year-end 2023 target of $1.83. which was 52% higher than the price at the time of my preview. My target was based on a 12X ratio of EV/EBITDA for 2024 by my estimate. There are just two analysts covering the stock right now, and neither offers a 2024 estimate. In 2023, they currently project adjusted EBITDA of $15 million, and this is down from $20 million right before the Q3 report and $33 million before the Q2 report. I’m now expecting the company to generate $152 million in revenue in 2024, up 30% from the analysts’ current estimate. I’m projecting adjusted EBITDA to be 20%, which would be $30.4 million. Updating my target for year-end 2023, I’m still using a 12 multiple, which is $365 million. This works out to a market cap of $415 million, which is $1.85, up 61%.

The Chart Is Attractive

I like the company and its valuation, and I really like the chart too. The stock plunged along with peers in early 2020 when the pandemic hit, and it has held, like most of its peers, that low. It’s down a lot since the peak in February 2021 of $8.67. Down 79% since the end of 2020, it is down more than its peers but not the most. Here is the action over the past five years:

Planet 13 Chart at StreetSmart edge (Charles Schwab)

If cannabis stocks remain in their downtrend, I think $1 could hold. I see a good low potentially in late September, when the cannabis market bottomed. PLNHF has lifted 8.5% from its 52-week closing low on 9/29, while the Global Cannabis Stock Index is up 8.2% since 9/30. PLNHF is up just 3.6% since then. The overly concentrated AdvisorShares Pure US Cannabis ETF (MSOS), which has a tiny position in PLNHF, has rallied 14.7% since 9/30.

Conclusion

I really like Planet 13 Holdings, but I have no position currently at 420 Investor in my model portfolios. The company has been very successful, in my view, and it has cash and no debt. The valuation is cheap relative to peers when compared to tangible book value, but it looks expensive relative to 2023 projected sales and adjusted EBITDA. The company isn’t covered by a lot of analysts, and there’s no estimate for 2024 yet. Based on my own outlook for the company in 2024 and applying a very low multiple in my view of the expected adjusted EBITDA yields a price of $1.85 at the end of 2023. I think it could be a lot higher. I am watching closely for potential entry in my model portfolios.

Be the first to comment