Digital Vision./DigitalVision via Getty Images

The Biggest Fed Pivot In History

When we try to defy nature with science, nature often has a way of winning. Forestry policies have suppressed fires for decades, allowing dead wood and fuel to continually build. So when fires do start, they rapidly spiral out of control. Naturally, politicians are keen to blame massive forest fires on external factors like climate change rather than questioning their own policies. Similarly, we slap up new developments in areas that are likely to be trashed by flooding over the life of a 30-year mortgage, or worse, put millions of people in desert areas where water reserves will eventually run out. By and large, modern medicine similarly excels at keeping large numbers of unhealthy people alive rather than focusing on preventing the core drivers of poor health down the road. Finally, the policies of central banks over the last 10 years focused on keeping businesses going and stock markets up, no matter how unprofitable the underlying enterprises were. Prices for tech stocks, global bonds, and housing were so high that market observers called it the “Everything Bubble.” This was until out-of-control inflation forced the Fed to step away from intervening and let the market more or less take control.

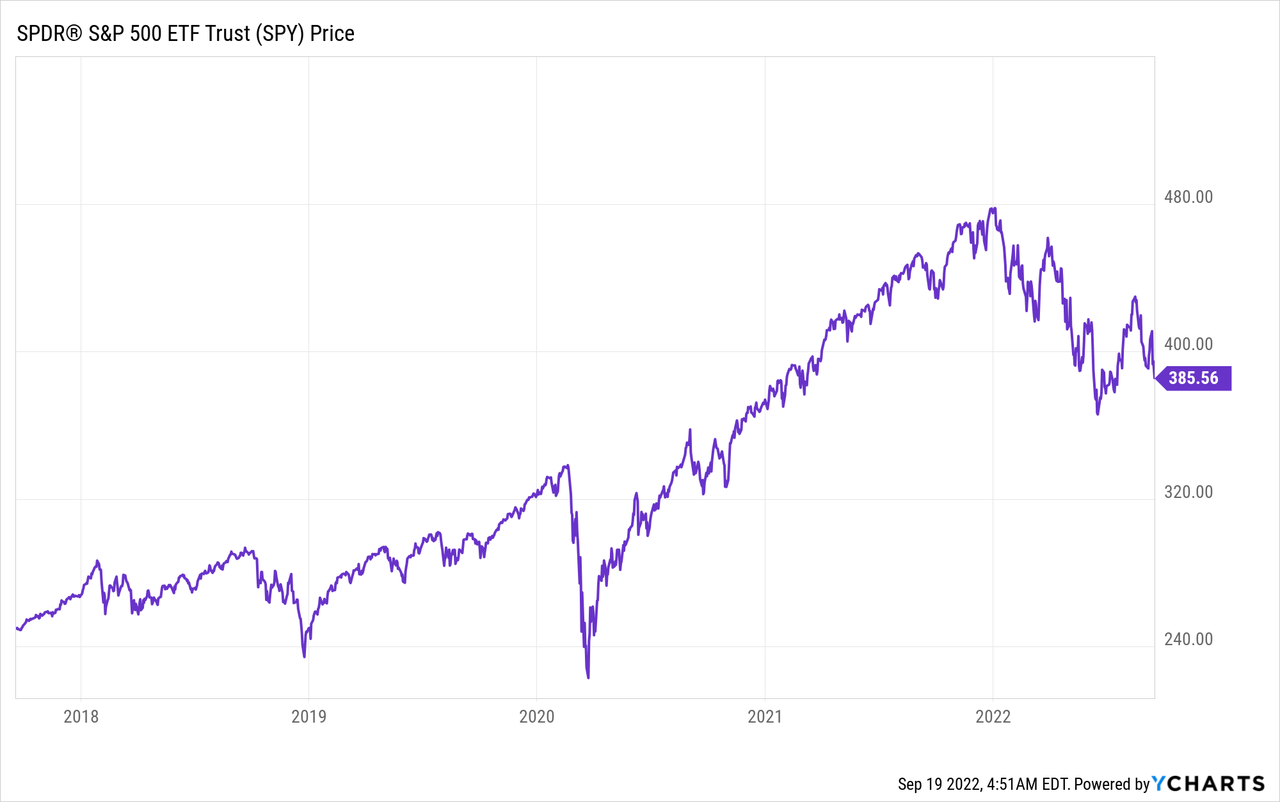

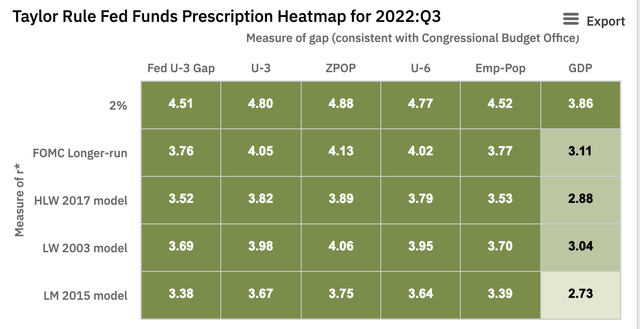

As of my writing this, S&P 500 (SPY) is down about 20% for the year and is threatening to take out its June low after another brutal report card on inflation last week. The Federal Reserve meets this week, and markets are debating whether they’ll raise cash interest rates by 75 basis points to 3.25%, or by a whopping 100 bps to 3.5%. Fed funds futures are showing that markets expect the Fed to raise rates to roughly 4.4% by April, finally aligning expected Fed policy with mainstream economic theory.

Where Should Interest Rates Be? (Atlanta Fed)

Twelve months ago, this was nearly inconceivable. Then, the Fed was buying massive amounts of mortgages, pouring gasoline on the inflation fire while insisting inflation was “transitory.” Each month, the market spoke, driving inflation higher and higher while panic began to set in among American workers crushed by higher prices for food, gas, and rent. The causes of these were far more complex than the Fed, but at the same time, antisocial behavior like crime soared, drug overdoses surged, life expectancy fell, car crashes skyrocketed, and the public mood plunged. Stocks, however, defied gravity, earning windfall gains for the top 1% of households. In his book on the 1929 Crash, John Kenneth Galbraith referred to these kinds of markets as “bezzle,” as in “embezzlement.”

If this isn’t abundantly clear by now, markets should set exchange rates, wages, rent, interest rates, and consumer prices in general. These should generally not be set by elected or appointed government officials. If we insist on having the Fed set the price of money, this reinforces that they need to use the actual economic theory, not what pleases politicians looking to win reelection. Anything else was playing with fire. You wouldn’t feed your kid Mountain Dew and cake for breakfast every day. Similarly, the Fed needs to be the adult in the relationship with Congress and not finance deficit spending that the market won’t bear. Look at Turkey – their government believes that inflation is caused by higher interest rates, so they’ve cut rates to “fight” inflation. End result – 81% inflation. Similarly, Hungary is showing that Eastern Bloc policies die hard, deciding that the government will set the prices for food, fuel, and mortgages. It’s very likely you’ll be reading about shortages in Hungary this winter.

Do Stock Valuations Make Sense?

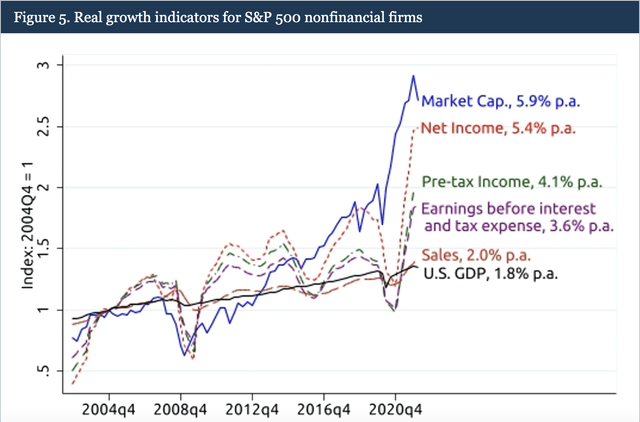

It’s debatable. Over the past 20 years, market caps have risen faster than net income (rising valuations), which in turn have risen faster than pre-tax income (tax cuts/deficit spending), which in turn have risen faster than earnings before taxes and interest (falling interest rates).

Earnings before interest and taxes have risen faster than sales, from increased profit margins. Those are mostly legitimate and from better technology/increased productivity. But these aren’t up nearly as much as share prices. Research shows that about a third of the return of the S&P 500 has come straight from tax cuts and interest rates over the last 20 years, and rising valuations are kicking in as well. If taxes and rates come up, it’s double trouble for stocks already trading on the high side of normal valuations.

Sales Vs. Profits Vs. Market Cap (Federal Reserve)

Now, with the realization that the Fed cannot indefinitely hold rates at zero and peg mortgages and junk bonds to below-market rates, the “everything bubble” is being rapidly unwound. I can’t overstate how crazy high asset prices were crazy in 2021. I wrestled with the ugly actuarial predictions- at the market peak, I had modeled returns for a 60/40 portfolio of roughly 5.5% annually with 2.5% inflation (a bit over 8% annually for stocks, and ~1.5% annually for bonds). Take out the typical 25% for federal and state capital gains/dividend taxes, and that’s a real return of 1.5%. Over the last 10 years, you’d have gotten a real return of 4.1% under the same assumptions. Take out 35% for high-income earners in New York or California, and the real returns were even uglier. Another $25,000 per year for health insurance premiums and the long-term situation was nearly hopeless for the ~3 million early retirees who called it quits in 2021.

To get more than 2% or so after inflation, you could pick your poison between:

1. Concentrating risk in stocks (instead of 60/40 going to 80/20) and risking a 50% decline in stocks-should prices go back to 2018 levels.

2. Using leverage on long-term stocks and bonds.

3. Or trying your hand with private businesses or investments.

My initial try at dealing with crazy valuations was PSLDX, a long-duration bond fund that should return about 300 bps annually more than the S&P over the long run. My timing was terrible though, and it’s been crushed this year. Realizing that everyone was making the same calculations as me to get any long-term returns, my second try was to go for puts on some of the craziest stocks and puts that would profit if the market crashed. So far, puts have helped but market declines have yet to reach the point where the turbos kick in. The best move in 2021 was not obvious at all, but it would have been to sit in cash and wait for the forest to catch fire, after 10 years of the Fed putting every blaze out.

What’s Next For Stocks?

Last week, the market fired several warnings shots about the sustainability of corporate earnings. FedEx (FDX) reported earnings. The company warned of an impending recession, froze hiring, and announced office closures. It was one of the bigger earnings misses of the year, sending the stock down 21% in one day. Of course, weak companies tend to blame macro factors while strong companies are eager to take all the credit for themselves. FedEx wasn’t doing amazing before the pandemic but has delivered reasonable long-term returns for shareholders.

Adobe (ADBE) reported earnings as well and got rocked, with the stock down 23% last week. The bottom line is that growth is slowing and tech companies are not so invincible that you can pay 50x earnings for them and sell them for 100x. In an effort to keep the growth going, Adobe announced a $20 billion acquisition of Figma, a tech company I’ve never heard of. The market reaction was to swiftly and furiously punish Adobe stock for the acquisition. Since expectations are sky high for stocks like Adobe, they can fall a long way and still not be cheap.

Restoration Hardware (RH) is a well-run, high-end furniture company that reports early in the earnings cycle as well. They forecasted continued softening in sales but an improvement in margins. The stock is roughly flat since earnings. Earnings season kicks into gear in about three weeks, giving more information on how corporate America is navigating inflation and negative growth.

As is the case in every bear market, in the coming months, you will be hearing of flashy companies that weren’t what they seemed. Enron, Madoff, and almost every other major fraud were exposed during bear markets, not during good times. In the words of Warren Buffett, “it’s not until the tide goes out that you know who is swimming naked.”

All eyes will be on the Fed this week. The Fed has pivoted and now faces the challenges of maintaining market-aligned policy even if:

- It hurts millions of real estate speculators (and their powerful lobbying groups) who profited from runaway housing prices.

- It hurts private equity investors dependent on cheap financing.

- It crushes the dreams of early retirees who had hoped to live off of booming tech stocks.

- It will cause unemployment to rise in industries that have built business models around zero-interest rate policy (but to a historically normal range of 5-6%).

It’s not impossible for the Fed to accept the tradeoffs that come with stopping inflation and letting unprofitable companies fail. It has been done before, with Paul Volcker’s interest rate hikes in the early 1980s and when the tax reform in 1986 brought income tax rates from 50% to 28% at the expense of powerful real estate speculators. A lot of people know about Arthur Burns and the 1970s Fed, but fewer people know about Paul Volcker’s first attempt to stop inflation when he cut rates and relented and was immediately crushed by the market. Volcker was then forced to raise rates to 20% to kill inflation, which was what needed to be done but was a lot more than he’d have had to do had he stayed the course the first time.

Keep an eye on the Fed’s GDPNow gauge, which took a big hit after the inflation report. It’s steadily being revised down for Q3, and my guess is when it’s all said and done, it will show that we’re in our third consecutive quarter of recession.

Conclusion

Well-known macro investors are fairly negative. Ray Dalio’s and Bridgewater recently called for another 20-25% downside. Stanley Druckenmiller has warned that there’s a high probability for markets to be flat for a decade. Of course, people like Michael Burry and Nouriel Roubini have issued increasingly dire warnings as well. I’m not as negative as most of them, but it’s tough to ignore how much of the market’s success over the last 10 years has been driven by unsustainable factors. I’ve assessed the fair value for the S&P 500 at around 3300, and that’s where I think you should start buying. The situation is somewhat better for global stocks (VEA), which may even be undervalued for US dollar-based investors. In any case, the free market price for large-cap stocks is lower than it was in a zero interest rate and QE world, and with the mostly failed experiment behind us, markets will eventually reallocate wasted resources toward innovation and growth.

Be the first to comment