Options are valuable but wasting assets. A put option appreciates when the price of an asset falls, and a call option’s value moves higher when the underlying market rises. The beauty of options is that they give market participants choices. Options can serve as price insurance or speculative tools. The options markets have flourished because of the leverage they allow. Buyers can control a significant position for a small payment, the premium. Sellers can act as the insurance company, collecting the premium.

The primary determinate of the price of a put or a call option is implied volatility, or the level of price variance the market forecasts into the future. Since the beginning of the global financial crisis caused by Coronavirus, option premiums have increased dramatically. As with all insurance products, premiums are a function of risk levels.

Savvy traders search for optionality in markets at all times. Experience attorneys attempt to create options for their clients in contracts. A free option is a valuable asset. The US Fed and global central banks have responded to the worldwide pandemic with policies that amount to free options for market participants in the interest rate markets and gold.

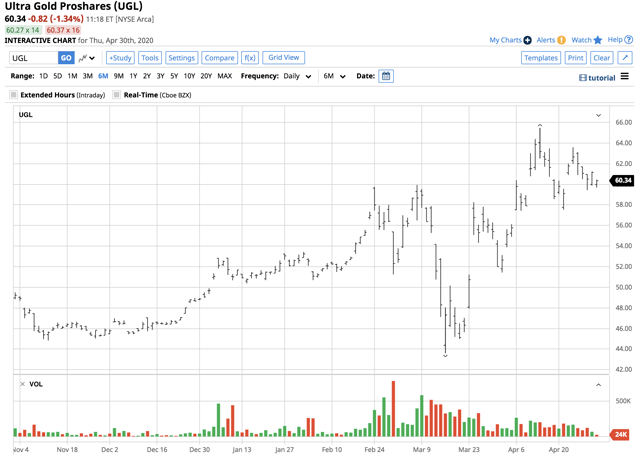

The ProShares Ultra Gold product (UGL) is a double leveraged instrument that moves higher and lower with the price of the yellow metal.

The Fed is back in dovish mode, and it is more accommodative than ever

After realizing that the Fed went too far when it hiked the Fed Funds rate four times in 2018 at a time when quantitative tightening was pushing rates higher, the central bank reversed course in 2019. Three 25 basis point rate cuts and the end of the balance sheet normalization program last year caused the price of gold to break out to the upside above its critical level of technical resistance at $1377.50 per ounce on the nearby COMEX futures contract.

In late February, as Coronavirus spread around the globe, the stock market in the US began to fall. In March, it crashed alongside many other markets across all asset classes. At first, the Fed cut the short-term rate by 50 basis points in an emergency move. Less than two weeks later, the Fed Funds rate was back at zero percent, and quantitative easing was back and bigger than ever before. The global pandemic caused the Fed and central banks around the world to give new meaning to monetary policy accommodation. At its latest meeting on April 29, the US central bank told markets it was prepared to do whatever is necessary to provide stability to the market for the foreseeable future. The Fed gave no forward guidance.

Central banks around the world are spraying liquidity with a massive firehose

The Fed and its cohorts around the world are dumping unprecedented amounts of liquidity into the global financial system to buy time and stabilize markets. Trillion or dollars, euros, and other currencies are flowing into markets along with government stimulus programs. The current policies inhibit savings while encouraging borrowing and spending and have all the hallmarks of a Bernanke-style response to the current environment. Scientists are scrambling for answers that end the global pandemic as the virus spreads like wildfire, and markets react in the blink of an eye. So far, the stimulus has calmed markets, but the longer social distancing puts the economy in the US and around the world in a self-induced coma, the more stimulus will be necessary. The price tag in the aftermath of the pandemic will be steep.

Look past the exchange rates- Currencies are falling

The dollar is the reserve currency of the world, and the bullish trend in the dollar versus other currencies has remained intact throughout the crisis. The US greenback is the world’s leading fiat currency because of the perceived stability of the economic and political system in the United States. At the same time, the dollar is freely convertible to other foreign exchange instruments.

Source: CQG

The weekly chart highlights the rise in the dollar index from a low of 88.15 in February 2018 to 99.815 in mid-February 2020. When all hell broke loose in markets, the currency markets experienced massive price volatility with the index trading between 94.61 and 103.96, the highest level since 2002 from the week of March 9 through March 23. The dollar stabilized at the 100 level over past weeks, possibly because of significant government intervention in the currency arena.

The dollar remains strong again all world currencies. The only exception is gold, which was trading above the $1700 per ounce level on April 30. Gold has rallied in all currency terms since last June. Central banks hold the yellow precious metal as an integral part of their foreign exchange reserves. Therefore, all fiat currencies, including the US dollar, have weakened against gold. The bottom line is that the foreign exchange asset class is a mirage, and all fiat means of exchange are declining. The central bank and government policies to stabilize markets weigh on the value of all currencies as they amount to running the legal tender printing presses in overdrive.

The put on bond markets is a put on the price of gold

Free options are hard to come by in transactions and markets. An astute attorney always attempts to create free optionality in a contract. When it comes to markets, quantitative easing and zero percent interest rates in the US and below that level in Europe, Japan, and other parts of the world create a free put option on the bond market. As the government step in to buy government and corporate debt securities, the risk of a decline in bond prices is currently at a point where a free put option has developed.

Based on the price action in gold from 2008-2011 and from June 2019 through the present time, a put option on bonds translates to a put option on the precious metal.

Nothing is free, but this put option is as close as it gets in the markets

There is never any free lunch in markets, but the puts on bonds and gold could be as close as it gets given the corner that central banks and governments currently occupy. The impact of Coronavirus will last long after scientists come up with treatments that eliminate the need for social distancing. Until some semblance of normalcy returns to the economy, the need for stimulus and government programs will continue. Therefore, the put on bonds and gold is long-dated.

In 2008, gold hit a low of $681 and rallied to $1920.70 by 2011. The low in gold during the height of risk-off conditions in March was at $1450.90. Citigroup forecast that gold would rise to $2000 in 2021 and Bank of America expects the price to reach $3000 per ounce. If 2008 was a guide, the price of gold could reach over $4000. And, the current levels of stimulus are far higher than in 2008 and the period that followed the financial crisis, so the eventual high in gold could reach even greater heights.

If the Fed, ECB, other central banks, and governments have written a long-dated put on the bond market, every pullback in gold should be a buying opportunity. Meanwhile, that pattern in gold would be a continuation of the path of least resistance that has been in place since August 2018 when the price hit bottom at $1161.40.

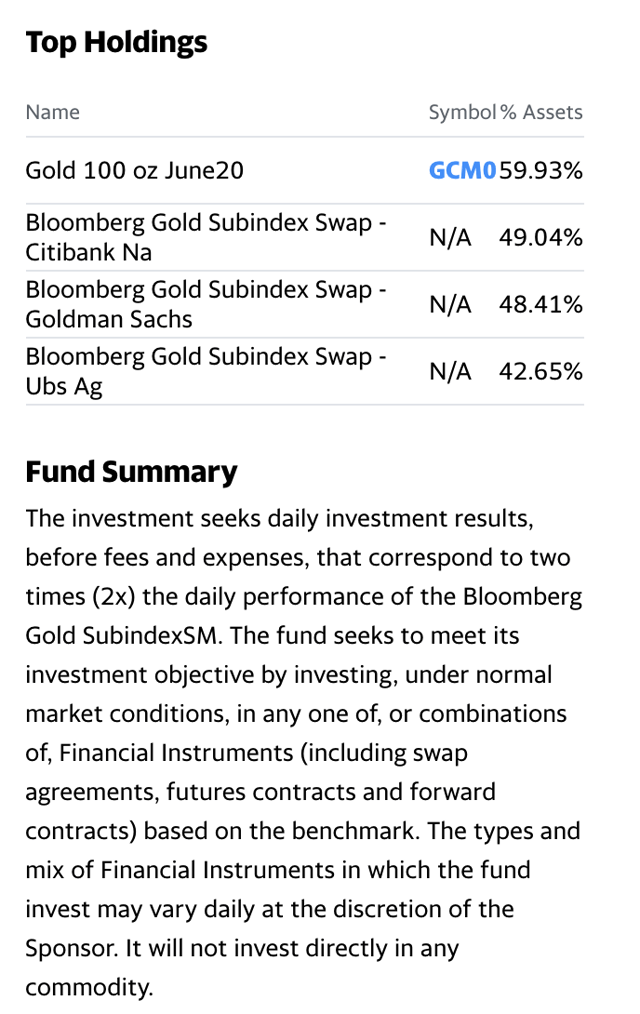

I favor holding physical gold for the medium and long-term. From a short-term perspective, the ProShares Ultra Gold product (UGL) offers market participants double leverage on a percentage basis. The fund summary and top holdings of UGL include:

Source: Yahoo Finance

UGL holds futures contracts and swaps to create double leverage. The most recent net assets stood at $128.42 million, with an average of 206,773 shares changing hands each day. UGL charges an expense ratio of 0.95%.

Gold rose from $1666.20 on April 21 on the June futures contract to a high of $1764.20 on April 23 or 5.88%.

Source: Barchart

Over the same period, UGL rose from $57.52 to $63.58 per share or 10.54%. Products like UGL are only appropriate for short-term positions of less than a few weeks at the most. Since gold trades around the clock during the business week and UGL is only available for trading during US stock market hours, the product can miss peaks or troughs in the gold price at times.

There is always a risk in any long or short position in any asset. When it comes to the bond market and gold, the central banks and governments of the world are doing their utmost to create the closest thing to a free put given their addiction to stimulus.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

The author is long gold

Be the first to comment