Spencer Platt/Getty Images News

No matter how much the Fed has tried, the market still doesn’t believe how serious the Fed is about bringing down inflation. The Fed has consistently said that it plans to raise rates to restrictive territory and hold rates there until there are clear signs that inflation is heading lower.

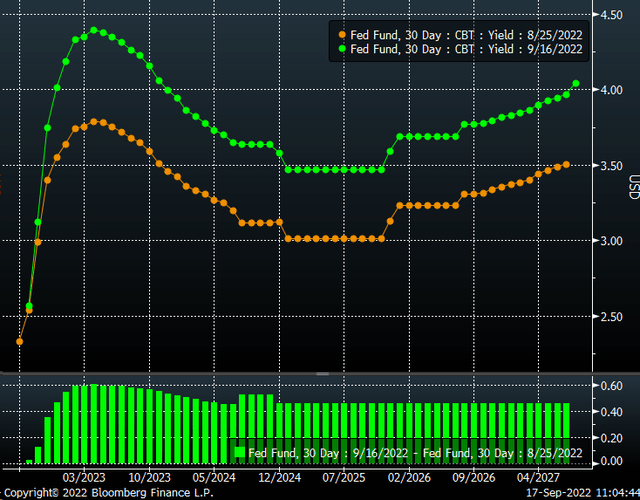

Yes, the Fed made a massive attempt to rein in the markets at Jackson Hole and hammered the point further in the days after Jackson Hole. Now, it needs to seal the deal. Yes, the market has started to buckle, but not enough. Fed Funds futures have repriced rapidly and now see terminal rates hitting nearly 4.4% by April.

Markets Still Don’t Believe The Fed

But still, the market is pricing in rate cuts by the end of 2023 and sees rates falling back to 4%. So yes, while the market agrees that rates need to go higher, it still believes the Fed will be cutting rates by around 40 bps by the end of next year. The spread between the April 2023 Fed Fund futures and December 2023 contracts on August 25 was 32 bps. The current spread suggests the market believes the Fed may be more aggressive in cutting rates next year.

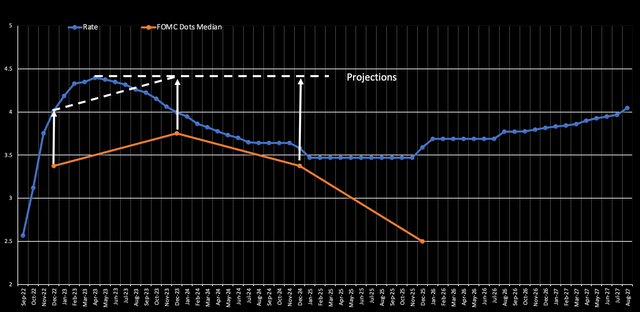

Sure, the Fed is making progress on higher rates, but the market doesn’t believe that the Fed will be holding rates at the terminal level. That is where the Fed needs to finish what it started at Jackson Hole, and the best place for the Fed to deliver that final blow will be in its Summary of Economic Projections, or dot plots.

Higher For Longer

If the Fed wants to make its point clear, it will need to ensure that it not only sees rates getting to 4.4% or higher by the middle of 2023 but that it sees rates staying there for all of 2023 and perhaps through 2024. That is the message the Fed needs to send the market so that the Fed Funds futures begin repricing with that terminal rate holding at 4.4% so that the back of the futures curve lifts.

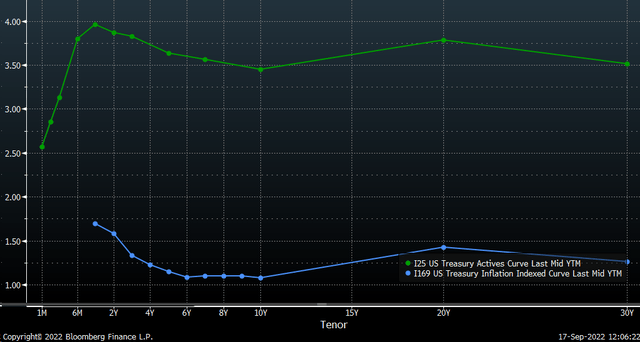

It is a critical message because if the Fed can deliver it, it would help to reprice the Treasury and Real Yield curve, pulling longer-term rates higher. It would help to steepen the yield curve, especially on rates beyond the 2-year, where a clear inversion occurs on both nominal and real yields.

This curve reshaping would be very bullish for the dollar and help it continue strengthening over the euro, yen, and yuan. Meanwhile, it would be bad news for risk assets, especially stocks, as rising real yields would weigh heavily on equity valuations.

No Room For Error

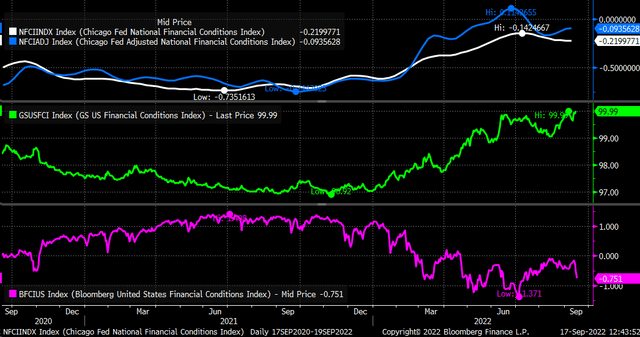

The Fed can’t afford to have the same disaster at the July FOMC meeting, which made financial conditions materially ease. As much as financial conditions have tightened since Jackson Hole, they have not tightened enough. The Chicago Fed Financial Conditions Index (NFCI) and adjusted NFCI is still well below their late June highs, while the Bloomberg Financial Conditions Index (the measurements are inverted) has also failed to get back to June levels. The Goldman Sachs US Financial Conditions Index is the only index that shows financial conditions have tightened back to their June levels.

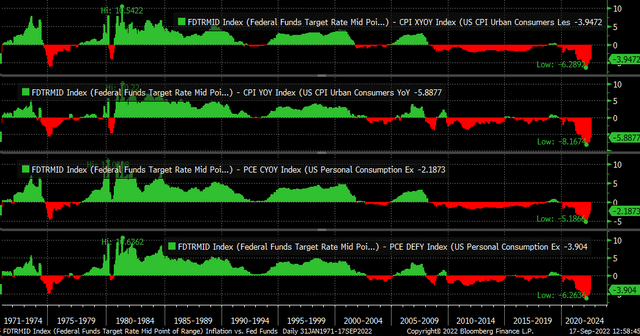

The Fed cannot afford to get further behind the inflation battle and needs rates to continue pushing higher and financial conditions to tighten further. The Fed is still very much behind in bringing inflation down. The Fed Funds rates are profoundly negative against the inflation rate on CPI and PCE measures, including or excluding energy.

The Fed Needs To Break The Market

This is the Fed’s battle, and it needs the market to align with its view if it has any chance of bringing inflation down. Because the Fed can only really move the front of the yield curve, but through communications and projections, it can heavily influence the longer-dated side of the curve, and that is the part of the curve the Fed has struggled the most with.

So while stocks may rise sharply if the Fed only delivers a 75 bps rate, don’t be surprised if that rally fades quickly if the Fed can provide a hawkish message through its forward guidance. That is where the Fed can finally shock the markets and get them to break.

Because for the first time in many years, it may be the market that finally gives into the Fed, not the Fed giving into the market.

Be the first to comment