Cavan Images/iStock via Getty Images

Business combination with Alternus Energy, a fast growing international renewable power developer and producer currently generating 168 MWs in production across 40 owned and operated solar parks, represents a major positive catalyst for Clean Earth Acquisitions Corp. (NASDAQ:CLIN), a Special Purpose Acquisition Company that successfully IPO’ed at the end of February 2022.

Headquartered in Ireland, Alternus is an emerging leader in the development, construction and operation of utility scale commercial and industrial solar power parks. Currently the company is operational in eight countries across Europe, and Alternus recently established a US presence headquartered in North Carolina. After years of building its platform, Alternus is positioned to accelerate the growth of produced megawatts from existing operations and also from its pipeline.

The conservative valuation of the transaction of the business combination agreement between Alternus and Clean Earth represents an attractive entry point for potential shareholders, with the valuation being based solely on owned and contracted solar pipeline. The conservative valuation does not include any potential upside from future solar project development and acquisitions or expansion into other renewable energy technologies. With forecasted 2023 EBITDA of $47.2 million, and a pro forma enterprise value of $992 million for the merged Clean Earth/Alternus Energy, this implies a valuation of 21x EV to EBITDA. The deal is expected to close in the first quarter of 2023.

A focused, long-term strategy makes Alternus a stand-out clean energy producer

Alternus develops, installs and operates utility scale solar parks across Europe and the U.S. as long-term owners. As a long-term owner they focus on ensuring that the solar parks which are owned by Alternus are designed for the most efficient operations and built to last. The company views the solar parks as truly long-life assets, given the fact the energy production typically spans 35-plus years. This focused and long-term strategy has made Alternus a preferred partner to in-country developers and also to banks and local governments who prefer long-term focused market participants. The company sells the clean power to its commercial energy clients.

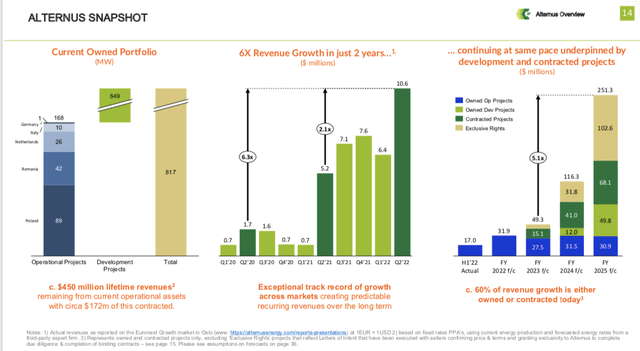

The company’s track record of operating success is clear. In 2017 Alternus had two solar parks in Romania and a total of 6 MWs operating with about 1 million Euros a year in revenues. Today, Alternus has grown to 40 operating parks across eight countries, a total of 168 MWs in production, and 30 million in recurring annual revenues. Based on the current energy production levels across the operating parks, $400 million+ more in future lifetime revenues from these parks is expected, out of which $172 million already has been contracted for the next 10 years.

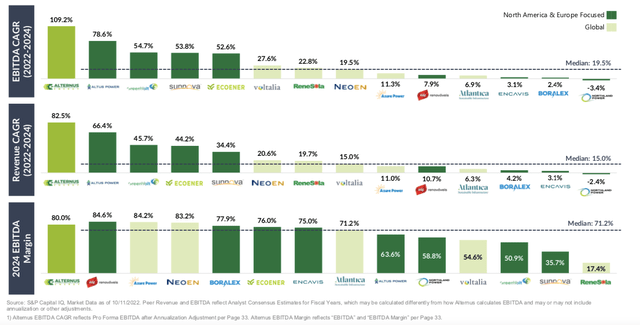

Alternus has plans to continue driving exceptional growth. They have 600-plus projects under development which they own today, that are set to deliver further predictable revenues in the next few years as the projects come on-line. From contracted and owned projects of 1.4 gigawatts, booked EBITDA is forecasted to reach $200 million-plus by the end of 2025. Importantly, 60% of these projects are owned and contracted today and have installation start dates during 2023 and 2024. This supports the management team’s ability to continue its pace of fast growth.

In line with the company’s long-term focus, for each project assessed by the management team, a critical factor for undertaking the project is the LCOE, the levelized cost of energy, which represents the total cost of developing, installing and operating the solar parks over their expected lifetime. This focus allows the management team to stay focused on the highest-return projects, to the benefit of aligned shareholders.

Alternus also employs a capital-efficient financing strategy that delivers operating cash earlier in the process to reinvest into new assets to support long-term growth. With the company’s PV solar projects generating long-term steady cash flow streams, a healthy amount of leverage is used in the operating model, however never more than 75% of the market value of the project. Importantly, the company uses flexible debt options structured as non-amortizing for the first three years of the project life, with traditional project debt used for the remaining 22 years (for an average 25-year term).

As an operator at each stage in the PV solar cycle process, Alternus is able to capture value at each stage, which helps to reduce capex and ultimately the opex needs, while increasing the certainty of pipeline and predictability of new revenues. The company is uniquely positioned across the cycle end-to-end, also recently announcing its acquisition of Altnua that focuses on the project development phase. The acquisition of Altnua represents a new source of organic growth as a leader in renewable development partnerships for future energy solutions.

The company has grown to more than 60 employees, with an experienced and driven management team led by Vincent Browne. Alternus is modeling itself as a best in class ESG operator focused on its social and governance impact, bringing in mostly independent board directors. With an installed capacity of 168 MWs in production, Alternus is currently saving more than 96,000 tonnes of CO2 emissions per year while producing enough annual power for 31,500 homes.

An acceleration of capital being deployed into the renewable energy sector in the EU and US

The renewable energy sector is growing, with forecasted targets for the sector being over four times the current size by just 2030. EU and US policymakers are accelerating this growth with financial and regulatory support packages (i.e. the U.S. Inflation Reduction Act bringing $350 million+ in investment to renewables). The ongoing Russia/Ukraine conflict has only brought additional momentum to “energy independence,” putting renewables further in the spotlight.

With operations in Europe and a growing footprint in the U.S., shares of Alternus / Clean Earth can provide investors with exposure to the energy transition across both sides on the Atlantic.

Alternus now being listed on Nasdaq via CLIN

Alternus getting listed on Nasdaq via Clean Earth will be transformative for the company, allowing it to access a broader investor base that’s looking for credible ESG and clean energy investment options. With a Nasdaq listing, Alternus is planning to add dedicated investor relations to improve the company’s visibility.

Alternus has been listed on the Euronext Growth Oslo since 2021 under ticker ALT.OL. At the time of writing, on Nov. 1, ALT.OL is trading at 20.00 NOK/share, closer to the bottom end of its 52-week range of 16.10-31.00, and off its recent peak of 25.00 NOK/share on Oct. 14 following the deal announcement. This suggests market skepticism regarding whether the business combination with the Clean Earth SPAC will go through. However, Alternus’ management team has publicly put their support behind the business combination with Clean Earth and have expressed their plan to have the minimum capital requirement waived to increase the probability of the merger going through successfully.

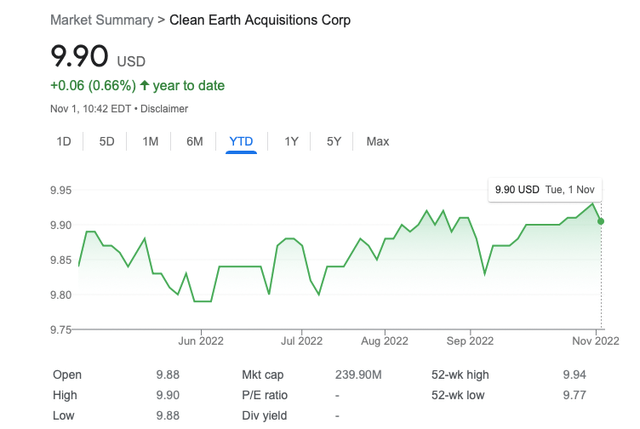

In the event of higher than expected redemptions from CLIN following the business combination announcement, CLIN will have sufficient financing options to provide Alternus with enough capital into the merger. Shares of CLIN have remained range-bound and have yet to meaningfully respond to the news of the announcement on Oct. 12. Since its Feb. 24, 2022, IPO, shares of Clean Earth, as represented by ticker CLINU, are +0.80%, that compares favorably to the S&P 500’s decline of -12% over the same time frame.

CLIN currently offers investors tremendous upside potential for undervalued growth in Alternus

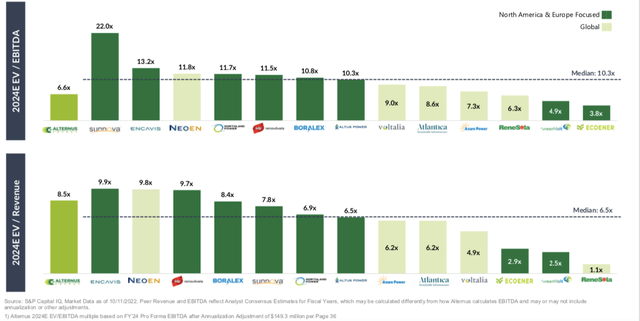

On valuation metrics, you can see from the below charts how shares of Alternus are valued on 2024 EV-to-EBITDA and EV-to-revenue with current market comparables across the North American and European markets.

These valuation metrics appear to discount the company growing significantly through 2024 compared to the overall peer group. In our view this supports the potential for significant upside potential, based on the company’s existing owned and contracted projects.

With the long-term track record of the Alternus management team, a clear outlined growth plan and a high likelihood of success for the business combination between Alternus and Clean Earth, shares of CLIN offer investors great upside potential with limited downside at current levels.

Conclusion

With around $10.17 of cash in trust, this SPAC has about a 7% yield to maturity between now and the redemption date. So you can buy CLIN today, get a decent return and slightly better than tie or win if the market changes its current collective mind and drives the price well above liquidation value.

TL; DR

Buy CLIN.

Be the first to comment