Richard Drury

Nu Holdings (NYSE:NU) is an interesting company that has fallen substantially due to the general rotation out of tech, where multiples have collapsed. We liked Nu on the basis that it would easily grow revenues on penetrating unbanked populations and also cross-selling customers, maximising lifetime values on customers at minimum customer acquisition costs. It continues to deliver revenue growth, and likely will continue to despite struggles expected in the macroeconomy, with a clear sink for marketing and business development efforts as a mode of reinvestment. While we hesitate to make a call on tech due to the sector’s sensitivity to market movements, we confidently place Nu on the watchlist.

Q2 Results

Our insight into Nu focuses primarily on one concept, which is that as of our last coverage, and presumably still, customer acquisition costs are low at the $5 level. This might have changed as marginal consumption declines due to drops in consumer confidence, possibly seeing some rise, but likewise has revenue per customer.

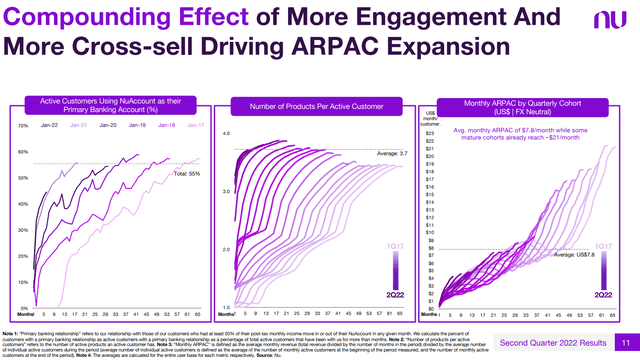

While growth in ARPAC is tapering across cohorts, what is attractive is the higher ARPACs achieved on longer standing cohorts, and the growth in average ARPAC has been 50%. At $7.8 monthly APRAC, assuming fall-off is being considered within cohorts, the figure implies a 50% average ROI on a customer acquisition in a month. With overall growth in number of customers (75% YoY active user growth), this has resulted in phenomenal revenue growth of 230% YoY, and has brought the company into technical profitability, even including share compensation and other early-stage company expenses.

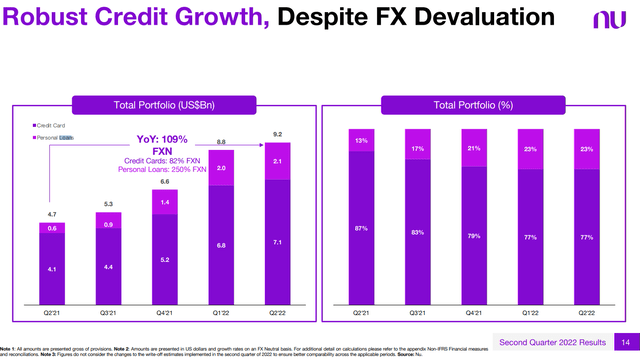

This has been in no small part due to the growth in consumer lending, but also more elements of a full banking platform including Nu Vida the life insurance product, one of the most successful in terms of early growth in the history of Brazil, and cross-selling brokerage services through Easyinvest, now called NuInvest after integration. The only thing that hasn’t grown quite as stunningly is the loan book due to tightening credit standards as a consequence of macroeconomic outlook. Thankfully, loans, including credit card assets, are very short term, and there is no sign of major uptick in loan non-performance.

We are also seeing increasing yield levels on loans consistent with monetary tightening, however the rate thesis is quite marginal in the overall Nu picture.

Conclusions

The P/S multiple is relatively low these days at only 3.83x. While it is true some momentum may be lost as the world economy contracts, Nu’s main markets are more resilient thanks to their local currencies being commodity levered and strong against reserve currencies like even the dollar, and local access to commodities supported by relatively left leaning governments, with Lula’s likely victory making that rather true for Brazil which had long leaned right.

We think the low multiple does not reflect the growth potential and the ability to generate margin, but this can be said of much of tech, and therefore, we find this exposure unnecessarily speculative and volatile given our house view that markets will continue to fall.

Another thing to consider is that left-leaning governments have been known to clamp down on companies that deal in predatory practices. The credit card industry in general can be considered somewhat predatory in terms of rates, and in general strategies focused on large unbanked populations are generally likely to be clamped down upon by left-leaning governments as seen in Qudian’s (QD) case in China. Lula is addressing household debt concerns and has said he’d consider negotiating with the private sector on this issue, and benefits to the households are likely to come at the private sector’s expense.

While this last issue is still remote in probability, we do consider it, and generally will not move with Nu beyond putting it on the watchlist to monitor.

Be the first to comment