Justin Sullivan/Getty Images News

Elevator Pitch

This is the time to hold (rather than buy or sell) HP Inc.’s (NYSE:HPQ) stock.

A Buy rating for HPQ is unwarranted. There are already signs of demand weakness which will be a drag on HP Inc.’s future top line growth; while supply constraints are likely to ease before end-2022, and this could lead to lower prices and margin compression for the company.

On the flip side, HPQ doesn’t deserve to be rated as a Sell. HP Inc. currently trades at a reasonable high single digit forward P/E multiple, and I have a positive view of its long-term prospects considering the rise of hybrid work and the company’s capital allocation approach.

HPQ Stock Key Metrics

HPQ, which describes itself as “a leading global provider of personal computing and other access devices, imaging and printing products” in its fiscal 2021 (YE October 31) 10-K filing, released its Q2 FY 2022 earnings on May 31, 2022.

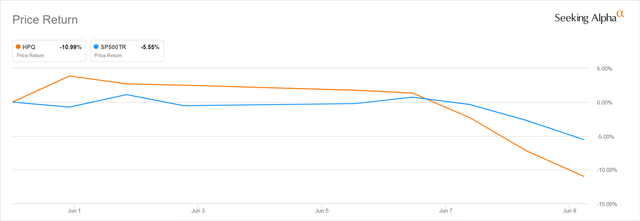

Although HP Inc’s second-quarter financial performance came in ahead of market expectations, its shares (-11.0%) have underperformed the S&P 500 (-5.6%) in the two weeks following its most recent quarterly earnings release as per the chart below. I will analyze HPQ’s key metrics below, which will help to explain the stock’s poor share price performance in the past two weeks.

HP Inc’s Stock Price Performance Post-Q2 FY 2022 Results Announcement

Seeking Alpha

HPQ’s revenue increased by +4% YoY from $15.9 billion in the second quarter of fiscal 2021 to $16.5 billion in the most recent quarter. The company’s actual Q2 FY 2022 top line turned out to be +2% better than the Wall Street analysts’ consensus second-quarter sales forecast of $16.2 billion. HP Inc’s Q2 FY 2022 non-GAAP adjusted EPS of $1.08 represented a +16% YoY growth as compared to the company’s bottom line in the quarter a year ago. Its most recent quarterly EPS also surpassed market expectations ($1.05 per share) by +3%.

As per the company’s stock price chart presented above, HPQ initially outperformed the S&P 500 after delivering better-than-expected top line and bottom line for the second quarter of fiscal 2022. But HPQ’s outperformance relative to the S&P 500 gradually narrowed in the next few days following earnings release, and the company’s shares eventually underperformed the market index at the end of the recent two-week period. This is because HP Inc’s Q2 financial performance wasn’t as good as what it appeared to be on paper (i.e. beat on headline financial metrics).

According to the company’s Q2 FY 2022 financial results presentation slides, HP Inc’s Personal Systems business segment saw a +9% YoY revenue growth in the recent quarter, despite experiencing a -17% YoY decline in units sold. Separately, segment revenue for HPQ’s Printing business decreased by -7% YoY in Q2 FY 2022, even though units sold contracted by a more severe -23% YoY during the same period.

At its Q2 FY 2022 investor briefing on May 31, 2022, HP Inc explained that “our continued mix shift towards commercial and premium combined with our pricing strategy allowed us to more than offset fewer unit shipments in the quarter.” In other words, a favorable sales mix and higher selling prices enabled HPQ to neutralize the negative impact of lower volumes.

HPQ achieved operating profit margins of 6.9% and 19.3% for its Personal Systems and Printing business segments in the second quarter of fiscal 2022, respectively. As a comparison, the company revealed at its Q2 earnings briefing that it expects to generate operating margins in the 5-7% range and 16-18% range for its Personal Systems and Printing segments, respectively in the long run.

Notably, HPQ acknowledged at the recent quarterly earnings briefing that the consumer sub-segment of the Personal Systems market “has seen some signs of softening demand”, and noted there was “some softening” of “consumer demand” for the Print segment in the European market. In terms of supply, the company mentioned at its Q2 FY 2022 earnings call that “we expect the supply situation to improve through the end of the year” and it sees that “pricing will be normalized” by then as well. In other words, favorable demand and supply conditions which provided support for HP Inc.’s strong pricing and high margins (as compared to long-term expectations) might not be sustainable.

In conclusion, an analysis of the company’s key metrics for Q2 FY 2022 suggests that there are risks relating to a revenue slowdown and a normalization of profit margins going forward as a result of an unfavorable change in demand-supply dynamics as discussed above.

Is HPQ Stock Overvalued?

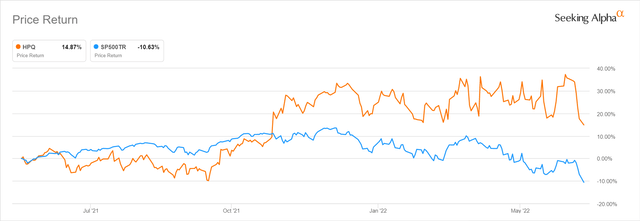

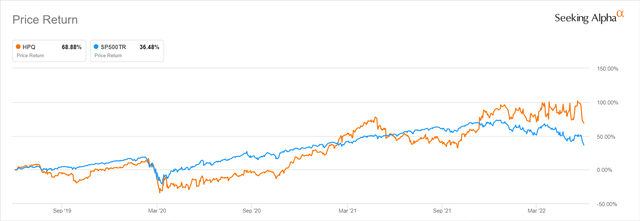

In the preceding section, I noted that HPQ stock has underperformed the S&P 500 in the last two weeks. But HP Inc.’s shares have done much better than the broader market in the past one year and three years as observed in the company’s stock price charts presented below. Specifically, HPQ’s shares are up by +14.9% and +68.9%, for the last one-year and three-year time periods, respectively.

HPQ’s One-Year Share Price Chart

Seeking Alpha

HP Inc.’s Three-Year Stock Price Chart

Seeking Alpha

The obvious question to ask is whether HP Inc.’s shares are overvalued given its share price performance.

The market currently values HPQ at a consensus forward next twelve months’ P/E multiple of 7.9 times as per S&P Capital IQ’s valuation data. This is lower than HP Inc.’s five-year and 10-year mean forward P/E multiples of 9.6 times and 8.7 times, respectively. One of HP Inc.’s key peers, Xerox Holdings Corp. (XRX), is valued by the market at a relatively higher 9.7 times consensus forward next twelve months’ P/E multiple.

Taking into account HP Inc.’s historical and peer valuation comparisons, I don’t view HPQ’s shares as overvalued. But I also don’t think that HP Inc.’s stock is undervalued considering its outlook, which I discuss in the next section.

Will HP Stock Keep Going Up?

It will be challenging for HP stock to keep going up, as it did in the past one year and three years.

Consensus financial projections sourced from S&P Capital IQ suggest that HP Inc.’s revenue growth will moderate from +12.1% in fiscal 2021 to +4.3% in FY 2022. The sell-side analysts expect HPQ’s top line to decline by -1.1%, -1.2%, and -2.5% for FY 2023, FY 2024, and FY 2025, respectively.

The lackluster revenue outlook for HPQ is validated by industry forecasts. Market research firm IDC expects global PC shipments to contract by a -0.6% CAGR for the 2021-2026 period as per its latest forecasts released on June 8, 2022. Specifically, IDC predicts that global PC shipments will decrease by -8.2% for full-year 2022, and this is aligned with HP Inc.’s expected top line growth slowdown this year (partially offset by the company’s favorable mix with a focus on the premium sub-segment).

In summary, HPQ’s positive stock price momentum can’t be sustained indefinitely. As I highlighted in an earlier section of this article, favorable demand-supply dynamics won’t last forever, and slower growth for HP Inc.’s Personal Systems and Print businesses in the future is inevitable. With expectations of top line contraction in the intermediate term, it will be difficult for HPQ to experience a positive valuation re-rating even though its current P/E multiple is undemanding.

Is HP A Good Long-Term Investment?

Looking beyond HP Inc.’s recent Q2 results and its medium-term financial outlook, I do think that HPQ is a good long-term investment for two key reasons.

Firstly, HP Inc.’s ability to bundle personal computers and print solutions makes it well-positioned to benefit from the rise of hybrid work.

According to a Gallup article published on March 15, 2022, a survey of over 140,000 workers in the US found that 53% of the respondents expect to have a hybrid work arrangement for this year and in the future, as compared to a lower 32% of respondents prior to COVID-19.

Hybrid work should help to drive demand for PCs and other related IT products, which will benefit HP Inc.

Secondly, HPQ’s capital allocation strategy makes a lot of sense intuitively, and this should create value for its shareholders in the long run.

At Bernstein’s 38th Annual Strategic Decisions Conference on June 2, 2022, HP Inc. stressed that “we are going to continue to return 100% of free cash flow unless opportunities with a better return show up.” HPQ’s target is to do $4 billion (11% of market capitalization) in share repurchases for fiscal 2022. It is encouraging to see that HP Inc. is buying back shares aggressively at a time when its P/E multiple is at a discount to historical averages.

HPQ also highlighted at the Bank of America 2022 Global Technology Conference on June 8, 2022 that these growth opportunities which the company could potentially invest in include “value accretive M&A” such as “tuck-ins we’ve done over the last 12-month.” Notably, the company has clearly stated that value accretion is a key criteria for acquisitions, so it is less likely to overpay for M&A targets. Also, HPQ is focusing its attention on “tuck-ins” or smaller deals which have a greater chance of success as compared to mega-deals or large acquisitions.

Is HPQ Stock A Buy, Sell, or Hold?

HPQ stock is a Hold. I am of the opinion that HP Inc. is a good investment in the long term, and its current valuations are inexpensive. But expectations of more moderate top line expansion in the intermediate term will prevent HPQ’s shares from rising substantially in the foreseeable future. This explains my Neutral view for the company’s shares.

Be the first to comment