bagi1998/iStock via Getty Images

The Buckle, Inc. (NYSE:BKE) operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States. It markets a selection of brand name casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories, and footwear, as well as private label merchandise. The company also provides services, such as hemming, gift-packaging, layaways, guest loyalty program, the Buckle private label credit card, and personalized stylist services, as well as special order system that allows stores to obtain requested merchandise from other company stores or its online order fulfillment center.

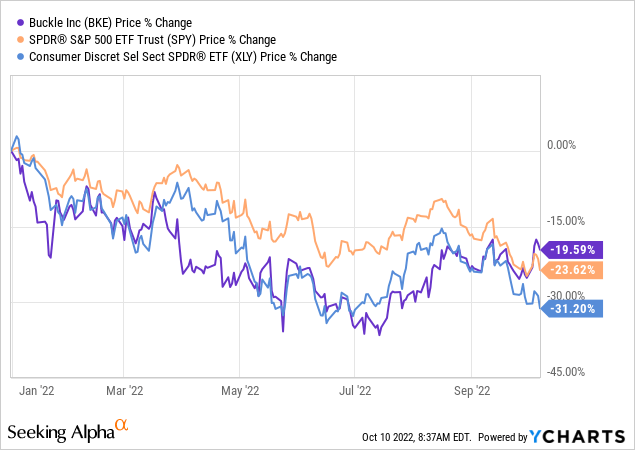

BKE’s stock price has declined by 20% year-to-date, outperforming both the S&P 500 (SPY) and the consumer discretionary sector (XLY).

In today’s article we are going to take a look at the macroeconomic environment and how it may influence BKE’s financial performance in the upcoming quarters. We are also going to analyse the firm’s latest quarterly earnings report and its financial position, to gauge how well-positioned the firm is in the current market environment.

Quarterly results

Revenue

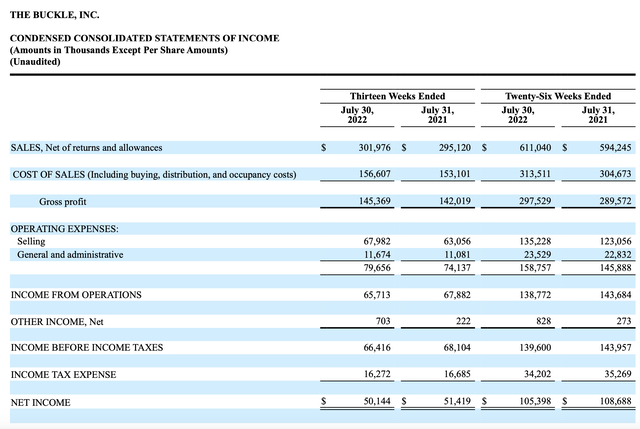

The net sales of BKE in the second quarter have reached as much as $301.9 million, compared to the $295.1 million in the year ago quarter, representing a 2.3% increase.

Condensed consolidated statements of income (BKE)

In the 10-Q filing, management detailed the drivers for this growth:

Total sales growth for the period was the result of a 3.6% increase in the average unit retail and a 0.3% increase in the average number of units sold per transaction, partially offset by a 1.5% decrease in the number of transactions. Online sales for the quarter increased 6.5% to $46.2 million for the thirteen week period ended July 30, 2022 compared to $43.4 million for the thirteen week period ended July 31, 2021. […] The Company’s average retail price per piece of merchandise sold increased $1.53, or 3.6%, during the second quarter of fiscal 2022 compared to the second quarter of fiscal 2021. This $1.53 increase was primarily attributable to the following changes (with their corresponding effect on the overall average price per piece): a 3.8% increase in average denim price points ($0.52), an 8.9% increase in average sportswear price points ($0.46), a 3.5% increase in average knit shirt price points ($0.36), a 5.3% increase in average accessory price points ($0.24), a 5.5% increase in average footwear price points ($0.19), a 6.8% increase in average woven shirt price points ($0.18), and an increase in average price points for certain other merchandise categories ($0.23); which were partially offset by a shift in the merchandise mix (-$0.65).

In our opinion, these figures are impressive, when taking the current macroeconomic environment into account. When writing about firms in the consumer discretionary segment, we often focus on consumer confidence, which to some extent dictates the demand for discretionary goods and services.

Consumer sentiment

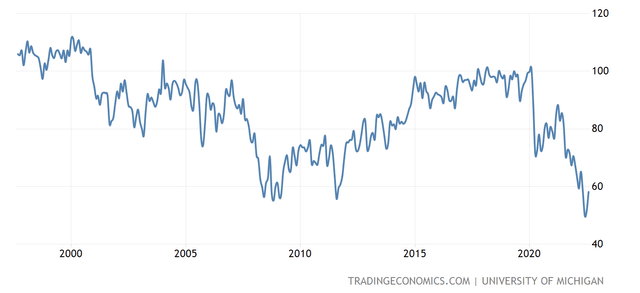

Consumer confidence – a leading economic indicator – is often used to estimate potential changes in the spending behaviour of the consumer in the near future.

Since the beginning of 2020, consumer confidence in the United States has been on a steep decline, despite the short uptick in the second half of 2020 and in August 2022.

U.S. Consumer confidence (Tradingeconomics.com)

In 2022, confidence has even fallen below the levels observed during the 2008-2009 financial crisis.

Confidence can be driven by a wide range of parameters, including inflation, energy prices, job security and it gives a measure of how optimistic or pessimistic people are about their financial outlook and the economy in general. Low readings imply that people are less certain about their financials and the economy and therefore are likely to save more. Such trends can lead to reduced demand for durable, discretionary, non-essential items, resulting in a negative impact on the financial performance of the firm’s manufacturing and selling such goods.

Because of the extremely low readings of the consumer confidence indicators, we have been staying away from most consumer discretionary stocks this year. We have published several articles on Seeking Alpha, highlighting the risks associated with investing in such firms. For example:

In our opinion, consumer sentiment may also create headwinds for BKE in the near future; however, the firm’s latest quarterly figures still indicate that the demand for their products and services remains high. For this reason, we believe that BKE may continue to outperform the consumer discretionary sector in the near term.

We also cannot forget about the expense side of the equation.

Expenses

While many firms in the consumer discretionary sector have been reporting skyrocketing expenses due to rising inflation, elevated raw material prices and rising shipping costs in the second quarter, BKE’s cost of goods sold and SG&A expenses have been relatively flat.

Gross profit after buying, distribution, and occupancy expenses was $145.4 million in the second quarter of fiscal 2022, compared to $142.0 million in the second quarter of fiscal 2021. As a percentage of net sales, gross profit was 48.2% in the second quarter of fiscal 2022, up slightly from 48.1% in the second quarter of fiscal 2021. The current quarter margin improvement was due to leveraged buying, distribution, and occupancy expenses. Merchandise margins were flat for the quarter.

Selling, general, and administrative expenses were 26.4% of net sales for the second quarter of fiscal 2022, compared to 25.1% for the second quarter of fiscal 2021. The increase was the result of increases in store labor-related expenses (1.35%, as a percentage of net sales) and certain other expense categories (0.55%, as a percentage of net sales).

Net income

Naturally, as a result of the slightly increased SG&A expenses, net income has somewhat declined year-over year.

As a result of the above changes, the Company’s income from operations was $65.7 million, or 21.8% of net sales, for the second quarter of fiscal 2022, compared to income from operations of $67.9 million, or 23.0% of net sales, for the second quarter of fiscal 2021.

Despite the decline, we believe that BKE is actually navigating the challenging macroeconomic environment quite well.

Before moving on, we also want to take a look at selected balance sheet items.

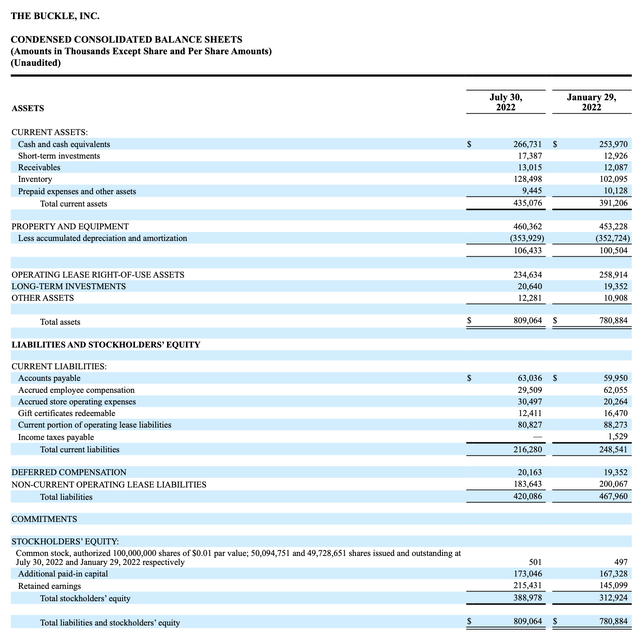

Selected balance sheet items

Current assets

In our opinion the recent increase in current assets, especially in cash and cash equivalents and short term investments are important. These two items, combined with the current liabilities, can give us an idea how flexible the firm may be financially in the near term.

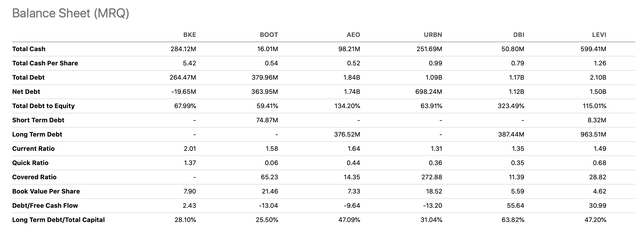

Balance sheet (MRQ) (Seeking Alpha)

Both the current and the quick ratio are above 1, meaning that current assets (quick ratio excludes inventory) exceed current liabilities. It is an indication that the firm has enough financial resources to cover its short-term liabilities. Compared to its peers, we believe that BKE’s financial flexibility is significantly better.

Let us also take a brief look at the inventory.

Inventory

Many firms have been having significant issues with inventory management this year, including Target (TGT) and Walmart (WMT). Both of these firms had to use significant discounting to get rid of obsolete excess inventory.

In fact, BKE’s inventory has also grown substantially compared to the prior year, however to a lesser extent than for many of its competitors.

While we cannot be sure that BKE will not face inventory related issues in the upcoming quarters, we believe that they are better situated than many firms in the consumer discretionary sector.

All in all, we believe that BKE’s financial performance in Q2 has been better than we would have expected in the current macroeconomic environment. Both the income statement and the balance sheet of the firm indicate that BKE is managing macroeconomic challenges well.

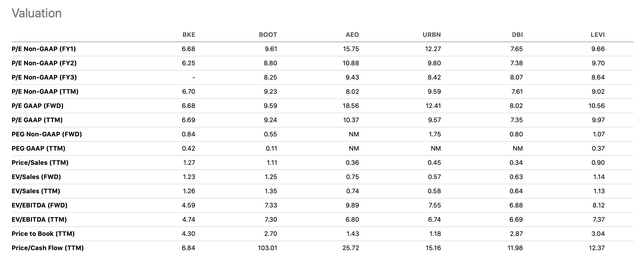

Valuation

Not only the financial performance, but also the valuation of the firm appears attractive. According to various price multiples, BKE is trading at a substantial discount compared to its peers.

Further, compared to its own 5Y average, the firm is also trading at significantly lower multiples.

In our opinion, based on the firm’s recent performance, such a discount is not justified.

To sum up

Despite the significant macroeconomic headwinds, BKE’s second quarter financial performance was surprisingly good. Net sales have increased year over year, potentially indicating that the demand for BKE’s products and services remains strong.

Based on the firm’s balance sheet, BKE’s current and quick ratios indicate that the firm has enough financial flexibility to navigate the uncertain and volatile market environment.

BKE also appears attractive from a valuation point of view.

We currently rate BKE as “hold”, due to the potential headwinds associated with low consumer confidence readings and inventory management.

Be the first to comment