Kathrin Ziegler/DigitalVision via Getty Images

Overview

In my March 8, 2022 article, I wrote:

The internet revolution continues to connect more people and enable more information to be exchanged cheaper and faster than ever. On a platform like Airbnb (NASDAQ:ABNB), hosts can easily locate and communicate with potential renters of underutilized living spaces that were previously uneconomical to connect with.

“As a result, underutilized accommodation space can now be rented out to travelers for revenue with very little incremental cost… The host gets paid for the space that would otherwise have been wasted and the traveler gets a cheaper accommodation or a more personalized, hyper-local experience at a lower cost, so (almost) everyone [except the incumbent accommodation providers] wins.

My original investment thesis, which is summarized in figure 1, has held up well. However, I now realize that I have under-appreciated the longer-term growth potential of the extended-stay category.

Figure 1: My original investment thesis

|

Thesis |

Update |

Outlook |

|

Travel rebound as the economies around the world re-open |

The rebound has been very strong. Room nights overtook 2019 even though many places of the world (particularly in Asia, China in particular) have yet to re-open. Airbnb and the other online travel agencies ((OTAs)) are gaining share. ↗️ |

“Revenge travel” will continue and Airbnb will continue to gain market share. ↗️ |

|

Continued penetration of the travel lodging and vacation rental markets |

Market is still growing as both the supply of and demand for rooms have continued to rise. ↗️ |

Supply will increase as property owners become hosts to generate supplementary income to offset the loss of buying power from their salaries or retirement incomes. Similarly, demand will grow as travelers look for ways to stretch their lodging budgets. ↗️ |

|

Growth in the longer (> 7 day) stay categories |

I under-appreciated the growth potential in this category: rentals of over 28 days now make 20% of the total nights, while rentals of over 7 days now make up half of total nights. ↗️ |

I expect Airbnb to make further inroads into the extended stay market. ↗️ |

|

Future growth and long-term prospects |

Airbnb has many long-term growth opportunities, including the possibility of expanding into the multi-month or longer stay or apartment rental market. ↗️ |

Even though Airbnb has the brand recognition and relevant customer data it can leverage to enter this market, it faces tough competition from Costar Group (CSGP) and other incumbent online rental platforms.➡️ |

|

Valuation: attractive free cash flow yield |

Free cash flow yield has risen from 2.6% to 3.6% due to earnings growth and the stock price pullback. ↗️ |

The announced $2 billion share repurchase program indicates the company’s confidence in its near- to intermediate-term prospects. ↗️ |

The recovery in travel

TSA passenger count

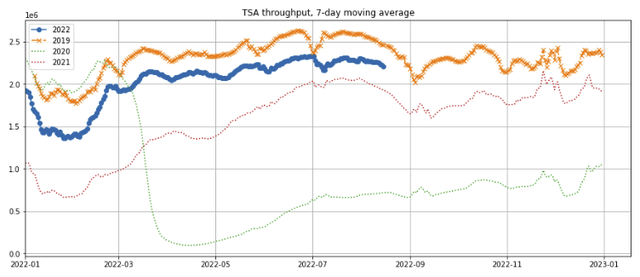

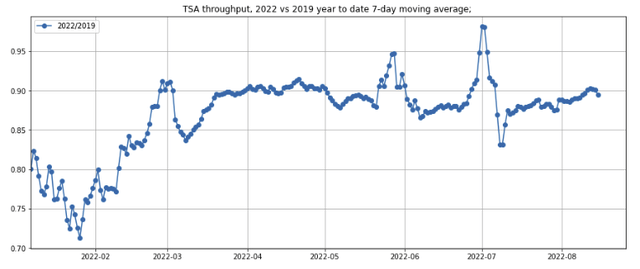

Even though the TSA passenger count has re-bounded from COVID-19 pandemic lows, the numbers have not returned to 2019 levels (figure 2, dark blue line vs orange line). They remain at about 90% of 2019 level (figure 3).

Figure 2: TSA passenger count:

Created by author using TSA passenger count data

Figure 3: TSA passenger count: 2022 as a percentage of 2019

Created by author using TSA passenger count data

IATA statistics and projections

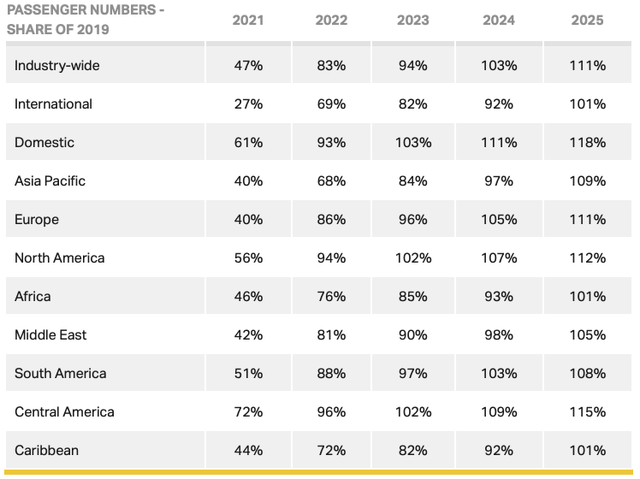

Statistics published by the International Air Travel Association (IATA) in March 2022 project air traffic this year to be at ~83% of 2019 levels (figure 4, line 1) and does not expect the number of air travelers to return to 2019 levels before 2024.

International travel recover is expected to lag domestic travel (line 2 vs line 3), and travel in the Asia Pacific region is still far below 2019 levels as many countries (e.g., China and Japan) have not fully opened their borders due to the COVID-19 pandemic. I also believe there is a huge pent-up demand from international travelers that will be unleashed when borders fully re-open.

Figure 4: IATA passenger count as a % of 2019–statistics and projections

IATA/Tourism Economics Air Passenger Forecast, March 2022

Airbnb has been gaining market share

Room night and revenue growth vs peers

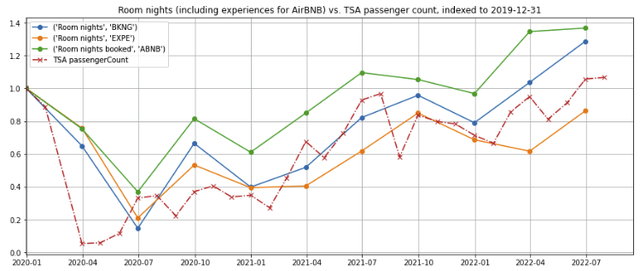

In contrast, Airbnb overall room nights (figure 5, green line) has re-bounded more strongly than TSA passenger count (figure 5, red dashed line) and exceeded its pre-pandemic levels by a comfortable margin. Airbnb’s room night bookings have also rebounded more strongly than its OTA peers Booking Holdings (BKNG) and Expedia Group (EXPE) (blue and orange lines). Airbnb noted that even though the growth in overall nights booked was up 25% compared to Q2 2019, the growth would have been 35% if Asia Pacific growth were excluded.

Figure 5: ABNB and OTA Room nights vs TSA passenger count, indexed to 2019-12-31

Created by author using public financial data

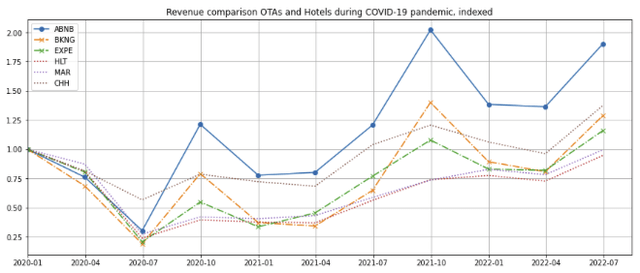

Airbnb’s quarterly revenue (figure 6, blue line) has also rebounded faster than its OTA peers Booking and Expedia (orange and green lines) as well as major hotel chains Hilton (HLT) (red line), Marriott (MAR) (purple line), and lower-end Choice Hotels (CHH) (brown line). All this is evidence that Airbnb is gaining share in the travel lodging market.

Figure 6: ABNB quarterly revenue vs OTA and hotel chains, indexed

Created by author using public financial data

Airbnb has leapfrogged direct competitor VRBO

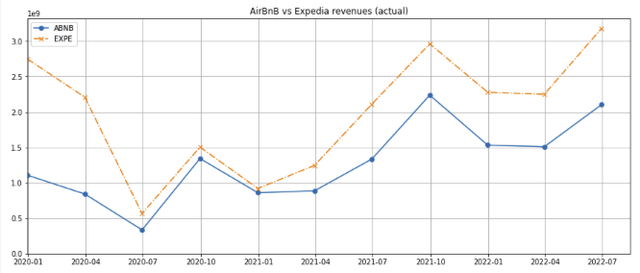

Airbnb’s revenue, which is heavily skewed towards owner-listed properties, is now about two-thirds that of Expedia (figure 7, blue line vs dashed orange line) — the owner of Airbnb’s direct competitor VRBO.com (Vacation Rentals By Owner). Expedia has not reported VRBO’s revenues separately since 2019–something that the SEC would require if VRBO represented a meaningful percentage of the firm’s total revenues. Furthermore, unless Expedia derives more than two-thirds of its current revenues from VRBO–which I believe is highly unlikely based on its 2019 revenue–I can quite comfortably surmise that Airbnb has surpassed VRBO in revenues.

Figure 7: ABNB revenues vs Expedia

Created by author using public financial data

In what is admittedly an unscientific and subjective “mystery shopper” study, I compared Airbnb’s website against VRBO’s, and felt that Airbnb had a better layout and provided me with a better user experience. In my unrepresentative sampling of cities, which consisted of those I have previously lived in, am familiar with, or would like to visit (e.g., Dubai in the UAE, Hualian in Taiwan, Marrakesh in Morocco, and Santorini in Greece), I found that Airbnb had more appealing rental properties, higher quality reviews, and instilled a higher level of confidence for a traveler like me. I wasn’t quite able pinpoint the specific factors or cause, other than to attribute it to the firm’s culture which may have originated from founders’ design-oriented mindset and training at the Rhode Island School of Design.

I believe there is still much upside from the travel rebound as borders around the world continue to re-open. This is especially true of the Asian countries, which have lagged the US and Europe. It is a matter of time before countries like China, which has been essentially closed since the COVID-19 outbreak in early 2020, re-open. Even though Airbnb recently exited China’s domestic listing market, it will still benefit from the tsunami of “revenge” travel by Chinese residents when outbound travel resumes.

Expanding market, particularly in the extended-stay category

Supply begets demand, and vice versa

The growth in demand for Airbnb rentals attracts more hosts who provide the supply of rental properties. This in turn attracts more visitors to the website, propagating a virtuous cycle for the company. On its Q2 2022 earnings call, Airbnb CEO Ben Chesky stated:

We have 4 million hosts on Airbnb, and I think that millions more can turn to hosting, especially during these economic times… Since 2019, our nights and experiences booked, they grew 24% and our active listings have grown 23%.

Guest demand is driving growth on our host community. We continue to see the strongest supply increases in areas of greatest demand, with nonurban active listings up 50% compared to Q2 2019. But as demand is returning to cities, we’re also seeing an increase in total urban supply.

He further noted that the top professions of hosts in the US are schoolteachers, healthcare works, and students. Unlike the professional hosts who are looking at a return on their property investment, many individual hosts come back on Airbnb when demand drives rental rates up.

In today’s inflationary environment, it is likely that more property owners will enter the short-term rental market to generate supplementary income to offset the loss of buying power from their salaries or retirement incomes. By introducing additional supply of short-term housing onto the market, they also potentially help mitigate the inflationary pressures.

The growth in extended-stay rentals is accelerating

According to Airbnb management, nearly 50% of rentals are over seven days and rentals over 28 days now represents one-fifth of total room nights, up from ~14% just a year ago. This is partly due to lifestyle changes enabled by remote working technology that accelerated with the outbreak of the COVID-19 pandemic. The ability to work remotely has enabled workers to move to and work from locations they enjoy, as well as to take long weekends and working “vacations” away from their homes.

As workplaces re-open, employees who have moved away from the cities their offices are located in but required to return to the office periodically can opt stay in an Airbnb property, which is likely more cost effective and comfortable than a cookie cutter hotel room or an Extended Stay America-type suite.

Longer-term growth opportunities

Airbnb has enabled individual property owners to compete against larger professional property owners, managers, and brokers. It has also blurred the line between very short-term lodging and extended stays, as increasing numbers of people are booking month or two-month long stays at Airbnb properties. To quote Airbnb CEO Brian Chesky:

People are now living on Airbnb

My conjecture is that the growth in Airbnb longer term stays were initially largely driven by digital nomads and now remote workers, but I would be watching closely to see if the company gradually encroaches the traditional rental market occupied by incumbent platforms such as Apartments.com and ForRent.com (both owned by CoStar Group (CSGP)).

For many decades, housing rental landlords have required potential tenants to submit formal applications, undergo detailed background, credit, and reference checks, then enter into lease agreements that are typically at least 12 months. They require the tenants put up a security deposit based on their monthly rent and extract a penalty should tenants decide to terminate the lease early. Airbnb’s marketplace and review system could reduce some of the friction in yet another example of how disruptive innovators can up-end well-entrenched incumbents.

In his book The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail, Harvard professor Clayton Christensen described how large incumbent companies lose market share by listening to their customers and providing what appears to be the highest-value products, but new companies that serve low-value customers with poorly developed technology can improve that technology incrementally until it is good enough to quickly take market share from established business.

While Airbnb can hardly be described as having “low-value customers” or “poorly developed technology” today, it has the technology, customer reviews, and proprietary data that could enable it to potentially replace the cumbersome renter background, credit check, and lease signing processes the way companies like Credit Karma and Upstart are doing in the loan market.

This is purely a conjecture and just one of a vast number of potential opportunities for Airbnb to leverage its existing assets and data trove to expand into new markets.

Airbnb CEO Brian Chesky said during the company’s Q1 2022 earnings call:

We are absolutely looking at new opportunities and new services. Nothing we paused from from the pandemic is off the table to resume … there are some really big opportunities going forward … But the name of game is [to stay] focused, just a few things at a time, [on] the most perishable opportunities to get as much scale into an ecosystem, and then you can do a variety of line extensions for guest and for host.”

He concluded,

I’m 40, and I don’t want to feel like the best ideas we had were in my 20s or 30s … You’re going to see some major new offerings around Airbnb experiences and a significant demand. And I think that some of our best ideas are ahead of us.

Brian Chesky successfully transformed Airbnb from an unproven idea into a lodging behemoth, and I believe it is a reasonable bet that he can pull more bunnies out of the hat.

Financials

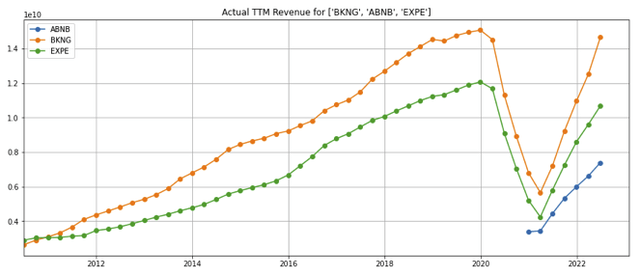

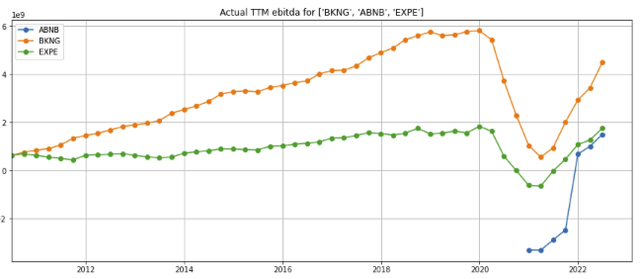

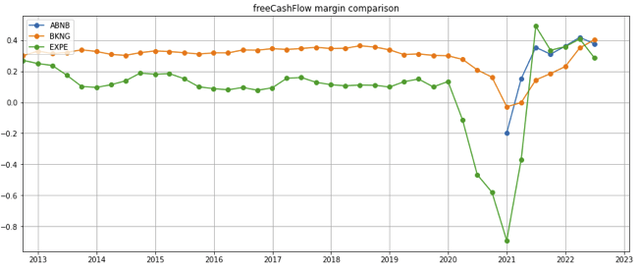

Airbnb’s trailing twelve-month (TTM) revenues have recovered sharply from the COVID-19 pandemic (figure 8, blue line) and is approaching two-thirds that of Expedia (green line). Its EBITDA is close to Expedia’s (figure 9) and its free cash flow margin has expanded into the 40% range (figure 10).

Figure 8: ABNB TTM revenues vs comparables

Created by author using public financial data

Figure 9: ABNB TTM EBITDA vs comparables

Created by author using public financial data

Figure 10: ABNB TTM free cash flow margin vs comparables

Created by author using public financial data

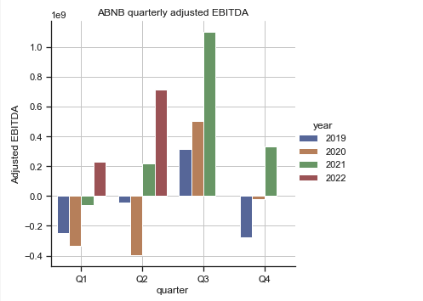

The company’s Q2 2022 quarterly adjusted EBITDA tripled from the year-ago period (figure 11, Q2, red vs green line). I am optimistic about the EBITDA for Q3 2022, but it would be too much to hope for a tripling over Q3 2021 EBITDA.

Figure 11: ABNB quarterly revenues vs comparables

Created by author using public financial data

Stock price and valuation

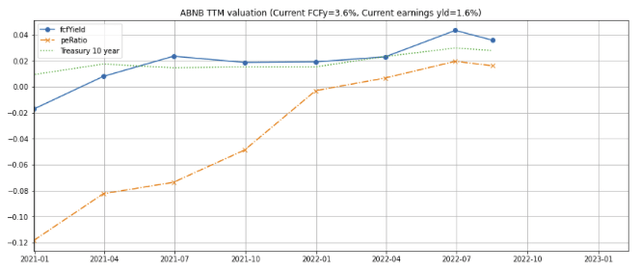

When I wrote my previous article, Airbnb’s free cash flow yield (FCFy) was ~2.6%, but it has since expanded to 3.6% due to the stock price pullback and earnings growth.

Figure 9: Airbnb valuation: free cash flow and earnings yield

Created by author using public financial and stock price data

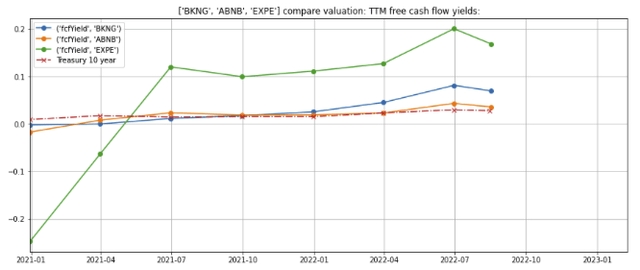

Airbnb’s FCFy is lower than both Booking and Expedia (i.e., the valuation is higher), which I believe is justified due to the relatively lower penetration of its potential addressable market and higher expected growth rate for the next several years.

Figure 10: Airbnb free cash flow yield vs comparables

Created by author using public financial and stock price data

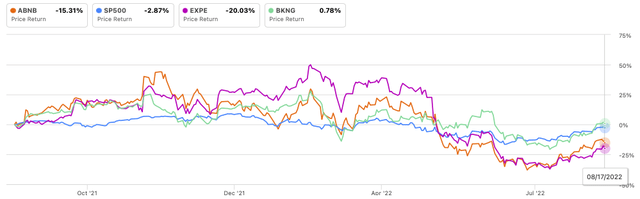

Even though the stock price is up 30% from its early July 2022 lows (figure 11), I believe it still trades at an attractive level.

Figure 11: Airbnb stock price

Seeking Alpha charting

Concerns

-

Risk of deceleration in growth as firms require employees to return to the offices full time, reducing the employees’ flexibility to choose where they live and work: In what the media call the Great Return, many large companies in the technology and financial services industries, which are well suited for remote work, are requiring their workers return to the office. According to a survey by Microsoft, 50% of companies are planning to require employees to return to in-person work full-time in the next year. Given the amount of employee pushback firms have received, it is possible that some employers will continue to give employees the flexibility to work remotely part of the time, but this is a trend I will be monitoring closely.

-

The negative impact of the war in Ukraine on travel: Airbnb CFO Dave Stephenson noted that the war has had an impact on the number of bookings in Europe, which were up 25%, compared to a 37% growth in the US (Asia Pacific has continued to be a drag because many countries have been slow to re-open their borders). However, the overall number of nights and experiences booked was up 25% to 104 million–the highest number achieved in the company’s history.

-

Another pandemic outbreak or the spread of another infectious and high fatality COVID-19 variant: Although the world is probably far better prepared to handle a pandemic now than before, this could still cause the volume of travel to fall significantly in the short term.

In summary

-

My original investment thesis on Airbnb based on its continued penetration into the travel lodging market and the rebound in travel is playing out, and Airbnb is gaining market share.

-

I under-appreciated the growth potential of the longer-stay category: rentals over 28 days now make 20% of the total nights and rentals over 7 days now make up half of total nights sold on Airbnb. I expect the company to make further inroads into the extended stay category.

-

The stock price has pulled back sharply following the Federal Reserve interest rate hikes and fears of a travel slowdown due to the Ukraine War. It now trades at an attractive free cash flow yield of almost 3.6%.

-

As a long-term investor, I am planning to increase my position in Airbnb.

Be the first to comment