Win McNamee

The FOMC meeting on Wednesday, December 14, will be a meaningful event as it will end the expeditious process of raising rates to catch up with inflation and shift to the next phase, focusing on how high and for how long.

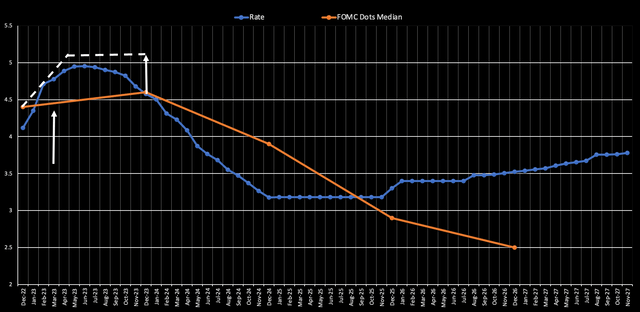

Listening to Fed officials since the November FOMC meeting, it is clear that the Fed’s projected path of rate hikes will be higher than where they stood at the September FOMC meeting. At that point, the Fed saw the peak terminal rate at 4.6%. Rates are likely heading much higher than what the market has priced in for 2023.

The problem is that the market doesn’t believe the Fed and currently sees rates at just 4.6% by December 2023.

Much Higher, For Much Longer

A 50 bps rate hike at the December meeting has been well-telegraphed, and Powell confirmed as much at his Q&A session at the Brookings Institutions on November 30. At least 6 Fed governors have openly noted that they see rates peaking above 5%, and while Powell may not have indicated where he sees the terminal rate, he has stated he sees it higher than the September projection. Additionally, Fed board members like Christopher Waller have suggested that rates have a long way to go and is among the Fed’s most hawkish members. Also, Loretta Mester saw the market pricing of a peak rate of around 5% as not being far off.

Jim Bullard of the St. Louis Fed thinks rates need to rise to between 5 and 7% to be restrictive enough to kill inflation. Meanwhile, Mary Daly of the San Francisco Fed sees rates at 5% as a good starting point. Raphael Bostic of the Atlanta Fed sees rates between 4.75% and 5%. Thomas Barkin of the Richmond Fed notes that rates may need to rise above 5%, while Neel Kashkari sees rates above his 4.9% September projection.

So if there were only 6 FOMC members who saw rates above 5% at the September FOMC, there are likely to be at least nine now, and probably several more at the December FOMC meeting that will signal that rates need to be in that 5 to 5.25% region for the peak terminal rate.

If more evidence is needed, this article from the Wall Street Journal followed the jobs report “suggesting” the Fed would raise rates above 5% in 2023. Then another piece came out on December 5, which again “suggested” rates going above 5% in 2023. The WSJ has often telegraphed Fed monetary policy in 2022, such as back in June ahead of the Fed’s first 75 bps rate hike.

Given the messaging that rates are likely to be at least 5% and probably higher, it is highly probable the Fed will illustrate its projections through the December dot plot noting a terminal rate for 2023 at 5.1% or 50 bps higher rate than the September projection for 2023.

The Market Doesn’t Believe The Fed

Of course, this would come at odds with the market, which currently sees the peak terminal rate around 4.9%, and then the Fed cutting rates to 4.58% by December 2023, which is lower than the Fed’s September projections of 4.6%. The market does not believe the Fed will hold rates above 5% for all of 2023, despite Fed officials consistently delivering that message for months.

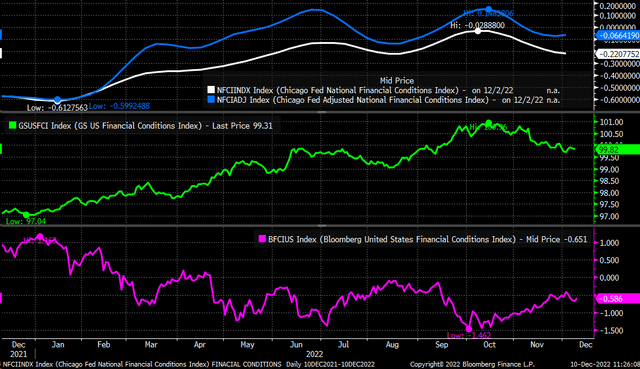

It is perhaps the reasoning behind Powell’s apparent change in positioning at the Brookings Institution, where he seemed to give the market a pass regarding the recent easing of financial conditions. Instead, he focused on telegraphing the pace of rate hikes slowing from 75 to 50 bps. He knew he could also push back against the easing of financial conditions two weeks later at the December FOMC through the projections indicating a higher for longer timing, which the market has been unwilling to accept.

Financial Conditions Need To Tighten

By any measure, financial conditions have eased a lot since mid-October. The easing financial conditions do not help the Fed’s overall cause of keeping policy restrictive enough to bring down inflation.

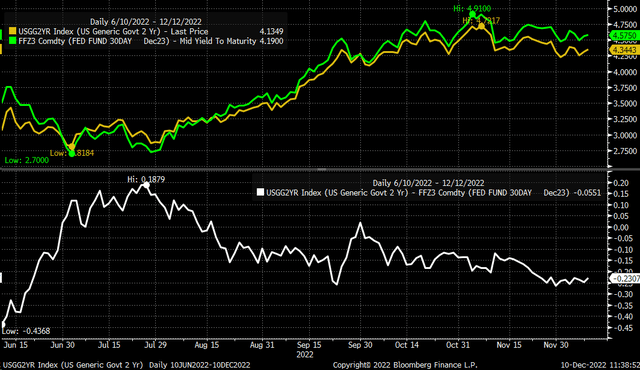

If the Fed can deliver this message of a 5% or higher terminal rate through the end of 2023, we will find that the 2-year rate is too low, which will need to rise. Since the summer, the 2-year rate has been trading at a discount to the December Fed Funds Futures by 10 to 25 bps. So if the Fed can convince the market it sees the Fed Funds rate at 5 to 5.25% by the end of 2023, then it seems probable that the 2-year rate can trade to as high as 4.8% to 5%.

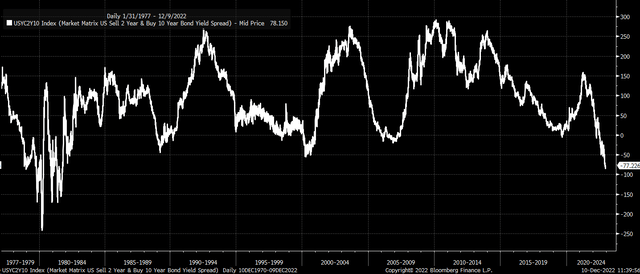

It would likely result in the yield curve steepening further and the spread between the 2-year and the 10-year becoming more deeply inverted, as the market prices in a higher recession risk, and rates just staying higher for a longer period.

It would probably help to reverse a lot of the weakening in the dollar index and potentially push the index higher and back towards 110 over time.

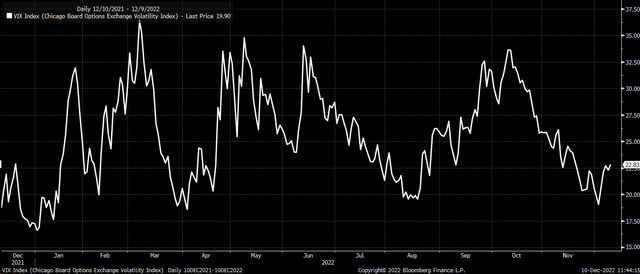

It should also raise the VIX index as traders look to add protection again due to the increased risk of the Fed over-tightening. The VIX has already started moving higher since the Fed minutes were released just a couple of weeks ago, which also messaged a higher-for-longer approach to monetary policy in 2023.

A strong dollar, higher rates, and higher implied volatility should tighten financial conditions. That will be a massive headwind for equity prices, resulting in stocks giving back nearly all of the gains witnessed since the October lows and potentially filling the technical gaps at 3,745 and 3,580.

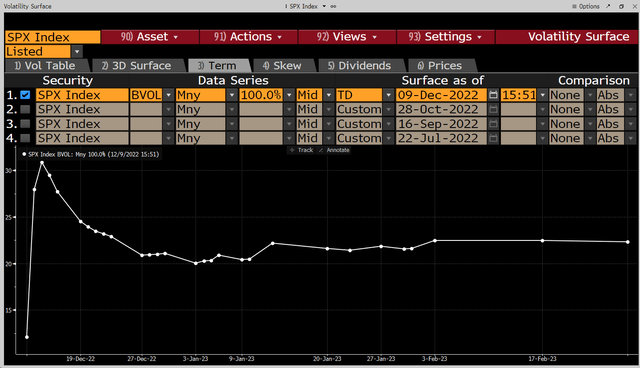

Is it likely to materialize at the time of the release of the FOMC statement or the press conference? That is impossible to say because that will depend on where implied volatility levels are and whether or not implied volatility is high enough to create a short-squeeze once IV comes crashing down following the news. As of December 9, IV was relatively high, at almost 31% for December 14 options expiration, and is only likely to rise further heading to the meeting next week.

Could Lose Control

If the Fed fails to gain control of the narrative and prove to the market it plans to get rates to 5% and hold them there in 2023, it risks losing control of the market, resulting in financial conditions easing further as rates drop, the dollar weakens, implied volatility falls, and stocks rip higher.

Further easing of financial conditions would likely result in mortgage rates falling, lifting the housing market. Meanwhile, a weaker dollar would increase commodity prices and raise import prices, undoing much of the Fed’s accomplishments in 2022.

That is why the Fed must stand firm through the dot plot and the press conference if it is serious about bringing inflation down and cooling the labor.

Be the first to comment