SeanShot

The first time I heard about Moody’s (NYSE:MCO) was the first time I heard about value, from a seminar given by a fund manager who used MCO in all the case studies. His view was that it was an unimpeachable business model that could basically be forecast into perpetuity: the ultimate value profile. It has what I call the DCF premium, which is where generous DCF assumptions in a low WACC environment guide a stock’s price because the business model is highly predictable. With the current rate hike environment really hitting its credit rating business, and with the refinancing conditions only worsening, DCM is looking to be in an enduring depression. The credit rating business has operating leverage and is where MCO gets margin. MCO has nothing going for it in the medium-term.

Q2 Update

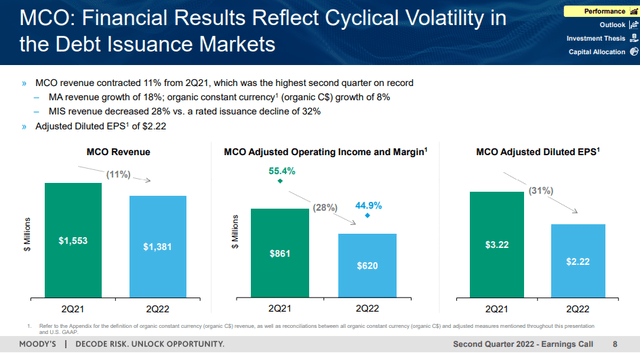

The results were somewhat in line with what a lot of financial players were seeing as transaction volumes declined. Operating income declined 28%, but revenue only declined 11%. The 11% decline comes out from a 28% revenue decline in the credit rating business of MIS, which gets offset by an 18% increase in the Moody’s Analytics business which accounts for about 33% of revenue.

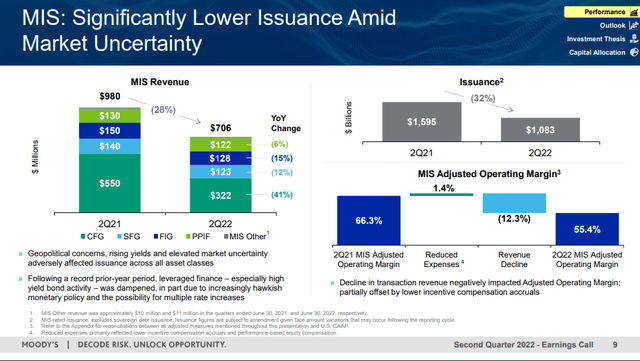

The MIS segment really had pretty dismal performance. The decline in issuances was very much consistent with what we’d seen among other financial players in their DCM businesses, and operating leverage in MIS meant that operating income declined almost 50%.

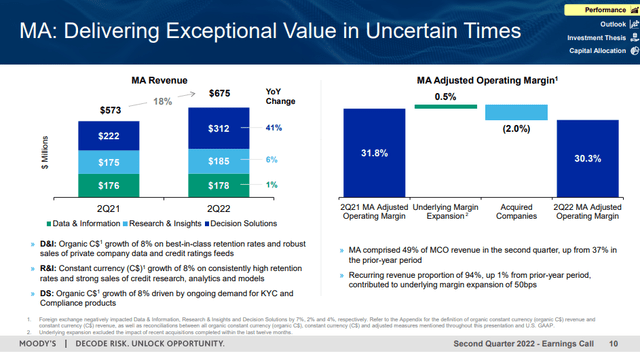

The only saving grace was the MA segment, which has about half the margin of the MIS segment, and therefore accounts for only about 14% of operating income. The D&I business saw particularly strong increases to drive overall segment revenue. The credit assessment tools saw good growth, especially CreditLens.

There’s no question that the MA products and services are generally useful, but their mix effects are pretty unhelpful due to the lacking margin.

Remarks

While the MA segment growth seems rather sustainable, MIS continues to be a major problem for several reasons. Firstly, MCO trades at almost more than a 25x PE. That implies a very weak 4% earnings yield which is barely above the reference rate. Indeed, the multiple implies that the business is virtually looked upon as a perpetuity. The risks of MIS certainly cannot be equated to government treasuries, since issuance declines could very well continue, which leads to the second issue: the MIS segment is actually somewhat likely to decline some more, and the 30% declines this quarter in issuance are guided to continue for all of 2022.

Even worse, these declined levels are likely to persist for years. Consider the financing decision of companies. With rates surely rising, companies have probably already upfronted their refinancing activities as is, especially since a large bulge of maturities come in the next couple of years. Companies would not want to be forced into refinancing at even higher rates. What’s more is that even if rates peak in the next year or two, which they might not because the global economy still needs to pay with inflation for economic disintegration and geopolitically induced supply chain issues, companies are likely to delays further on the trend down in rates in anticipation of even better financing conditions.

While some DCM activity is assured at debt maturity, companies do have discretion to finance with their own cash flows and deleverage, especially in these intermediate years. While companies in distress might not be able to do that, the majority of companies are likely to be more or less fine, and far from solvency concerns even in a recession. Moreover, the ability for sponsors to deploy credit in their investments are much less likely to recovery due to the importance of leverage as a lever in returns in our high multiple environment. Massive dry powder reserves in private markets are keeping multiples in PE high, so the leverage penalty induced by higher rates will definitely affect buyout activity in particular. The age of the mega-deal is probably over.

While MA will grow and somewhat bolster the revenue situation, the loss in revenue in MIS will mean depressed profits. The company claims a restructuring effort will restore 10% to the operating profit line, but that could take a while and also depends on execution. With further declines possible in MIS, on top of a likely persisting lower level of profit, MCO looks worse off than a lot of financial players despite its privileged market position. Overall, not an interesting stock at all especially at perpetuity valuations given little scope for profit growth.

Be the first to comment