Artur Nichiporenko

Introduction

Otter Tail Corporation (NASDAQ: OTTR) is primarily an electric utility company with a well executed diversification into manufacturing. It is very well positioned to overcome near-term challenges; however, I think the current valuations have priced in all the remaining upside for this company.

Company Profile

Otter Tail is a somewhat diversified corporation that can be divided into 5 corporations in three segments. They have their primary segment, which is their electric utility segment, which consists of Otter Tail Power Company. Their manufacturing segment consists of BTD Manufacturing Inc. and T.O. Plastics Inc. The last segment (Plastics), which primarily focuses on polyvinyl chloride (PVC) plastic pipes consists of Northern Pipe Products and Vinyltech Corporation.

Deeper Dive

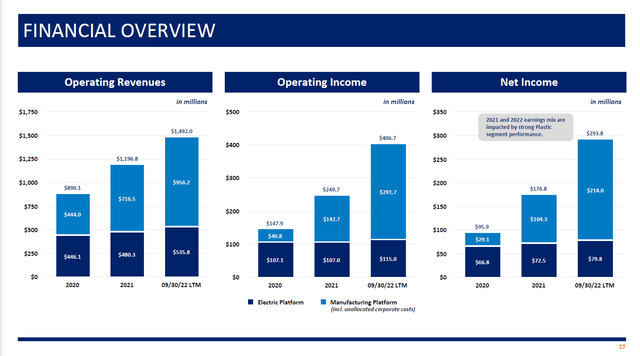

Reading into their 10-K filing deeper, I start to notice something rather unusual. They claim that their typical revenue composition consists of their electricity segment making 70% of their earnings and their plastics and manufacturing segments combined making up the remaining 30% of their revenues, yet their earnings and revenue are clearly not in a normal position, which is further highlighted in OTTR’s investor presentation on page 27.

The main reason they provided when they wrote their 2021 10-K filing is that conditions in supply and demand (likely the demand side) in their PVC pipe segment have provided for unusual revenues. Considering that 2021 was the housing boom when do-it-yourself projects and housing starts were increasing along with home prices due to increased demand, it is reasonable to see that the housing market primarily drove the increased revenues. However, looking into their most recent 10-Q filing, it is very clear that revenue mixes have not normalized yet.

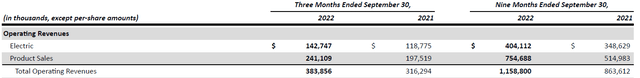

Otter Tail Q3 2022 Revenues (Otter Tail)

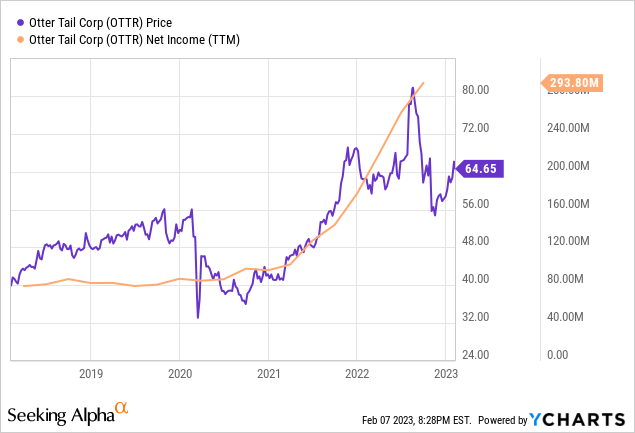

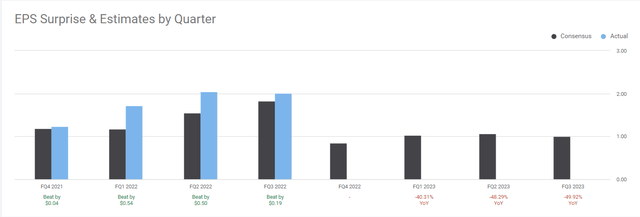

To return to the slide shown earlier, net income shows little signs of normalizing. Meanwhile on their earnings call, it seems that Otter Tail forecasts for these financial metrics to normalize and see some pressure as their clients use their stockpiled inventory (which was purchased at a higher price). At the same time, it seems the market isn’t too happy with that considering the major crash that occurred upon forecasting lower profit from their plastic segment, which also dragged down their official guidance.

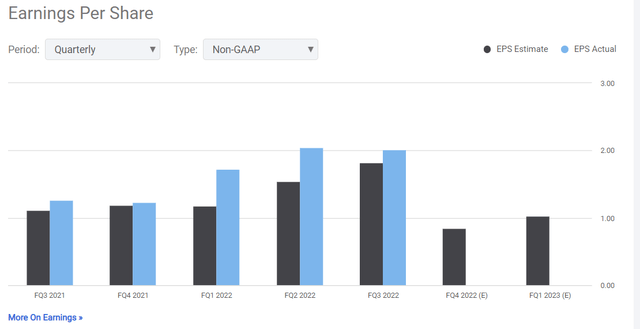

This is especially reflected in analyst estimates for both Q4 2022 and Q1 2023.

There is something strange, though. It seems that we’re going to see a quick bounce from the low earnings forecasted for Q4 2022, but then an increase in Q1 2023. They did note that winter and summer are their peak seasons, however I’m not sure what these estimates account for yet (as it’s not specific to any segment). Based on these estimates, it seems analysts are expecting a very quick fallout and recovery for the company. This might not be realistic as sometimes things take longer than expected to occur.

Looking even further on estimates, it seems that it is projected for Otter Tail to earn $4 per share (non-GAAP) annually. Considering that the stock price is elevated yet valuations give the impression of relative cheapness, it may be understandable if one falls in love with the stock just for how cheap it looks.

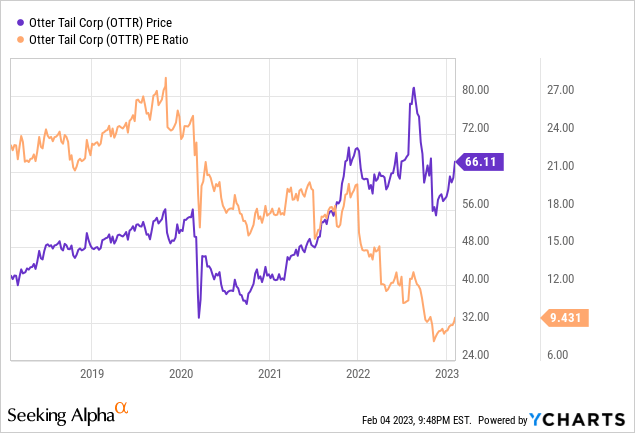

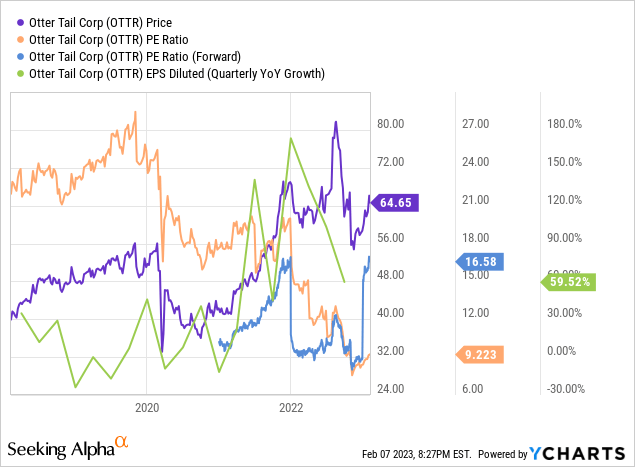

Historically, though, it seems that Otter Tail’s P/E ratio typically fluctuated between 22-24x earnings, which for my taste, is relatively expensive, but tolerable.

The low P/E ratio can justifiably be attributed to a low expectation for earnings. I would not expect major upside unless there was significant improvement in any segment for Otter Tail, especially as the stock price might start to catch up to reality or merely fluctuate in the current range.

However, I would not outright rule out the company. I’d need to see how it plays out over time and then decide based on how both the fundamental and technical factors play out. Otherwise, though, this is a promising and well-established diversified utility company with it’s own flaws and circumstances, but I can expect it to reasonably grow, even with its own constraints.

Expansions

There isn’t as much talk outside of SEC filings about the company expanding their capacity on the renewables or lower emissions scale. Looking around Seeking Alpha did not yield results and the company’s site has this article as the most recent thing I can qualify that dedicates some time to their long-term strategy.

The nature of expansions seems to be in line with their strategy to phase out their highly polluting plants or co-owned operations (namely coal plants) and replace them with renewable energy plants or less polluting resources such as natural gas.

In their 10-K, about three expansion projects are listed, each with their own different capacity and resources needed to generate electricity.

Merricourt Wind Energy Center: this is the oldest listed project, which was completed back in December 2020. It boasts a capacity of 150 megawatts and has a total expense spread between 2019 and 2020 of $260 million.

Astoria Station Natural Gas Plant: this project was done in tandem with Merricourt, especially considering the plant was operational months after Merricourt, but boasts a more impressive capacity of 245 megawatts. This plant was less expensive with a total cost spread between 2019 and early 2021 of $160 million.

These two plants together easily replace the capacity lost from retiring Hoot Lake’s coal plant around the middle of 2021. However, so far, there are no major projects that would contribute over a hundred megawatts, but we do have Hoot Lake’s solar plant being constructed. While it is expected to have a capacity of 49 megawatts for a total cost of $60 million, it does help begin a more direct replacement to Hoot Lake’s coal capacity. It won’t be operational, until 2023, however these timelines help for the next step.

These are the projects that were listed in the 10-K for 2021. When Otter Tail reports earnings for the full year of 2022 on the 13th, we’ll likely see an update to it.

With these expenditures in mind, we can also find a bit more information than at face value for their expansion efforts. Here’s a quick look at the data again:

| Expense | Capacity (MW) | Energy Type | Construction Start | Construction Finish | |

| Merricourt | $260M | 150 | Wind | 2019 | 2020 |

| Astoria | $160M | 245 | Natural Gas | 2019 | 2021 |

| Hoot Lake | $60M | 49 | Solar | ??? | 2023 |

Using Merricourt and Astoria’s numbers, it is possible to get a spread as to how much was spent across the two years of their construction (not counting the two months Astoria was still building in 2021). Total expense for both was $420 million and every year about $210 million was spent on both plants.

Currently, the solar plant doesn’t have a specified construction start date in the filings, but the tendency is that these plants take 2 years to become operational. It should be fair to assume a start date of December 2021, however it is not marked in the table to keep that data accurate as of Otter Tail’s filings.

Still, if we use the formula of splitting that expenditure into two years, Otter Tail might as well spend $30 million yearly on their solar plant.

If we look at the ratios we can get, here’s what we’ve got (Wind Capacity Expense Rate, Natural Gas and Solar too, Potential added wattage per year).

| Wind Capacity-Expense Rate | $1.73 million per MW |

| Natural Gas Capacity-Expense Rate | $653 thousand per MW |

| Solar Capacity-Expense Rate | $1.22 million per MW |

| Average Wattage Added Yearly | 148 MW |

Notably, wind energy is the most expensive investment that Otter Tail has incurred, which may make it reasonable for management to see the ROI of such an investment before making any more. Because they have made great progress in meeting their goals to provide 30% of their total power from renewable energy sources, it may be fair to understand why there isn’t much of a hurry for now to build more renewable plants, especially after such massive projects.

Natural Gas was easily the cheapest plant to construct on both a megawatt basis and a total expenditure basis. I can see why Otter Tail would want to add a second fuel type as this would allow to diversify their fuel sources and, if Otter Tail’s request implies expanding capacity for that second fuel, have a higher electric capacity.

However, considering that each year they added on average 148 megawatts since Merricourt opened in December 2020, I think the company is on good track to have more capacity available and being able to handle any changes in demand, as well as fulfill their emissions targets on time at least.

SWOT Analysis

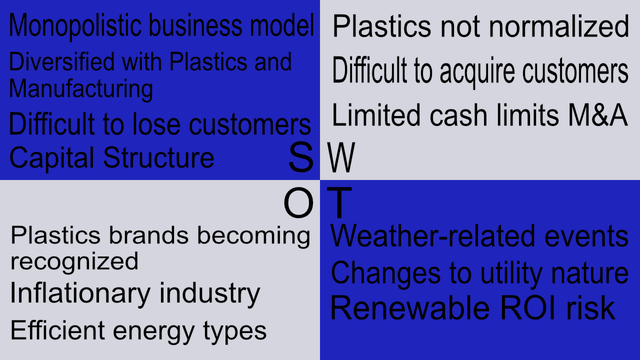

Meanwhile, I think it is fair to say that the company looks good. Here’s a SWOT Analysis that has some of the more important factors to consider that help or affect the company.

SWOT Analysis for Otter Tail (Made in-house)

Strengths

This company is rather strong by nature and virtue. I noted about four strengths here that I’ll explain further here.

Monopolistic business model: I’ll quote the 10-K filing to show this:

Retail electric sales are made to customers in assigned service territories. As a result, most retail customers do not have the ability to choose their electric supplier.

This basically means that these companies are legally allowed to have control of their service in a certain population. However, don’t expect this means they can raise prices. It is further mentioned that they also must file with local regulators (Public Utilities Commissions for the states they operate in) and the Federal Energy Regulatory Commission and depend on their decisions as to what price their electricity will have to be. This, however, eliminates competition in most jurisdictions and heads into the next part of their strengths:

Difficult to lose customers: as nature of their business model and environment, customers oftentimes can’t just switch to a different company if they don’t like Otter Tail’s service. Switching costs are very expensive for corporations and individuals alike as they would be forced to literally move elsewhere to get electric service from a different company, and as the Spanish (translated) saying goes: “better devil known than to know”. This is a double-edged sword, however, as I’ll explain later.

Diversified with Plastics and Manufacturing: in some places, they are tagged as a diversified utility company. Can’t say I disagree, especially as they hold three different businesses and seem to do well too. This is of the few conglomerates that could be worth buying longer term as Otter Tail has rather demanding requirements for each of their subsidiaries that all help to provide the consistent growth that they aim to achieve.

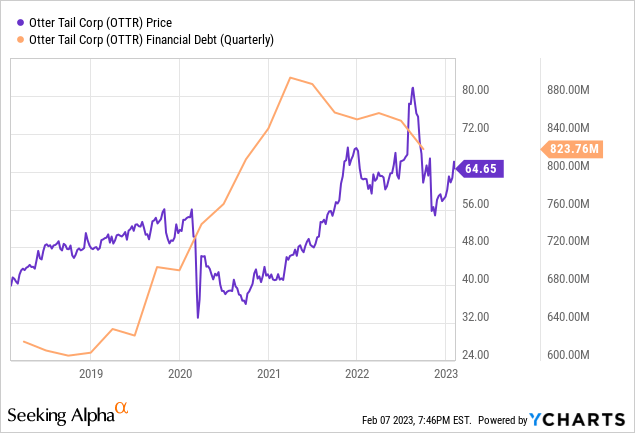

Capital Structure: If we go back to their earnings call, it is worthwhile noting that they do mention something about their company:

We assess our exposure to rising borrowing costs as low risk. Our variable rate debt consists of our two credit facilities. We don’t have any outstanding borrowings on the parent company facility and minimum amounts are drawn on the utility facility. Our holding company long-term debt is fixed rate and doesn’t mature until December 2026. And our utility long-term debt is also all fixed rate with maturities beginning in 2027 and extending to 2052

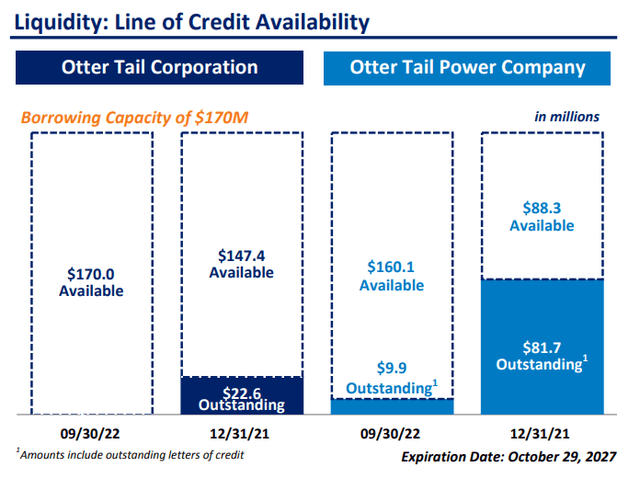

Another way to visualize this is through part of slide 30 of their presentation:

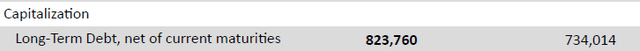

These are their shorter term borrowings. Now, I’ll show a part of their balance sheet to refer to what could be their outstanding long-term debt:

This is shown after long-term liabilities are counted, but it still counts as a liability. Let’s see if our YChart can validate these numbers

Debt clearly increased in the last few years but there are clearly some efforts made to reduce their debt, especially since 2021 began. This means that they didn’t wait for interest rates to go up, or for their debt to mature. This is good capital structure practice and the fact that they have any borrowings fully under control certainly shows good management in their financial situation.

Weaknesses

While there are strengths, there are also some weak points. While not enough to make Otter Tail stock an unreasonable investment, it is important to note that the way this company can be classified (slow growth, dividend, etc.) in your portfolio can be affected by these weaknesses.

Plastics not normalized: This is mostly a temporary headwind that should subside over time and is ultimately affected by external factors. There isn’t much the company can do about external factors; however, it is counted as a weakness due to it being an active problem in their income statements. It is likely because of this that management is focusing efforts to show results with and without Plastics. It is the title of the article, but it really reflects the takeaway and move I’d go with for now.

Difficult to acquire customers: at least in their electric segment. I haven’t covered Manufacturing and Plastics as much for now, however their electric segment – their most significant revenue and earnings contributor on a normalized basis – has a limit as to how much it can grow year over year consistently. Their bigger growth drivers might as well be their Manufacturing platform (Plastics and Manufacturing segments).

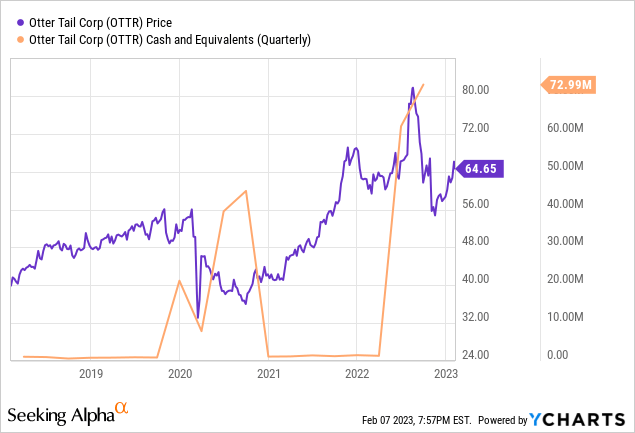

Limited cash limits M&A: In their 10-K, part of their strategy includes the possibility to acquire companies that meet their strict requirements (profitable growth, shortly put). Yet, let’s see how their cash position evolved over time.

Their cash position has made a solid improvement, yet they always run low on it. This is why they sometimes resort to financing new debt or issuing new equity, as they sometimes don’t have the cash to make important purchases immediately without financing efforts. Keep in mind, while this may be a weakness for now, further improvement will make this into an opportunity for the company.

Opportunities

Speaking of opportunities, I believe these are what I can see as potential ways to improve the company even further. They are mostly external factors, but by taking advantage of these, the company can capitalize on those and improve their balance sheet and bottom line.

Plastics brands becoming recognized: the plastics brands have seen a surge in demand here, but what would happen if those PVC pipes showed some characteristic that makes them more durable or affordable than others? If the brands contained in their Plastics segment do become more recognizable for their buyers, this could help normalize their Plastics segment with a higher volume and open the opportunity to expand into other geographic locations. This does need more research in case this opportunity is impossible, but I think it’s something that could happen. Emphasis on “could”.

Inflationary industry: I think that while Otter Tail won’t be saved from inflation itself, the nature of the electric business enables it to adapt to the changing worth of the dollar. One google search will show that a dollar back in 1970 adjusted for inflation is worth $7.44. If Otter Tail is meant to provide a return on investment (ROI) on their electricity, then they need to make sure that same revenue can be multiplied by 7.4x to compensate for inflation. Due to state regulations, they are allowed to have returns on investments they make through approved tariff rates. Those approved tariff rates would minimum increase by that much over that same period, otherwise Otter Tail would be forced to cut spending in other places. In an inflationary or “stagflationary” environment, Otter Tail would be among those more protected from the effects of inflation in a positive regulatory relationship.

Efficient energy types: As we’ve seen before, each of their plants had a different cost per megawatt of capacity created with their construction. In a similar fashion, should Otter Tail find a strategy with more efficient energy types both in up-front investment costs and continuous costs (maintenance, fuel or generation sources), I’m pretty sure that they’ll have even more incentive to prioritize those over coal and other fossil fuels.

Threats

The final part is certainly not the least important. Without threats, everyone would just buy bankrupt companies or obsolete businesses because they are basically untouchable. Here are a few I can see coming.

Weather-related events: while not limited to snowstorms, this is the main reason I have to add this here. As silly as it sounds, the Dakotas and Minnesota are some of the more frigid areas with the potential to see temperatures drop violently. While in a similar manner, these states would be prepared for such conditions, the weather is always unpredictable.

Changes to utility nature: We discussed prior that utilities are heavily regulated and allowed to run without competition. If this were to suddenly disappear, Otter Tail would have its business seriously affected as it would have to compete with another company willing to operate in the same territories, giving consumers more options. One never knows in an ever-changing regulatory landscape.

Renewable ROI Risk: This came to mind thanks to a prior commenter in a previous article I wrote. Here’s what they wrote:

BP management is disappointed in their Green returns and will start scaling some of them back.

This actually brings a counter to one of the opportunities I presented: what if those plants don’t bring a great return on investment? That will be a problem that could run counter to their emissions plans. Granted, if they can find just one renewable energy source that provides them with a good profit, it’ll be enough. Doesn’t mean that some of those costs incurred in prior plants won’t be lost. We’ll see over time how these new plants perform and if they integrate properly into the business. If there’s a serious problem in their ROI, we’ll likely hear it in an earnings call in the future.

Valuation

Finally, the part where we determine a price target for Otter Tail. Looking at historical P/E ratios are nice, although I have another idea in mind…

Alright, lots of data to take into account. As with growth companies, high P/E ratios are usually assigned with the expectation that earnings will grow at a fast rate. I don’t have a model to change fair value based on these subjective assumptions, but I can provide my own subjective view as to what valuation would be fair.

Historically, Otter Tail ran on a rather elevated valuation between 22x and 24x earnings. As they grew as a company, that valuation began to decrease as expectations for growth decreased amidst improving financial health conditions. Right now, Otter Tail is trading at one of the cheapest trailing ratios in the last five years. Now, remember when I said that it is estimated that Otter Tail will earn $4 per share? Here’s the reason why:

This is the basis of a forward-looking P/E. It is a subjective metric backed by analysts’ expectations for the company, often influenced by both data, the company’s guidance and emotions. It shows another side to the company’s perceived value. Forward P/E as of the close of February 7 is around 16; this is close to their historic trailing P/E. It certainly shows that Otter Tail should normalize over the next year.

This would then mean that normalizing earnings are already factored in, but not any future growth into them. When investing for the long term, you’re really just gazing into a wormhole not knowing where you’ll end up. You could end up with a 10-bagger or could end up with a bankrupt corporation. You know what you want to do right now, but if I’m honest with myself, there isn’t a single analyst in the world – no matter how arrogant or confident (or lack thereof) they are and brag about how they predict every move in the stock market – that has a crystal ball and knows what stocks will outperform.

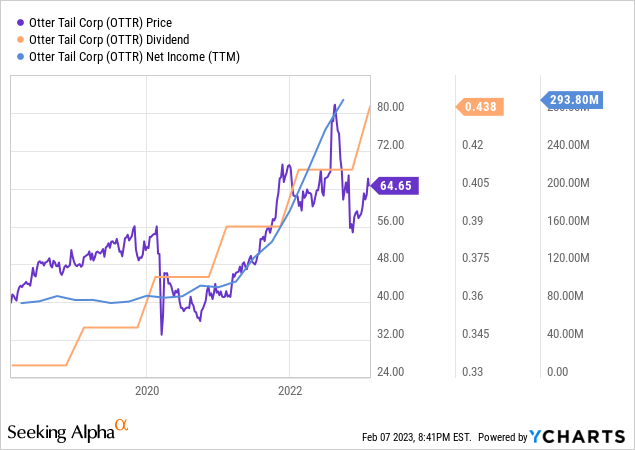

We can only use the current data to at least try to find companies that are in decent conditions for now, but continuous due diligence is certainly necessary. With that said, I can say that a P/E of 15x for a modest earnings growth would be fair, especially considering it boasts a pretty decent dividend that somewhat correlates with earnings growth.

I pretty much say somewhat mainly because it rises annually along with earnings after 2020. It does have earnings to now back up those increased pay-outs, which can certainly make this a future dividend king with a track record of raising dividends and earnings.

Because the expectation is to earn around $4 per share, a 15x P/E ratio would imply a fair price of $60 per share. This makes the case that there is not much upside to expect in the current year as most of the near-term conditions have been factored in. It is up for debate whether this company will continue growing as it was or stagnate and simply become a reliable dividend payer.

Conclusion

Otter Tail Corporation is a pretty good company overall with quite the potential to be one of those reliable companies that grow somewhat consistently. Current conditions have been factored into the stock price, and so there is no hurry to buy the company. It is better to let their Plastics segment normalize and take advantage of dips below the estimated fair value to at least get some bargain for an entry point.

With their advantages in mind, I rate OTTR stock a Hold (around a score of 3.30) with a price target of $60 and think it can be considered a “plain vanilla” Buy once Otter Tail’s Plastics segment potentially undergoes normalization this year.

Be the first to comment