sdigital/iStock via Getty Images

A Quick Take On Core & Main

Core & Main (NYSE:CNM) went public in July 2021, raising approximately $698 million in gross proceeds from an IPO that was priced at $20.00 per share.

The firm distributes water, wastewater, drainage, fire protection and soil erosion control products in the United States.

It appears Core & Main is well-positioned to ultimately benefit from increased infrastructure spending, but those benefits may not materialize until well into 2023 or 2024.

For the time being, I’m on Hold for CNM but recommend putting it on a watch list for reconsideration as 2022 progresses.

Core & Main Overview

St. Louis, Missouri-based Core & Main was founded to sell a range of products and related services for municipal and regional water system operators, fire protection and soil erosion control purposes.

Core & Main was previously known as HD Supply Waterworks and was acquired from HD Supply by private equity firm Clayton, Dubilier & Rice in 2017 for $2.5 billion.

Management is headed by Chief Executive Officer, Stephen LeClair, who has been with the firm since September 2017 and was previously President of HD Supply Waterworks and held various leadership positions at GE Equipment Services and GE Appliances.

The company’s primary offerings include:

-

Pipes, valves and fittings

-

Storm drainage

-

Fire protection

-

Soil erosion control

-

Water meters and software

CNM appears to be pursuing an aggressive M&A strategy to add market share and geographic footprint.

Core & Main’s Market & Competition

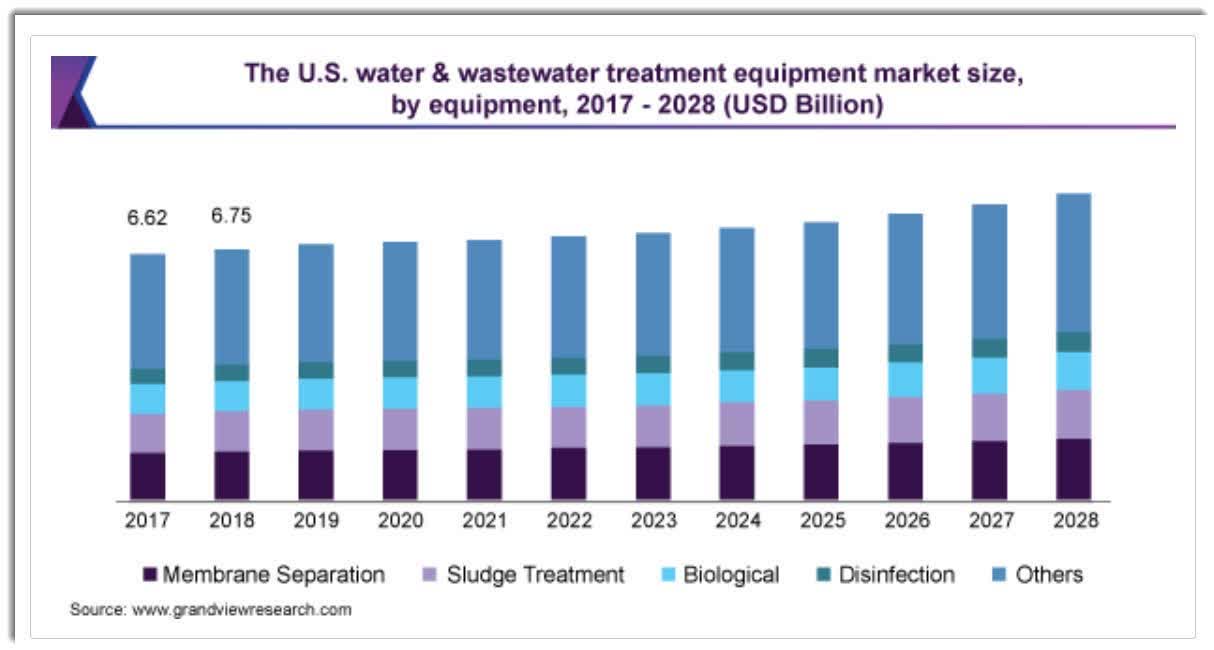

According to a 2021 market research report by Grand View Research, the global market for water and wastewater treatment equipment was an estimated $61.6 billion in 2020 is forecast to reach $84 billion by 2028.

This represents a forecast CAGR of 4.0% from 2021 to 2028.

The main drivers for this expected growth are a rising demand for clean water in urban areas, which are seeing a continued influx in population combined with reduced freshwater resources.

In the U.S., the country’s degrading infrastructure is in increasing need of repair and replacement.

Also, growing environmental requirements by governments are likely to add growth pressures, including in the wastewater treatment sector.

Below is a historical and projected future growth trajectory chart for the U.S. water and wastewater treatment equipment market:

U.S. Water & Wastewater Equipment Market (Grand View Research)

The company’s primary major competitor is Ferguson.

The markets the firm operates in are substantially fragmented into regional, local and specialty niche distributors as well as through manufacturer direct sales, together which management estimates accounts for a combined 70% of the market.

Core & Main’s Recent Financial Performance

-

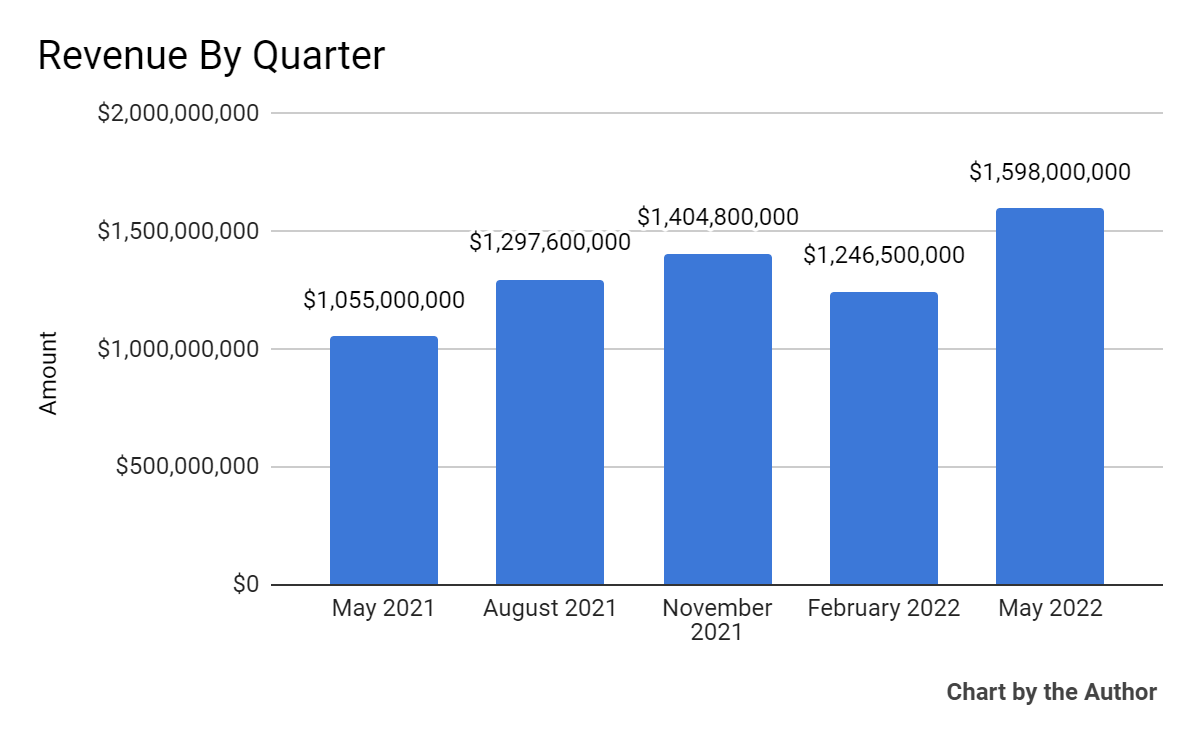

Total revenue by quarter has risen per the chart below:

5 Quarter Total Revenue (Seeking Alpha)

-

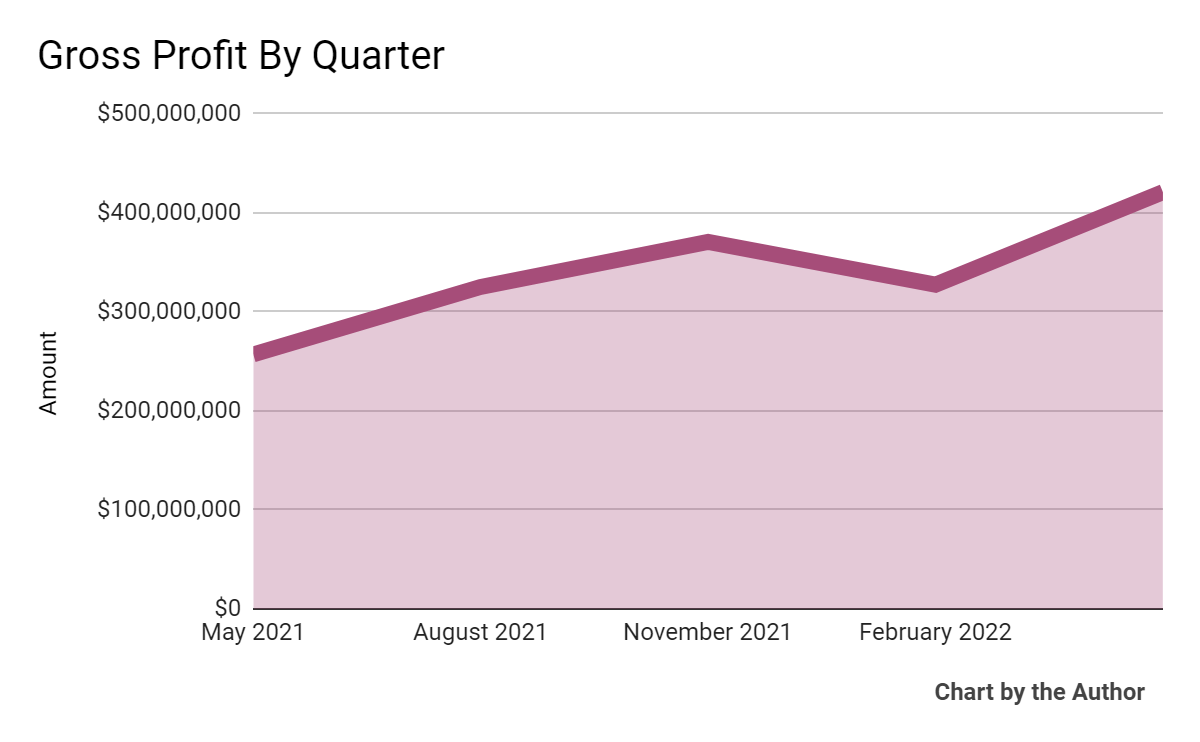

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

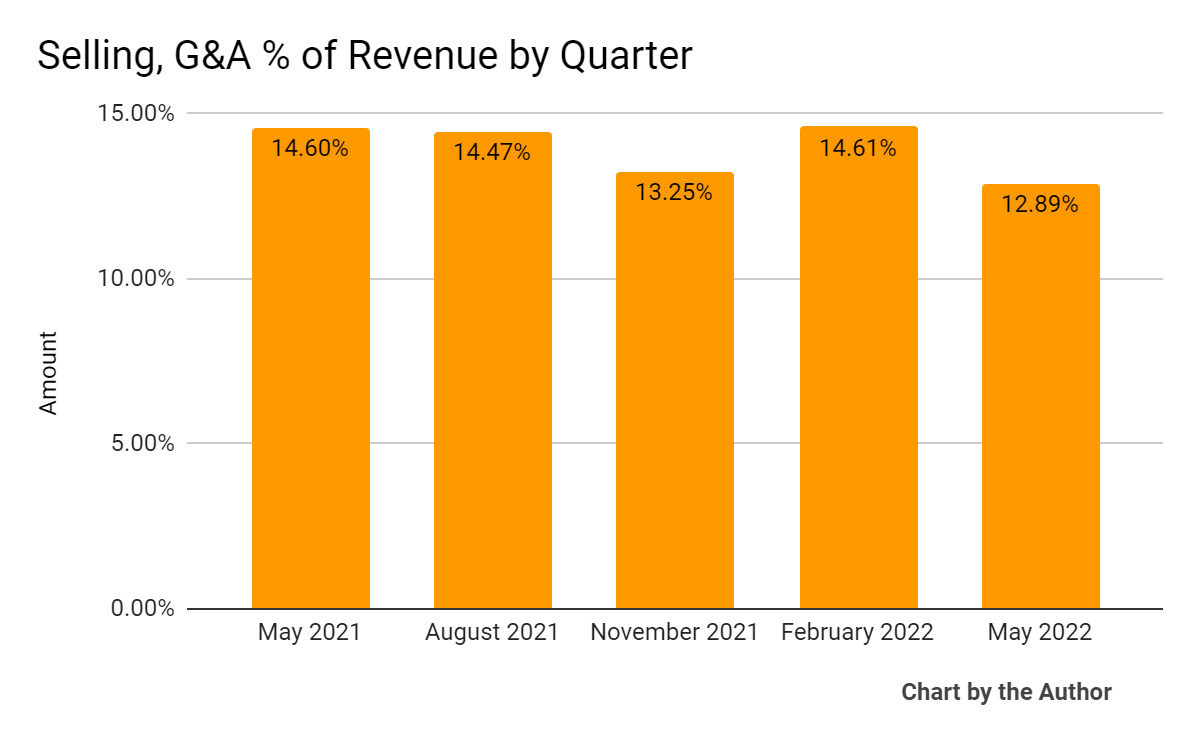

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a fairly tight range in recent quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

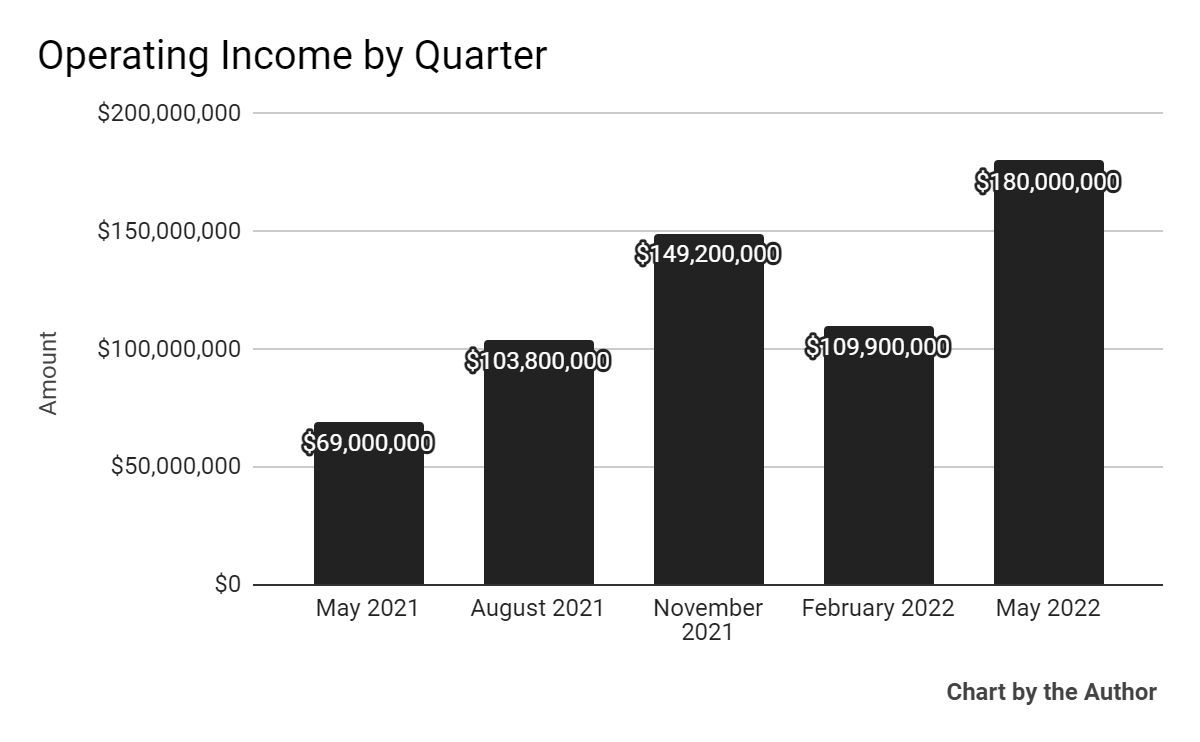

Operating income by quarter has risen significantly, if unevenly, in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

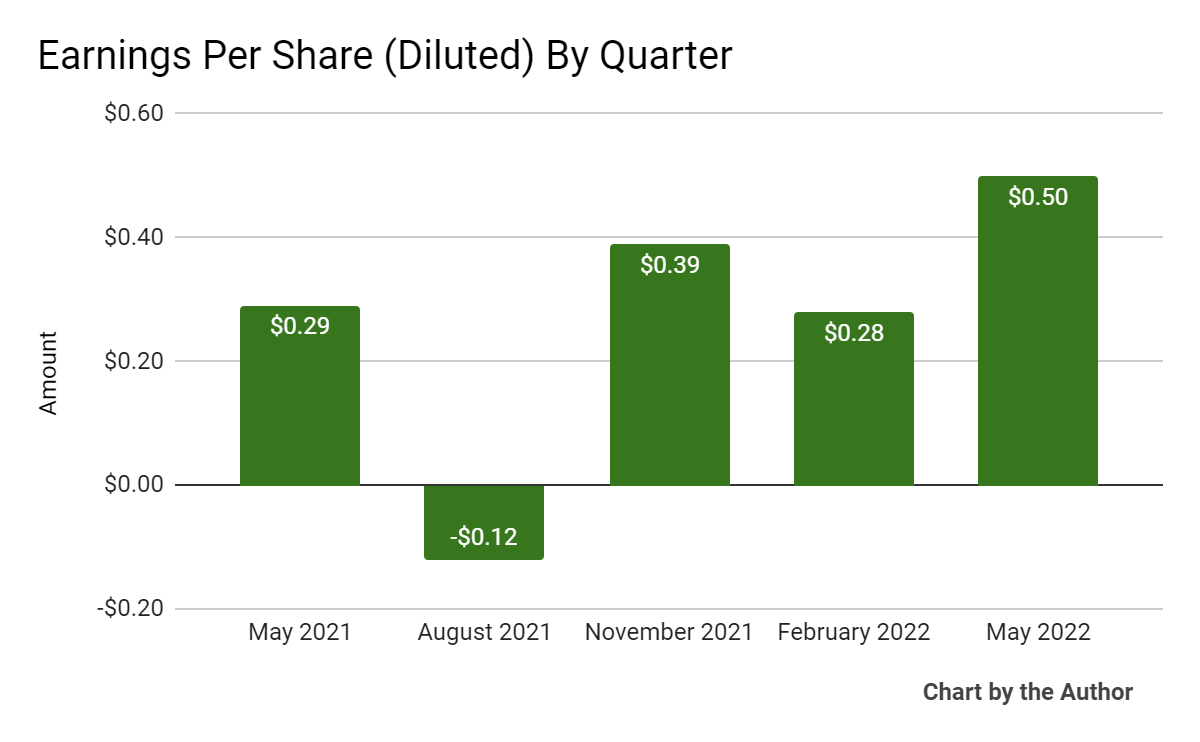

Earnings per share (Diluted) have also grown appreciably:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

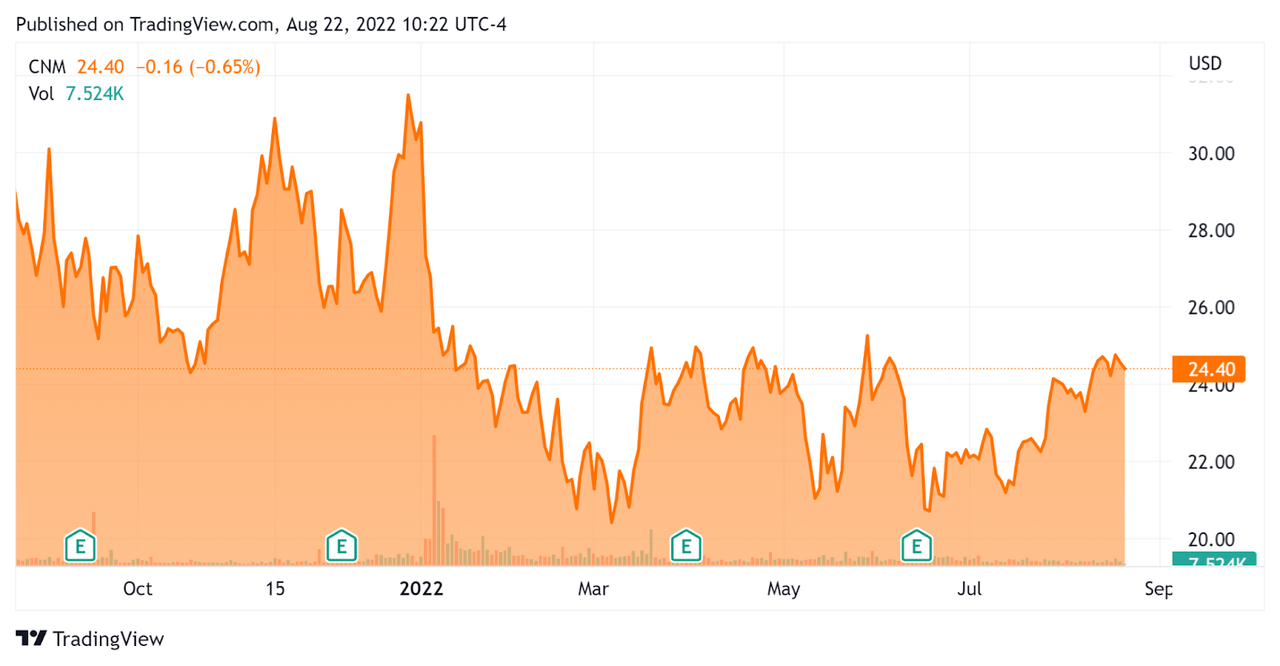

In the past 12 months, CNM’s stock price has fallen 16.4% vs. the U.S. S&P 500 Index’s drop of around 5.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Core & Main

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.15 |

|

Revenue Growth Rate |

43.9% |

|

Net Income Margin |

4.1% |

|

GAAP EBITDA % |

12.5% |

|

Market Capitalization |

$6,040,000,000 |

|

Enterprise Value |

$6,380,000,000 |

|

Operating Cash Flow |

-$24,000,000 |

|

Earnings Per Share (Fully Diluted) |

$1.05 |

(Source – Seeking Alpha)

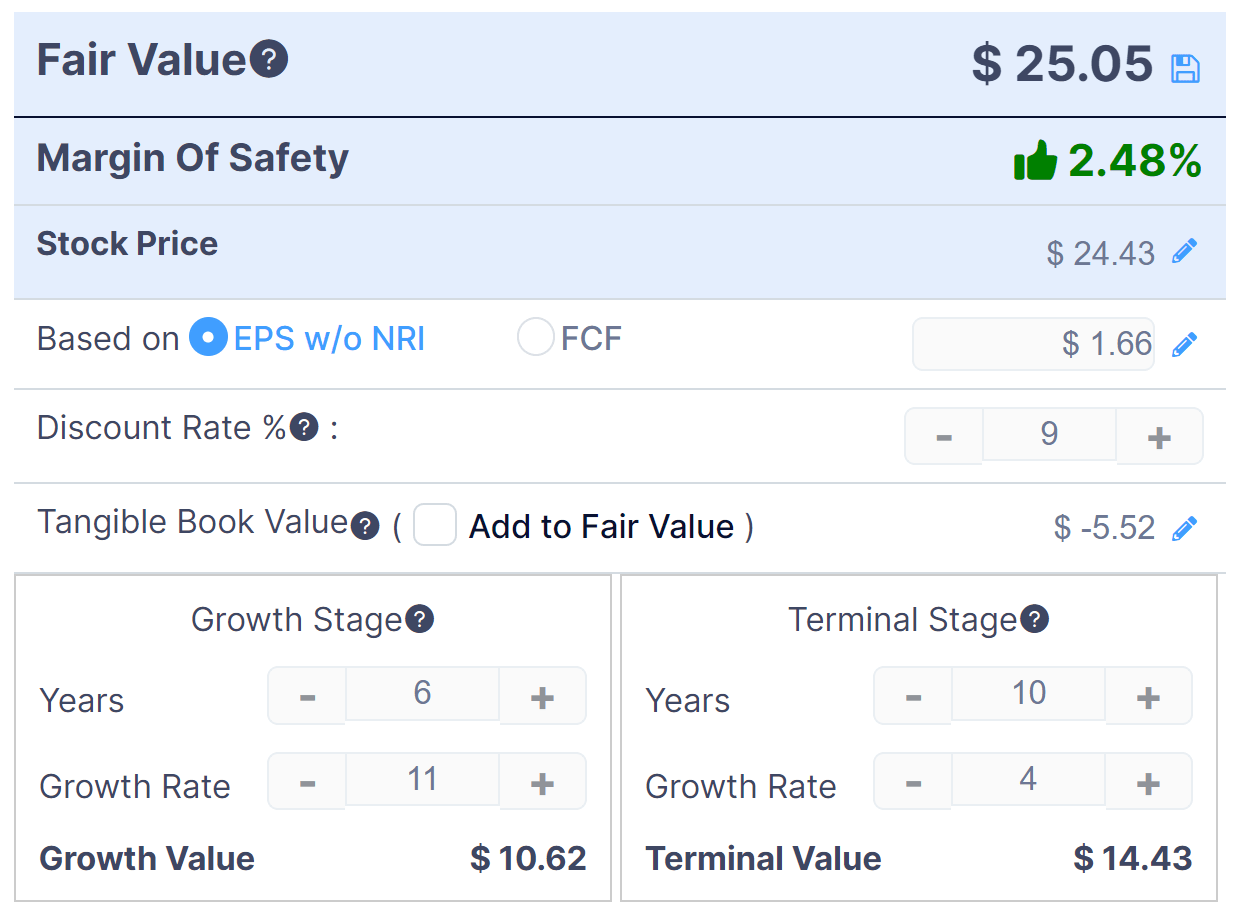

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

CNM DCF (GuruFocus)

Assuming the above DCF parameters, the firm’s shares would be valued at approximately $25.05 versus the current price of $24.43, indicating they are potentially currently approximately fairly valued, with the given earnings, growth and discount rate assumptions of the DCF.

As another reference, a relevant public comparable would be Ferguson plc (FERG); shown below is a comparison of their primary valuation metrics:

|

Metric |

Ferguson |

Core & Main |

Variance |

|

Enterprise Value/Sales |

1.08 |

1.15 |

6.5% |

|

Operating Cash Flow |

$1,430,000,000 |

-$24,000,000 |

-101.7% |

|

Revenue Growth Rate |

27.8% |

43.9% |

57.7% |

|

Net Income Margin |

8.3% |

4.1% |

-51.0% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Core & Main

In its last earnings call (Source – Seeking Alpha), covering FQ1 2022’s results, management highlighted growth in demand across its various end markets along with higher selling prices due to passing along price increases.

Notably, 40% of the company’s business is municipal repair and replacement activity, which is generally non-discretionary and thus more recession resilient.

While bidding opportunities grew during the quarter, the company continued to see product shortages, resulting in longer lead times and increasing material costs.

On the M&A front, the firm continued to close acquisitions to expand its distribution coverage into new geographies and new product lines.

As to its financial results, total revenue grew by 52% year-over-year and gross margin rate expansion was approximately 200 basis points, from 24.3% to 26.3% in the current quarter.

SG&A rose 34%, but fell as a percentage of net sales, due primarily to management’s ‘ability to leverage our fixed costs.’

As a result, operating income grew markedly during the quarter, producing the company’s best result in the past 5 quarters.

For the balance sheet, the firm ended the quarter with $1.0 billion in cash and equivalents, using free cash of $43 million. The company had net debt of $1.545 billion at quarter end, a reduction of .3x down to 2.2x sequentially.

Looking ahead, management does not see volume growth from the Infrastructure Bill until at least 2023 due to ongoing labor shortages and constrained supply chains.

The firm is also seeking to expand within the soil erosion control market, which management believes is a $5 billion addressable market. As the property is developed, soil erosion occurs, increasing the need for various erosion control solutions.

Management is seeking both organic growth and acquisition opportunities in this space.

For guidance, the firm increased its adjusted EBITDA for fiscal 2022 to $730 million at the midpoint, which would represent 21% growth year-over-year.

Regarding valuation, compared to competitor Ferguson, CNM appears similarly valued on an EV/Revenue multiple.

My discounted cash flow analysis also indicates the stock may be fully valued at its present level, although the DCF is highly sensitive to future growth rates and the firm may outperform on that account.

The primary risk to the company’s outlook is a macroeconomic slowdown, which would affect its discretionary business (60% of its total) and slow customer decision-making and project cycles.

A potential upside catalyst to the stock could include a ‘short and shallow’ slowdown or a pause in its rate rises, which could increase its valuation multiple by reducing its projected forward cost of capital.

It appears Core & Main is well-positioned to ultimately benefit from increased infrastructure spending, but those benefits may not materialize until well into 2023 or 2024.

For the time being, I’m on Hold for CNM but recommend putting it on a watch list for reconsideration as 2022 progresses.

Be the first to comment