KadnikovValerii/iStock Editorial via Getty Images

Introduction

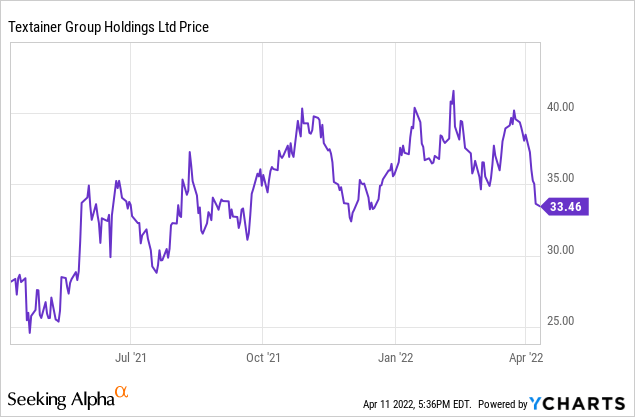

I have been keeping an eye on Textainer (NYSE:TGH) for the better part of two years but I only gained exposure when the company floated its preferred shares and at this point in time I own both the Preferred Series A (NYSE:TGH.PA) and Preferred Series B (NYSE:TGH.PB). Despite the massive tailwinds for container lessors which have been able to expand their asset base while locking in lease agreements for a longer duration and at higher prices, the share price of the common shares of Textainer appears to be running out of steam and I have started to write put options on Textainer in an attempt to go long at a lower share price.

A strong performance in 2021

I’m still looking at Textainer from the perspective of the preferred shares, but in order to figure out how appealing the preferred shares are, we obviously always need to have a look at how the underlying business is performing.

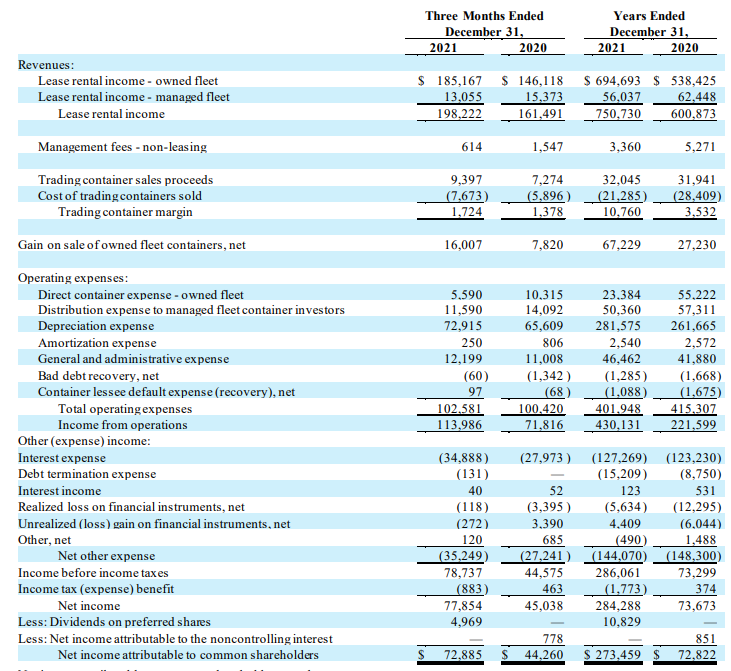

In 2021, the company reported a 25% increase in the lease rental income to in excess of $750M and as you can see in the image below, on an annualized rate based on the Q4 performance, Textainer appears to be on track to generate in excess of $800M in lease revenue in 2022. The company also made some money on the sale of (second-hand) containers, and as the operating expenses actually decreased compared to the previous financial year, the operating income almost doubled in 2021 to $430M.

Textainer Investor Relations

And once again you can see the final quarter of 2021 was very strong with a total operating income of almost $114M, which would exceed $450M on an annualized basis. The interest expenses also increased (as Textainer borrowed a bit more cash to fund its $2B asset expansion program). But looking at the FY 2021 results, the net income of $273 or $5.51/share is absolutely excellent. And in the final quarter of the year, Textainer’s bottom line shows a net income of just under $73M or $1.48/share. That’s excellent considering almost half of the full-year preferred dividend payments occurred in that quarter.

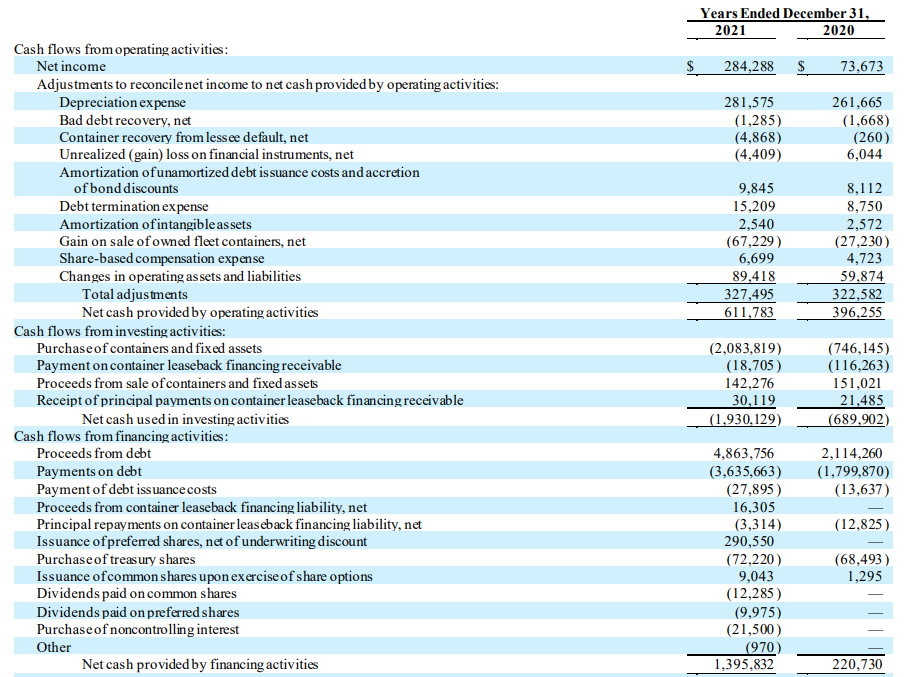

While the reported net income is important, I think the cash flows generated by Textainer are even more important as the operating cash flow will give us a good idea of what we can expect going forward. In Textainer’s case, the reported free cash flow will be meaningless as the company invested quite heavily in expanding its container fleet (the total capex was more than seven times higher than the depreciation and amortization expenses). These investments in expansion will likely not reoccur in 2022 (or will happen at a much lower scale), so the operating cash flow will tell us more than the free cash flow.

Textainer Investor Relations

Textainer reported an operating cash flow of $612M, more than 50% higher than in FY 2020 thanks to the much higher reported net income. We should also deduct the $3.3M in lease payments as well as the preferred dividend payments. During FY 2021, Textainer paid just under $10M in preferred dividends but as those preferred shares were issued throughout the year, the normalized annual preferred dividend payments will be higher. There are 6 million preferred shares outstanding of both the 7% and the 6.25% series, resulting in a total annualized preferred dividend cost of around $20M. So on an adjusted basis, the operating cash flow was approximately $590M.

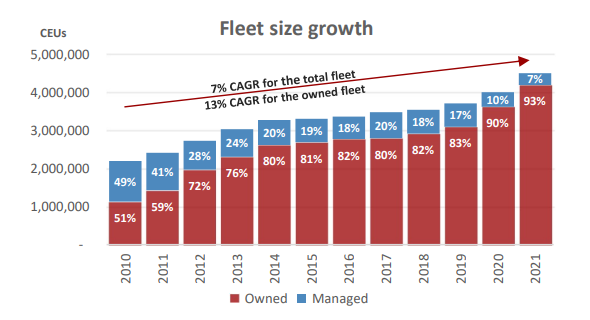

We see the total capex was almost $2.1B but those are predominantly investments in growth as Textainer increased its owned fleet by in excess of half a million TEU ( 4.32M TEU versus 3.77M TEU as of the end of 2020).

Textainer Investor Relations

The net debt as of the end of 2021 increased from $4B as of the end of 2020 to $5.1B. That sounds very high but keep in mind the debt is amortized over the useful life of the containers. And considering Textainer has been able to sign contracts at higher rates for extended periods of time, the debt amortization shouldn’t be an issue and the main risk would be to see shipping companies going out of business and not paying nor immediately returning the containers for redeployment. But considering the very strong container shipping market, I don’t see this as a huge risk. As mentioned in a previous article, the tailwinds in the container sector could last a decade.

I still think the preferred shares offer an excellent risk/reward ratio

As interest rates have been increasing, the share price of the preferred shares has been decreasing. The most recently issued preferred shares, the Series B, have a preferred dividend of 6.25% per year, or $1.5625 per year. Based on the current share price of $23.15, the yield is 6.75%, making this a very attractive option for an income-oriented portfolio.

The Series A preferred shares are currently still trading at a premium to their face value of $25 share as the share price at the closing bell was $25.53. This would result in a yield to call of approximately 6.6% but after the call date in June 2026, these securities will see their preferred dividend being reset to 6.134% + the 5 year US treasury yield. As that five-year treasury yield is currently 2.79%, this would imply that from 2026 on, the preferred series A would be reset to a preferred dividend yield of almost 9%. Interesting, but this also makes it more likely the A-series will be called in 2026 and that explains why this issue of the preferred shares is trading at a small premium.

Both issues of the preferred shares are cumulative in nature.

Investment thesis

The preferred shares of Textainer are an excellent addition to my income-focused portfolio and the lack of dividend withholding tax for this Bermuda-based company is a nice bonus. That being said, the share price of the common shares has gone down as the fears for a full-blown recession are hurting the expectations for the world trade and the demand for shipping containers. I took advantage of the situation by writing put options on Textainer in an attempt to initiate a long position at a lower share price. A P30 expiring in May, for instance, has an option premium of $1 while a P25 for August can be sold for the same option price. Considering a substantial portion of Textainer’s container fleet has been leased for a long period resulting in excellent earnings visibility and considering the (high) net debt will be amortized over the useful life of the containers, I wouldn’t mind establishing a long position in Textainer’s common shares. Those common shares currently also pay a quarterly dividend of $0.25 for a yield of 3.3-4% based on the $30/$25 strike price of the put options I have sold.

Be the first to comment