The US is the economic behemoth of the world, and this stems from its unique place at the centre of the world’s financial, monetary and cultural crossroads. It has the strongest conventional military, it has the world’s most used currency, and everyone holds its issued government debt. One would be hard-pressed to find any place in the world under any government where the USD is not accepted. This is the position that MMTers (Modern Monetary Theory) dream about. A government that can issue debt without consequences. It seems that someone in the Fed was listening. The US is not the place of completely free markets anymore, nor does it even approach its position of regulating to ensure free market competition the same way (see Thomas Philippon’s book The Great Reversal for a better discussion on these changes). It would have been impossible to think that the Federal Reserve would step in and ensure the financing of private companies, states, municipalities or even ensure unlimited federal spending just months ago. Yet, the current crisis has turned all these assumptions on their heads.

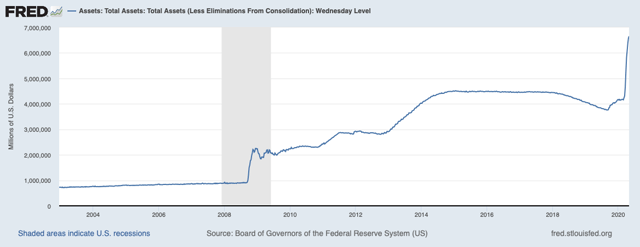

Since the beginning of the COVID-19 crisis in the US, the Fed has stepped to the plate and continuously batted for a homerun. They have cut the effective federal fund rate down from its 2.4 plateau before the crisis to under 1% again. They reduced reserve requirements for banks to help combat any liquidity crunch in the financial system. It also announced that they would be buying up unsecured short-term debt to allow for sellers of this type of debt, typically businesses rely on this for operational purposes, to find a buyer. This was a historic move that showed the beginnings of how far the Fed is willing to grow to prop up the US economy. There has also been the entrance of the Fed into the municipal bond market in the US, which could possibly increase the depth of liquidity in these previously shallow markets. The biggest stimulant from the Fed, and the item that shows its commitment and willingness to engage in the US economy is its unlimited asset purchases plan. This is QE 2.0 with all the support and all of the problems it brings. It does underline the depth of the US financial and monetary system, which is unrivalled in the world, as it is backed by the USD and the US Government.

Source: FRED

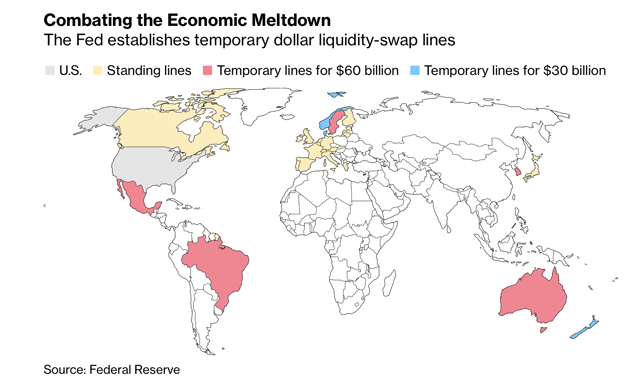

The Fed also reopened and opened up new swap lines to foreign central banks, which highlights the demand for USD abroad, and the position that the Fed has in ensuring the liquidity of markets globally in the mission for shoring up the US . It furthers highlights as well just the geographical reach of USD-denominated debt and the preference in a variety of countries in holding some form of asset in USD.

Source: Bloomberg

Source: Bloomberg

The Fed has shown that monetary policy and central banking has not run out of tools in its toolbox yet and that predictions that claim central banks would not have any room to manoeuvre due to extraordinary measures taken in 2008 were short-sighted. While, conventional monetary policy may not be as effective as it was, it is most definitely not the only tool available anymore for the Fed to utilise in its mission. There is clearly ample room for action by the Fed in terms of propping up businesses and the financial system through their asset purchases, alongside forcefully pumping liquidity into credit markets through banks. These asset purchases essentially make the Fed the lender of last resort to not only the financial system but to the entire system, which is clearly seen in the magnitude of the purchases relative to the beginning of QE in 2009. It has definitively expanded the role of the Fed in the macroeconomic management framework of the US for better or for worse and we shall see the balance sheet be inflated for quite some time. This role is being copied by others across the world, most notably the ECB, the BoJ and the BoE.

Source: FRED

Source: FRED

All of these actions alongside the $2 trillion fiscal stimulus passed by Congress just highlights the length that the US will go to in terms of ensuring the stability and vitality of its economy in ways other economic areas cannot. This crisis has also seen the return of the USD as being the true safe haven and the flight from other assets to the USD. This further supports the position of the US as leader in the global financial and economic arena and shows that the calls of the eclipsing of the US to be short-sighted at least for the near-future.

The US, due to these factors, will continue to be the centre of the world’s crossroads. After the crisis ends, the US markets in terms of treasuries, corporate debt and more broadly the equity market will most likely see the quickest and strongest revival, and will continue to probably be overbought due to its position as a hedge against risk.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment