ipuwadol

This year’s market chaos has called what I would call “dislocation” in the growth stock segment. Investors have sold off high-valued growth stocks, especially in the tech sector, in an almost indiscriminate fashion. Fear bred selling momentum, and just like in the tech run-up of the pandemic when fundamentals were ignored in sharp rallies, fundamentals were also ignored on the way down.

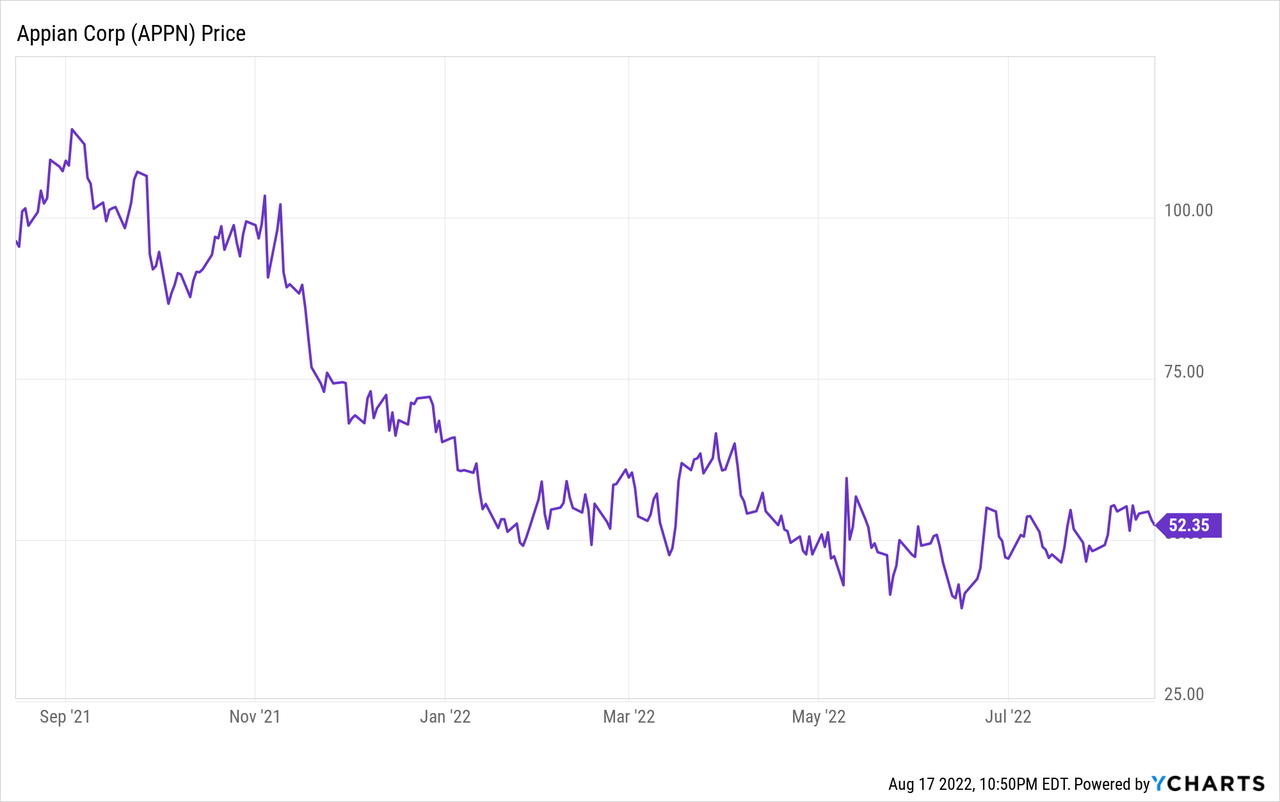

It’s a good time, in my view, to buy into shares of high-quality tech stocks on these pullbacks, and Appian (NASDAQ:APPN) is a great candidate here. This business process management (BPM) software company is capitalizing on a post-pandemic surge in demand for business transformation and automation. But in spite of continued strong results, the stock has followed the rest of the market in a downtrend this year, and has shed 20% of its value to date.

Though I haven’t always been bullish on Appian, I remain a solid buy here. The company’s management has an interesting stance on the state of the macroeconomy – while Appian is officially “bearish” and has seen some signs of deal cycles elongating, it’s so far citing no impact from macro conditions on its results. More on this regard from CEO Matt Calkins’ prepared remarks on the Q2 earnings call:

Appian is officially bearish on the economy. I’m bearish. I think inflation will persist and economy-wide demand will slow, and the U.S. will probably end up accommodating an unhealthy level of inflation while suffering the penalties of reduced growth as well, essentially the opposite of the soft landing theory.

I say this upfront because I want to be clear that while my forecast informs Appian’s plans, it stands apart from Appian’s experience. Appian is not seeing any evidence of a downturn. None of the symptoms I just described are visible from the perspective of our business.

We saw some deals slip out of the second quarter, which could be taken as a sign that deal cycles are lengthening but we always see a few deals slip, and Q2 wasn’t unusual.”

Looking ahead to the longer term, as a reminder for investors who are newer to this name, here are what I view to be the key bullish drivers for Appian:

- Broad use cases and deeply greenfield market. Appian estimates its TAM at roughly $37 billion, indicating that its present ~$500 million annual revenue run rate is only a fraction penetrated into the BPM space (business process management). Automation is a benefit to any industry, any department, and any workflow – and with the dearth and expense of technical workers to go solve these problems, businesses are finding it faster and easier to have line-of-business users automate their own processes instead, as long as limited technical knowledge is needed.

- $2 billion court decision against Pegasystems in Appian’s favor. The quick background here: Pegasystems (PEGA), one of Appian’s key rivals in BPM, was found guilty of hiring a worker as a government contractor to remit back Appian’s internal software secrets back to Pegasystems. Needless to say, a $2 billion windfall would be quite substantial for a company like Appian that generates shy of $500 million in revenue and whose market cap is less than $4 billion.

- Stellar growth is now coming from subscriptions. Appian continues to generate >30% y/y subscription revenue growth, and its mix of low-margin professional services revenue continues to shrink, which has pushed up Appian’s gross margins to be closer in line with software peers.

- High levels of government authorization. As software investors are aware, selling software into the U.S. federal government requires hard-earned approvals, but can command some of the highest contract values in the industry. Appian Government Cloud received provisional authorization at “Impact Level 5”, which broadens its scope with the Department of Defense. According to Appian, it is one of the first companies ever to receive this level of authorization.

Checking in on valuation: at current share prices near $52, Appian trades at a market cap of $3.79 billion. After we net off the $138.0 million of cash on Appian’s most recent balance sheet, the company’s resulting enterprise value is $3.66 billion.

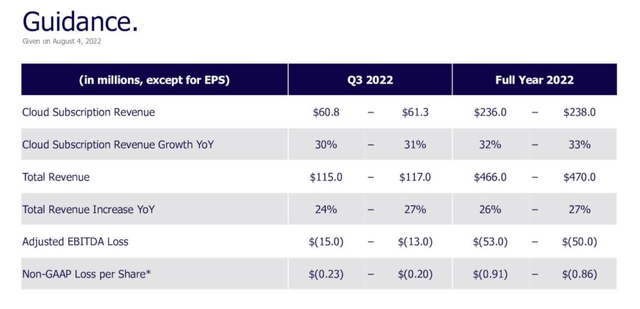

For the current fiscal year, Appian has guided to $466-$470 million in revenue, representing 26-27% y/y growth. This is an increase from the company’s prior outlook of 23-24% y/y growth – a refreshing instance of a tech companies boosting its forecast when guidance cuts are more the norm during the Q2 earnings cycle.

Appian outlook (Appian Q2 earnings deck)

Against this revenue outlook, Appian trades at 7.8x EV/FY22 revenue. If we look ahead to FY23, where Wall Street consensus is calling for Appian to grow revenue 16% y/y to $542.9 million (data from Yahoo Finance), Appian’s revenue multiple goes to 6.7x EV/FY23 revenue.

Note that it seems the market is heavily discounting the $2.036 billion in damages awarded to Appian in the Pegasystems case. Now, here’s the fine print on the press release announcing the court victory:

The jury’s verdict and the court’s entry of judgment is subject to appeal by Pegasystems. Pegasystems is not required to pay Appian the amount awarded by the jury until all appeals are exhausted and the judgment is final. Appian cannot predict the outcome of any appeals or the time it will take to resolve them.

While it’s certainly possible that the outcome will be appealed and the total damages reduced, this victory represents a giant windfall for Appian. Even if, say, ~$1 billion or half of the damages were ultimately awarded, Appian’s enterprise value would fall to $2.66 billion and trade at a ~4.9x multiple of FY23 revenue.

The bottom line here: there’s a lot to like about Appian in the current market. It has successfully pulled off a beat-and-raise quarter in Q2 at a time that many companies are voicing slowdown concerns. Its high mix of high-margin subscription revenue will eventually tip the company into profitability, and it is supported by secular tailwinds toward software-driven business transformation. Stay long here and wait on a full rebound.

Q2 download

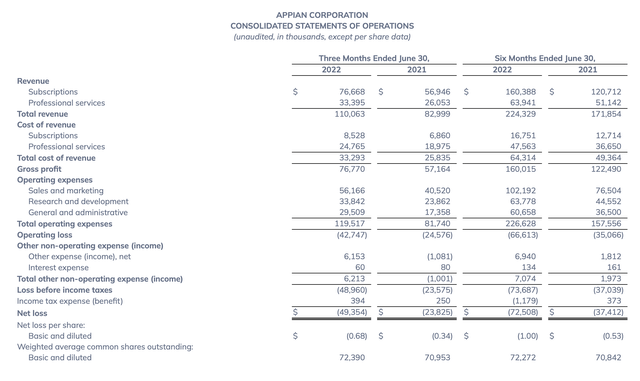

Let’s now cover Appian’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Appian Q2 results (Appian Q2 earnings deck)

Appian’s revenue grew 33% y/y to $110.1 million, beating Wall Street’s expectations of $104.0 million (+25% y/y) by a huge eight-point margin. Revenue growth also accelerated four points versus 29% y/y in Q1.

Public sector deals continue to drive major wins for Appian. In Q2, a federal health agency signed on a seven-figure deal with Appian to re-architect its budget management process. In addition, Appian is continuing to see success upselling to existing customers. Its cloud revenue retention rate was 116% in the quarter, on the high side of Appian’s 110-120% target.

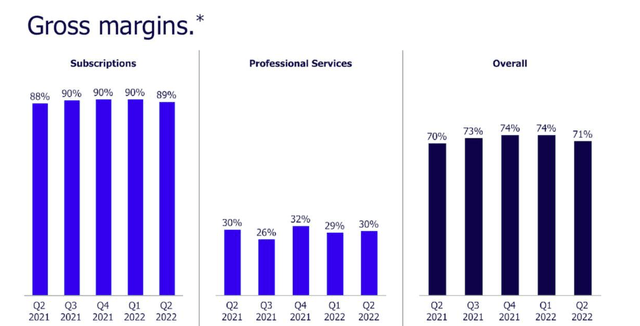

Overall gross margins in the quarter also slid up to 71%, one point higher than the year-ago Q2. This was driven by a one-point improvement in subscription margins to 89%, as well as a slight bump in the company’s subscription revenue mix to 70% of overall revenue (one point higher than the year-ago quarter).

Appian margin trends (Appian Q2 earnings deck)

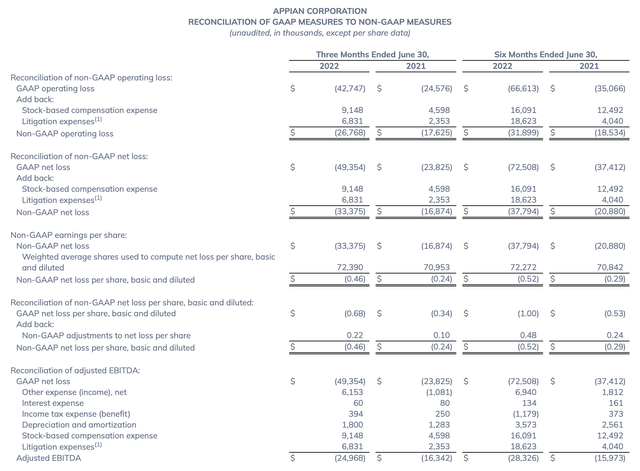

Like other companies, of course, Appian dealt with cost inflation in the quarter, with higher personnel costs added on top of a return to in-person sales events. Adjusted EBITDA losses widened to -$25.0 million, higher than the -$16.3 million loss in the year-ago quarter. Adjusted EBITDA loss margin slipped to -23%, three points worse than -20% in the year-ago Q2.

Appian profitability (Appian Q2 earnings deck)

I continue to emphasize, however, that with ~90% subscription gross margins and huge net retention rates, Appian’s business model lends itself well to scaling profitably in the future.

Key takeaways

With strong growth in a tough macro environment, high subscription gross margins and a rising subscription mix (Appian is expecting professional services to continue dropping off in Q3, with more partners taking on the low-margin services work), and a potential windfall from the Pegasystems case, there are a lot of bullish drivers at play for Appian. Stay long here.

Be the first to comment