Sergiy1975/iStock via Getty Images

Thesis

United Rentals’ (NYSE:URI) share price has fallen since the beginning of the year, as equipment rental companies are traditionally heavily impacted by downturns. This is due to its construction related end-markets. In addition, rental companies are heavily indebted and could potentially need to refinance during a recession. Substantially all of United Rentals’ equipment is encumbered. The equipment’s value could fall in a recession scenario, reducing the liquidity available to the company at the wrong time.

Despite these substantial risks, the equipment rental industry is growing fast. More and more companies are renting equipment rather than owning it. Equipment rental companies are able to utilize equipment at higher rates, bulk buy at lower prices, attain asset backed financing and are able to repair and manage complex products that are requiring more and more product knowledge.

United Rentals is priced in line with peers, despite being the operator with the best margins and ROE. Whilst the industry as a whole is cheap compared to historic standards. They say you should be greedy when others are fearful. I believe this might be one of those times.

Company Overview

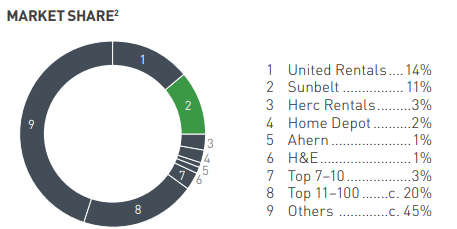

United Rentals primarily competes with Sunbelt which is part of the Ashtead Group (OTCPK:ASHTY), Herc (HRI) formerly part of Hertz and H&E Equipment Services (HEES). United Rentals is the clear market leader with 14-15% market share.

Industry Market Share (Ashtead Annual Report)

The industry overall is highly fragmented, and the biggest part of the market consists of small, independent businesses with one or two rental locations. The highly fragmented nature of the industry makes it hard for participants to exercise market power and raise prices.

United Rentals had revenues of $9.7 billion in 2021 and $8.5 billion in 2022, an increase driven by an increase in rental rates, time utilization and the mix of equipment rented.

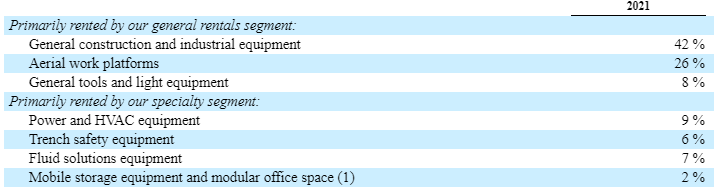

The company divides equipment up as General Rentals (76% of revenue) and Specialty (24% of revenue), per the 10-K. General Rentals include general construction and industrial equipment (42%), and aerial work platforms (26%) which are the largest sub-segments.

Equipment rental revenue by equipment type (Company 10-K)

The company has 1,345 rental locations, compared to 861 Sunbelt locations in the USA and 312 locations for HERC, and 102 for HEES.

Unit Economics

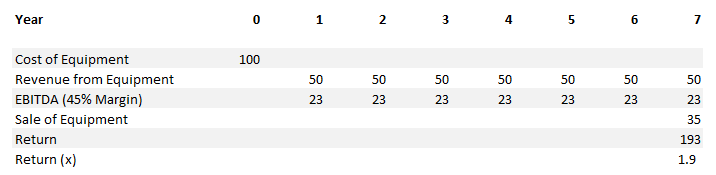

On a per unit basis, United Rentals will purchase an asset, rent it to customers through their platform and generate a revenue stream each year (on average, seven years) and then sell it in the second-hand market and receive a proportion of the original purchase price in disposal proceeds.

Assuming they purchase an asset for $100, generate revenue of $55 each year (equivalent to 50% dollar utilization) at a 45% EBITDA margin, and receive 35% of the original purchase price as disposal proceeds, they generate a return of $193, or more than 1.9x, on an initial outlay of $100 over a seven-year useful life.

Unit Economics (Author’s calculations)

Strategy

United Rentals stated in the most recent 10-K, that it is their strategy to provide good customer service, optimize the fleet, continue focus on “Lean” management techniques, expand specialty rentals and pursue strategic acquisitions.

Fleet Optimization

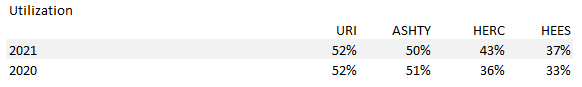

The utilization rate is one measure of how effectively a company is optimizing the fleet. The equation for utilization is annual revenue divided by the original cost of the equipment. United Rentals does not publish a utilization rate, but all its peers do.

I have estimated URI utilization below and I believe it to be the highest out of all the peers. I believe this is due to the benefit of United Rentals’ scale and the ability to utilize equipment across a wider number of customers and geographies. United Rentals also has the oldest fleet, which would also give them a higher utilization number.

Utilization (Author’s calculations and company financials )

‘Lean’ Management Techniques

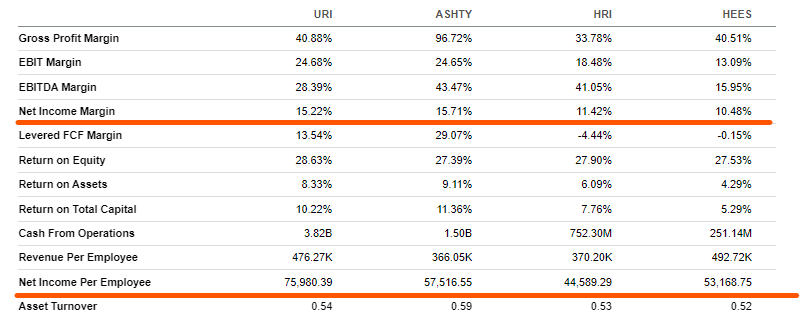

I believe you can see evidence of United Rentals “Lean” management strategy by comparing the number of employees the company has to its peers. The company has a net income per employee of $76,000, this is almost 70% more than that of HRI. The impact of the company’s cost control measures can also be seen on the bottom line. United Rentals has a net income margin of 15% in line with ASHTY, and well ahead of HRI and HEES.

Peer Margins (Seeking Alpha)

Acquisitions

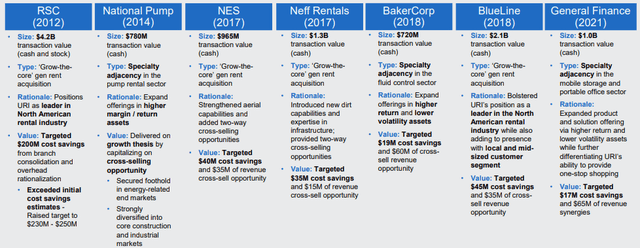

United Rentals have been the most aggressive acquirer in the space with more than $11bn of acquisitions since 2012. A number of the acquisitions were in the Specialty equipment focused and I expect this to continue.

United Rentals Acquisitions (Company Presentation)

Specialty Equipment

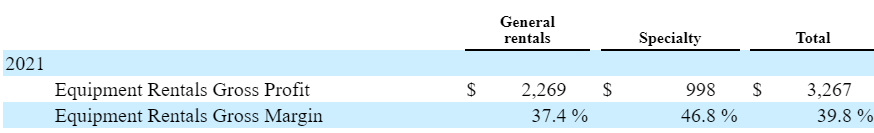

Specialty equipment include Power and HVAC, Climate Control and Air Quality, Scaffold Services, Shoring Solutions and Flooring Solutions. These products are still not as commonly rented versus bought by customers and are higher margin than the general rentals.

Segment Equipment Rentals Gross Profit (Company 10-K)

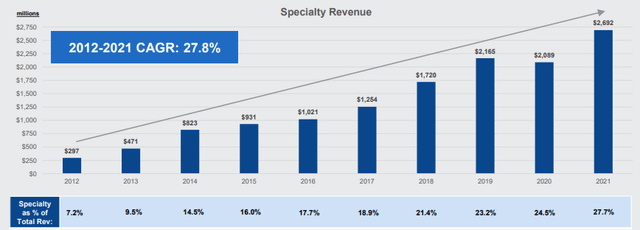

All the rental companies therefore see this as a higher margin growth area that they are trying to grow. In my view, United Rentals has been very successful at growing its Specialty business since 2012. It has both grown the Specialty business by 28% per year (with the help of acquisitions) and grown it to 28% of the company’s total revenue.

United Rentals Specialty Revenue (Company Presentation)

Risks

Cyclical Business

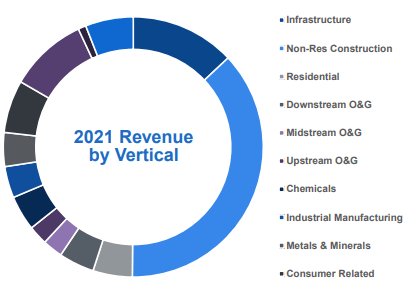

A large reason why United Rentals and its peers trade at such large discounts to the broader market is due the fact that they supply cyclical end markets. United Rentals’ end-markets consists of:

-

Industrial (50% of revenue) – this reflects revenue from manufacturers, energy companies, chemical companies, paper mills, railroads, shipbuilders, utilities, retailers and infrastructure entities

-

Non-residential (commercial) (46% of revenue) – reflect revenue from construction and remodeling of facilities for office space, lodging, healthcare, entertainment and other commercial purposes

-

Residential construction (4% of revenue)

Company end-markets (Company presentation)

The industrial and non-residential construction spending is driven by broader economic growth. Over the last 6 months, as we have entered a likely recession, there is an expectation the growth has slowed. Industry insiders look at the ABI index when determining the state of the non-residential market, and the index recently fell to 53.5 from 56.5 in April, any score above 50 indicates an increase in billings from the prior month

However, despite the recent slowdown United Rentals was able to survive the 2008 recession, which hit the construction industry particularly hard. I believe this was in part due to the fact that the non-residential construction market is a late cycle industry, allowing companies to cut back on capex when heading into a recession.

High Indebtedness

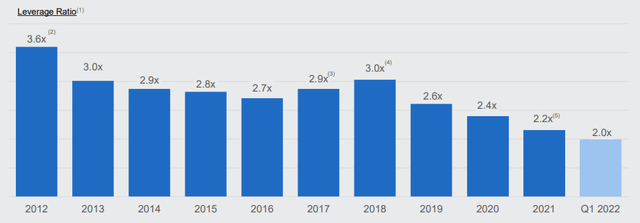

United Rentals has in recent years reduced its debt to EBITDA levels from 3.6x in 2012 to 2.0x in Q1, 2022. This is encouraging, however further analysis is needed.

Leverage Ratio (Company Presentation)

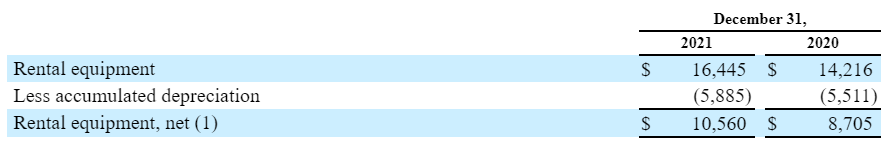

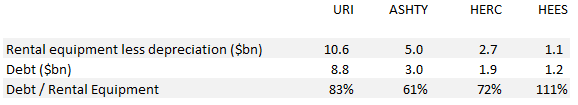

A key part of the equipment rental industry is getting cheap financing for the equipment that companies own and rent out. United Rental has said that substantially all of its equipment is encumbered. At year-end, United Rentals had rental equipment of $16.5 billion, which has been depreciated down to $10.56 billion.

Rental Equipment Book Value (Company 10-K)

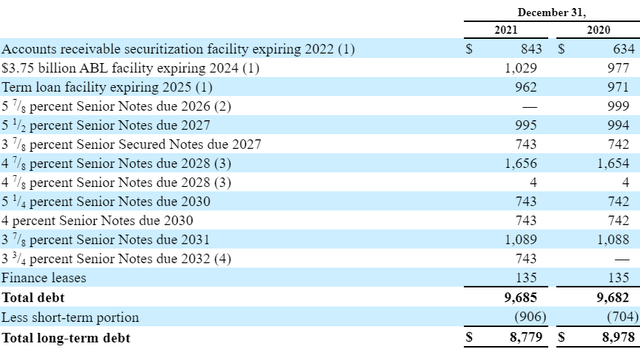

Against this, the company has debt of $8.8 billion outstanding. This comes to a ratio of 83% of debt to rental equipment. This is above HERC and Ashtead, but below HEES.

Debt as percentage of revenue (Author’s calculations and company financials )

When looking at the debt profile of United Rentals, 78% of the debt is due in 2027 and after. The company’s $3.75 billion ABL facility, of which $1bn was outstanding at year end, is only expiring in 2024. This gives me additional confidence that the company will be able to make it through a recession in the short-term.

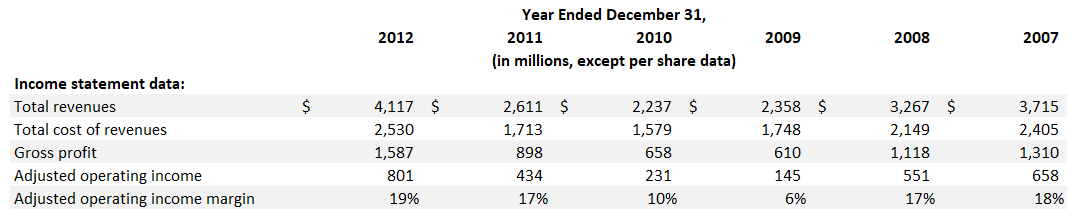

With the high possibility of currently being in a recession, I think it helps to look at what happened during the last extended recession. During the global financial crisis of 2008, the company’s revenue fell by 40% and adjusted operating income fell to 6%, at the lowest points.

2008 Recession Financials (Author’s calculations and company financials )

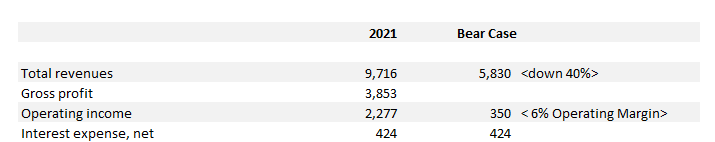

If we were to apply a 40% revenue fall and a 6% margin to 2021 financials would give us a loss of $74 million. Clearly not a good financial position, especially for a company carrying as much debt as United Rentals. One can see why the stock could trade down significantly if another extended recession was to come.

Bear Case Financials (Author’s calculations and company financials )

How then did United Rentals avoid going into bankruptcy?

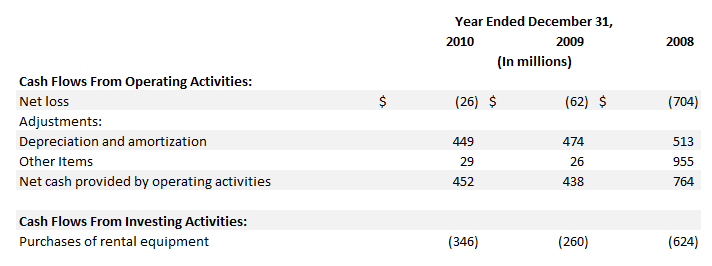

Remarkably, the company was able to remain free cash flow positive during 2009 and 2010 by cutting capex significantly. Capex fell from $624 million in 2008 to $260 million in 2009.

2008 Recession Financials (Company financials )

The rental market is a late cycle business. This gives companies a good degree of visibility and they can therefore plan accordingly and cut capex as United Rentals did in 2009.

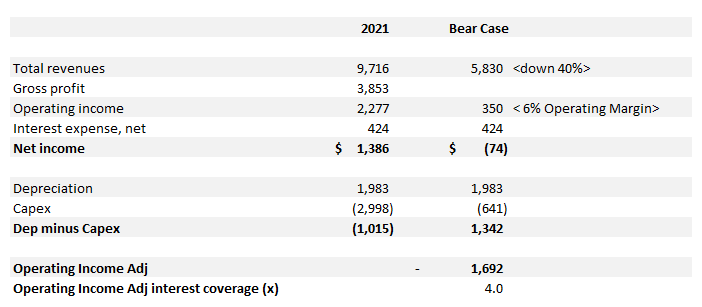

The company was able to cut capex to 11% of revenue in 2009. If we assume the same in a future recession scenario, this gives us $1.7 billion of free cash flow to cover interest payments of $424 million, or interest coverage of 4x. I believe this would allow the company to withstand another downturn like a financial crisis.

Bear Case Financials (Author’s calculations and company financials )

Inflation

United Rentals has the oldest equipment in the industry, which it will need to presumably update with much more expensive equipment, given the recent high inflation. This is indeed a risk and consideration.

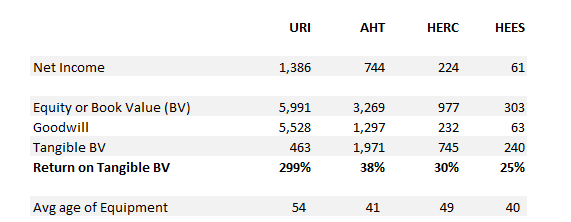

However, United Rentals’ use of older equipment also means that it can operate with higher ROEs. This is not obvious when looking at regular ROE, however if you adjust for the large amount of Goodwill that United Rentals had (due the acquisitions), it becomes clear.

I believe ASHTY does better on the ROE metric than its age fleet would imply due to its higher level of Specialty equipment rentals, which is higher margin. Specialty makes up 55% of ASHTY’s UK revenue.

ROE and equipment age of peers (Author’s calculations and company financials )

Industry Overview

Rental Market Growth

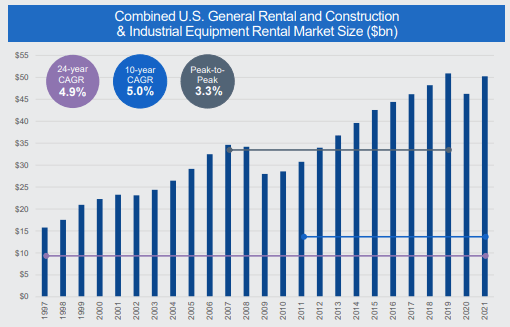

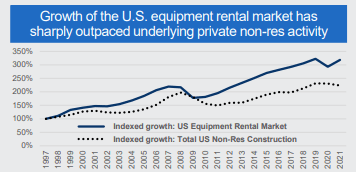

The equipment rental market has been growing at approximately 5% over the last 10 years and at 4.9% over the last 24 years. This is higher than the general non-residential construction market. The faster growth for the equipment rental companies has been due to their ability to utilize equipment at higher rates, bulk buy equipment at lower prices and attain cheaper financing.

The positive industry dynamics haven’t gone unnoticed with Terex, CEO recently saying, “their business model is winning“.

U.S. General Rental and Construction & Industrial Equipment Rental Market Size (Company presentation)

U.S. equipment rental market versus private non-res activity (Company presentation)

I expect this trend to continue going forward as many users are more reluctant to buy equipment and rent instead. This is in part due to the increased uncertainty following the pandemic and stock market pull-back.

Also, more complex equipment and maintenance have also caused more operators to decide to rent. Finally, the significant cost inflation in recent years associated with the replacement of equipment, makes renting more economical.

United Rentals expects the North American industry to grow by 10% in 2022 and 4% in 2023, per their latest 10-K.

Consolidation

Since 2010 the market share of the top 10 rental companies in the US has increased from 20% to 36%. Looking forward I do believe the industry will continue to consolidate. Larger equipment rental companies have a number of distinct advantages over smaller ones. Their large and diverse rental fleets allow them to serve large customers that require substantial quantities and wide varieties of equipment across state lines.

Also, larger players should have higher margins as they benefit from purchasing power when investing in new equipment. Fleet sharing across multiple branches increases equipment utilization as equipment that is idle at one branch can be marketed and rented through other branches.

Valuation

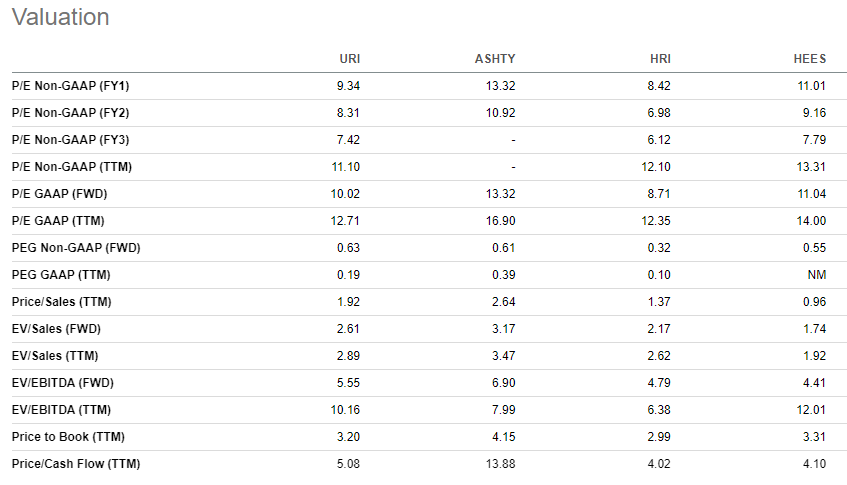

United Rentals has been trading at a discount to the rest of the market over the last 10 years, during which the company has had an average Fwd P/E of 11x. The company’s current valuation of 9x, would indicate investors are worried about a possible extended recession on the horizon.

Given United Rentals’ ability to service clients, keep costs down and allocate capital efficiently they should trade at a very least, in-line with their peers. Instead, it is trading below ASHTY and HEES. If you look at an EV/EBITDA multiple URI is trading higher than the other peers with the exception of HEES. However, it still trades in line with the sector.

Valuation metrics (Seeking Alpha)

Conclusion

United Rentals share price has fallen recently. The company is traditionally heavily impacted by downturns, due to the volatility of the end markets, being heavily indebted.

However, I believe United Rentals will be able to manage the next downturn comfortably. The equipment rental market is growing and consolidating. Equipment rental companies are able to utilize equipment at higher rates, bulk buy equipment at lower prices, attain asset backed financing and are able to repair and manage complex products that are requiring more and more product knowledge.

United Rentals is fairly priced compared to peers, despite being the operator with the best in class utilization and its low cost operator model. Given the company’s excellent execution, the growing industry and fair valuation, this stock should be part of your portfolio.

Be the first to comment