Zerbor

Article Thesis

Fears about a recession and an overall weak equity market have made the stocks of many energy midstream companies drop considerably in the recent past. That holds true despite the fact that the macro environment is very positive for these companies right now. Income investors have the chance to load up on high-yielding pipeline players, which is why we pitch Energy Transfer (NYSE:ET) and its 9% yield versus MPLX (NYSE:MPLX) and its 10% yield in this article in order to see which one is more attractive right here.

The Macro Environment For Energy Midstream Companies Is Compelling

Right now, the world is experiencing a massive energy crisis. Growing energy hunger following the pandemic, underinvestment in new production over many years, and supply disruptions caused by the current Russia-Ukraine war explain why energy prices have soared around the globe. This holds true for coal, natural gas, oil, and even electricity. In this environment, the companies that make money by supplying these commodities are highly profitable. But infrastructure players that offer pipeline and storage services benefit as well, in several ways.

First, due to massive energy hunger around the world, their services are in high demand. Pipelines are easily filled as producing oil and gas and moving those commodities to demand centers is highly profitable. The strong profits for upstream and downstream players in the energy space mean that counterparty risk for midstream infrastructure players has declined to a very low level — with Exxon Mobil (XOM) and others generating record profits, infrastructure players don’t have to worry that these energy companies won’t pay their bills.

At the same time, midstream companies benefit from high inflation rates. Many fee-based contracts are CPI-linked, which means that the cash flows that the pipelines of ET, MPLX, and others generate will be growing considerably. High inflation also makes the value of the underlying assets increase over time — those are “real assets”, after all. Since debt has been locked in at lowish rates, interest expenses are not rising a lot in the near term, which results in debt getting inflated away in real terms, as most midstream players pay far less than 8% on their debt.

Energy Infrastructure Has Been Sold Off

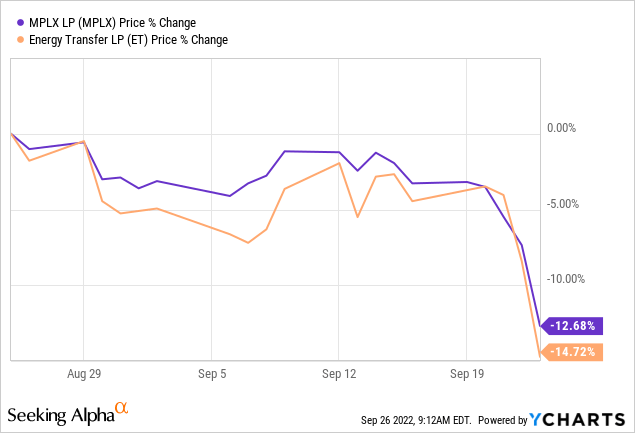

One can thus argue that the macro environment for energy infrastructure companies, including MPLX and Energy Transfer, is one of the best in many years. And yet, their stocks have sold off in the recent past:

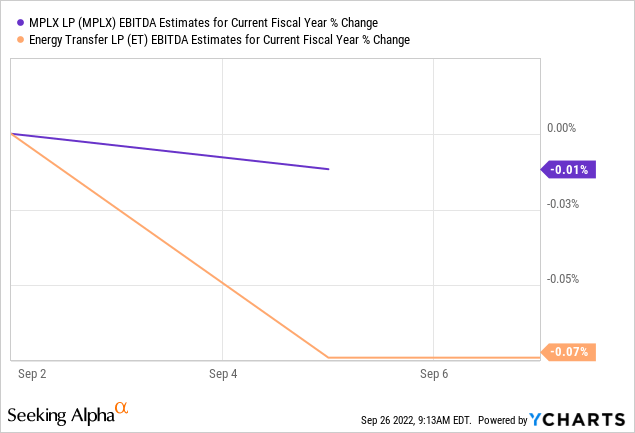

Over the last month alone, MPLX and ET have dropped by double-digits. Their business prospects have not declined to the same degree. In fact, ET’s and MPLX’s forecasted EBITDA for the current year is essentially flat in the same time frame, as we can see in the following chart:

There thus is a clear discrepancy between how the outlook for the two businesses has changed, and the performance of these two stocks. The discrepancy can be explained by the indiscriminate selling of equities due to the ongoing correction. At the same time, forced selling by energy ETFs also seems to play a role in the weak performance of energy infrastructure players, even though the outlook for their businesses has not really changed. For enterprising investors, this disconnect provides a compelling buying opportunity, we believe. After all, buying stocks that have dropped without a good reason can make for attractive entry points and compelling starting dividend yields. Both seem to be the case with MPLX and ET.

MPLX Versus ET: Pros And Cons

One can of course argue that energy midstream as a whole is an attractive sector right now and opt for an ETF, although leveraged ETFs are risky and it could thus be a good idea to avoid them. For those that opt for individual stocks, which I personally prefer, we’ll look into the pros of MPLX and ET — two high-yielding midstream infrastructure players that are both attractive.

Income Consistency And Growth

Both companies offer high dividend yields, with MPLX offering a slightly higher yield right now. That being said, ET’s 9% dividend yield is also very attractive, although slightly lower than MPLX’s yield. But high yields alone do not make for great investments, as reliability and growth need to be considered as well.

Energy Transfer angered many (former) investors when it decided to cut its dividend in half during the midst of the pandemic. MPLX has fared better, as it didn’t cut its dividend during the pandemic. Even better, it actually increased its payout in both 2020 and 2021, maintaining its dividend growth streak even during this crisis.

MPLX thus clearly wins out on dividend reliability and when it comes to management being committed to the dividend. ET, however, has more dividend growth potential, one could say. The company’s management team has stated repeatedly that bringing the dividend to pre-crisis levels was its top priority. The company also has hiked the dividend by a combined 53% over the last year, which is more than the dividend growth delivered by MPLX. If Energy Transfer increases the dividend to the pre-pandemic level of $1.22, that would mean another 33% in dividend increases from the current level. ET could achieve that over the next year if its recent dividend growth pace is maintained. MPLX will most likely not deliver similar dividend growth.

Overall, MPLX is thus the more conservative income investment. Energy Transfer has a weaker track record but more potential, making it the more aggressive, or higher-risk/higher-reward income from a dividend growth perspective.

Balance Sheet Strength

Balance sheet strength matters due to two reasons. First, it helps protect a company during an industry downturn (although energy is experiencing a favorable macro environment right now). On top of that, balance sheet strength also matters due to the fact that rising interest rates will make high debt loads more costly over time.

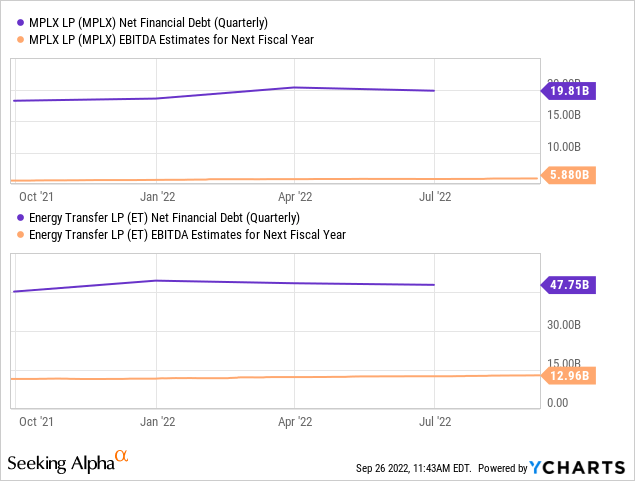

When we look at each company’s debt load and the forecasted EBITDA for next year, we see that MPLX is more conservatively financed. Its net leverage ratio is 3.3, which is far from high for an infrastructure company with strong cash flows and low capital expenditure needs. ET is more leveraged, sporting a 3.7x net debt to EBITDA ratio. When we adjust for some accounting items at ET, such as its partially-owned daughter entities USA Compression Partners (USAC) and Sunoco (SUN), its net leverage ratio is even higher, in the 4x range. That makes for a considerably weaker balance sheet relative to MPLX, but ET does still not seem overly risky from a financial health perspective. Its debt load has declined and its cash flows are high enough to pay growing dividends while bringing down debt further. With EBITDA likely growing over time due to fee increases etc. it’s highly likely that ET’s leverage ratio will decline further in the next couple of years — although it will remain higher than that of MPLX.

Again, MPLX looks like the more conservative, lower-risk pick, while ET has somewhat higher risk.

Valuation

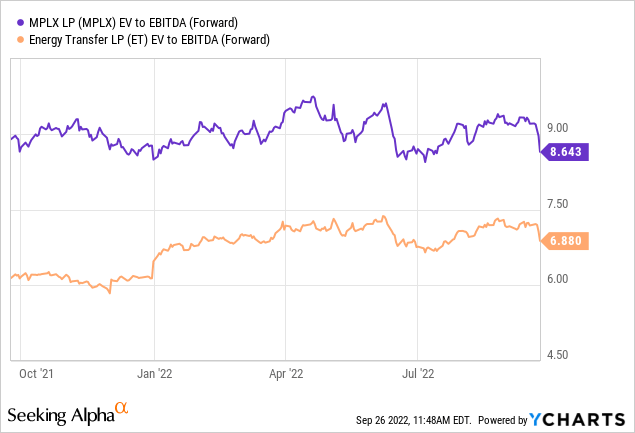

Quality has its price. That is reflected in the valuations of MPLX and Energy Transfer:

MPLX, with its better dividend consistency and stronger balance sheet, and arguably better management, trades at 8.6x forward EBITDA. That’s an inexpensive, although not outright cheap valuation, I believe. Energy Transfer has somewhat lower quality characteristics when it comes to balance sheet strength, dividend consistency, etc. It’s trading at a meaningful discount relative to MPLX, being valued at less than 7x forward EBITDA even when we account for its higher debt load by looking at enterprise value. ET deserves to trade at a somewhat lower valuation, I believe. But still, ET’s lower valuation also offers some opportunity — if the industry were to rerate to a higher valuation and 1x EBITDA would be added to each company’s enterprise value, the share price upside for Energy Transfer would be larger versus MPLX. This aligns with previous interim conclusions that ET offers somewhat higher potential rewards in case things go right.

Which Company Is Better?

I do believe that the answer to this question depends on one’s investment goals. Both companies clearly offer a compelling dividend yield today, with MPLX’s dividend yield being slightly higher.

MPLX looks like the better choice for more conservative investors due to its stronger balance sheet and more predictable income stream that was maintained and even grown during the pandemic.

ET is less predictable and riskier due to a more leveraged balance sheet. Its past dividend cut has shown that it’s a less reliable income investment. That being said, it would not be surprising to see ET grow its dividend more over the next year, as management seeks to reinstate the dividend to pre-pandemic levels. Its lower valuation also means that ET might have more upside potential once the market turns more bullish again.

MPLX could thus be the better pick for risk-averse investors, while ET looks more favorable for those with more appetite for risk. Overall, both companies look attractive at current prices, I believe. I own a stake in both, with more exposure to MPLX.

Be the first to comment