Antoine2K

Introduction

I like to write about companies that lack coverage on SA and today I’m taking a look at Texas Mineral Resources (OTCQB:TMRC). The company owns 20% of Round Top, which is in one of the largest heavy rare-earth elements (REE) projects in the USA. However, the latter has been stuck at the Preliminary Economic Assessment (PEA) stage for over 3 years now. Considering the 80% shareholder in the project is currently investing $100 million in a rare earth metal and sintered neo-magnet plant in Oklahoma, I doubt it has the funds to develop Round Top at the moment. In addition, Texas Mineral Resources seems overvalued based on the net asset value (NAV) attributable to its stake. Let’s review.

Overview of the business and financials

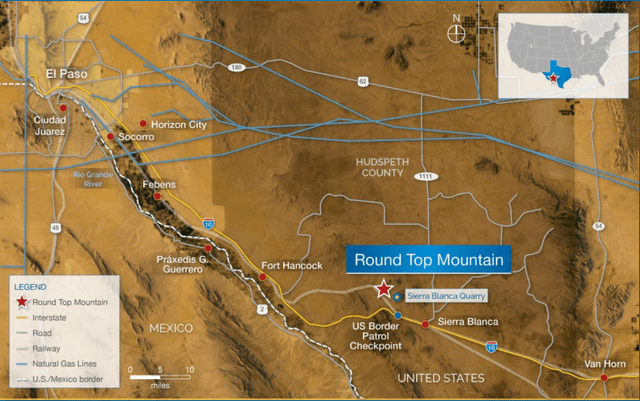

Texas Mineral Resources is involved in the acquisition, exploration, and development of mineral properties and its main asset is a 20% stake in the Round Top heavy rare earth, lithium, and critical minerals project in Hudspeth County, Texas. Looking at the deposit, you can easily tell where the name comes from.

Texas Mineral Resources

Texas Mineral Resources

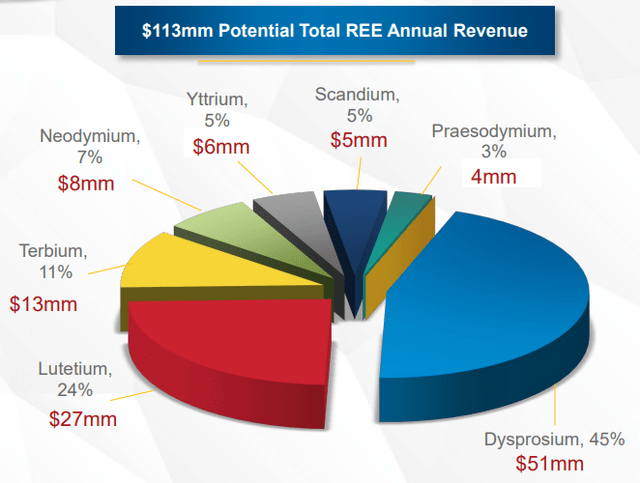

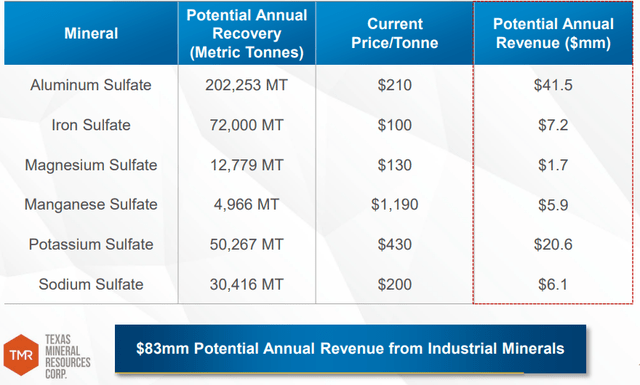

The deposit is 1,250 feet high, and it has a diameter of around a mile. Considering it’s located above ground and mineralization is spread evenly, there will be little waste mined. In addition, Round Top is close to US I-10 and there’s electricity and water nearby. The project contains a multitude of rare earth minerals, technology metals, and industrial minerals with the main ones being lithium, dysprosium, and aluminum sulfate. Many of them are used in magnets or electric vehicles, so the demand is growing.

Texas Mineral Resources

Texas Mineral Resources

Texas Mineral Resources

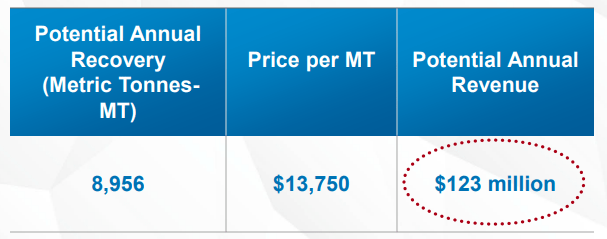

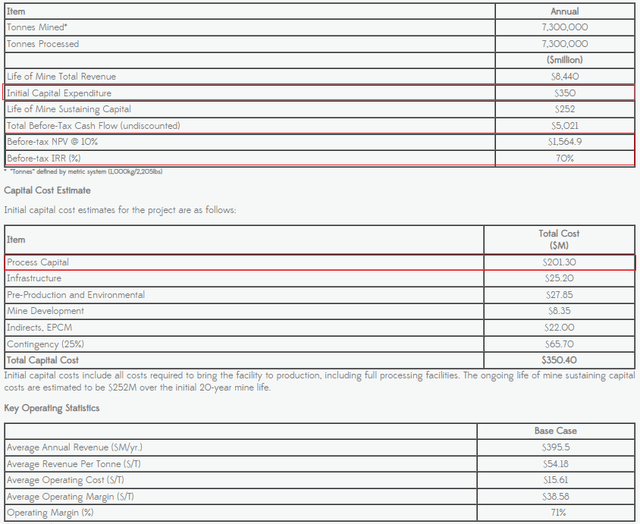

In 2019, Texas Mineral Resources released an updated PEA on Round Top which showed that the project had a pre-tax NPV of $1.56 billion and a pre-tax internal rate of return (IRR) of 70%. The reason the IRR is this high is the relatively modest initial CAPEX of $350.4 million for a project of this size. In the mining sector, an IRR of above 20% is usually considered compelling. The mine life is 20 years based on just 14% of the existing mineral resource estimate, which implies it can be longer than a century. Looking at the initial CAPEX, most of it is expected to go into the construction of a 20,000 tonnes per day processing plant.

Texas Mineral Resources

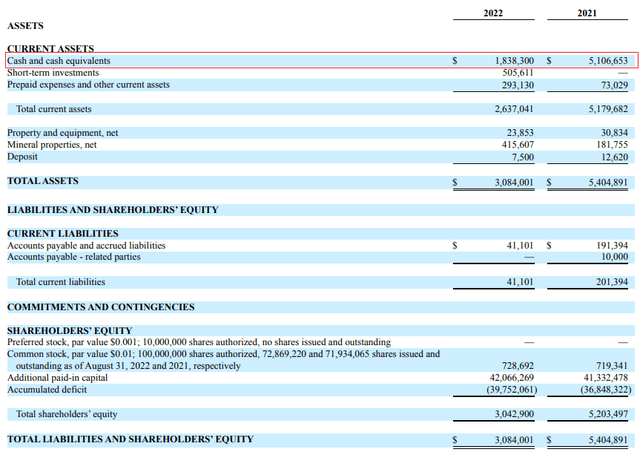

In my view, this is where the red flags start to show up. You see, Round Top will rely on conventional ion exchange and ion chromatography (CIX/CIC) technology to process rare earths. While ion exchange has been used for rare earth separation since the 1940s, continuous ion exchange isn’t a proven technology that is widely used today in this sector. According to the FY22 financial report of Texas Mineral Resources, about $77.1 million will be invested to optimize the leaching and developing of the CIX/CIC processing at Round Top in FY23 (see page here 14 here). Initial process design work will be carried out at the Wheat Ridge facility of USA Rare Earth, which holds the remaining 80% of Round Top. Following this, this facility will either be relocated to or replicated at the Round Top Project where a pilot plant is expected to be established. The issue here is that Texas Mineral Resources doesn’t currently have the $15.4 million it needs to fund its part of this investment. As of August, the company had just $2.3 million in cash and short-term investments which leads me to think that significant stock dilution is likely in the near future. G&A expenses are about $1.4 million per year.

Texas Mineral Resources

Turning our attention to USA Rare Earth, the company raised $50 million in a Series C funding round in May 2021 and earlier this year started the development of a $100 million rare earth metal and sintered neo-magnet manufacturing facility in Stillwater, Oklahoma. While this facility could have significant synergies with Round Top, I find it concerning that USA Rare Earth hasn’t closed a funding round for over a year now and I doubt it has the funding available to develop Round Top. Securing financing is made even more difficult considering there is still no bankable feasibility study. And before completing a bankable feasibility study, USA Rare Earth and Texas Mineral Resources will need to go through a pre-feasibility study. In my view, Round Top is several years away from a construction decision.

Looking at the valuation, development-stage mining companies in the mining sector rarely trade above 30% NAV, and looking at the 2019 PEA, this would put the amount attributable to the 20% stake of Texas Mineral Resources at about $93.9 million. Considering the company has barely any cash left and its market capitalization stands at $129.2 million as of the time of writing, I think it looks significantly overvalued.

So, how do you play this? Well, short selling seems like a viable idea as data from Fintel shows that the short borrow fee rate is just 4.48% as of the time of writing. However, there are still no call options available. In addition, I think that short selling mining companies is dangerous as the prices of commodities are notoriously volatile. It could be best for risk-averse investors to avoid this stock. Looking at other risks for the bear case, I think there are two major ones. First, it’s possible that the high NPV and IRR of Round Top attract the interest of a major mining company which is likely to provide a boost to the share price of Texas Mineral Resources. Second, the share prices of microcap companies can increase for spurious and unknown reasons.

Investor takeaway

The key financial figures in the PEA for Round Top look compelling but the development of the project over the past few years is almost non-existent. The owners of the project don’t seem to have enough funding to move to the construction phase and I think that Texas Mineral Resources looks overvalued at the moment considering it’s trading at above 0.4x pre-tax NPV.

In my view, it’s best for risk-averse investors to avoid this stock.

Be the first to comment