400tmax/iStock Unreleased via Getty Images

Investment Thesis: While a rebound in memberships and sales of VOIs is encouraging, I take the view that investors will look for further evidence of earnings growth from here before we see bullish momentum behind the stock.

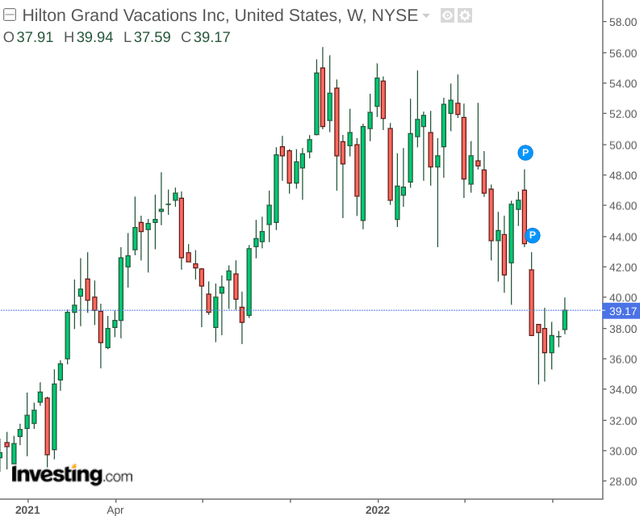

In a previous article back in March, I made the argument that Hilton Grand Vacations (NYSE:HGV) could see short-term downside on the basis of inflation concerns and the ongoing situation in Ukraine.

However, I also made the argument that the acquisition of Diamond Resorts could provide a significant long-term boost for the company.

So far, the stock has continued to show downside:

The purpose of this article is to assess whether Hilton Grand Vacations could see a rebound in upside going forward.

Performance and Net Owner Growth

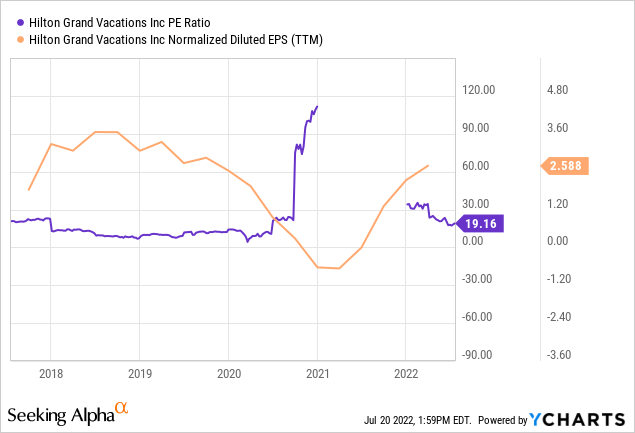

From a P/E ratio standpoint, we can see that while earnings per share have started to rebound, the company’s P/E ratio still remains slightly higher than that of pre-2020 levels:

ycharts.com

As a result, investors could be waiting for deeper value before turning bullish on this stock.

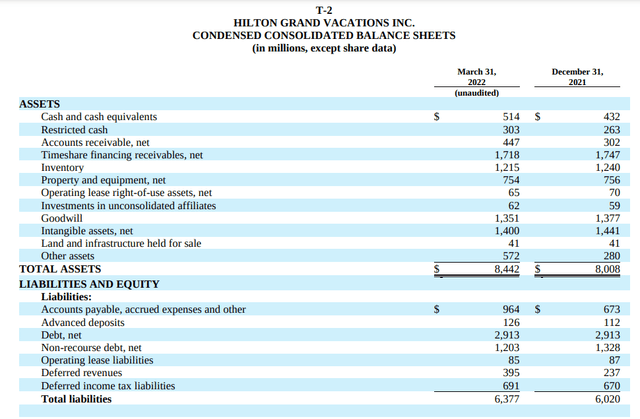

From a balance sheet standpoint, we can see that net debt has remained constant from that of the last quarter, while cash and cash equivalents are up by just under 20% – which is encouraging as the company is improving its position to meet its short-term debt obligations.

Hilton Grand Vacations: First Quarter Results 2022

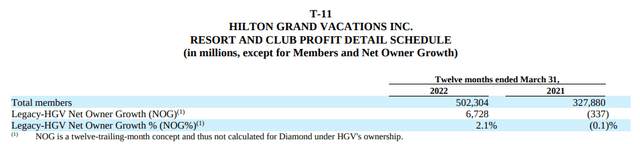

So far, the Diamond acquisition seems to have aided Net Owner Growth – with Diamond itself having added 1,600 members in the quarter as well as overall member count having increased for the seventh quarter in a row.

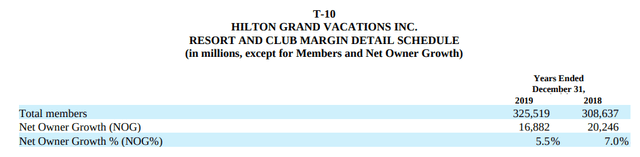

Excluding the impact of the Diamond acquisition, we see that while Net Owner Growth has continued to rise – the growth (in percentage terms) has slowed from that seen between 2018 and 2019:

2018 and 2019 Net Owner Growth

Hilton Grand Vacations: First Quarter Results 2019

2021 and 2022 Net Owner Growth

Hilton Grand Vacations: First Quarter Results 2022

From this standpoint, while membership continues to grow – I take the view that investors will increasingly look for a stronger rebound in growth post-COVID. Particularly, with travel almost back to pre-pandemic levels this summer – growth in NOG in the upcoming quarter will be a key telling point as to whether Hilton Grand Vacations is in a good position to capitalize on the rebound in travel demand.

Timeshares and Inflation

In the current inflationary environment, we could see demand for timeshares increase significantly.

The reason for this is that timeshares can allow a member to secure a long-term vacation rental at a fixed cost. While inflation is causing a broad increase in hotel room prices, timeshares can potentially shield longer-term members from such a rise in prices by locking in a fixed-rate upfront – depending on the terms of the timeshare contract.

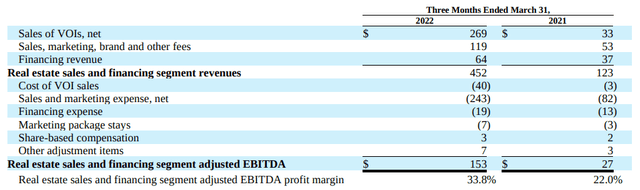

When looking at sales of VOIs (or vacation ownership interests) over the past year, we can see a strong jump in sales compared to that of the same quarter last year:

Hilton Grand Vacations: First Quarter Results 2022

From this standpoint – should we continue to see significant growth in VOI sales under an inflationary environment – then we might see a situation where Hilton Grand Vacations sees a rebound in growth despite inflation bringing down the broader market.

Of course, the flip side of this argument is that in spite of potential cost savings on inflation – would be vacationers would be less likely to commit to the upfront costs that a timeshare entails. Performance in the upcoming quarter will give good indications as to whether this might prove to be the case.

Conclusion

To conclude, Hilton Grand Vacations has shown a significant rebound in memberships and sales of VOIs could potentially thrive in an inflationary environment.

With that being said, I take the view that investors will look for further evidence of earnings growth from here before we see bullish momentum behind the stock.

Be the first to comment