Giulio Fornasar/iStock via Getty Images

Investment Thesis

ON Semiconductor’s (NASDAQ:ON) long-term demand remains robust, with the massive win in $5.3B worth of long-term supply agreement just in FQ3’22. That would bring its total committed revenues to an impressive $14.1B over the next few years, despite the supposed economic slowdown. Since this number represents an impressive 60.22% QoQ growth, we are gob-smacked by the market’s irrational reaction thus far. Mr. Market had unreasonably punished the stock with an -8.97% plunge instead, despite its excellent FQ3’22 performance.

ON further boasts Q3 design growth of 19% QoQ for its intelligent power and sensing solutions segment, which equally reported an excellent 6% growth in revenues in FQ3’22. Naturally, this is attributed to the tremendous momentum for EVs and renewable energy markets, as the global electrification efforts hasten due to the record high oil/gas prices through the difficult winter ahead. Additionally, the company continues to expand its long-term supply agreements, capturing approximately 64% of the global solar inverter market. Combined with ON’s energy infrastructure revenues reporting an accelerating 70% YoY growth in revenues in the latest quarter, there is no room for pessimism here.

Mr. Market Is Convinced That FQ3’22 Will Be ON’s Last Hurrah For A While

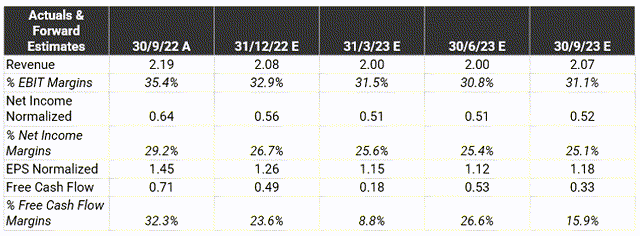

ON Revenue, Net Income (in billion $) %, EBIT %, EPS, FCF %

ON has somehow guided lower revenues of up to $2.14B for FQ4’22, indicating relatively in-line QoQ or 19.02% growth YoY. While non-GAAP gross margins are expected to be relatively in line as well, it is apparent that we will be seeing lower profitability ahead as operating expenses rise for the next quarter. Thereby, affecting its FQ4’22 net income to $0.56B with net income margins of 26.7% instead.

Furthermore, ON will be reporting a lower Free Cash Flow (FCF) generation of $0.49B in FQ4’22, indicating a QoQ fall of -30.98%. However, we are not overly concerned since this is attributed to its elevated capital expenditure of up to $330M for the ramping up of its SiC production. Naturally, this investment would eventually be top and bottom-line accretive, with $4B in pipeline already won thus far.

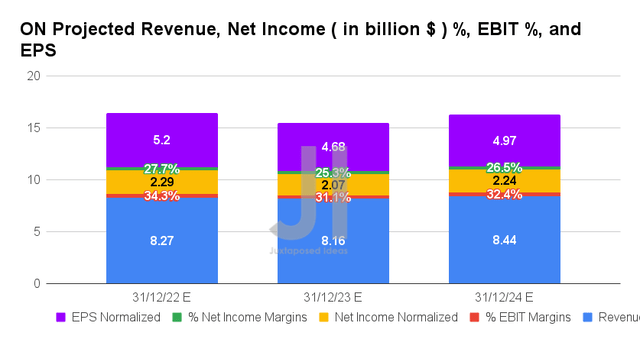

In the long run, market analysts have temporarily downgraded ON’s top and bottom line growth by -2.54% and 6.36% for FY2023, pointing to the growing concerns about demand destruction. However, we remain optimistic that previous estimates of $8.36B in revenues and $2.2B in net incomes will hold while the management has proved competent in managing expectations thus far. Combined with its twelve months’ worth of non-cancellable, non-returnable contracts, these are temporary headwinds at best, since we expect ON to exceed expectations and deliver brilliantly through 2023. Do not be fooled by the overly pessimistic market.

In the meantime, we encourage you to read our previous article on ON, which would help you better understand its position and market opportunities.

- ON Semiconductor: This Correction Is A Downright Gift For You And Me

- ON Semiconductor: Ready For Takeoff – Do Not Ignore The Next Giant

So, Is ON Stock A Buy, Sell, Or Hold?

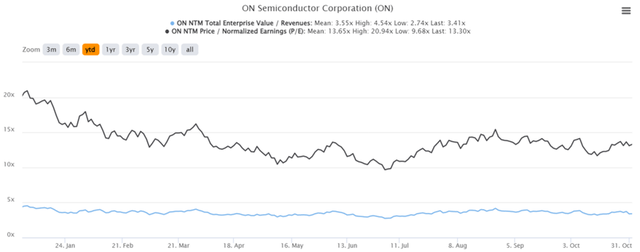

ON YTD EV/Revenue and P/E Valuations

ON is currently trading at an EV/NTM Revenue of 3.41x and NTM P/E of 13.30x, lower than its YTD mean of 3.55x and 13.65x, respectively. The stock is also trading at $61.74, down -19.58% from its 52-week high of $76.78, though at a premium of 37.93% from its 52-week low of $44.76. Nonetheless, consensus estimates remain bullish about ON’s prospects, given their price target of $74.28 and a 20.92% upside from current prices.

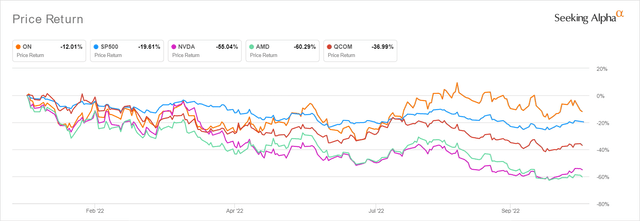

ON YTD Stock Price

In addition, ON has fared much better than its semiconductor peers, both in terms of financial performance and stock valuations. The former had only retraced by -12.01% YTD against the wider market plunge of -19.61%, while the rest have obviously been decimated, notably Advanced Micro Devices (AMD) by -60.29% and Nvidia (NVDA) by -55.04% at the same time. The latter two have continued to suffer from the PC demand destruction, impacting up to $1.11B and $1.02B of their top-line growth in FQ3’22, respectively. Since ON has guided impressive FQ4’22 revenues and EPS beating consensus estimates, it seems that we have to resign ourselves to the current market pessimism for now. After all, a minor retracement is definitely better than a catastrophic plunge, isn’t it?

In the meantime, ON continued to hover around the $60s over the past two weeks, since Mr. Market appears uncertain about the Fed’s next action. This is natural, given the conflictingly elevated September PPI/CPI rates against the Bank of Canada’s recent 50 basis points pivot. Depending on the Fed’s message at the upcoming meeting, we are definitely in for more volatility ahead, potentially triggering more short-term pain as 86.2% of analysts predict an in line 75 basis points hike instead. Furthermore, we expect a raised terminal rate ahead, since the inflation will likely remain sticky through the most difficult winter months, before potentially moderating from spring onwards.

Therefore, investors would be wise to wait a little more and load up at the $50s for an improved margin of safety. Even then, one should be prepared for some stormy nights before the Feds truly pivot and market sentiments improve. Speculatively, from H2’23 onwards. May the odds ever be in our favor.

Be the first to comment