grandriver

We all know that we’re paying more to fill up at the pump, so why not get on “the other side of the trade” and earn a high dividend income with conventional oil producer Berry Corporation (NASDAQ:BRY)!? Berry is extremely profitable at these prices, and the company’s program of returning profits to shareholders via dividends makes it a very attractive choice for income investors.

All investments have risks, and in this case we should consider how strong a view we can take on future oil prices and possible regulatory changes. But as I’ll discuss below, I feel very comfortable with the price of oil staying high for some time (and possibly rising), and I’m prepared to take the regulatory risk for the same reason.

For these reasons, I think you’ll agree Berry Petroleum for those reasons is a good way to be “long” oil prices and a good choice for the dividend income investor.

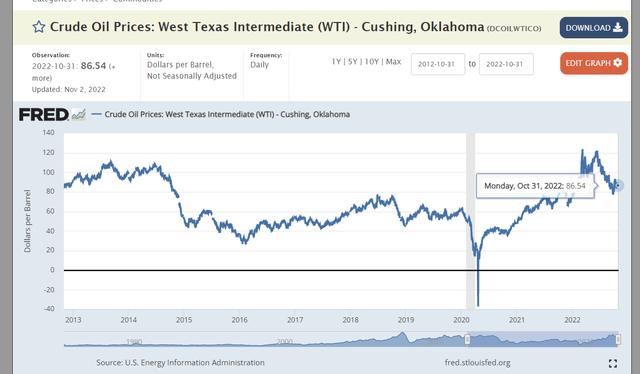

Oil and Gasoline Prices Can Stay High

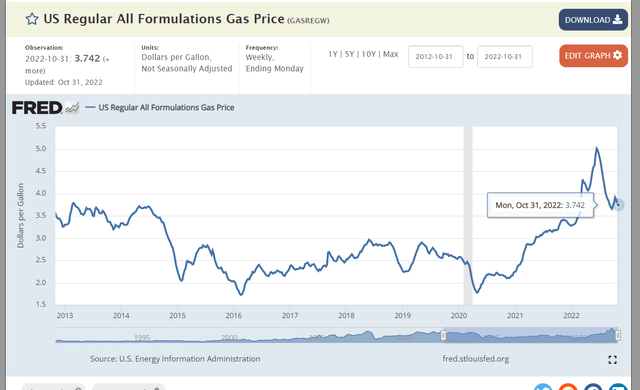

It’s not news to anyone that oil prices are higher than they’ve been in the past and gasoline and heating prices are rising along with them.

Gasoline Prices (Fred St. Louis)

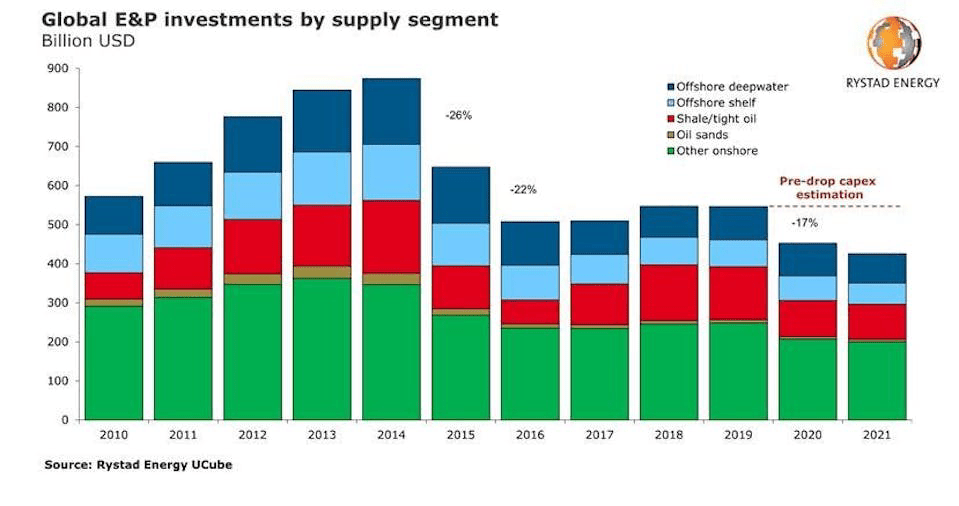

As you can see from charts such as the one below and other sources, global upstream cap-ex (money invested in oil and gas production) is lower than it’s been in previous years:

Global Investment Is Low (Rystad Energy Update)

To my mind, the question of “how much investment is enough?” is actually rather difficult to answer. On the one hand, we seem to be able to produce the current amount of petroleum with cap-ex at levels much lower than we say in years such as 2014. On the other hand, there are important reasons this may not be enough going forward, namely:

1) Depletion of “good” assets: especially in U.S. shale production, meaning the incremental new drilling not only produces less oil and gas, but also requires greater investment

2) Cost inflation: the same way that materials and labor in other fields cost more to achieve the same results than they did five years ago, so, too, in oil and gas production

3) Investment cycles: our recent lower levels of investment were “subsidized” by prior over-investment in infrastructure and equipment.

For these reasons, I conclude we’re under-investing and oil supplies will stay scarce. A recent article in the Financial Times also reviewed reasons why oil companies are choosing not to reinvest in production. These are the kinds of things that lead me to conclude I want to be long oil and gas producers and oilfield services.

Berry Petroleum is Profitable and Returning Capital Through Dividends

Income investors might do well to look at integrated majors such as Exxon Mobil (XOM), Chevron (CVX) and Shell (SHEL), royalty companies such as Black Stone Minerals (BSM), or refiners such as PBF Energy (PBF), Marathon (MPC), Phillips 66 (PSX), and Valero (VLO), along with many others. I’m more interested in Berry because I think it’s an “under-the-radar” opportunity.

The first thing to note is the company is very profitable at current prices. As they reported in Third Quarter Earnings, Berry earned net income of $192 million or $2.34 per diluted share, Adjusted Net Income of $46 million or $0.55 per diluted share, Adjusted EBITDA of $97 million and cash flows from operating activities of $96 million. (As an aside – be a lot more comfortable with adjusted numbers that come in below net income than ones that come in above net income!) The prior quarter’s Adjusted EBITDA was even higher of $110 million. Cash provided by operations was $96 million this quarter and $111 million in the prior quarter. These results show the company definitely earns money with high leverage to oil prices!

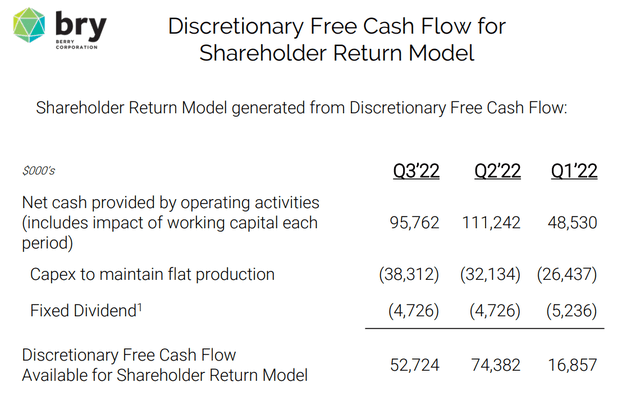

What matters next to investors is what the company does with all this money. In Berry’s case, they’re just returning it to shareholders in the form of dividends and buybacks:

Berry Shareholder Presentation (Berry Petroleum)

Using this quarter’s “Discretionary Free Cash Flow Available for Shareholder Return” as typical of Q4 as well, we see that the company could have $200 million available for return in this year alone.

In the last quarter, Berry repurchased 2 million shares of stock for $19 million and declared a variable dividend of $0.41 per share in addition to its regular dividend of $0.06 per share for a total of $0.47. I believe the fact that Berry is paying out these large sums as variable dividends has thrown a number of dividend-seeking investors off-track. As you’ll see with a quick search of your favorite stock website such as Seeking Alpha, most websites only report the fixed dividend portion of Berry’s payments to shareholders:

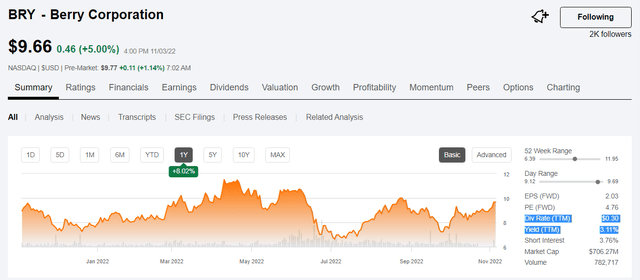

Typical Website Report on Berry (Seeking Alpha)

So it looks to many like the company is only paying out a 3% dividend yield, not a 16% yield including the special dividends described above.

But at what price?

Valuation is a critical component of investing. Before we talk about how much Berry could be worth, let me just concede that this question depends largely on the path of future oil prices. If you’re bearish on crude, then the right thing to do isn’t to argue about valuation – it’s just not to invest here.

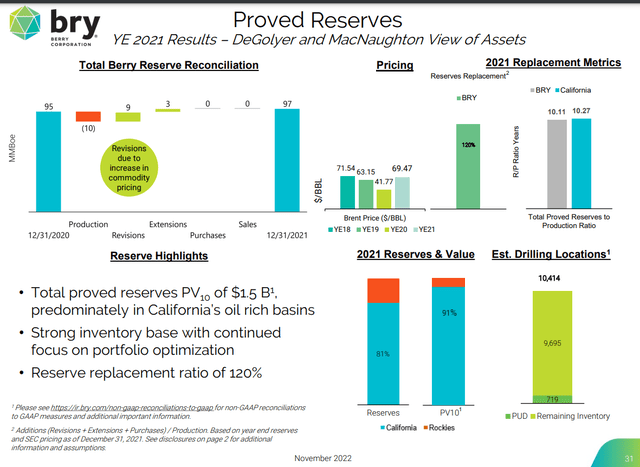

Berry described its most recent “PV-10” estimation of reserves at $1.5 billion, as you can see from its earnings presentation:

Berry’s Assets (Berry Petroleum)

Calculating PV-10 relies on many estimates, including future oil prices and costs of production, so in and of itself it can be fraught metric, but it gives us a basis for discussion. Against Berry’s market cap of $760 million and total debt of almost $400 million, it’s not clear that a $1,160 million of enterprise value against PV-10 provides a big margin of safety, but I’m still interested for the following reasons.

First of all, as we said before I’m bullish on oil prices so I believe the PV-10 understates the value of the company’s assets and income from future production. Second, I view dividends funded by earnings and not debt as a return of capital. This means that if I invest $1.00 today and receive 10 cents in dividends from earnings, then I only have investment of 90 cents left at work in the business. So over time, if I bought the whole company today at this market cap, my exposure to its future valuation would go down, thus de-risking my future investment.

Possible Clouds on the Horizon

We’ve already discussed lower future oil prices as a major risk factor. My other big concern with buying stock in Berry would be that the majority of its assets are in California, which may increase the regulatory burden on oil and gas production within its borders. My first thought on that is that regulation in California is not new and the company should be able to continue to make due. My second thought is that the public’s attitude for government intervention to reduce oil production probably goes down – not up – as gasoline prices get higher. (Others may see it differently, of course.)

Berry and its Dividends Look Great to Me

As discussed above, I am of the opinion that oil prices will continue to stay high and may go up further. I think owning stock in Berry and taking home large and increasing dividends is a great way to invest here, and the rewards outweigh the risks.

Thanks for reading and best of luck to all!

Be the first to comment