Justin Sullivan

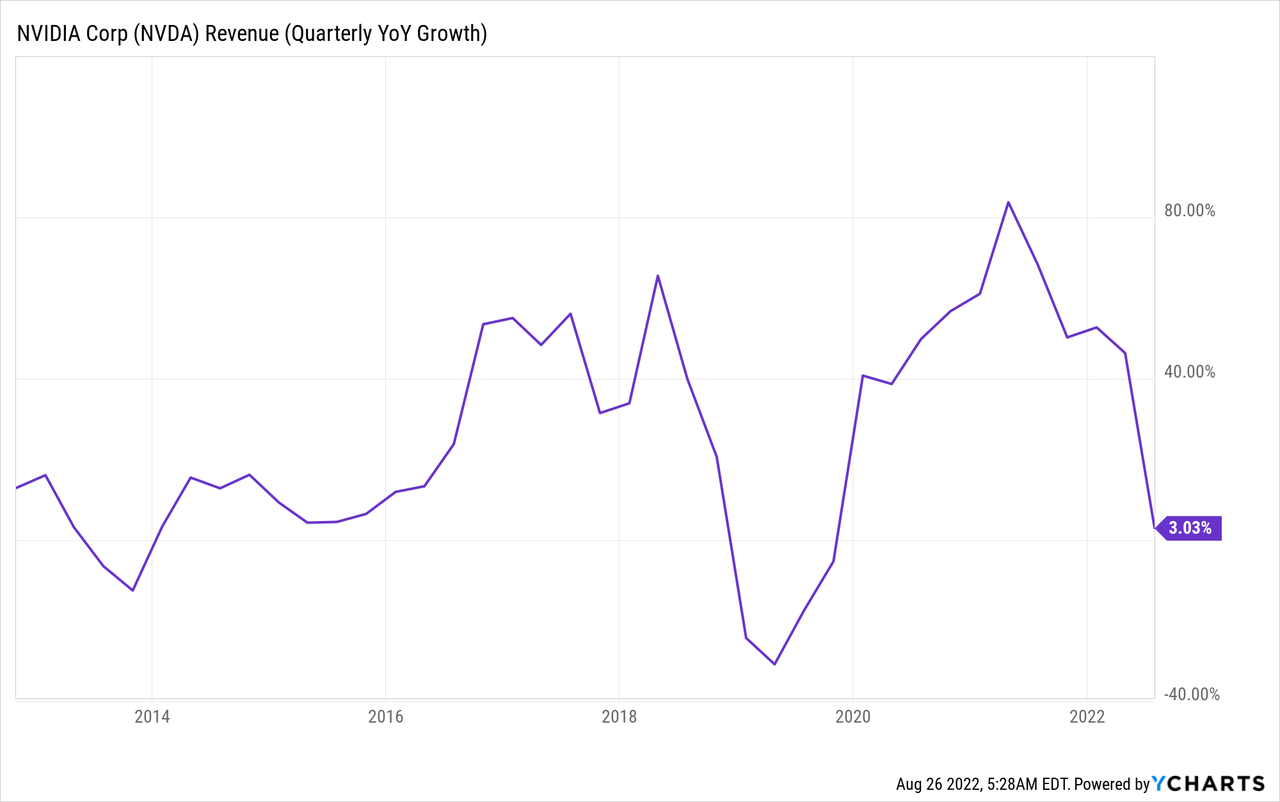

Nvidia (NASDAQ:NVDA) finally released highly anticipated earnings for its second fiscal quarter of FY 2023. Part of the earnings report card was the outlook for Nvidia’s third fiscal quarter, which was significantly worse than expected. Nvidia is seeing a massive slowdown in its Gaming business due to weakening demand and pricing for graphics processing units which have supported the chip maker’s results last year. Because of the size of the expected revenue drop-off in FQ3’23, Nvidia’s shares are likely set to correct further to the downside!

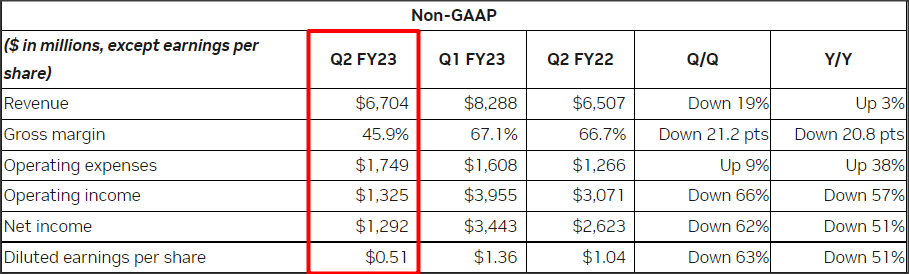

Nvidia’s FQ2’23 earnings card was as expected

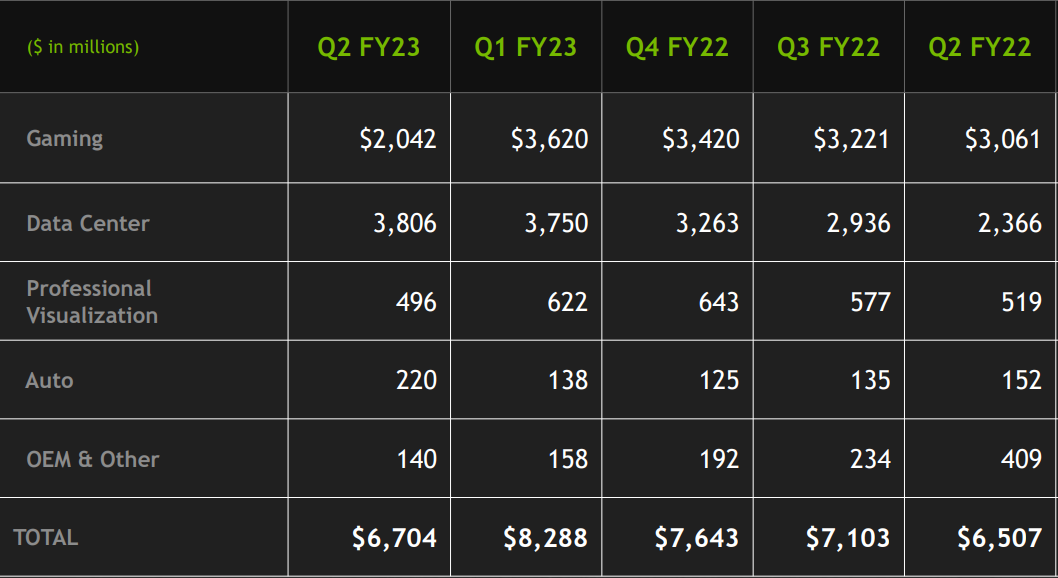

Nvidia’s second quarter results largely conformed with the release of preliminary results from the beginning of August. Nvidia guided for $6.7B in FQ2 revenues due to a 33% year-over-year top line decrease in the Gaming segment. Actual revenues for Nvidia’s FQ2’23 were indeed $6.7B, showing 3% growth year-over-year, but also a 19% drop-off compared to FQ1. Unfortunately, Nvidia’s gross margins collapsed in the second fiscal quarter to 45.9%, showing a decrease of 21.1 PP quarter-over-quarter. The drop in revenues and gross margins was overwhelmingly caused by the Gaming segment which reported, as expected, a 44% quarter-over-quarter drop in revenues due to weakening demand for GPUs and declining pricing strength for Nvidia’s graphic cards. Weakening pricing for GPUs also affected AMD in the last quarter, but Nvidia is more reliant on GPU sales than AMD and therefore more affected than its rival by the slowdown in the industry.

Nvidia: Final FQ2’23 Results

Nvidia’s Data Center revenues soared 61% year-over-year to $3.8B in FQ2 due to growing customer uptake of Nvidia’s computing platforms that support data analysis and allow for the managing and scaling of artificial intelligence applications. Nvidia’s Data Center business, because of the slowdown in the GPU segment, pulled ahead of Nvidia’s Gaming segment regarding revenue generation in FQ2.

While Nvidia’s Gaming business saw the biggest slowdown, the firm’s ‘OEM and Other’ business — which includes the sale of dedicated cryptocurrency mining processors/CMPs — also slumped. Nvidia’s CMPs are used by cryptocurrency miners to validate transactions for proof of work cryptocurrencies like Ethereum (ETH-USD).

Nvidia doesn’t break out how much of its OEM revenues are related to CMP sales, but crashing cryptocurrency prices in 2022 have not been good for business, obviously. Nvidia generated just $140M of OEM and Other revenues in FQ2, showing a decline of 66% year-over-year, due chiefly to decelerating demand for dedicated cryptocurrency mining processors. For those reasons, I don’t see Nvidia developing its CMP business into a multi-billion dollar revenue opportunity, as predicted previously, in the near term.

Nvidia: Segment Revenue Trends

Nightmarish guidance

The most important piece of new information in Nvidia’s release was the outlook for FQ3. Nvidia expects revenues of $5.90B plus or minus $118M, which would mark another 12% quarter-over-quarter decrease in consolidated revenues, which comes on top of the 19% quarter-over-quarter drop in revenues in FQ2. On an annualized basis, FQ3 revenues are down 29% compared to the beginning of the year, which marks a massive slowdown in Nvidia’s business. The revenue downgrade for FQ3 occurred as Nvidia expects the Gaming industry to adjust to lower GPU demand and work through high inventory levels. Nvidia’s revenue guidance of $5.9B for FQ3 compares to a consensus FQ3 estimate of $6.9B, meaning actual guidance was a massive $1.0B below the most recent revenue prediction.

I expected a sequential down-turn in revenues, led by Gaming, and projected FQ3 revenues to be between $6.0B to $6.2B, which reflected a sequential decline of up to 10%. Apparently, the situation in the Gaming industry is even more serious for Nvidia than expected, and it will affect how the market generates revenue estimates and values the stock going forward.

My expectations for Nvidia going forward

I expect Nvidia to continue to expand its Data Center business as demand for cloud computing, AI applications and hyper-scale platforms is only going to grow. However, I expect growth in this segment to be overshadowed by continual declines and pricing weakness in the Gaming segment. Worldwide PC shipments are expected to decline 9.5% (according to Gartner) in 2022, but I believe the drop could be even larger if a deeper US recession were to bite.

Since there is no short-term solution to getting rid of high inventories in the PC industry, I expect pricing weakness in the GPU market to weigh on Nvidia’s revenue potential. I also expect the pricing trend for both NVIDIA’s GeForce RTX 30 and AMD’s Radeon RX 6000 to remain negative, with larger discounts to the manufacturer’s suggested retail price possible. Nvidia’s RTX 30 GPU was available at a 9% discount to MSRP in July. Given the high inventory levels in the PC market paired with a drop-off in GPU demand, I expect Nvidia’s flagship graphics card to trade at even higher discount to the MSRP going forward.

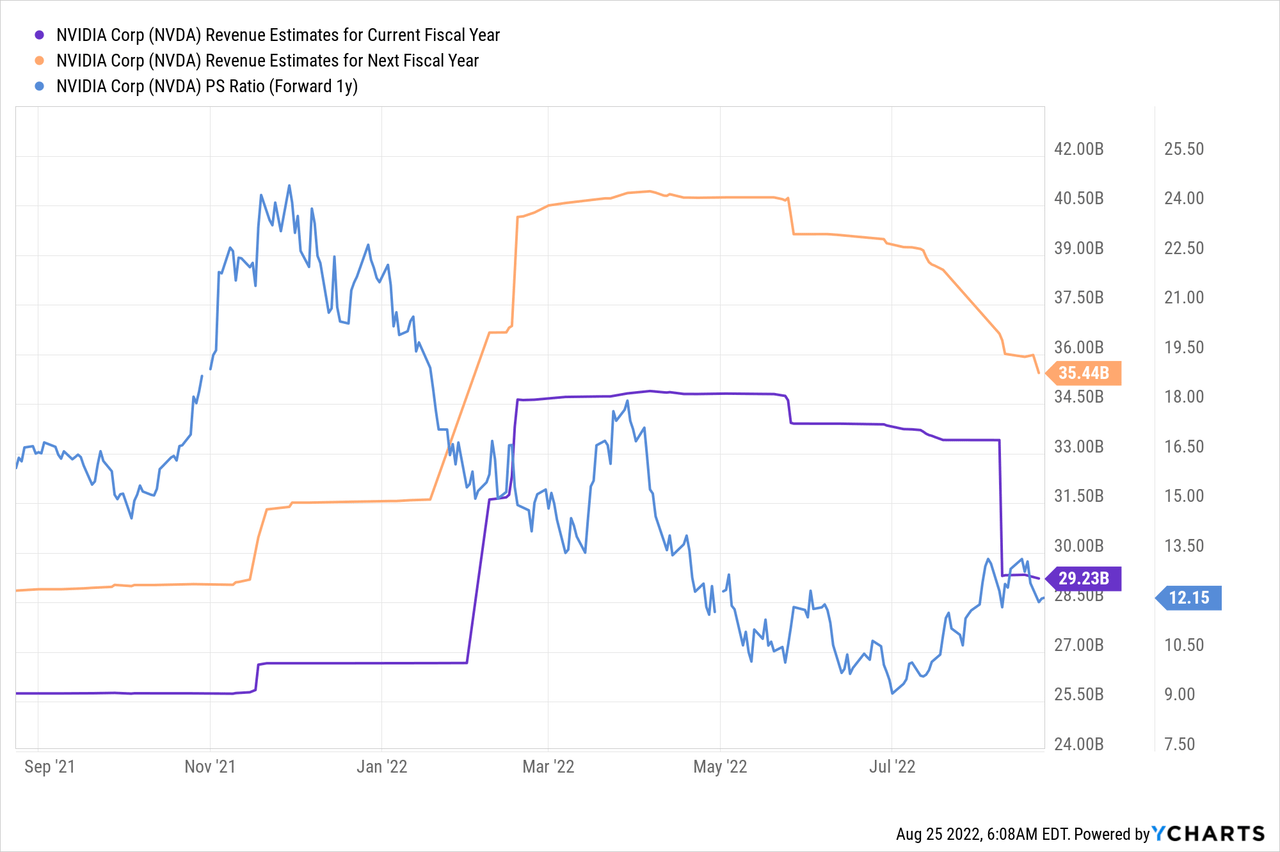

Because of the headwinds in the Gaming business, I expect Nvidia to generate about $27B in full-year revenues in FY 2023 (down from $28B), which means the chip maker could see no year-over-year growth whatsoever this year.

Estimate and valuation risk

Nvidia’s revenue estimates are now going to reset after the chip maker submitted a seriously bad guidance for its third fiscal quarter. As analysts incorporate Nvidia’s FQ3’23 revenue guidance into their projections, Nvidia is likely going to see a massive, broad-based reduction for its FY 2023 revenue predictions. Since lofty revenue expectations have been used to justify Nvidia’s generous valuation, a reset of expectations has the potential to drive a downward revaluation of Nvidia’s shares.

Nvidia’s shares dropped 4.6% after regular trading yesterday and, I believe, the drop does not accurately reflect the seriousness of the sequential revenue downgrade. Nvidia currently has a P-S ratio of 12.2x, and if revenue estimates continue to fall, the valuation factor may even increase.

Other risks/considerations with Nvidia

I see two big risks for Nvidia at this point in time. The first one is that the slowdown in the GPU market may last for quite some time, meaning Nvidia may have to deal with slowing Gaming segment revenues for more than just one more quarter. This is because the PC market is in a decline which affects the shipment of Nvidia’s GPUs. Secondly, revenue and earnings estimates, especially after the nightmarish guidance for FQ3’23, will reflect a reset of growth expectations which in itself could lead Nvidia’s shares into a new down-leg.

Final thoughts

Shares of Nvidia dropped 4.6% after the market closed, but I believe the sharpness of the expected revenue decline in FQ3 is not accurately reflected in this drop. The guidance truly is a game-changer because Nvidia’s period of hyper-growth is ending.

Nvidia’s outlook for FQ3’23 revenues was $1.0B below expectations and the company is going through a major post-pandemic reset in the GPU market… which could affect Nvidia’s valuation much more severely going forward. As estimates correct to the downside, Nvidia’s valuation is set to experience more pressure!

Be the first to comment