Mario Tama/Getty Images News

When Adobe’s (NASDAQ:ADBE) Illustrator was released in 1986, it worked only on Apple’s (NASDAQ:AAPL) Mac computer which was powerful enough to run the new program. You had to wait until 1993 for the software to become available on Microsoft’s (NASDAQ:MSFT) Windows, but, many complained about the quality.

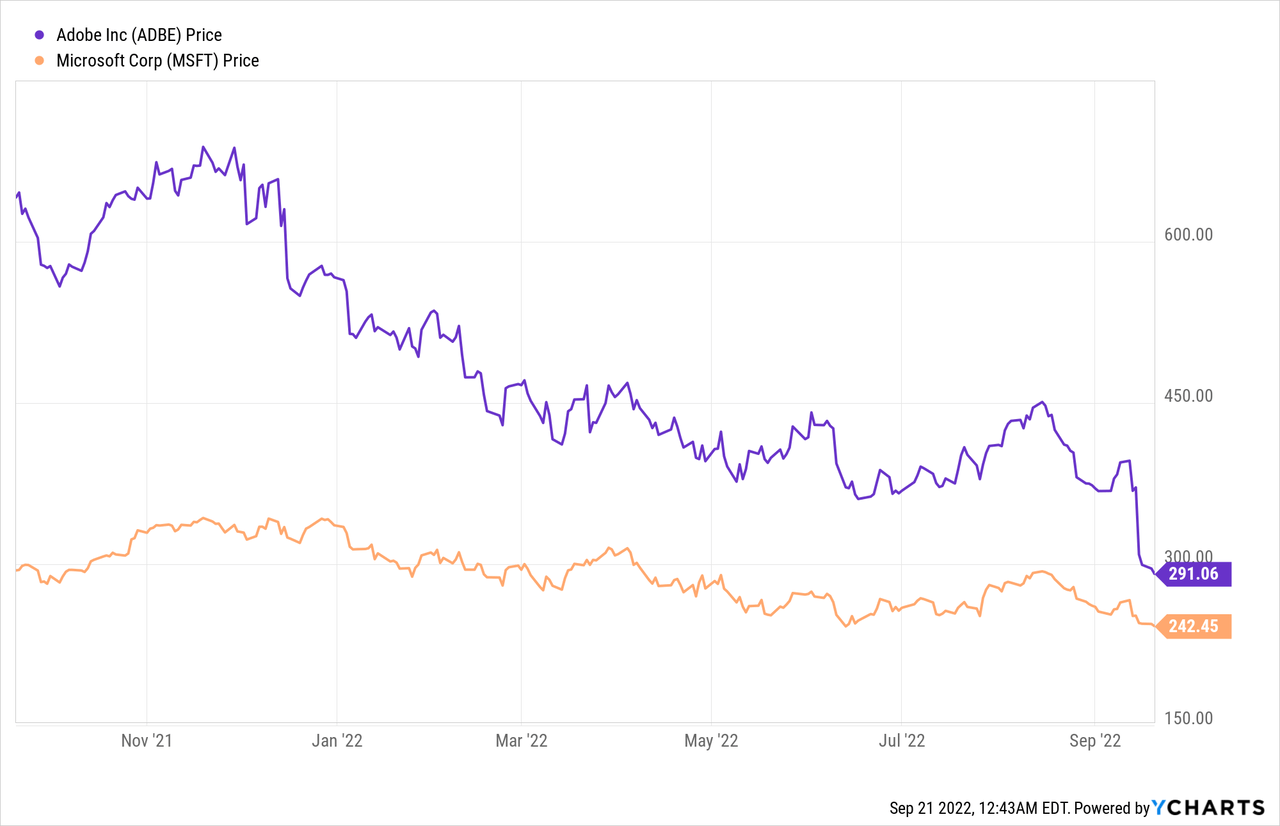

Then, for Adobe’s Digital Media, Creative, and Document products to be so pervasive today at the point of being present on most designer’s laptops, its partnership with the software giant must have been crucial. This deserves analysis, especially given that the stock has been battered by more than 55% in the last year to trade at less than $300. A comparison with Microsoft in the orange chart below reveals the extent of the damages but these started well before the Figma episode.

This thesis is also of the opinion that it is important to look beyond the astronomical acquisition costs of 50x revenues, and instead focus on the benefits to Adobe’s competitive positioning in light of the partnership.

I start by making sense of the acquisition.

The Need for “Collaborative Creativity”

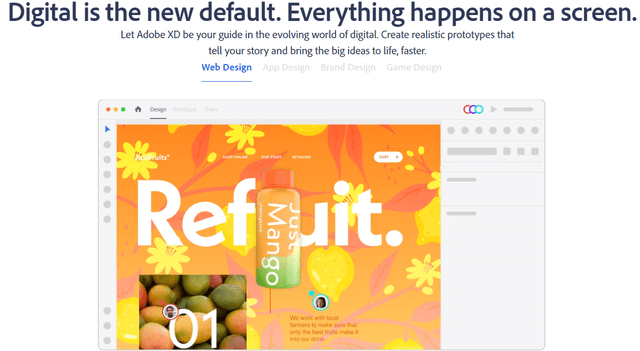

First, Adobe, the creativity company, does not do many acquisitions and is more focused on organic growth, and boasts a rich pipeline. While it is predominantly known for its Reader software in order to open PDF documents, other products like Adobe InDesign and XD are used by graphic designers in creating, and publishing documents for print and, increasingly for digital media.

With everything going digital, comes the concept of “collaborative creativity” whereby, in order to deliver a project involving multi-skilled persons working together on a tight schedule, there is a need for active collaboration as well as the need to be creative. However, with the advent of Covid, the way teams operate has changed, with the team leader no longer being constantly around in order to motivate his team of web designers. He can still use tools like Zoom (NASDAQ:ZM) to communicate remotely with them as they mostly work from home, but, just think of a scenario where the collaboration can be achieved within the very software they are using to do their work. Well, this is enabled by Figma, a little-known company, but with a great collaborative platform used mostly for browser-based design.

Figma Collaboration (www.figma.com)

After initially being adopted by smaller companies, Figma has become popular at Salesforce (CRM) and Atlassian (NASDAQ:TEAM) together with Oracle (ORCL), and Google (NASDAQ:GOOG). This popularity became an acute problem for the creativity company, especially with the usage of Figma at Microsoft, which has traditionally used Adobe products, to the point of threatening the partnership between these two.

The Adobe-Microsoft Partnership

This partnership which started decades ago as I mentioned earlier was reinforced in April 2015 and involved integrations between Adobe’s Document Cloud and Microsoft products, giving users the ability to create a PDF directly in applications like Office 365, which is Microsoft’s cloud-based version of its office productivity tools.

Moving beyond the technical integration phase, the partnership later expanded to the co-selling of applications and co-marketing products, with one concrete example being software integrators having to purchase both licenses of Adobe’s Document cloud and Microsoft products. Therefore, the deal has been lucrative for both.

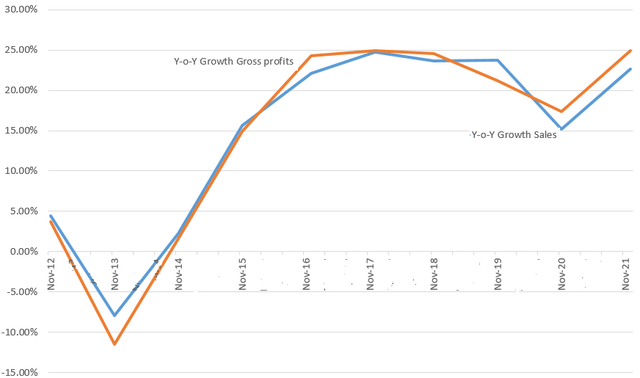

At the same time, deeper integration at the application level ensured less customization works for both Adobe and Microsoft resellers with fewer support hours in tackling customer support requests. As a result, not only Adobe’s annual revenues (as measured on a year-on-year basis increased) but gross profits as well, since the end of 2015 as shown in the charts below. At this point, it can be argued whether Adobe’s phenomenal progress was solely due to its partnership with Microsoft, but, one has to admit that there is indeed some coincidence.

The YoY progression in Adobe’s annual revenues since 2012 (Seeking Alpha)

Pursuing further, given its product positioning focused primarily on design for the web, Figma is a strategic company and in case it is acquired by someone else, Adobe may see an erosion of market share.

This said Adobe remains committed to Apple and, to this end, Adobe XD, its competing product for Figma was first released as “Adobe Experience Design CC” in March 2016 for macOS, with the Windows version only released eight months later.

Without going into the Mac-Windows debate, choosing between these two is more a matter of preference and finances, but, it is Microsoft’s gear that equips most corporations’ desktops today, and, Adobe’s strategy which consisted of expanding from a niche customer base (composed of macOS users) to a more commoditized one (Windows) has immensely benefited the creative company.

Then, of course, there is the competitive standpoint.

Adobe XD Vs Figma

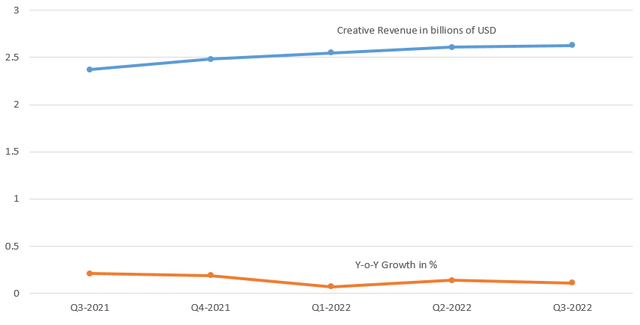

The acquisition was also done because of the increasing competition faced by Adobe XD, which is part of the Creative Cloud segment, and to this effect, the blue chart below shows how segmental revenues, despite showing progress, seem to have reached a peak. Thus, revenues grew to $2.63 billion in Q3-2022, representing an 11% year-over-year growth, but this is down from the 21% growth experienced in the third quarter of 2021 when revenues were $2.37 billion.

Charts built using data from (Seeking Alpha)

For this purpose, the orange chart above depicts how the year-on-year growth has been decreasing, and the fact that Adobe charges $9.99 per month, or less than Figma’s $12 seems not to have helped much.

Adopting a dose of realism, some of the deceleration is also due to Adobe’s revenues being impacted by the war in Ukraine and foreign currency headwinds, but, Figma, on the other hand, seems to be immune to these concerns as it is enjoying “explosive revenue growth“. Moreover, as per Adobe’s CEO, Figma is profitable too.

Consequently, by buying out the competition, Adobe, not only makes sure that it will see growth in a period when there are risks of market stagnation due to recession risks but should also see more profitability, as Figma’s margins get added to its own and there is a reduction in sales and marketing expenses.

Viewed from this angle, the acquisition makes sense, but, with opportunities also come challenges.

Opportunities and Challenges

As per Adobe, the two entities will not merge since Figma will maintain independent operations. This is perfectly understandable given that Adobe XD also has its own strength namely as a vector-based design tool for anything from fully-fledged websites to smartphone apps. There will also be switching costs in case customers move away from products like User Experience (“UX”) designer and Adobe’s Photoshop or Illustrator.

Consequently, equipped with Figma and XD, Adobe has a unique opportunity to “tie up” designers and developers by proposing a broader range of solutions, while progressing to create new markets. Talking figures, Figma’s TAM alone is estimated at $16.5 billion by 2025. Add to this, the TAM of $205 billion forecasted by 2024, comprising Adobe Experience Cloud, Document Cloud, and Adobe Creation cloud, then, you have a total market opportunity of over $220 billion.

Therefore, there are opportunities to increment the top line and bottom line as listed in the table below.

| 1 | Growth Opportunities | Add to topline growth in 2023 |

| 2 | Microsoft Partnership | Makes sure the partnership is sustained |

| 3 | Adobe XD competition and Profitability |

Ensuring that growth continues for Creative Cloud, Less operating expenses |

| 4 | Total Addressable Market | Above $220 billion |

| 5 | Execution |

Two completely different corporate cultures Product overlapping features How Figma’s customers will adapt to Adobe |

|

6 |

Regulations |

Buying out of the competition Regulators in the U.S. and the E.U. |

However, the above table also highlights the execution aspect, with, on the one hand, Figma relying on adoption mostly through a freemium business model, while for Adobe, it is primarily a top-to-bottom approach whereby designers have to use its products after its sales representatives have inked an agreement with an enterprise. Hence, some customers may not digest the acquisition, but the fact that Adobe intends to keep Figma as a separate entity should help.

Furthermore, it would be useful to watch how Adobe executives execute the product and go-to-market strategies due to the overlapping features between XD and Figma. Equally important, it will also depend on how things work out with partner Microsoft.

Sticking with the cautionary side, while regulations seem less stringent in the software industry, it is also important to watch out for how the regulatory approval plays out, especially in an economic landscape where the cost of doing business escalates globally. Here, investors should bear in mind that the Federal Reserve’s hawkishness aimed at addressing the inflation problem should induce further volatility in the stock market till the end of this year unless the CPI (consumer production index) which was quite hot for the month of August stabilizes.

This is the reason, why, unless you are a trader who wants to profit from a bounce, it is preferable to avoid both stocks for the time being and wait for a better margin of entry. According to some sources, the S&P 500 could drop to 3,020 points or 22% below the current value of 3,873.

Conclusion

In addition to competitive reasons, it makes sense for Adobe to disburse $20 billion to ensure that its products continue to occupy the sweet spot-on Windows desktops as well as in Microsoft’s cloud. However, in a market where steady top-line growth, profitability, and stable free cash flows are being prioritized, caution is mandated when investing, especially for the creative company.

Moreover, a lot will also depend on Microsoft, and to this end when responding to a general question about its partners and the use of third-party technology in its cloud during a recent conference organized by Goldman Sachs (GS), Microsoft’s EVP and CCO, Judson Althoff, responded that their approach depends primarily on making the customer successful.

Finally, bearing in mind that Microsoft prioritizes the customer over its partners, it is important to monitor the software giant’s product strategy while also waiting for Adobe’s guidance for 2023 which should comprise Figma’s financials.

Be the first to comment