Kevin Dietsch

Introduction

Palantir (NYSE:PLTR) continues to attract the interest of SA writers with consistent Buy ratings on the notion that valuation has become compelling at under 7x est. 2023 revenue of $2.37 billion. Despite a more cautious stance amongst Wall Street analysts, the Street has an average price target of $10.4 implying a 40% upside from the most recent closing price. As appealing as shares may look at current levels, I remain bearish on the company’s fundamental outlook as management has never established a path to sustainable profitability. Instead, I believe those willing to own the stock are putting themselves on an uncomfortable path to wealth destruction.

Let’s start with the bull case

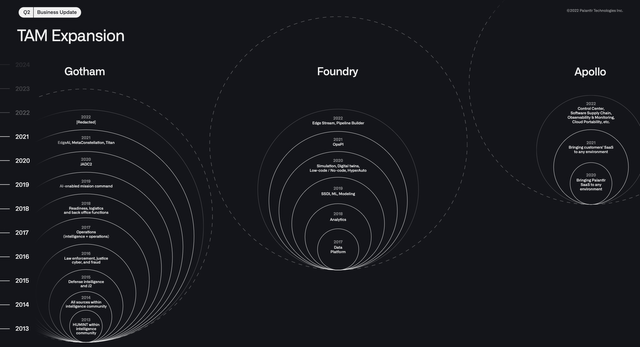

This is an article that not many people will enjoy reading so I will start with the bull case for Palantir as positive reinforcement is always more desirable than negative reinforcement in human psychology. Palantir is a fast-growing software company helping governments and companies analyze data using AI and machine learning and is a key beneficiary of the growing demand for data platforms driven by higher government needs to modernize their military intelligence systems. The company is a high-growth play in the software sector as management targets revenue of $4.5 billion by 2025, implying a 30%+ growth rate over the next several years thanks to its core products (Gotham, Foundry, and Apollo) that compete in a large and expanding TAM.

PLTR investor presentation

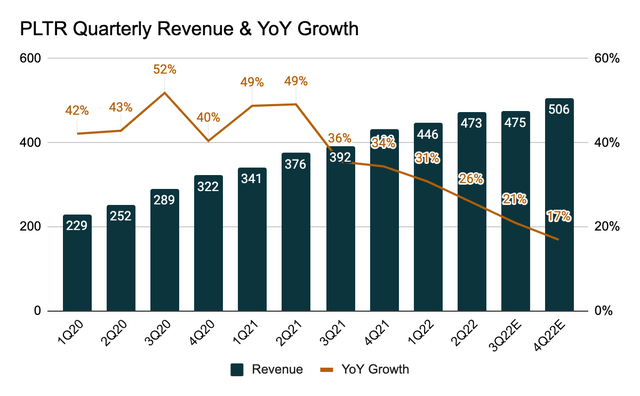

In 2Q22, Palantir reported revenue of $473 million (+26% YoY) that came in above Street consensus of $472 million. The beat was due to strong performance in the Commercial segment (~45% of total revenue) which grew 46% YoY while the US commercial business grew 120% YoY vs. 136% in 1Q22. The company added 27 net new customers and saw its total customers go up 80% YoY to 304 at the end of the quarter. Backlog was strong with RPO of roughly $1.2 billion which grew 79% YoY.

Company data, Albert Lin

While management provided disappointing 3Q22 revenue guidance ($474-$475 million vs. $500 consensus) and lowered its full year 2022 revenue outlook to $1.9 billion (+23%) vs. $1.95 billion consensus, the miss could be attributed to delayed US government contracts. On the bright side, the company is winning deals in the healthcare vertical which saw 91% growth on a 2-year CAGR basis to $153 million in the first half of 2022, with customers like Merck, UK NHS and Sanofi.

Although management did not reiterate its original target of 30%+ top-line growth until 2025, CEO Alex Karp remained confident on 2Q22 call that he would drive lead the company to $4.5 billion in revenue by 2025. In short, despite the macro headwinds and a softer government award environment in 2022, Palantir’s stock has experienced a meaningful reset during the market turmoil with an increasingly attractive risk/reward profile at just 6.5x 2023 sales.

Now the bear case

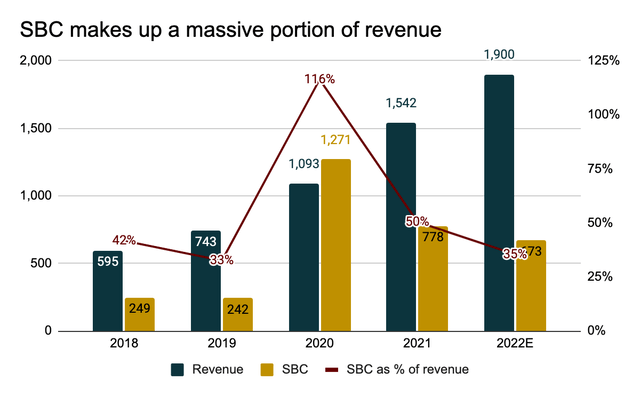

While Palantir may be able to grow its revenue at a 20%+ clip over the next several years, the bottom line is really where the bull thesis begins to fall apart. To start with, the majority of the company’s “adjusted operating income” is driven largely by adding back the indiscriminate provisions for stock-based compensation (SBC). It’s notable that in 2020, SBC of $1.2 billion was more than the $1.1 billion in total sales. As a percentage of revenue, SBC continued to remain at an elevated level at 50% in 2021 and is expected to be 35% in 2022.

Company data, Albert Lin

When a company is willing to pump up SBC as a way to attract top talents in the tech world, investors will only be okay with earnings deeply in the red if revenue growth can consistently outperform market expectations. Unfortunately, not only did Palantir lowered its revenue outlook for the year, adj. operating income guidance was a much bigger miss at $54-$55 million for 3Q22 (vs. $137 million consensus) and $341-$343 million for 2022 (vs. $521 million consensus). This comes down to an updated adj. operating margin of 18% (vs. 27% guided in Q1) for the current year, assuming SBC is completely disregarded as an expense item.

Company data, Albert Lin

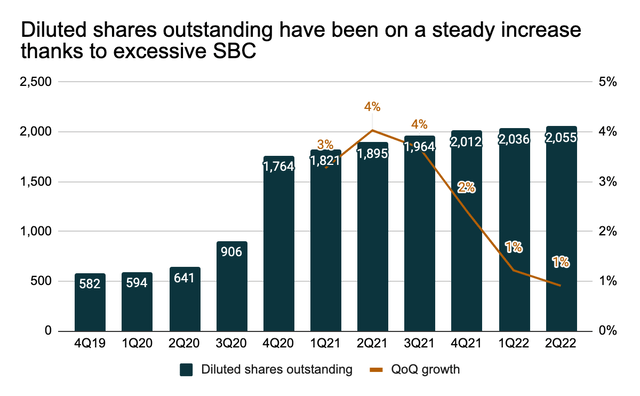

While the investment community likes to pretend as if SBC was never part of a company’s cost structure, shareholder dilution cannot be treated as something that never happened. Palantir’s diluted shares outstanding increased exponentially in the quarter following the company’s IPO in September 2020 and has been on a steady increase ever since.

Company data, Albert Lin

Though diluted share count growth has been moderating on a sequential basis, investors who have stayed with the stock through thick and thin have witnessed nothing but more dilution thus far. Put simply, not only has more water been added to the glass of whiskey on your hand, but you’ll also have to share it with more people. Even if Palantir’s net losses begin to improve from here, earnings are likely to be minimal on a per share basis.

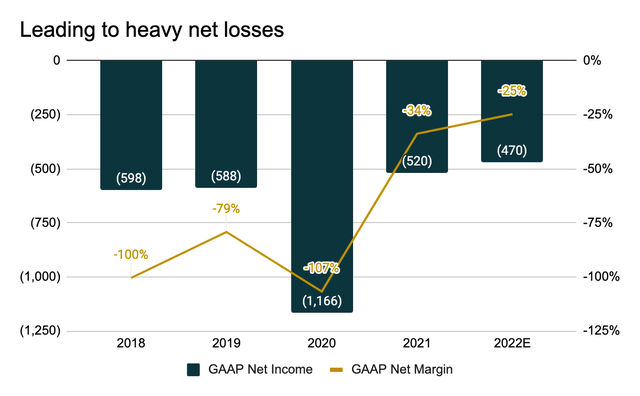

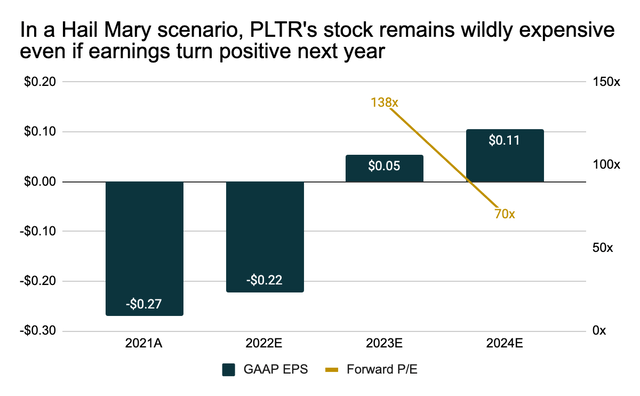

In 2022, Palantir is expected to deliver net income of negative $470 million (-25% net margin) on revenue of $1.9 billion (+23% YoY). Suppose the company can somehow engineer an earnings turnaround and deliver a 5% net profit margin (a Hail Mary scenario) on a GAAP basis, EPS will grow from -$0.22 to $0.05 in 2023 for a forward P/E of just 138x. Assume earnings are to miraculously double in 2024, investors will see a 70x forward P/E.

Company data, Albert Lin

But what if Palantir is the next Amazon (AMZN)? This is usually the part where growth investors will refer to success stories like Amazon and Netflix (NFLX) that had years of aggressive investments and minimal earnings before becoming juggernauts in their respective industries and made investors incredibly rich. While I admit I could be wrong about Palantir, I’d also point out the fact that the company has been around for 19 years and has NEVER turned a profit. For a business venture that has not been able to make money for almost two decades, what exactly gives investors the confidence that it will become a profitable growth story in the next decade? More importantly, how many more years of unprofitability will investors put up with Palantir until management finally discovers a viable path to profitability?

The rationale behind my Sell rating

My Sell rating on the stock is based on the notion that investors should treat any short-term rally as a selling opportunity to reduce or exit their position. For someone looking to short Palantir at current levels, this could be highly risky considering the stock has fallen a lot with the broader market and any irrational exuberance amongst Redditors on WallStreetBets could easily send the stock up 20% in one day. In addition, the company could become an acquisition target with just $15 billion of market cap. As terrible as market conditions are today, a software giant like Adobe (ADBE) didn’t seem to have any issues acquiring a competitor (Figma) for 50x ARR (analysis here).

Final thoughts

In short, I don’t see how an investment like Palantir will ever lead to any wealth creation as the company has generated nothing but consistent losses leading to a total accumulated deficit of $5.3 billion on the balance sheet. Unless Palantir can come up with a clear plan to make money without adding back stock-based compensation, markets will likely find more questions than answers when revenue growth eventually slows. As a result, I believe investors who remain bullish on the stock should ask themselves the following questions:

- Why is the stock a buy when prices of high-quality companies from Microsoft (MSFT) to Google (GOOG) have been declining with valuations becoming less demanding?

- Is management really acting in the best interest of shareholders by expanding the shareholder base with stock-based compensation?

- In the event that inflation falls back to 2%, will markets again be convinced of the company’s earnings quality based on adjusted operating margins and free cash flows?

2022 has been a difficult year for investors and 2023 will likely be another choppy year as the economy is walking into a recession (if not already). If it’s hard enough to make money investing in some of the best tech stocks in today’s market, buyers of Palantir are surely putting themselves on an uncomfortable path to wealth destruction.

Be the first to comment