Leonid Sorokin

I visited England recently. It was my first time in that beautiful country, and I can’t say enough good things about it. Something interesting happened while I was in the U.K. The Bank of England “BoE” announced it was going ahead with quantitative easing “QE.” The central bank plans to buy up to 65 billion pounds of government bonds to shore up the British economy. That’s roughly $72 billion by today’s exchange rate, and provided that the U.K.’s population is around 67 million, it’s approximately the same as announcing a $355 billion QE plan in the U.S.

Moreover, the latest round of the BoE’s QE comes on top of the massive 875-billion-pound bond-buying programs the central bank has launched since the financial crisis of 2008. With the U.K.’s inflation rate hovering around 10%, it’s no wonder that the pound is trading at its lowest point against the buck in more than 35 years. The BoE has made several 50 basis point increases since tightening started in late 2021. With the benchmark now around 2.25% and inflation around 10%, the BoE is the first major central bank to return to easing.

With the BoE’s recent “Pivot,” there’s been much discussion about a “Fed Pivot” in the U.S. The S&P 500/SPX (SP500) even rallied about 7% off the lows. Some market participants began discussing a possible bottom to the bear market and that stocks were setting up for a big move higher. However, the non-farm payrolls report came out on Friday, and the U.S. added 263K more jobs (better than the 250K expected). Additionally, the U.S. unemployment rate decreased to 3.5%, illustrating remarkable resistance and strength in the U.S. labor market.

This better-than-expected jobs report threw a bucket of cold water on any near-term hopes for a pivot, and the stock market sold off. As the probabilities for another 75 basis point hike increased to around 80%, stocks tanked, with the DJIA dropping by more than 600 points, the SPX sliding by 2.8%, and the Nasdaq sinking by nearly 4% in Friday’s session. While the Fed should pivot eventually, it’s not likely to happen now but after the stock market drops significantly.

Jackson Hole Bearish Symposium

Ever since the Fed’s Bearish Symposium out of Jackson Hole, it became clear that stocks had a significant downside ahead. One statement, in particular, stuck out in my mind. The Fed Chair indicated that the dynamic of high-interest rates, slower growth, and a worsening labor market would bring pain to households and businesses. While we are seeing higher interest rates and slower growth, the full effects of the bearish dynamic have not been felt and are not priced in yet. Inflation remains very elevated (the last CPI reading was 8.3%).

Moreover, the labor market remains relatively healthy, and we’ve yet to see any meaningful deterioration. Therefore, the Fed will continue raising interest rates to around 4% in early November and probably higher after that. Furthermore, I don’t see the Fed following in the BoE’s footsteps. On the contrary, the Fed has pledged to continue with QT, and we have accelerated to about $95 billion in monthly bond sales. Thus, we will not likely see a quick pivot, and there will probably be more pain and downside ahead for most stocks.

How it May Play Out in The Near Term

It’s challenging to predict what will happen in a bear market several months from now, so it may be better to stay focused on the near term. We have the November Fed meeting in about 23 days, and earnings season is about to kick off this week. Technically, the SPX, other major averages, and stocks, in general, are in a vulnerable spot. We also saw earnings soften last earnings season, and many companies warned of slowdowns and provided lower guidance. Therefore, we could see increased volatility going into earnings season and the upcoming FOMC event. As a result of the increased volatility, we could see another technical breakdown and a drop-down to new lows.

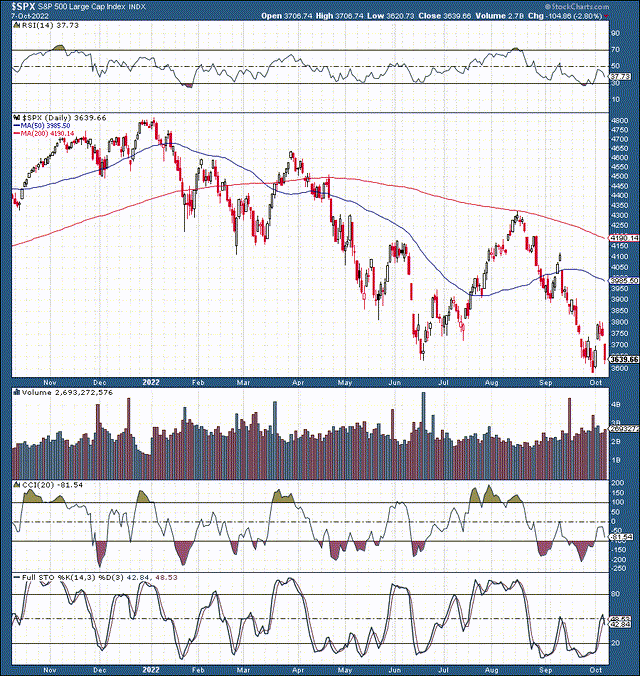

SPX 1-Year

SPX (StockCharts.com)

We saw a new low recently as the SPX tested below 3,600 for the first time in this bear market. Then we got the BoE pivot, and the market rallied a bit on the expectations that the Fed could follow. However, now that the pivot hopes are fading, we will likely see new lows materialize soon. If the 3,600 support level breaks down decisively, we will likely see the SPX fall to the 3,300-3,200 support range next, roughly 8%-10% below current levels.

Looking for Opportunities

Markets don’t move in one direction, and sharp selloffs create buying opportunities, even in bear markets. While I expect a sustainable bottom may materialize around the 2,800-3,000 level in the S&P 500, we should get another substantial buying opportunity at the next major low around the 3,300-3,200 level. Therefore, I’m looking at some high-quality, badly beaten-down companies to get even cheaper from here before I buy more.

Several Stocks on My Buy List

The “chip stocks” may be a great place to start looking for deals. Companies like Advanced Micro Devices (AMD), Nvidia (NVDA), and others are going through temporary earnings declines, and this is typically the best time to start buying.

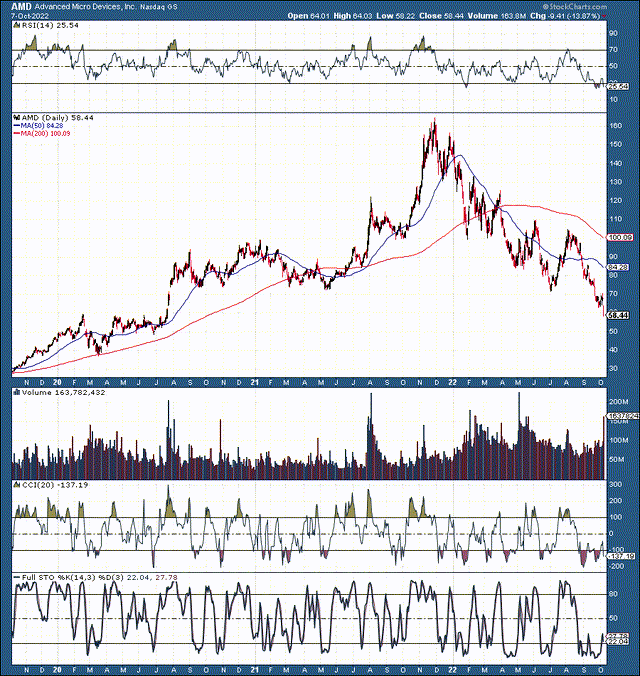

AMD 3-Year Chart

AMD (StockCharts.com)

AMD is now down by 65% from its high last year, and the stock is trading below 15 times forward earnings estimates. AMD is back down to its pre-coronavirus highs. The stock dropped below $60 recently due to disappointing preliminary results. While we could see additional transitory downside in the near term, and AMD could fall into the $40-50 range, there’s a high probability that shares won’t stay depressed for long, and AMD’s stock could be significantly higher several years from now.

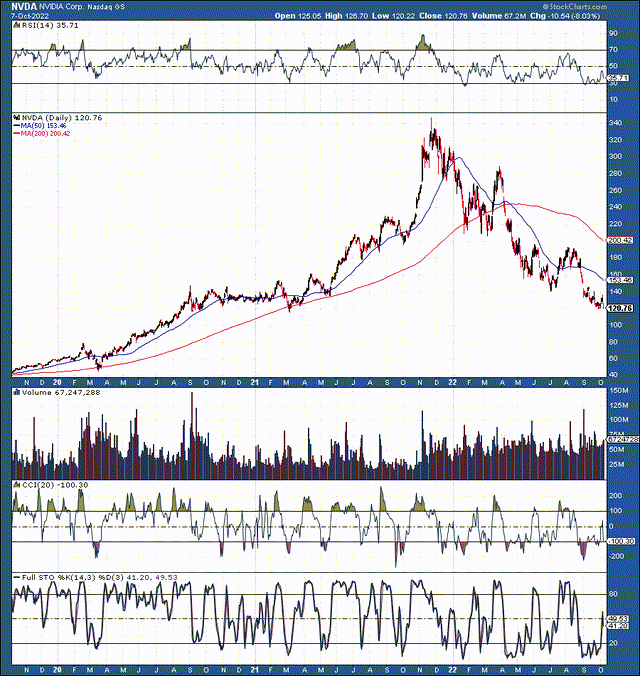

Nvidia 3-Year Chart

NVDA (StockCharts.com)

Nvidia, another Wall Street darling that’s been taken out to the woodshed, also is down by 65% from its high last year. Like AMD, Nvidia is going through a transitory earnings decline phase, and its stock price should rebound substantially once the company returns to growth in the coming years. While it may be early to call a bottom in Nvidia shares at around $100, the stock should be trading at only approximately 20 times next year’s earnings estimates, making Nvidia one of the best buys in the market if it heads down to par.

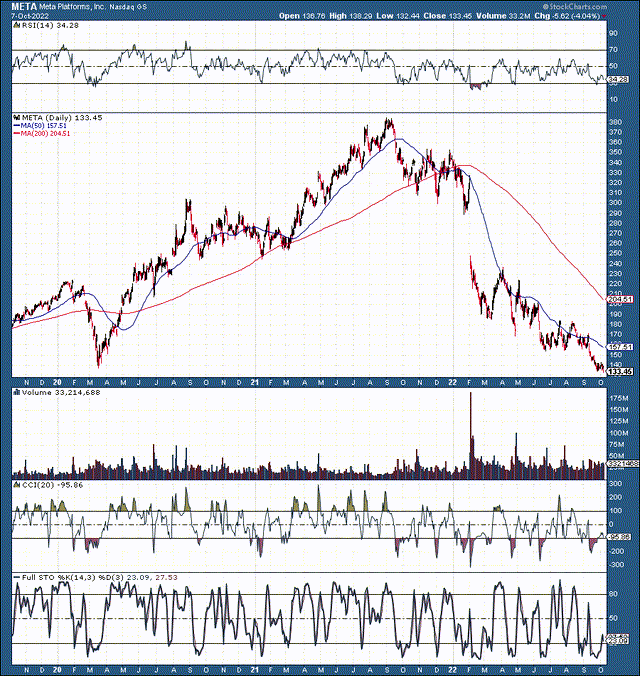

Meta (META) 3-Year Chart

META (StockCharts.com)

The next company is not a chip stock, but I want to talk about Meta Platforms. Meta is down to its post-coronavirus low. The stock is down by a staggering 67% from its high last year. Moreover, shares are now trading at around 12 times next year’s earnings estimates, possibly making Facebook one of the market’s best intermediate and longer-term buys.

Other Strong Buys in the Tech Sector

Alphabet (GOOG), (GOOGL) – Down by around 37% from its high and trading below 20 times this year’s earnings estimates now.

Roku (ROKU) – Roku is down by a whopping 88% from its top, and the stock is down to only about two times sales now. While there could be some transitory downside in the near term, Roku’s shares could be much higher several years from now. The company has significant growth and earnings potential, and there’s a probability of a potential buyout.

Netflix (NFLX) – Netflix is one of the world’s best streaming platforms and content creators, and its stock is down by about 68% from its high last year. Netflix has significant earnings growth potential, and its stock is trading at only about 20 times forward EPS estimates.

The Takeaway

These are just several examples, and I’ve only mentioned several high-quality tech stocks. There are many compelling buying opportunities in technology and other sectors. Other sectors I prefer include materials, industrials, metals, gold/silver, financials, and defense. We may see another leg lower into earnings and the FOMC event. Thus, we should consider hedging our current positions and look for opportunities to buy high-quality, badly beaten-down stocks when they trade down to lower levels. While this may be an appropriate time to open partial positions (with hedges), a better buying opportunity should materialize in the coming weeks as earnings and Fed-related volatility will likely persist in the near term.

As far as the “Pivot.” The Fed will pivot eventually, but it probably won’t be until we see some real fear and panic in the market. We also need to see inflation come down a bit. I don’t see the Fed pivoting with inflation around 7%-8%. We probably need to get well into 2023 before inflation begins coming down to acceptable levels, and the stock market will likely be lower by then (3,000 or lower). Therefore, we could start expecting a pivot (realistically) with the SPX at around 3,000 or lower in early to mid-2023. Also, we should look for a market bottom several months before the actual pivot in monetary policy occurs. Therefore, we could see the stock market bottom form in late 2022 to early 2023.

Be the first to comment