Pgiam/iStock via Getty Images

Investment technology

Engineering exists in investments, too, in activities like communications, information technology, securities design, and regulatory adaptations.

When the whole back-office of the securities industry gets computerized, the expensive human-labor component gets minimized to the point where there’s no need to charge a fee every time a share changes hands between investors. And when small trades occur continually, records get kept.

But when securities worth multi-millions of $ in one lump changes hands, there’s a profit-making event worthy of a substantial fee. So a way gets arranged to get both activities done, legally and under adequate control.

And interestingly, it involves recorded actions which identify the coming price expectations of the big-volume trading parties. Having records which can later be compared with actual market outcomes to reveal how well the then underlying expectations could be believed, and perhaps of even similar beliefs useful now for the near-future.

This article will use that approach to tell how much more profit there is likely to be made by and from Textainer Group Holdings Limited (NYSE:TGH).

Description of the Subject Company

“Textainer Group Holdings Limited, through its subsidiaries, purchases, owns, manages, leases, and disposes a fleet of intermodal containers worldwide. It operates through three segments: Container Ownership, Container Management, and Container Resale. The company’s containers include standard and specialized dry freight, and refrigerated containers, as well as other special-purpose containers, which include tank, 45′, pallet-wide, and other types of containers. It also provides container management, acquisition, and disposal services to affiliated and unaffiliated container investors. In addition, the company is involved in the sale of containers from its fleet, as well as purchase, lease, or resale of containers from shipping line customers, container traders, and other sellers of containers. It operates a fleet of approximately 2.7 million containers representing 4.3 million twenty-foot equivalent units. The company primarily serves shipping lines, as well as freight forwarding companies and the U.S. military. Textainer Group Holdings Limited was founded in 1979 and is headquartered in Hamilton, Bermuda.” – Source: Yahoo Finance

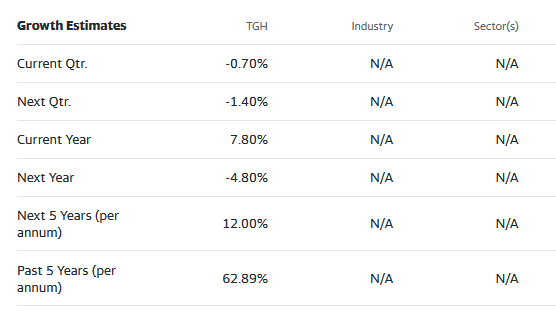

Yahoo Finance

These growth estimates have been made by and are collected from Wall Street analysts to suggest what conventional methodology currently produces. The typical variations across forecast horizons of different time periods illustrate the difficulty of making value comparisons when the forecast horizon is not clearly defined.

Investment Alternatives: Geographic Mobility Industry Competitors

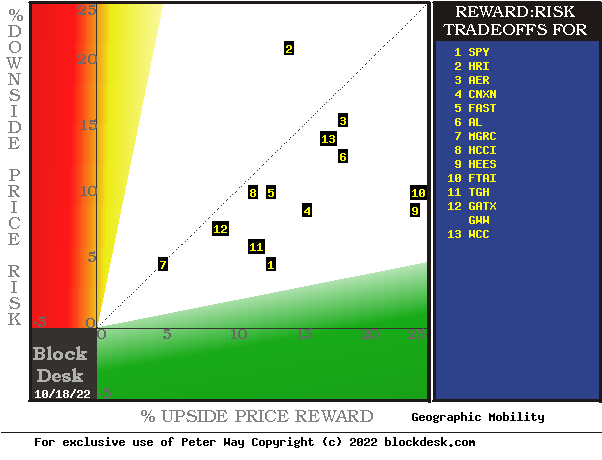

Figure 1

blockdesk.com

(used with prior permission)

The tradeoffs here are between near-term upside price gains (green horizontal scale) seen worth protecting against by Market-makers with short positions in each of the stocks, and the prior actual price draw-downs experienced during holdings of those stocks (red vertical scale). Both scales are of percent change from zero to 25%.

The intersection of those coordinates by the numbered positions is identified by the stock symbols in the blue field to the right.

The dotted diagonal line marks the points of equal upside price change forecasts derived from Market-Maker [MM] hedging actions and the actual worst-case price draw-downs from positions that could have been taken following prior MM forecasts like today’s.

Our principal interest is in TGH at location [11]. A “market index” norm of reward~risk tradeoffs is offered by SPDR S&P 500 index ETF (SPY) at [1]. Best positions are suggested by the 5 to 1 Risk-to-Reward area in green.

Those forecasts are implied by the self-protective behaviors of MMs who must usually put firm capital at temporary risk to balance buyer and seller interests in helping big-money portfolio managers make volume adjustments to multi-billion-dollar portfolios. The protective hedging actions taken with real-money bets define daily the extent of likely expected specific price changes for thousands of stocks and ETFs.

This map is a good starting point, but it can only cover some of the investment characteristics that often should influence an investor’s choice of where to put his/her capital to work. The table in Figure 2 covers the above considerations and several others.

Comparing Alternative Investments

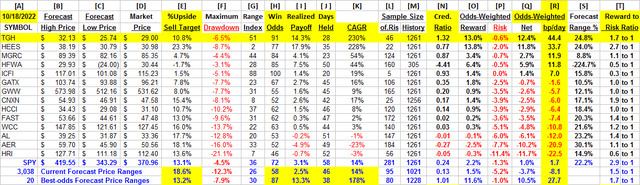

Figure 2

(used with permission)

Column headers for Figure 2 define elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stock of principal interest and of all issues at the ranking column, [R].

Readers familiar with our analysis methods may wish to skip to the next section viewing price range forecast trends for TGH.

Figure 2’s purpose is to attempt universally comparable measures, stock by stock, of a) How BIG the price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how soon it may happen, and d) what price draw-down RISK may be encountered during its holding period.

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. An average of the most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are most likely to accept losses.

[H] tells what proportion of the [L] sample of prior like forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [ I ] gives the net gains-losses of those [L] experiences and [N] suggests how credible [E] may be compared to [ I ].

Further Reward~Risk tradeoffs involve using the [H] odds for gains and the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferences. Figure 2 is row-ranked on [R] among candidate securities, with TGH yellow-row identified.

Along with the candidate-specific stocks these selection considerations are provided for the averages of over 3,000 stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P500 Index ETF as an equity market proxy.

Recent Trends in TGH MM Price-Range Forecasts

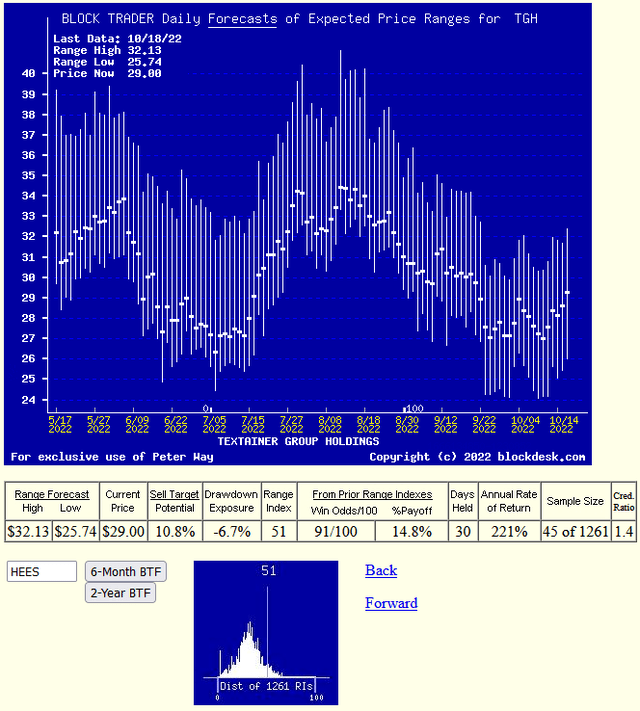

Figure 3

used with prior permission

This picture is not a “technical chart” of past prices for TGH. Instead, its vertical lines show the past 6 months of daily price range forecasts of market actions yet to come in the next few months. The only past information there is the heavy dot of the closing stock price on the day of each forecast.

That data splits the price range’s opposite forecasts into upside and downside prospects. Their trends over time provide additional insights into coming potentials, and helps keep perspective on what may be coming.

The small picture at the bottom of Figure 3 is a frequency distribution of the Range Index’s appearance daily during the past 5 years of daily forecasts. The Range Index [RI] tells how much the downside of the forecast range occupies of that percentage of the entire range each day, and its frequency suggests what may seem “normal” for that stock, in the expectations of its evaluators’ eyes. A RI of 51 (out of 100), leaves the other 49% of the price change potential to the upside.

With the dominant proportion of past RIs as lesser amounts, the “Win” odds of Figure 2 and Figure 3 above as profits having been achieved 10 out of every time reached, TGH takes on at this point the appearance of a “momentum” stock. One likely to reach prices at the upper end of those present and recent earlier forecast vertical lines in Figure 3.

Here the present level is near its least frequent, lowest-cost presence, encouraging the acceptance that we are looking at a realistic evaluation for TGH.

Conclusion

Among these alternative investments explicitly compared Textainer Group Holdings Limited appears to be a logical buy preference now for investors seeking near-term capital gain.

Be the first to comment