bjdlzx

(Note: This article was in the newsletter on November 29, 2022)

(Note: This is a Canadian company that reports in Canadian Dollars unless otherwise indicated.)

Paramount Resources (OTCPK:PRMRF) (TSX:POU:CA) has changed a lot since I first began following the company. This company was an asset story for years and it often grew by developing production and then selling most of what it developed. The money gained in the transaction was used to repeat the process while slowly growing production retained.

That was seen as risky by the market. Since key ratios had gotten extended along the way, fiscal year 2020 saw the stock price plummet. But by that time this had become a very different company. Even the production mix changed from largely dry gas to a significant amount of liquids. Now the company can grow from its cash flow without having to sell large chunks of production.

However, from the experience gained in the past, this management is likely to take advantage of any opportunity that comes up for a profitable sale. It is also likely to invest in other companies because it has in the past. So, some differences remain here compared to the rest of the industry. But the future is likely to be far more traditional than it has been in the past when asset stories ruled the strategy.

Management just announced a noncore sale. Proceeds will be used to repay the bank line and declare a special dividend of C$1.00 per share.

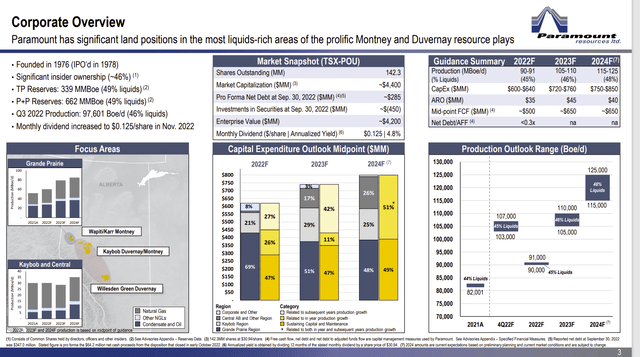

Paramount Resources Company Overview (Paramount Resources Corporate Presentation November 2022)

The insiders are largely the Riddell family. Clayton Riddell founded the company and passed away a few years back. James Riddell, Chairman and CEO, and some other family members continue to be involved in the company.

The insiders own enough stock to resist short-term market pressures. This is one of the advantages of a large insider ownership. There is generally a long-term view of the corporate strategy. Some things like returning capital get a tepid response because the controlling insiders know that the market values growth.

The result was the strategy here was to grow production a lot early on as shown above to take advantage of the strong commodity prices. Most of the company prospects offer a quick payback in the current environment. Then the shareholders not only receive the capital money back, but also a reasonable profit before the next cyclical downturn.

The other part about growing production now is that many times a company like this with low debt can simply “sit back and cash checks” during the next downturn while waiting for a recovery to begin. The debt balance is not a threat in a downturn as it can easily be handled at much lower commodity prices.

The focus areas evidently have the potential to produce at projected levels for more than a decade. The company has a lot of prospects to develop with the money they generate. Management is flexible enough to grow when the money invested returns satisfactorily. This management is very likely to reduce operations when it sees a cyclical downturn on the way. So long-term growth is likely to be lumpy.

Similarly, the dividend policy is likely to be a little more flexible with a Canadian company than is the case in the United States. Management does make the case that the current guidance is good for a very low oil price. However, investors need to remember that the balance sheet strength comes first. Second is the strategy of taking advantage of the early part of a recovery to get production to a certain level. Then the dividend and stock repurchases would be considered.

The outlook for commodity prices appears to make the dividend look very safe for the time being. The growing production may lead to management guidance that the dividend is safe at lower commodity price levels. There is also the possibility that management would issue a variable dividend in addition to the base dividend which would increase the safety of the monthly dividend.

Value

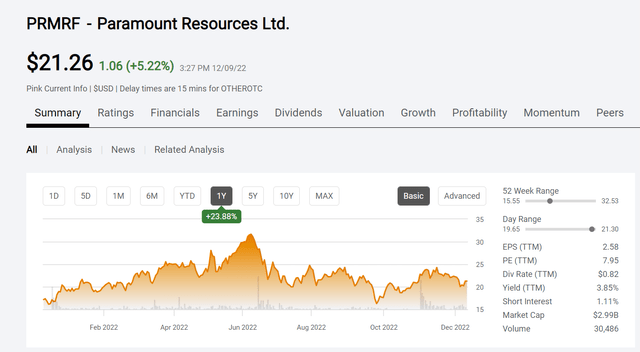

This stock is one of the cheaper stocks that I follow in an industry that remains undervalued.

Paramount Resources Stock Price History And Key Valuation Measures (Seeking Alpha Website December 10, 2022)

The dividend was recently increased to C$.125 per share each month. That is equal to C$1.50 per share each year.

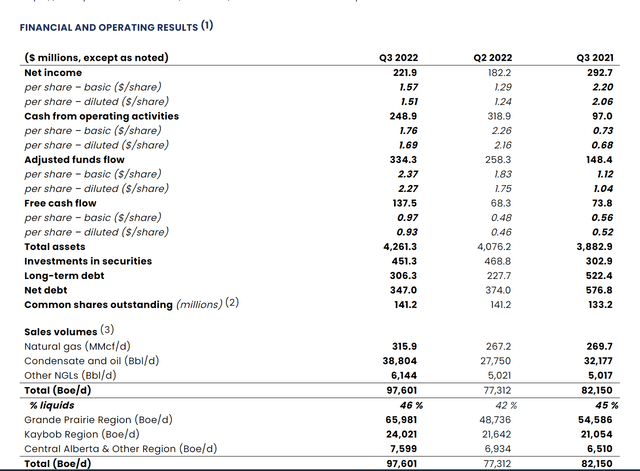

What is unusual is that production is rising at a decent pace that is unusual for the size of the company. But management is profitable enough that production can increase while also generating decent free cash flow.

Paramount Resources Summary Of Third Quarter 2022, Results (Paramount Resources Third Quarter 2022, Earnings Press Release)

Production has increased considerably from the second quarter and from the previous fiscal year third quarter. This rate of growth is unusual throughout the industry as well as for the size of the company.

Even with that growth, management still generated decent free cash flow after funding the growth. Net debt declined as well. There are a lot of companies that are paying out some generous returns in response to market demands to return cash to shareholders.

But with the growth pace shown above, this company is likely to return far more to shareholders in the future than will the companies that return profits to shareholders without growing production.

The period 2015-2020 was an adjustment period that really tainted the market view of the industry. A period of rapid growth and perennial high commodity prices came to an end when oil prices plummeted in 2015. Gas prices had actually begun to decline before that.

A lot of speculators jumped in to the 2018 recovery which caused it to abort because supplies grew too fast. The losses from that episode have led to the current situation.

But the lenders that know the industry are still there and still supplying money for sound financial proposals. The bond market also appears to be open to the industry for financing that is sound. The difference this time around is the lack of speculative money funding projects that never should have seen the light of day. So, this time the recovery is likely to “have legs” and be far more like the cyclical recoveries of the past.

This management is likely to continue the combination of growth with dividend growth and opportunistic share repurchases in the future. Management has some of the most profitable leases in North America to develop. Not many companies can grow while still generating a fair amount of free cash flow. The insider control of a lot of stock allows this management to take a longer-term view than is the case for many public companies where management cannot resist market pressures.

Family-owned companies (and for that matter companies with large insider ownership) tend to outperform the market over the long term. The opportunity to get in on that outperformance while the stock remains relatively cheap will not last. Sooner or later the market will realize that the strategy going forward is much more conservative than it was in the past because there is now a generous cash flow. Management can now grow the company at a good rate while keeping the debt levels low and paying a dividend. Not many in the industry can say that.

Be the first to comment