cofotoisme/iStock via Getty Images

The TFS Financial Corporation (NASDAQ: TFSL) remains stagnant as inflationary pressures intensify. That is why investors are still hammered by the continued decline in the stock price. It must be more careful with liquidity as it appears to be sensitive to interest rate changes. Even so, it remains profitable to sustain its operations and cover dividends. Also, investors may have more attractive dividends as the company focuses on them.

Company Performance

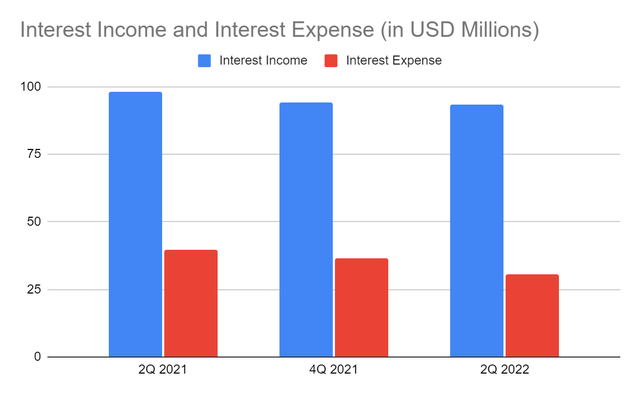

Banks are subject to higher risks amidst economic downturns and disruptions. The TFS Financial Corporation is not an exemption as its growth remains hampered. It is logical as the company appears to be interest-sensitive. So as the interest rate remains near zero, interest income remains lower than usual. At $93.46 million, TFSL has a 4% year-over-year decrease. Nevertheless, it keeps its deposits and borrowings manageable to sustain its operations. At $30.72 million, the interest expense is 24% lower than in 2Q 2022. It is a testament to the efficient asset management of the company. Also, we must understand that the quality of its assets remains solid. It can be seen in its investments and securities as the combined interest income is higher today. As such, its net interest income remains higher with or without provisions.

Interest Income and Interest Expense (MarketWatch)

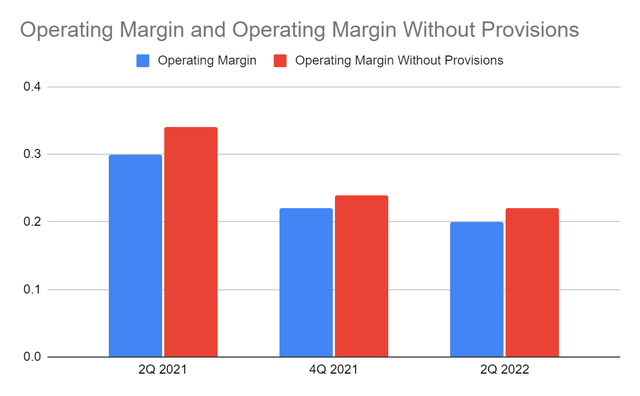

Meanwhile, its non-interest income is far lower than in the comparative quarter. The decrease is most evident in the sale of loans. We can confirm it in the Balance Sheet since the portion of the loan portfolio it sells off is lower. That is why its total loans are 4% higher today. Non-interest expenses are higher as prices remain on the rise. Its SG&A and office equipment expenses are higher. The decrease in its non-interest-related operations has a partial offsetting effect. Hence, the operating margin of the company took a nosedive from 0.30 to 0.20. Even so, it is a good thing that the company remains profitable amidst the massive changes. Its non-core operations are stable so net income remains a positive value. Its gap from the previous quarters is still reasonable. The values are also more impressive than in 1Q 2022, showing its rebound.

Operating Margin (MarketWatch)

In the second half, I expect a better performance despite inflation. The quality of assets, particularly investment securities and loans may drive its rebound. Also, deposits are increasing, showing more demand for its services. These may pay off as TFSL appears to have an obvious sensitivity to interest rate changes. Higher interests may entice more savings and investments.

Macroeconomic Pressures

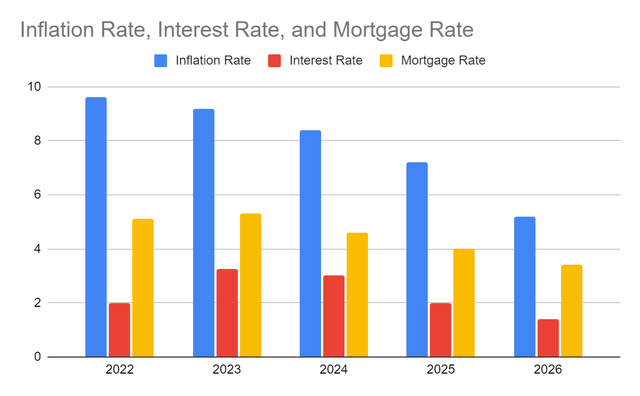

The efficient asset management and strong capital base of the company are evident. But, it has to keep a keener eye on its liquidity position. It also has to beware of inflation, given that it has already surpassed our expectations. The general price level is on the rise, and the momentum remains strong. Since March, the inflation rate has been above 8%. And most recently, it reached 8.6%, the highest in the last four decades. In my previous articles, I estimated it to reach 8.8% this year. But to be more conservative, I am raising it to 9.6%.

In response, interest rate hikes by the Fed may become higher than expected. From the initial 0.75-1% target, it went up to 3.00-3.25%. It is even higher today at 3.25-3.50%. Likewise, mortgage rates may reach 4.80-5.50%. That is why it must keep watch on more changes to manage its loans and deposits better. Thankfully, it maintains stable operations as shown by its maintained viability amidst disruptions.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, CNBC, Barron’s, and Forbes)

Moreover, many people are getting a higher minimum wage of $27.33. The unemployment rate in the US remains stable at 3.6%. So, many people may become more capable of saving, investing, and paying for borrowing. Many recent surveys show that 43% of Americans want to save more this year. With more finances, there is a lower frequency of defaults. TFSL may even cater to more banked and unbanked customers.

Why The TFS Financial Corporation Must Still Be Careful

The TFS Financial Corporation continues to prove its stability and resilience. The fact that it remains profitable amidst macroeconomic pressures is a plus. Even better, the quality of assets is solid as investments generate higher income. However, it must watch out for its liquidity position.

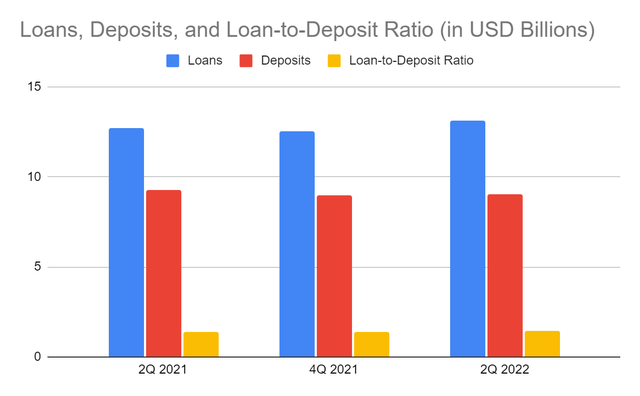

For instance, its loans and deposits are high which leads to more revenues. But, the loan-to-deposit ratio is more than 100%. It shows that the amount that the company lends out is way higher than its deposits. It may be a wise move since it may generate more interest income. Its sensitivity to interest rate changes may give it an edge in the second half. It may be the reason why the amount of loan portfolio it sells off is lower than in 2Q 2021. It is no wonder that it continues to capitalize on prudent lending and investments. Despite all the promising growth prospects, it must be more conservative today. Economic uncertainty remains evident, which may affect its performance. It may not have enough reserves for defaults although it can sell off more loans if it wants to. Doing so may give it more non-interest income on the sale of loans. But, I understand it may make the rising interest rates and opportunity to derive more income.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

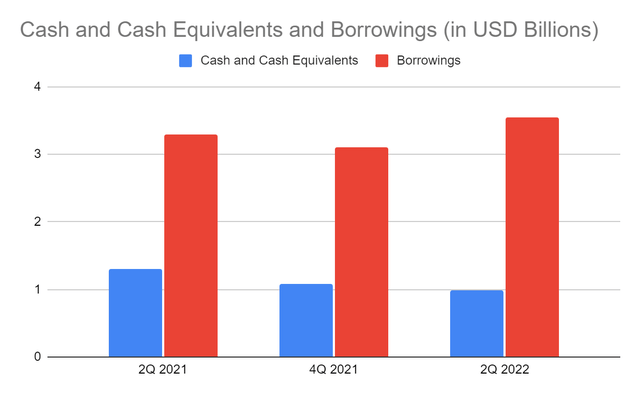

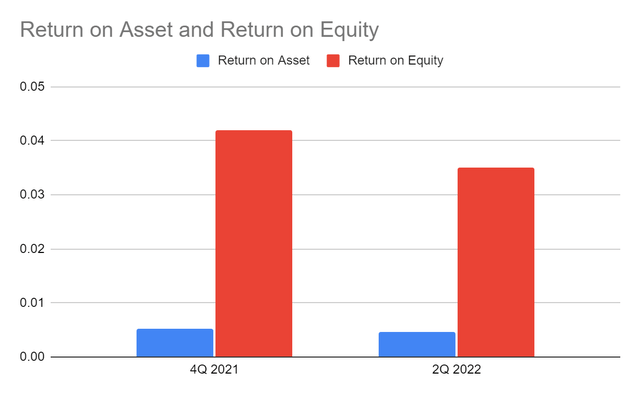

Its cash and cash equivalents are way lower than its borrowings. With $980 million of cash and cash equivalents, it is 25% lower than in 1Q 2021. The value is also lower relative to borrowings. Its percentage of borrowings is only 28% from 39% in the previous year. Plus, it is only 6% of the total assets. The good thing about it is that the quality of its investments and securities remains solid. It can be seen in its interest income from investment securities and dividend income. Also, cash levels are stable, given the maintained profitability and cash inflows. Its ROA and ROE TTM remain almost the same in the comparative quarter at 0.46% and 3.8%. But of course, it is still lower than the ideal level, given its current size and capitalization.

Cash and Cash Equivalents and Borrowings (MarketWatch) Return on Asset and Return on Equity (MarketWatch)

Stock Price Assessment

The stock price of TFS Financial Corporation has been in a consistent decline in the last year. At $13.66, it has already been cut by 24% from the starting price. But, it does not appear to be cheap as per its PE and PS Ratio. If we exclude the shares of MHC, the PE Ratio decreases.

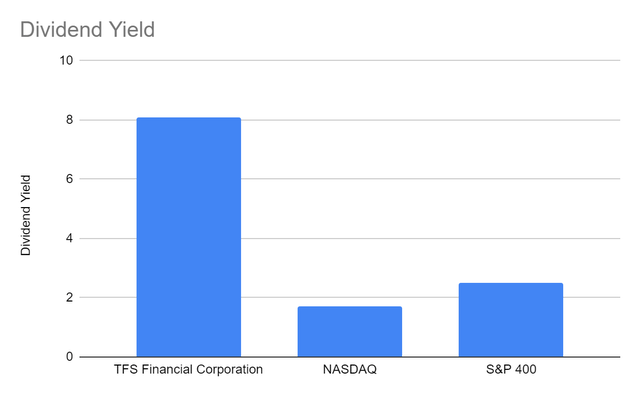

Meanwhile, TFSL appears to be an excellent dividend stock with a dividend yield of 8.1%. It is way higher than the average dividend yield of NASDAQ-listed companies and the S&P 400. What is good about the company is that it did not cut dividends despite market uncertainties. Its dividend payments are consistent with an average growth of 24% in recent years. But, analysts and investors alike are apprehensive, given the high dividend payout ratio. The cumulative value of EPS in the first half is $0.12 while dividends per share are $0.5650. It leads to a high dividend payout ratio of 4.72. But, we must note that over 80% of shares belong to MHC. We can say that only 20% are the actual common shares outstanding. If we use it instead of the reported WAV, the 1Q and 2Q EPS will be $0.58. Hence, the dividend payout ratio will decrease to 0.96. It shows that the company still has adequate means to sustain its dividends. We may value the price using the DCF Model and the Dividend Discount Model.

Dividend Yield (Yahoo Finance)

|

FCFF Cash Outstanding Borrowings |

$73,240,000 $24,400,000 $870,000,000 |

|

Perpetual Growth Rate WACC |

4.80% 9.00% |

|

Common Shares Outstanding Excluding MHC |

53,639,000 |

|

Stock Price |

$13.66 |

|

Derived Value |

$18.37 |

|

Stock Price |

$13.66 |

|

Average Dividend Growth |

0.2397540107 |

|

Estimated Dividends Per Share |

$1.13 |

|

Stock Price |

$13.66 |

|

Derived Value |

$17.29036443 or $17.29 |

Both models show potential undervaluation of the stock price. There may be a potential upside of 20-26% in 12-24 months. There may be an increase, which may be reasonable, given the growth prospects.

Bottomline

The TFS Financial Corporation has not shown robust performance in a stormy market. It has to be careful, especially with its current liquidity position. Even so, its efficient asset management and solid asset quality remain evident. It is no wonder it remains bold with its loans and deposits. Also, it is sensitive to interest rate changes. This factor may become its edge as interest rate hikes continue. Its stock price appears undervalued, making it a good entry point. The recommendation, for now, is that TFS Financial Corporation is a buy.

Be the first to comment