R.M. Nunes

The iShares MSCI Mexico ETF (NYSEARCA:EWW) is idiosyncratic but an interesting geographical ETF that could make sense in the current environment due to exposures to consumer staples. While for US investors there is some logic to a Mexico investment due to lessened FX risks, latent risks leveled at it and its movement in line with what we think are overvalued US indices has us looking elsewhere due to directional risk, although we note the low PE, high earnings yield and relatively limited risks.

Thinking About Mexico

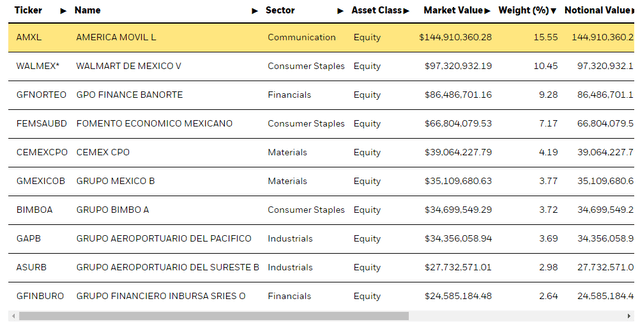

Mexico has been somewhat of an economic peculiarity these last years. In response to COVID-19 they went with austerity, in stark contrast with the rest of the world. In exchange, they have much less inflation but also very muted growth and lessened investment. The situation is certainly less volatile, although not great. However, as far as the EWW goes, exposures are primarily to consumer staples at a 30% exposure that have stayed strong in the current environment. The top stocks reflect this consumer staple heavy exposure, with Fomento (FMX) which is a Coca-Cola bottling company, Walmart De Mexico which doesn’t need to be explained and Grupo Bimbo (OTCPK:GRBMF) which is a consumer brands company that sells rolls, biscuits snacks and whatever else through supermarkets.

Top Holdings EWW (iShares.com)

Besides that, the major exposure is America Movil (AMX) which is a legacy telecoms company that produces voice services as well as wireless and wireline internet. So the premier Latin American telco company.

The skew towards necessities is pretty substantial, and the austerity regime in Mexico is unlikely to decimate a portfolio like this. Moreover, the Mexican economy is not on stilts unlike other western economies. But that doesn’t make it immune to the fortunes of others.

U.S. Connection

The connections between the US and Mexico are myriad, but we focus on two relationships. Firstly, the traditional effective dollarization of the Peso against the dollar due to the relationship between oil production of Mexico and the refining capacity in the US, and then the rebuying of refined products. Pesos and dollars trade hands a lot. Moreover, remittances are a very substantial source of foreign income for Mexico, which further connects the currencies. They trade very in line historically and this is a good thing for US investors looking at EWW. There isn’t much FX risk, the MXP is in a relatively good fundamental spot due to the set-up in the local economy.

The issue is to do with recession in the US, which has been stilted by loose monetary policy. Recession there will mean less remittances, and a smaller sink for Mexican exports. It also means a slower velocity of sent crude in exchange for refined products. The net effect isn’t big on MXP, but it does affect national income in total. Remittances are 5% of GDP and growing unemployment in the US due to latent forces coming from a corporate reckoning against consumer confidence and the invitation from high inflation for more rate hikes are an important risk for Mexican households.

The good thing is EWW trades really cheaply at 10x on stable, consumer staple companies. 10% earnings yield on a stable income source offers a good spread relative to higher reference rates. Things are good on that front, and markets seem to recognise that with YTD declines being only 5%. But the growth in the last years has also been a lot less than US markets, therefore the substantial discount on Mexican markets compared to the US. Directionally, latent issues with the US economy and indices make us worried, but taking a longer term view the valuation here looks alright with a decent 3% yield. FX risks being historically minimal could make it interesting for US investors. We’ll pass though.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment