koto_feja

Thesis

I have covered Athira Pharma (NASDAQ:ATHA) before on June 22, 2022, the day of its press release which had the stock sell off from above $8 to about $2.65. In that article, I took the contrarian view that the market was missing a potential new Alzheimer’s drug. A day later, coverage by Seeking Alpha author Derek Lowe was published, which concluded Athira’s drug Fosgonimeton was a fail. So we’ve got a bull and a bear thesis on the same press release here.

The press release reported topline data of a randomized Phase 2 trial. Topline results were that the trial did not meet its primary endpoint. The actual data presented an interesting mixed bag. The data from the monotherapy arm were actually remarkable good in view of the state of the randomized trial readouts in Alzheimer’s disease. Patient’s cognition on Fosgonimeton did decline, but remarkably less than patients on placebo. On the contrary, if patients were given both standard of care in the form of acetylcholinesterase inhibitors as well as Athira Pharma’s drug candidate Fosgonimeton, that combination did not show efficacy, and that’s what the company had to report. That unexpected result had the stock sell off.

Athira Pharma has now been able to talk to slightly modify its trial to focus on monotherapy, and include some extra patients in its Phase 2/3 trial. Meanwhile, it also reported data which may be of value to the FDA, as it may be indicative of a disease-modifying effect. Insiders have been considerably buying the dip in June 2022, and one of them has just this week executed his call options.

I believe that, if Athira Pharma were to be able to repeat its Phase 2 monotherapy results in its Phase 2/3 trial, results may come in equally good or better than Eisai’s lecanemab. Both of Athira Pharma’s trials are randomized and placebo-controlled, or well-controlled as the FDA likes to call it. That may mean the upcoming readout may lead the way to an approval pathway. To me, that means the investment here is considerably de-risked, if one were to believe data from the Phase 2 trial are good enough.

On the sight of it, Fosgonimeton seems to potentially outperform Lecanemab. That may mean a valuation in the billions may be possible at a given point.

The wait is not so long for investors wanting to be long.

At a $140 million valuation, with $282 million in cash as of June 30, 2022, Athira Pharma’s stock comes as a steal.

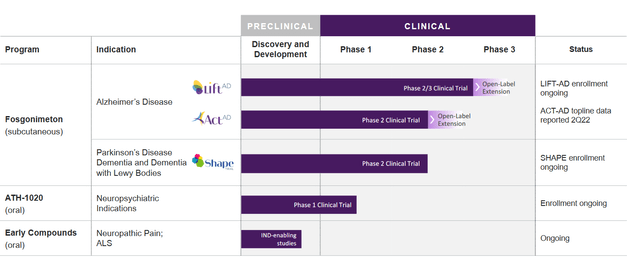

Athira Pharma’s Pipeline

Athira’s pipeline focuses on Alzheimer’s disease, but also includes a Phase 2 trial in Parkinson’s Disease dementia and dementia with Lewy bodies, an oral version of the same drug in a Phase 1 trial for neuropsychiatric indications, and other compounds in preclinical development.

Company pipeline (Corporate presentation)

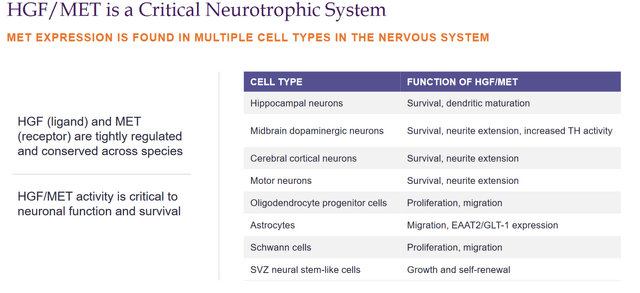

My previous coverage gives a more in-depth overview of Fosgonimeton. In short, Fosgonimeton or ATH-1017 is a small molecule drug candidate to be administered via once daily subcutaneous injection that works on the hepatocyte growth factor HGF/ MET receptor system. It is supposed to be involved in multiple pathways implicated in neurodegenerative diseases.

HGF/MET slide (Corporate presentation)

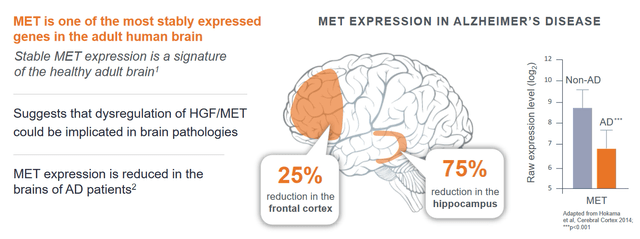

Taking the drug candidate to trials builds on the knowledge that expression of MET receptors is downregulated in Alzheimer’s patients.

MET expression slide (Corporate presentation)

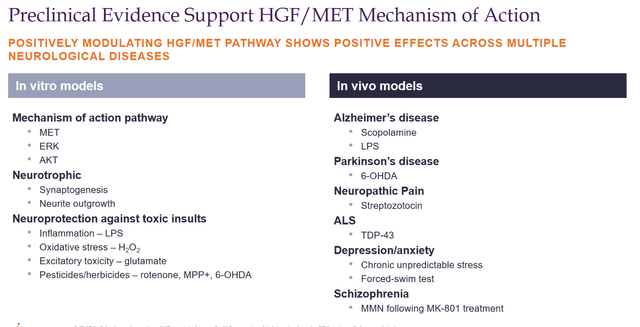

Expression of HGF has shown good results in animal models of Alzheimer’s disease, Parkinson’s disease, and ALS.

HGF/MET MoA preclinical (Corporate Presentation)

Athira has made P300 latency its main biomarker focus, a measure of working memory processing speed. The technical details of this measure are well explained in the company’s November 5, 2021, KOL webinar (slides here, summary here).

The Phase 1 study results in 88 healthy people and Alzheimer’s patients, which had been well received by investors and analysts, showed no adverse events or safety issues. Biomarkers that were evaluated were EEG gamma power, associated with learning, memory, and executive functions, and ERP P300 latency as a marker of cognitive processing speed. People with Alzheimer’s disease have reduced gamma power and lengthened P300 latency.

The Phase 1 trial showed an increase in gamma power in healthy people, as well as in Alzheimer’s patients. The latter also showed improved P300 latency.

The June 2022 data on ACT-AD

Introduction

ACT-AD was the name of Athira Pharma’s randomized, placebo-controlled Phase 2 trial, which ran for 26 weeks in 777 patients. The primary endpoint was ERP P300 latency, but additionally Adas-Cog11 would be measured as well. That means we will get a pretty good image of how cognition will be affected in Alzheimer’s patients.

The June 22, 2022 press release headlined:

Primary endpoint of change in biomarker ERP P300 latency was not statistically significant for the full study population as combination of fosgonimeton and standard-of-care (AChEIs) given together showed potential diminished effect of fosgonimeton

A pre-specified subgroup analysis of patients on fosgonimeton monotherapy suggests improvement in both ERP P300 latency and ADAS-Cog11 at week 26 compared to placebo indicating pharmacological activity

Fosgonimeton had a favorable safety profile over 26 weeks and ACT-AD provides important learnings for ongoing LIFT-AD study.

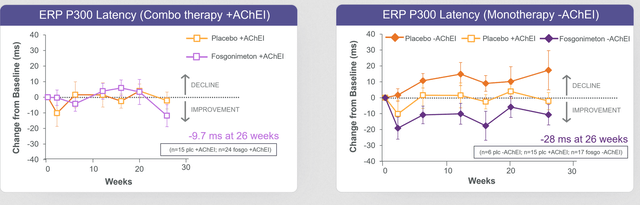

This was the graph of ERP300 latency, a biomarker that Athira Pharma likes to use to measure, both for combo therapy on the left and monotherapy treatment on the right.

ERP P300 latency ACT-AD (June 22 Press Release)

These were the ADAS-Cog data coming out of both treatment arms.

ADAS-COG ACT-AD (June 22, 2022 press release)

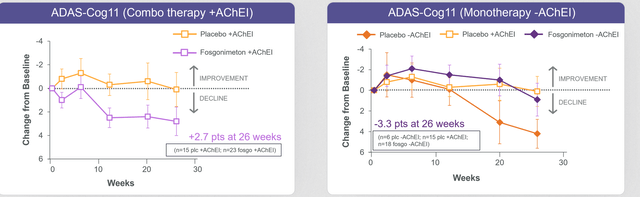

Focusing only on the patients in the monotherapy group, Fosgonimeton’s data looked as follows:

Monotherapy data slide (Corporate presentation)

Athira Pharma mentioned at the time that ACT-AD was planned to provide insights for the Phase 2/3 LIFT-AD trial, and that it would use insights from ACT-AD for a rational optimization of the ongoing LIFT-AD trial, after having sought advice from its scientific advisors, investigators and regulators. That optimization could include potentially adapting its LIFT-AD trial.

The bear thesis

The coverage by Seeking Alpha contributor Derek Low essentially stated that Fosgonimeton would appear to be done, as yet another Alzheimer’s drug candidate failed, just like all the others have failed in the past. The data having come out of the Phase 1 trial showed what looked like a significant effect, which wasn’t replicated in the Phase 2 study at all, as nothing showed significance, not the memory processing speed or any of the secondary measures. Athira Pharma’s talk of subgroup analysis and data re-examination should not be given much hope, as Fosgonimeton appears to be done, and it would be a big surprise to see positive results. The author then continues on the former CEO of Athira, Leen Kawas, who had to step aside after questions around some of her papers had arisen, but was correct in adding that these papers did not concern Fosgonimeton though they addressed HGF/MET.

The bull thesis

The bull thesis is that the combination therapy of Fosgonimeton with current standard of care unexpectedly showed no significant results suggesting that standard of care inhibits Fosgonimeton’s mechanism of action, and is not beneficial to its own mechanism of action. Fosgonimeton monotherapy does show remarkable efficacy. If Athira Pharma were to be able to revisit its ongoing randomized placebo-controlled Phase 2/3 trial in such a way that it can focus on patients on monotherapy, then positive results are on the way. Everybody knows at this point that the current standard of care, acetylcholinesterase inhibitors, is a temporary symptomatic treatment which basically covers up the ongoing cognitive decline in patients. There is an urgent need for better treatments, preferably with a potentially disease-modifying effect. Fosgonimeton may be one of those treatments, and it is perfectly possible that it can be combined with other future treatments for neurodegenerative diseases, which may perhaps also be disease-modifying.

The company’s actions since June 2022

Insider buying

Right after the press release, two insiders from Athira Pharma have bought a considerable amount of shares. On June 28, 2022, Hans Moebius, the chief medical officer, had bought 10,000 shares.

On June 30, 2022, Joseph Edelman, an Athira board member, has done so through his investment vehicle Perceptive Advisors. He picked up 1,371,362 shares, increasing his stake by 40% from 9.8% to 12.8%. That was $4,100,372 worth of shares in one go.

A SEC filing of October 17, 2022 showed that Hans Moebius had converted stock options at a strike price of $1,35, increasing his ownership by 15% by picking up 7,881 shares.

Those consistent actions, both from right after the press release as from just some days ago, are consistently bullish.

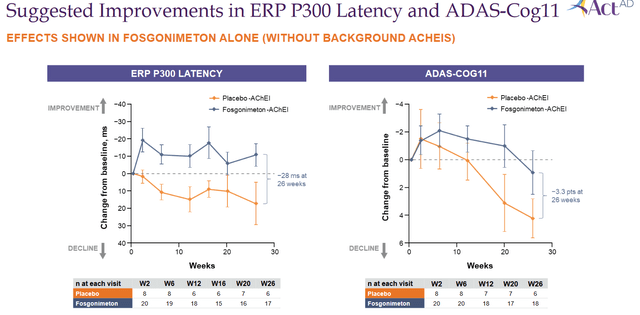

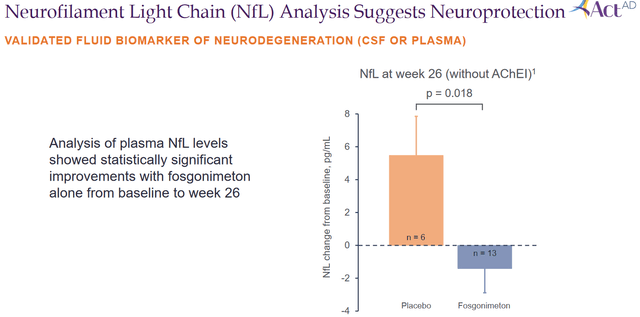

Additional data confirm potential effect and disease modification

On August 3, 2022, Athira reported further data from the ACT-AD trial which corroborated earlier results.

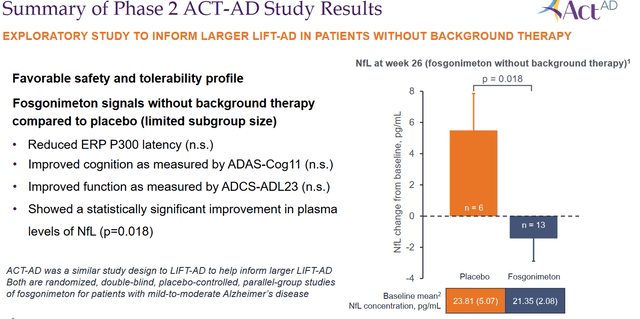

The most important reporting here was that Fosgonimeton had shown a statistically significant improvement in plasma levels of neurofilament light chain or NfL. NfL is an important biomarker that can be indicative of neurodegeneration in Alzheimer’s patients and other neurodegenerative diseases, but also of repair in patients on treatment. As I have mentioned in other articles, I see this biomarker emerging as one that is considered of primary importance both by the scientific field as by the FDA. If a treatment effect is noted here, it may be indicative of a disease-modifying effect. More and more companies are including it in their reporting, apparently also on request of the FDA. In a webcast of October 17, 2022, Athira Pharma mentioned: “NfL is released from damages axons, so in this case a direct marker of reduced neurodegeneration.” The data shown here by Athira Pharma show that patients on placebo’s mean change in NfL is a +5 pg/ml raise, but patients on Fosgonimeton have a mean -1.67 mg/ml reduction. The difference between both groups was 6.89 pg/ml. That reduction is statistically significant.

NfL slide (Corporate presentation)

Obviously, this effect is good, and confirms what has been seen in patients on monotherapy. On an October 17, 2022 webcast, Tom Shrader, a well-known analyst from BTIG, mentioned:

Congratulations, we’re not used to seeing good data like this in Alzheimer’s disease. Your neurofilament data, I think it’s the first time we’ve seen it that clearly. Was that seen only in monotherapy and does that make sense to you?

Athira Pharma’s reply was that the effect was not only seen in monotherapy, but that it did not reach statistical significance in the total patient population. It did so in subjects with monotherapy, and looking at effect size and baseline numbers which are in keeping with literature, there is a very sizeable effect size.

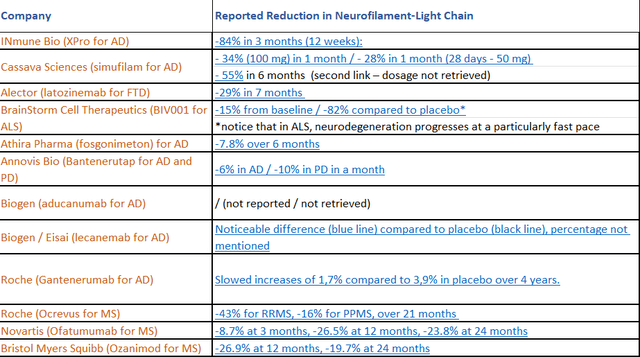

The presentation at CTAD 2022 contained baseline numbers, which for the monotherapy group was 21.35 pg/ml, with the mean reduction being 1.67 pg/ml. That means a percentage reduction from baseline of 7.8%, which is meaningful. I am attaching some own work compiling readouts from other companies here as well, for reference.

NfL reportings (Own work)

Athira Pharma further reported a numerical, but not statistically significant, improvement in the functional measure of ADCS-ADL23, compared to placebo at 26 weeks.

So this is where that leaves Athira Pharma at this point in time.

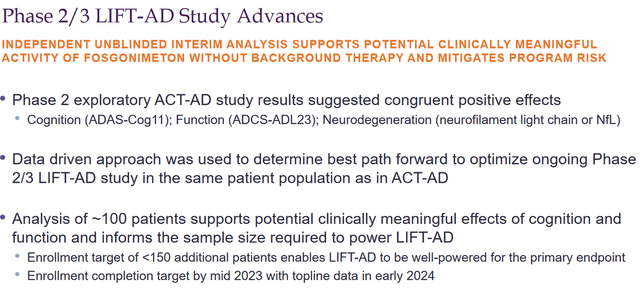

Summary phase 2 results (Corporate Presentation)

On August 2, 2022, Athira had also presented further preclinical data showing neuroprotective effects of fosgo-AM, the active metabolite of Fosgonimeton, in primary neuron cultures.

Phase 2/3 trial redesign successfully adapted

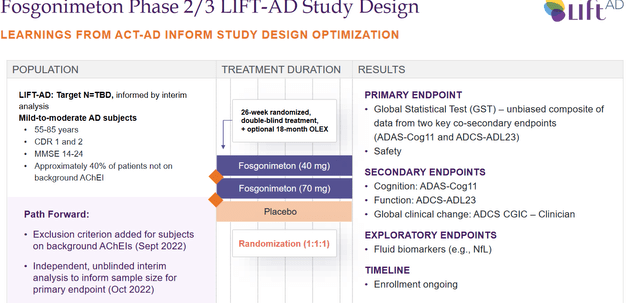

On September 6, 2022, Athira Pharma had reported that it would be adapting its LIFT-AD study to focus on monotherapy patients, and that it would be conducting an independent, unblinded interim analysis to confirm sample size for the primary endpoint of Global Statistical Test.

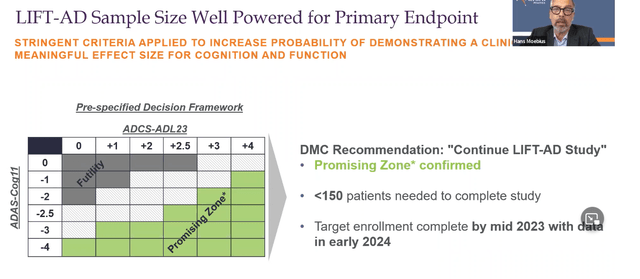

On October 17, 2022, Athira reported that it had updated its LIFT-AD trial to add less than 150 patients, so that total enrollment of patients on monotherapy would be less than 300 patients. That decision has followed an unblinded interim efficacy and futility analysis by an independent data monitoring committee.

Phase 2/3 progress (October 17 webcast)

That committee considered that, with this addition, the study would be well powered for the primary endpoint, given the preliminary effect size observed in the ACT-AD trial. LIFT-AD’s primary endpoint is the Global Statistical Test, an unweighted composite score comprising measures of cognition ADAS-Cog11 and function ADCS-ADL23.

LIFT-AD powered for primary endpoint (October webcast)

In the accompanying webcast, the company added that the recommended sample size was based on the actual effect size observed, not on an estimate, and that the data seen by the independent monitoring board showed that they were ‘in the promising zone’.

Completion of LIFT-AD is now targeted for mid-2023, and topline results are scheduled for early 2024.

That now leaves Athira Pharma with the following Phase 2/3 LIFT-AD study design.

LIFT-AD study design (Corporate presentation)

Apart from its Phase 1 trial of ATH-1020 and phase 2 trial in Parkinson’s disease dementia and dementia with Lewy Bodies, Athira Pharma is also enrolling patients coming out of the ACT-AD and LIFT-AD studies in an open label extension study up to 18 months following 26 weeks of treatment. That study is unblinded and could give material information on the longer term effects of the drug. The company reported that as of August 2022, more than 90 percent of patients who have completed either study have elected to participate in the open label extension study. That number is high and could be perceived as comforting.

Benchmarking against Lecanemab’s slowing of cognitive decline

Athira Pharma’s LIFT-AD trial is a randomized placebo-controlled Phase 2/3 trial, or a ‘well-controlled’ trial as the FDA likes to call it. The FDA uses that term in view of its different approval pathways.

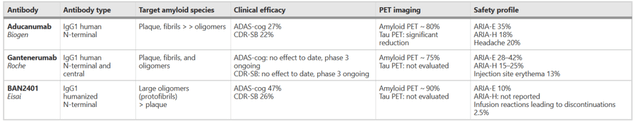

On September 27, 2022, Eisai (OTCPK:ESALY) had reported that its anti-amyloid antibody Lecanemab had shown a 27% slowing of cognitive decline in mild to moderate Alzheimer’s patients over the course of 18 months. Eisai had reported that finding on the basis of the CDR-SB measure, or Clinical Dementia Rating-Sum of Boxes.

Additionally, all secondary endpoints had also been met. Lecanemab did come with the typical safety concern all anti-amyloid antibodies so far seem to have, and that it is that it came with ARIA-E, or amyloid-related imaging abnormalities in the form of brain edema/effusion. The incidence of ARIA-E was 12.5% in the lecanemab group and 1.7% in the placebo group.

That trial opens a pathway for approval, and hence Eisai and its partner Biogen have seen their valuations massively increasing with several billions following that press release. In the wake of that data, other companies pursuing anti-amyloid treatments have also seen their valuations increasing, even if none of these anti-amyloid treatments is actually identical to the other one. In the case of Prothena (PRTA), insiders even started selling. For all clarity, I believe there is certain place for anti-amyloid therapies in Alzheimer’s disease. Seeing amyloid as a hallmark, but not the cause of disease and most certainly not its most important trigger, I believe the place for those therapies will all-in-all be limited. But historically, amyloid has most certainly been the most pursued target, which also means anti-amyloid therapies account for most trial failures.

No effect on Athira Pharma’s share price was seen. There is, for all clarity, no other company pursuing treatment via the HGF/MET pathway.

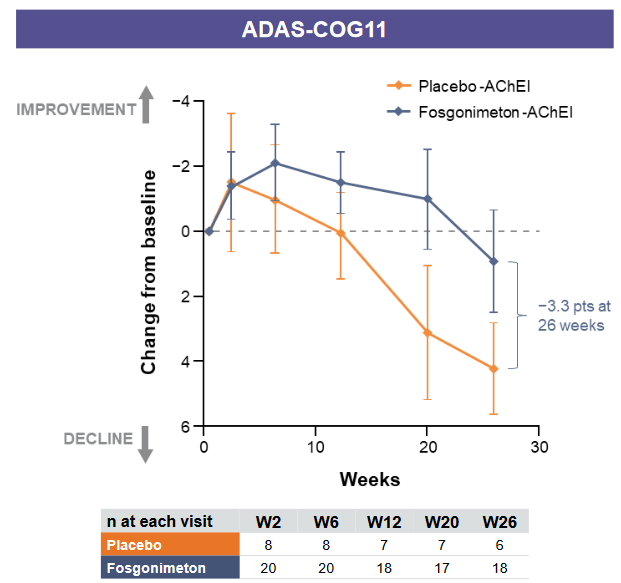

If LIFT-AD would read out as if it were a Fosgonimeton monotherapy treatment in Alzheimer’s disease, its results are likely to be similar to those of ACT-AD and could look something like this when it comes to cognition.

ADAS-Cog slowing on Fosgonimeton mono (Corporate presentation)

I don’t know the exact numbers of cognitive decline mentioned in the chart above. But assuming that cognitive decline of patients on placebo dropped about 4.2 points over the course of 6 months, and patients on monotherapy dropped about 0.9 points which is the mentioned -3.3 point difference, then we are talking about a -78% slowing of cognitive decline. If placebo patients would have declined only four points, then it is still a -77.5% slowing of cognitive decline. The 4 point decline seems in line with the 6-12 point decline Alzheimer’s patients may decline on Adas-Cog over a year’s time, but other literature mentions that patients with mild to moderate Alzheimer’s disease decline on average 5.5 points over a year’s time, and that a 4 point decline is what normal Alzheimer’s patients will in any case be seeing over the course of 9 months. Assuming that Athira Pharma’s patients on placebo actually declined faster than the normal Alzheimer’s population, and that the average decline of untreated patients over the course of six months is in the range of 2.6 points, then we are still talking about a -65% decline.

The scale of slowing of cognitive decline still exceeds that of lecanemab.

Furthermore, assuming on the basis of earlier data seen from among others Eisai’s lecanemab, formerly called BAN2401, that the degree of cognitive decline coming out of an Adas-Cog trial could be higher, even as high as 47%, then still Fosgonimeton monotherapy results from the ACT-AD trial are at least equally as good, better in fact.

Earlier results other amyloid antibodies (Alzheimer’s Research & Therapy)

Again, this is not just data from an open label study, which could be criticized for not having been placebo-controlled, and thus coming with a placebo effect. This is actually well-controlled data.

As mentioned above, Fosgonimeton does not appear to come with any side effects.

The valuation potential

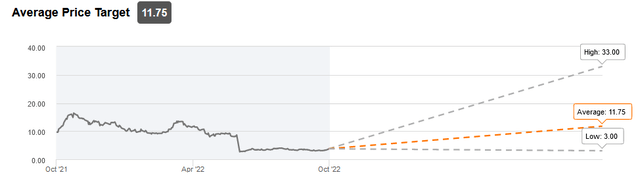

One starts to understand why more than one analyst, namely Tom Shrader from BTIG and Graig Suvannavejh from Mizuho Securities, remained particularly bullish on Athira Pharma after its June 2022 readout. Graig Suvannavejh only initiated coverage on July 6, 2022, with a Buy recommendation, expressly calling this a contrarian idea at the time.

Analyst price targets (Seeking Alpha)

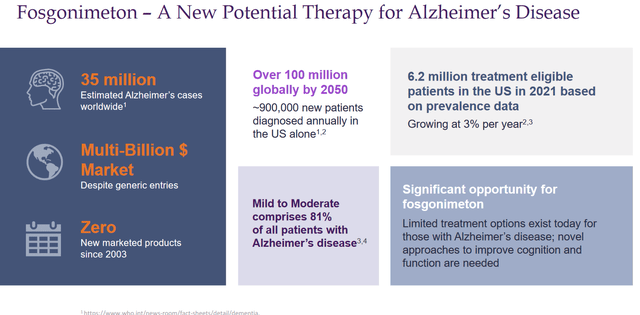

In the case of success, Fosgonimeton can apply for approval in an Alzheimer’s market with an estimated 35 million patients worldwide, which is quickly expanding, and with 6.2 million treatment eligible patients in the US alone. At a yearly drug price of $30,000, which is similar to the one projected by some for Lecanemab, that means a total peak sales potential of $186 billion. If Fosgonimeton would be able to reach 10% of that market, yearly peak sales could be around $18.6 billion. The numbers are dazzling, but one does comprehend that at this stage, Athira Pharma is largely undervalued.

Potential market slide (Corporate Presentation)

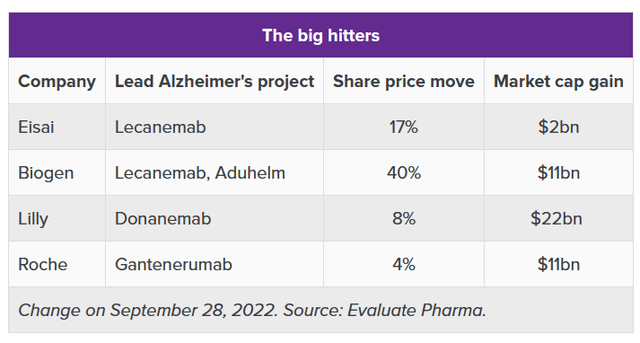

One starts to understand how, on the back of Eisai’s recent news, several companies’ market valuation had grown, sometimes tremendously. These were the ‘big hitters’ in the list of stocks riding on Lecanemab’s coat tails:

Big hitters post lecanemab news (Evaluate Pharma / A. Brown article ‘The Alzheimer’s stocks riding on lecanemab’s coat tails’)

Financials

Athira Pharma is momentarily in fact so undervalued that it comes at half its cash at hand. As of June 30, 2022, its cash position was $282.2 million. Its yearly cash burn for last year was $66 million. That means it could continue operations for another four years at that rate.

Risks

I have highlighted the bear thesis on Athira Pharma above. It goes without saying that the LIFT-AD trial can still fail, for whichever reason which may not yet be clear to investors. Furthermore, regulatory problems may occur during the trial, or may arise once the company intends to file an application for approval of Fosgonimeton.

Last but not least, there is the always stronger threat of competition in the Alzheimer’s space. Other companies with possibly good therapies are moving ahead with trials, some of which are potentially pivotal. These trials could potentially also raise the bar for what is perceived as successful in Alzheimer’s disease, though I am of the opinion that also drug candidates which may not be best-in-class may find their way to the market. Some of these competitors to watch are highlighted in recent coverage by Seeking Alpha contributor Jacob Braun. Athira Pharma is not my top pick in the space, but I like to pick more than one potential winner as I believe more than one therapy will in the end be necessary to treat Alzheimer’s. And Athira Pharma is undeniably far in its path towards approval, which is a plus.

Conclusion

At a $128 million valuation which is half of its cash value, I believe shares of Athira Pharma come as a steal, as the company has now had the chance to organize its potentially pivotal Phase 2/3 trial to focus on monotherapy patients. This company’s stock, with 62% of shares held by institutions, took a beating while it moved to its pivotal and most promising phase, which I saw as an opportunity.

The patients on Fosgonimeton monotherapy in the ACT-AD trial have actually seen a considerable slowing of cognitive decline, which I believe to be in the range of ~70% or higher. Importantly, the ACT-AD trial was randomized and placebo-controlled. If this result is able to be repeated in the LIFT-AD trial, it may do equally as well or even significantly outperform the 27% slowing of cognitive decline seen from Eisai’s Lecanemab. The recent NfL readout confirms the potentially disease-modifying effect of the drug. An all-in-all limited amount of patients will be enrolled in the LIFT-AD trial, which should end mid-2023 and should report topline data in the beginning of 2024. The sales potential is enormous, in light of a US market alone of 6.2 million patients. There is a reason why Eli Lilly’s market cap went $22 billion higher in light of news of Eisai’s competing anti-amyloid drug lecanemab. There is, I assume, also a reason why we have seen consistent and considerably insider purchases in Athira Pharma.

For all the reasons above, I continue to rate shares of Athira Pharma as a strong buy.

Be the first to comment