Drazen_

Main Thesis & Background

The purpose of this article is to evaluate the Direxion Daily Small Cap Bear 3x Shares ETF (NYSEARCA:TZA) as an investment option. The fund is managed with an objective to “seek daily investment results, before fees and expenses, of 300% the inverse of the performance of the Russell 2000 Index.” What this means is that for each 1% move in the Russell 2000 Index, TZA should in theory move 3% in the opposite direction.

This is not a fund I have never owned, but it has caught my attention in 2022 because inverse index ETFs have had a very strong year. This is because markets are down across the board – large cap and small cap alike. Because of this, funds like TZA are up handsomely, with a YTD gain over 44% at time of writing:

YTD Fund Performance (Seeking Alpha)

With this in mind, I wanted to take a look at TZA at current prices to see if there was room for more upside. Certainly, when the market has been having a tough year inverse funds are worthy of at least some consideration.

However, after taking stock of the broader environment, I think the buy case for this one has passed for the time being. The 3X leverage makes this an inherently risky play, and that is not one I want to take at this juncture. Small cap stocks have a valuation edge over large caps, suggesting there may be better short opportunities elsewhere. In fairness, the Russell 2000 index (which determines TZA’s performance) has been very volatile. So this could make an inverse play on it profitable going forward. But this means investors will need to be very proactive and nimble with regards to entering and exiting this position, and that is just not something I would recommend for retail investors at this point in time.

A Quick Overview Of How TZA Works

To start, I want to give a quick overview of what TZA is in a bit more detail. As someone who does not typically don’t short the market, there are occasions when I will. However, direct “shorting” a stock or fund is not the path I would follow. I prefer to either buy put options or buy an inverse ETF, such as TZA.

There are straightforward reasons for this. A position in TZA is different than shorting a stock or index outright – which would involve borrowing shares to sell and then buying them back to cover the position after (hopefully) the price has decreased. The difference between the price you shorted at and the price you cover at is the profit (or loss). While it is an easy strategy to put into practice, I do not do this for two key reasons. One, timing a particular security is difficult, and I would rather just avoid a stock I don’t like than take on the risk of losses if my outlook is incorrect. Two, borrowing shares to short them involves trading on margin. This has its own costs by way of margin interest. With rates rising, so is the cost of margin, and that eats into potential profits, sometimes in a big way if the position is held for a while. For this reason, I would recommend either options trading or inverse ETFs as a way to short the market because it limits that expense. This is especially true in a rising rate environment, as margin costs are going up along with rates.

With that background, readers should note that TZA is an inverse fund of the Russell 2000 index. This is vastly different than the Dow Jones or the S&P 500. Those are large cap indices, whereas the Russell 2000 Index is a small cap stock market index. Within this index are the smallest 2,000 stocks in the Russell 3000 Index (based on their market capitalization). Therefore, followers of this fund should be more concerned with how small cap stocks are performing, rather than the larger cap indices that dominate market headlines.

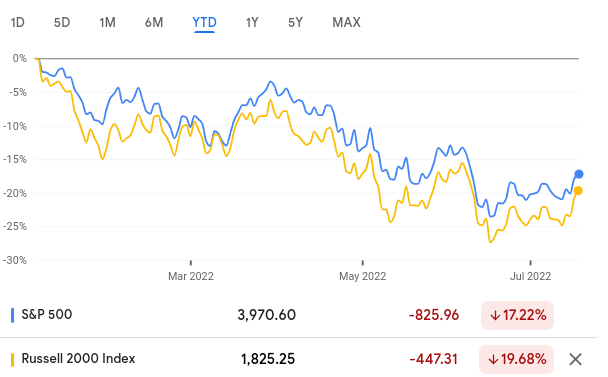

With this in mind, how has the Russell 2000 been performing? In 2022, so far, very poorly. In fairness, so has the S&P 500, and the moves have been pretty correlated. Still, it is worth noting that small caps have underperformed YTD:

YTD Performance (S&P 500 and Russell 2000) (Google Finance)

Therefore, we should acknowledge that TZA has been a big winner YTD. With the markets coming under pressure, TZA has benefited, and to a larger degree than if one was short the S&P 500 (since it is down by less than the Russell 2000). This is logical as investors have become fearful of a recession in the U.S., coupled with elevated inflation and a Fed rate hiking cycle. Small caps as a group are, on average, traditionally the most exposed to the domestic economy. So as the U.S. economy weakens – or investors predict it will weaken – the small cap index is going to be disproportionately impacted.

The conclusion I draw here is that if investors expect the U.S. to fall into a recession (or a deeper one if we are already in one now), than TZA is a smart way to play it. This fund should benefit more from U.S. weakness since small caps are most exposed to the U.S. economy, given that large caps often derive a higher percentage of their revenues overseas. This is a critical distinction.

Is There Still An Argument For Buying Here?

As I opened up this review, I mentioned I would not recommend buying TZA at this juncture. I do stand by this assessment, but before I get into the supporting reasons why, I would first balance out by mentioning that a buy case could certainly still exist. This statement is not meant to be confusing, but rather to point out some of the pros behind buying in at this level, which will be followed up by the cons. I try to present a balanced review on all the funds I cover, because a “buy” or “sell” argument is hardly ever a sure thing – there is always two sides to the coin.

In the case of TZA, why might someone want to buy it and therefore continue to be short the Russell 2000? The drop the index has already seen this year suggests a lot of downside has occurred already, but that doesn’t necessarily mean gains are on the horizon. The momentum for small cap equities this year has been firmly in the hands of the bears and that could continue in the second half of the year. If so, TZA is going to perform well.

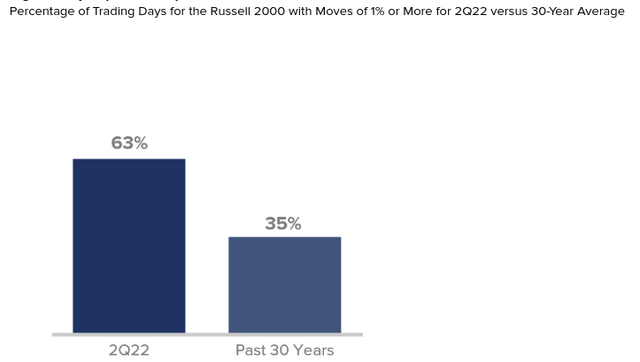

Another point to keep in mind is that volatility has been elevated this year as well. While the trend has been mostly down, markets have been very active. This opens up a justification for taking positions in TZA for trading. What I mean is, one does not necessarily have to have a longer-term bear market view of the small cap index. They could just expect outsized down days to occur going forward, in which case having a tactical position in TZA could make sense.

To understand why, consider that the Russell 2000 has seen a move of 1% or more on the majority of trading days this calendar year. In fact, almost two-thirds of days have seen such a move (or greater). If that sounds like a lot, it is because it is. While small caps tend to be more volatile on average, readers should note that in a typical year the Russell 2000 will only see a 1% move or greater in one out of every three trading days:

Percentage of Trading Days for the Russell 2000 with Moves of 1% or More (S&P Global)

What this suggests to me is that more volatility is probably likely in the near term. This elevated level of volatility won’t exist forever, but I can’t see an immediate change. This means that investors who are willing to try to time the market and have the ability to withstand swings (in both directions) could be well served here. Even if the broader trend is positive for the Russell 2000 over the next few months, this historically high level of daily swings means that TZA is likely to have some very strong days in isolation. Again, I must emphasize this is not a strategy I would suggest most retail investors undertake. But for those with a very risk-on mindset, a buy case in TZA could certainly be made as the underlying index is set to see a continuation of these big moves.

The Downside Risk Is Too High – Small Caps Are Cheap

I will now dig into some of the reasons why I would avoid TZA at the moment. I ran through why TZA has been performing well, as well as the scenario where it could continue to do so. Yet, this is not on my “buy” list, so I will dig into the rationale behind this.

A primary attribute telling me to steer clear of shorting the Russell 2000 is the valuation of small caps as a whole. While most of the equity market has seen valuations narrow as stock prices have fallen, small caps now seen to offer a relative bargain. In fact, when we compare small caps to large caps at this juncture, we see small caps have a much lower P/E ratio:

Small Caps Trading at Cheaper Valuation (Bloomberg)

To me this suggests shorting here is too big a risk. Valuations in small cap equities are rarely this low, and that tells me now is the time to buy, not go short. While the economic picture is mixed, this backdrop is not ideal for a 3X inverse play on a major index. Could it pay off? Of course. But the risk here seems too high to justify.

The Labor Market Signals Strength

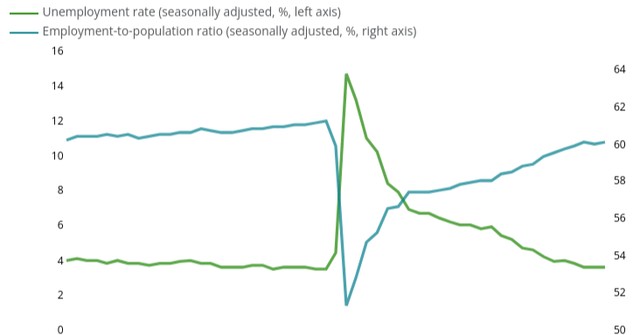

Expanding more on the state of the U.S. economy, another bright spot is the labor market. There is plenty of bad news out there to focus on – war in Europe, endless inflation, higher interest rates, declining consumer sentiment – but at the end of it all the labor market is telling us that people are working and being productive. Ultimately, more people working means more people earning and spending, and that is what drives the domestic economy. While this could change in the months ahead, I have to expect the U.S. economy will prove resilient to current challenges as it has many times in the past.

This is more important for small caps that are going to need consumer and business activity domestically to drive revenues and profits. Of course, there is still slack in the labor market. There are too many open positions that are going unfilled and the labor force participation rate is below where it stood pre-Covid. Yet, that figure is rising consistently and the unemployment rate in the U.S. is back to a very low level (around 3.6%):

U.S. Labor Market Metrics (Deloitte)

Am I suggesting we want to go wild buying up equities because of this labor story? Not at all – and my readers know I have been suggesting caution on many of the funds and sectors I cover. But this underlying strength in the labor market also doesn’t indicate that we want to be short 3X the market or the Russell 2000 either. Hence my reluctance to recommend buying TZA.

A Bumpy Ride Ahead

To wrap up this review, I would suggest readers continue to keep funds like TZA on their radar. After a 20%+ drop in the small cap index already in 2022, the time for shorting has probably passed us by. But that could be temporary. If we see an equity rebound, which I do expect and is actually currently underway, then risk-reward proposition of a fund like TZA improves considerably. We want to short when positive momentum begins fading and/or if a rebound is not supported by fundamentals.

In the case of small caps, this could very well happen in the second half of the year. This is a sub-sector that is known for having strong potential, but doesn’t enjoy the large cash cushion or profits that large caps typically do. This is, of course, a generalization, but it is fair to share that small caps are seen as more growth oriented and are inherently riskier companies than large caps.

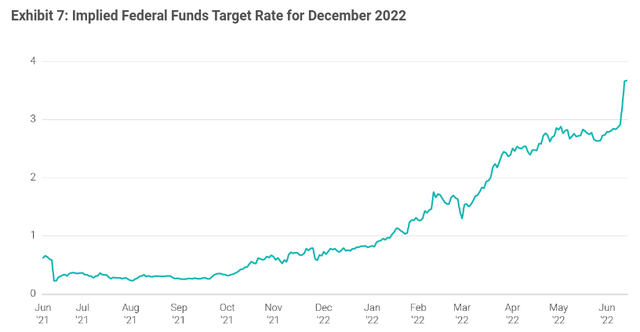

With this in mind, as interest rates keep rising, this could pressure future growth prospects. So if the Russell 2000 rallies in the weeks or months ahead, keep an eye on TZA. As interest rates rise, investors become less willing to wait for growth plays to materialize. They could be another rotation out of the sector, which could lead to more gains for TZA. In fact, the market is anticipating the Fed’s benchmark rate to end the year around 3.5%:

Implied Federal Funds Rate (Lazard Asset Management)

The impact of this could be meaningful on small caps and is likely the reason for the sharp weakness we have already since in 2022. If the Fed becomes more hawkish and this implied target rate keeps moving higher by year-end and in to 2023, then opening up a position in TZA has a lot more merit.

Bottom-line

If you have held TZA in 2022, you have my admiration. Inverse funds have done very well as equity markets have crumbled, and it would have been a very fruitful play to go short the Russell 2000 especially, rather than the Dow or S&P 500. However, the realized losses YTD strike me as a bit too far, too fast, and investors probably want to get cautious going forward. Small gaps are now trading at a historically cheap level, and the discount between them and large caps is very wide. This suggests near-term upside may be on the way. Further, with a strong labor market and some recent bullish momentum in equities, a 3X inverse play against the market doesn’t seem like a wise choice at this moment. As a result, I would wait for some additional upside to materialize before attempting to go short this market, supporting my “hold” rating on TZA for now. Therefore, I would suggest readers approach this particular ETF very cautiously at this time.

Be the first to comment