marekuliasz/iStock via Getty Images

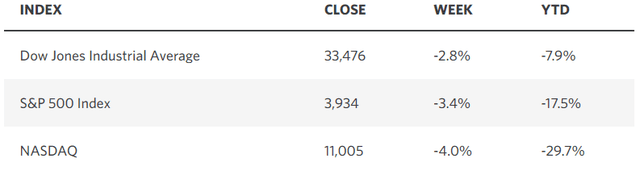

All news was bad news last week, as investors fret over signs of strength instigating inflation and more aggressive monetary policy, while weakness emboldens those who are calling for recession in the months ahead. This is why it is so easy to join the bearish consensus, as the path to a soft landing looks to be narrowing by the day. Nevertheless, I remain aligned with the 2% of economists in the latest Bloomberg News survey who see a soft landing over the next 24 months, while 81% remain convinced there will be a recession. While there are signposts flashing red that have historically been reliable leading indicators to economic contractions, I think this business cycle is so unique that the ongoing adjustments to higher interest rates and the draining of liquidity will not do as much damage to the real economy as most expect.

Edward Jones

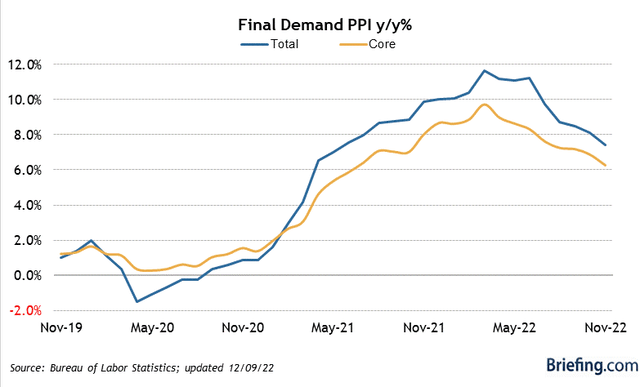

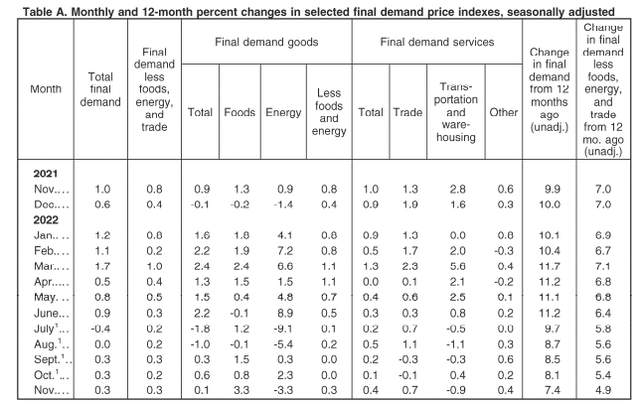

We saw more progress in producer prices last week, as the index for final demand rose by 0.3% for a third month in a row and was up 7.4% over the past year. The monthly increase was more than expected, which alarmed investors during Friday’s session, but the annual increase was the smallest in 18 months.

Briefing.com

The bottom line is that the peak rate is obviously behind us and the downtrend is undoubtedly confirmed. Regardless of how one looks at the data below, the theme is a decelerating rate of price increases. Granted, some line items are decelerating faster than others, but all are decelerating, and leading indicators point to a continuation of this trend. We should see a similar pattern in tomorrow’s Consumer Price Index report. Both reports should give the Fed comfort that its interest-rate increases to date with an additional 50 basis points on Wednesday, which collectively work with a lag, will be sufficient to bring the rate of inflation down to its target next year. I am not certain that Chairman Powell will acknowledge this during his press conference on Wednesday afternoon, because I am certain that he does not want to light a fire under risk asset prices going into year end. His tone is likely to be balanced.

BLS

A growing consensus on Wall Street seems resolute in its expectation for another leg lower in the S&P 500 index during the first half of next year, which will be followed by rate cuts and a rebound during the second half of the year in anticipation of a better 2024. The ranges vary from firm to firm with the less bearish targeting a retest of the October low, while the most bearish have the index falling as low as 3,000, but all see an eventual recovery. Regardless of the range, the near-term outlook is grim, as the Fed is expected to continue tightening into deteriorating fundamentals, as a recession grips the US economy, and corporate profits decline well below expectations.

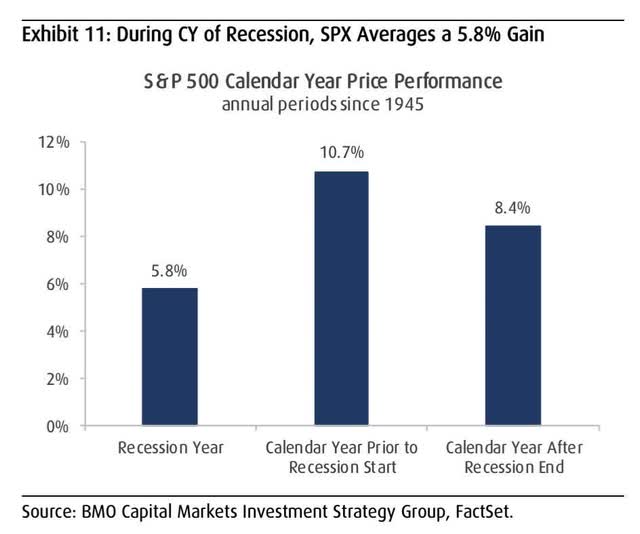

I think the challenge for the bears is timing the next decline that everyone now expects, as well as the inevitable turn back up, which is also expected. This will require precision on both ends. History shows the window of underperformance to be a narrow one, because the S&P 500 averages a gain of 5.8% for the year in which a recession occurs. To no surprise, it is better in the calendar year after the recession ends, but the best return has been in the calendar year before the recession starts. That is not consistent with what we have seen so far in 2022.

Yahoo Finance

Assuming the recession starts next year, as the consensus expects, history suggests this year should be the standout performer, as the excesses from the aging expansion hit a boiling point. The problem is that we have already expunged the majority of the excesses built up in the markets, while there are not a lot to be had in the real economy. This tells me that markets have already discounted most of the bad news that the consensus continues to pound the table on every day, which is also evident in our consumer sentiment numbers.

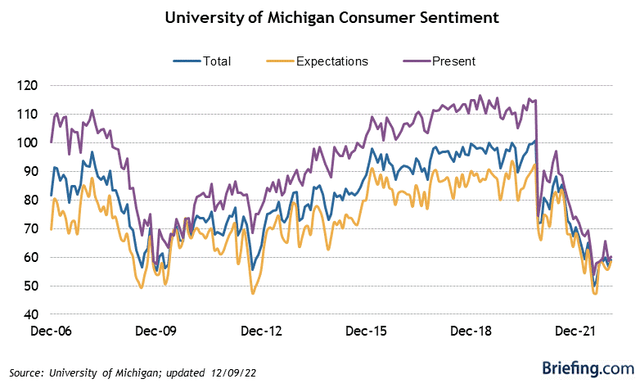

Last week the University of Michigan’s Index of Consumer Sentiment unexpectedly rose to 59.1 in December from 56.8 in November. The index for current conditions and expectations both improved. Most importantly, inflation expectations for the year ahead fell from 4.9% to 4.6%, which was the lowest level in 15 months. These are all positive rates of change, but from abysmal levels.

Briefing.com

I think this is a conundrum for the bears, because a look at the history of this indicator tells us that major downturns in the economy and markets don’t occur after sentiment reaches its lower bound. They start when sentiment is peaking, as they did in 2007 and 2019.

The Federal Reserve, led by Chairman Powell, was horribly late in tightening monetary policy during the economic recovery in 2021. There was a complete disregard for the unprecedented fiscal stimulus that accompanied its near-zero interest rate policy. Chairman Powell will forever be stained with his false assertion that the rise in inflation to a 40-year high was “transitory.” I do not think he wants to make the same mistake twice by being as wrong in forecasting the inevitable decline in inflation as he was in its ascent. Therefore, I think we will see the long awaited pivot between Wednesday’s 50-basis-point rate increase and the Fed’s next meeting on February 1, 2023. The high-frequency economic data between now and then should give the Fed confidence that a pause in rate hikes is the right course of action, as market forces and a 4.25-4.5% Fed funds rate bring the rate of inflation within target without ending the expansion.

Be the first to comment