stephenallen75/iStock via Getty Images

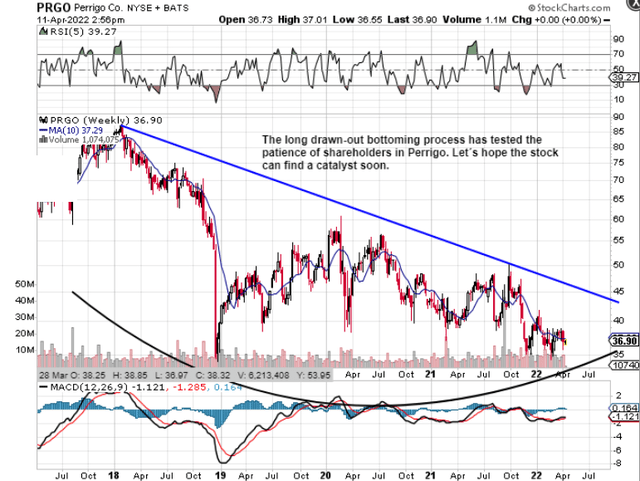

As we can see from the technical chart below, shares of Perrigo Company plc (NYSE:PRGO) have been potentially undergoing a bottoming pattern for well over three years now. In saying this, with the company expected to announce its first quarter numbers on the 6th of May next, it is crucial that shares remain above their year-to-date lows to keep the bullish argument intact. This is essentially the issue with value plays which is knowing when to enter into a position from the long side.

From a technical standpoint, for example, we would like to see a convincing break out above the stock’s 10-week moving average followed by a breakout above the multi-year downcycle trend line depicted below. We are mindful of the strong insider buying which took place last year and we are confident that short interest would fall below 5% if indeed these above-mentioned technical levels were taken out.

Although there have been plenty of changes afoot in Perrigo of late, the company’s dividend can give us insights into where the share price is headed here. Perrigo pays an attractive 2.8% dividend yield and has increased the annual payout for the past 18 years. Although the company recently announced a $500 million debt offering to help with the funding of the Hera SAS purchase, we will look to see how Perrigo’s key dividend metrics have changed over the past while, but more importantly, how the payout is expected to fare out going forward.

Bottoming Formation In PRGO (StockCharts.com)

Perrigo’s Dividend Yield

Perrigo’s dividend yield presently comes in at 2.82%. This yield is well ahead of the median in this sector (1.53%) and also Perrigo’s 5-year average of 1.59%. Many dividend growth investors use the yield as a barometer on whether shares are cheap or not, so off to a good start here.

PRGO’s Dividend Growth

One of the big calling cards in this stock has been its dividend growth. As we can see below, Perrigo’s dividend growth rates have easily outpaced the averages in this sector by some distance. Growth rates are important especially in the current climate as they protect against purchasing power erosion plus they also foster confidence with respect to future earnings growth.

| Dividend Growth Rate (CAGR) | 12 month | 3-Year | 5-Year | 10-Year |

| Perrigo | 6.67% | 17.09% | 16.03% | 15.45% |

| Sector | 5.56% | 5.5% | 6.25% | 5.45% |

Although management increased the quarterly dividend by $0.02 recently (8.3%), growth has slowed a tad in recent years. Here is where investors may assume that dividend growth rates will continue to decline but there is more to meet the eye here.

Perrigo’s Transformation

As alluded to earlier, many times dividend investors make the mistake of focusing too much on present growth rates instead of paying more attention to what is coming down the track. Perrigo’s shift to a consumer self-care company last year will have significant ramifications with respect to dividend growth going forward. For one, the $1.6 billion sales of the generic Rx business should bring more predictability to growth rates going forward which is precisely what the market wants to see. Proceeds from the divestiture will also go towards the HRA Pharma acquisition ($1.8 billion) which really has the potential to transform the company when we run through the numbers. Management estimates, for example, that sales will grow by approximately $400 million annually which will drive operating profit and the corresponding interest coverage ratio higher. Furthermore, the announcement last September concerning Perrigo’s Irish tax settlement ($266 million which was paid in Q4 versus an original $3 billion estimate) brings stability once more to the financials which the market should reward in due time.

Perrigo’s Cash Flow

Building on the momentum we witnessed in Perrigo’s recent fourth quarter where we saw earnings and top line beats, fiscal 2022 is expected to be robust based on current trends. What will be key here will be the execution of self-care and the speed of the HRA Pharma integration. From a cash flow perspective, for example, the dividend payout ratio would have actually come in at a healthy 50% last year were it not for that tax settlement payment in Q4. Free cash flow would have come in close to $260 million with dividend payments amounting to $130 million for the fiscal year. Furthermore, with $2.54 in earnings per share (23% growth) projected for fiscal 2022 on projected revenues of $4.46 billion (8% growth), it quickly becomes evident how margins from the transition will meaningfully increase going forward.

Conclusion

To sum up, given Perrigo’s current valuation and what is expected to come down the track here concerning earnings and margin growth, we would expect the market to price this stock higher over time. The dividend remains in solid shape (where strong double-digit annual growth rates should continue) but we will wait for the above-mentioned technicals to be taken out to the upside before entering on the long side here. We look forward to continued coverage.

Be the first to comment