Stefan Tomic/iStock via Getty Images

By: Alex Rosen

Summary

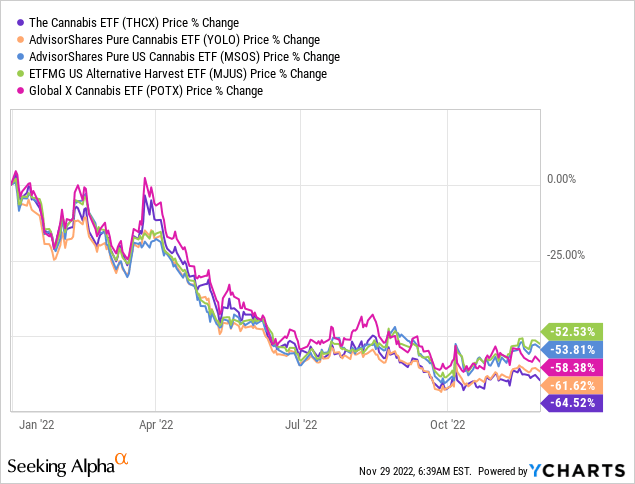

The Cannabis ETF (NYSEARCA:THCX) tracks selected North American Cannabis companies weighted by cap size. Overall the fund, which started in 2019 has had a rough go of it returning -35% over the past three years, and -63% YTD.

THCX is a fairly small fund with only $28 million in assets under management. Most of its holdings are in the top ten assets (71%) and they are evenly split between the U.S. and Canada.

Overall the Cannabis sector looks very promising, but we have concerns about the liquidity of this particular fund, and therefore rate it as a Sell.

Strategy

The Fund seeks to generally track the Innovation Labs Cannabis Index (The Index). According to THCX’s prospectus, the Index consists of publicly listed Cannabis Companies that are involved in the legal cannabis industry. The fund is rebalanced monthly, and is actively managed.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Aggressive

-

Sub-Segment: Cannabis

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): High

Holding Analysis

Due to the ambiguous state of the legality of the Cannabis industry, and the fund’s stated desire to hold shares in companies that strictly work in the cannabis sector, the fund has a high turnover rate. By excluding companies that also work with tobacco or alcohol, THCX has a fairly narrow universe from which to work in. As a result, the fund only has 25 holdings, and most of those (61%) are microcap holdings.

From a sector standpoint, the majority of the holdings are in either processing, or healthcare, and the entire fund is invested in either the U.S. or Canada.

Strengths

THCX takes a noble stance in avoiding any companies that also deal in alcohol and tobacco, and in the future that may very well be a good model to follow. For now though, as long as the legal status of Marijuana is still up for discussion, and illegal on a federal level in the U.S., it is difficult to see this model working. Strict cannabis companies have a very difficult time using traditional banking options, and access to lending is extremely limited.

One day and that day may be soon, laws will change, and the industry will be able to function on a par with alcohol and tobacco, and when that happens, it will be a good time to get on-board, but that day has yet to come.

Weaknesses

Other hemp and THC funds have acknowledged that the time to go it alone as a pure-play marijuana only fund has not yet arrived. Those funds are willing to invest in companies that may not be pure marijuana firms, but have a stake in the industry. Overall though every fund in the sector seems to be really struggling to find its way. Hopefully this will reverse course with a change in the legal status.

Opportunities

THCX is ahead of its time, it has lofty ambitions and is a principled fund. It is entirely possible, that the debate around the legal status of Cannabis is resolved and some of these microcap holdings blossom in to full grown large caps. If the fund can hold out until that day comes, it could really benefit.

Threats

While the trend seems to be toward full federal legalization, it is entirely possible, that it reverses course, and the Federal Government completely outlaws its use, not just for recreational purposes, but also for medicinal use.

If that were to happen funds that have a foot in the cannabis sector may survive, but a pure-play like THCX is certainly done.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

If you are a hardcore believer in the full legalization and expansion of the marijuana sector in the very near future, then the fundamentals that constitute THCX look promising. The fund does not hedge on Cannabis related companies, or just agriculture companies, instead it does as advertised. Unfortunately that has not brought about the desired returns.

ETF Investment Opinion

THCX is a visionary fund, much the same way electric car funds once were, and even airplane funds would have been if ETFs existed 120 years ago. The problem with visionary funds, is that no one knows when or even if that vision will become a reality. For THCX, it seems more likely the fund will stop trading before that time. As a result, we rate THCX a sell.

Be the first to comment