OwenPrice

Investment Thesis

LKQ Corporation (NASDAQ:LKQ) will see higher stock prices due to cost reductions from business integration and growing demand as more cars are on the road each year, and the average age is increasing. The company helps collision and mechanical repair shops, new and used car dealerships, and retail customers complete repairs faster, improving productivity at lower costs.

LKQ Corp.

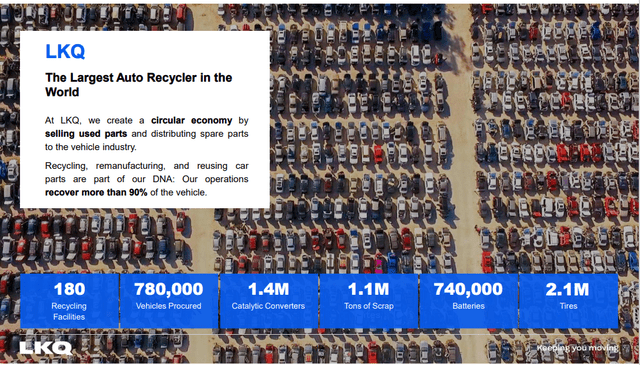

LKQ offers its customers a broad range of OEM recycled and non-OEM aftermarket parts, replacement systems, components, equipment, and services to repair and accessorize automobiles, trucks, and recreational and performance vehicles. Initially formed in 1998 as a consolidator of auto salvage operations in the United States, it has since greatly expanded its scope to include the distribution of new mechanical and collision parts, specialty auto equipment, and remanufactured and recycled parts. It maintains its auto salvage business and owns over 70 LKQ pick-your-part junkyards.

Globally, LKQ maintains approximately 1,700 facilities. The company operates in the United States, Canada, the United Kingdom, Germany, Belgium, the Netherlands, Luxembourg, Italy, the Czech Republic, Austria, Poland, Slovakia, Taiwan, and other European countries. LKQ Corporation is headquartered in Chicago, Illinois.

LKQ is the largest vehicle recycler in the world. They now recycle over 800K vehicles per year. This company is undoubtedly environmentally friendly as it removes all potentially hazardous fluids from each car and resells parts of the vehicles keeping them out of a landfill and reducing the impact that creating new parts would have caused.

www.lkqcorp.com

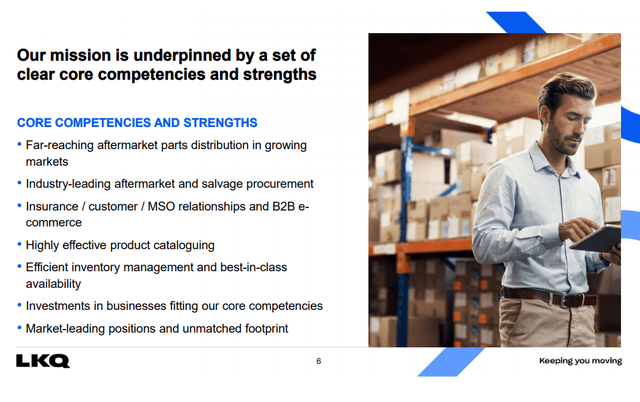

The strength of LKQ is found in its ability to procure and salvage parts, catalog, and handle inventory management. Their relationships with insurance companies, customers, and B2B e-commerce give them a competitive edge.

www.lkqcorp.com

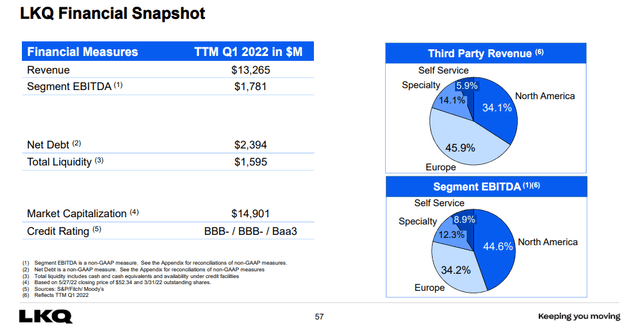

LKQ’s EBITDA comes from four segments. North America accounts for 44.6%, while Europe contributes 34.2%, followed by 12.3% from Specialty and 8.9% from Self Service, where customers pick their parts.

www.lkqcorp.com

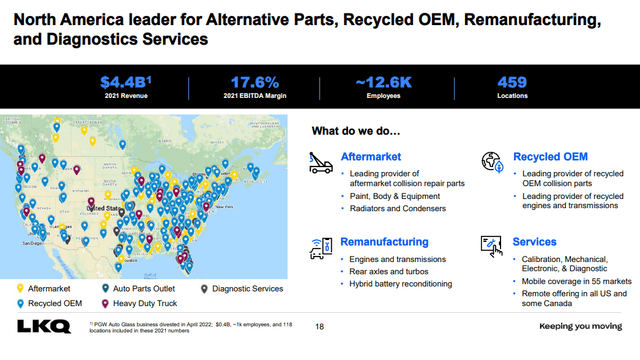

The North American segment is the leading aftermarket and recycled collision repair parts provider. They also remanufacture engines, transmissions, rear axles, turbos, and recondition hybrid batteries.

www.lkqcorp.com

The company has built scale-driven cost advantages in its business. Customers value LKQ’s consistent wide range of parts availability and quick delivery. LKQ helps customers complete repairs faster, improving productivity at lower costs. Some estimate fulfillment rates for salvage parts are about 75% for LKQ versus roughly 25% for competitors.

LKQ’ uses its company-owned fleet of trucks to shift inventory between warehouses. This allows LKQ to reduce order lead time to their customers cost-effectively.

If there is an economic slowdown, LKQ will benefit as consumers typically delay purchasing new vehicles. Owners will use non-OEM and recycled parts to keep their vehicles on the road longer at a lower cost.

The company sources its recycled vehicles from car auctions. LKQ’s bidders utilize internally developed software to cross-check current inventory levels and average selling prices to determine an optimal vehicle bid. This prevents the company from overspending on vehicles, driving higher profitability than smaller peers.

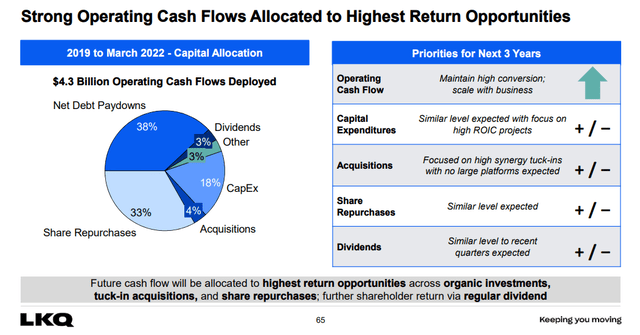

Historically, the company has used acquisitions to build up its capabilities and footprint, but that has changed over the past few years. LKQ has shifted its focus to integrating its businesses and improving its cost structure and will aim to make smaller tuck-in acquisitions instead of larger deals.

LKQ has annual sales of $12.9B with 46K employees. They are 97.9% owned by institutions, with 2.0% short interest. Their return on equity is 22.6%, and they have a 14.0% return on invested capital. The free cash flow yield per share is 4.6%, and their buyback yield per share is 8.1%. Their Piotroski F-score is five, indicating some strength. They have a price-to-book ratio of 2.8.

Q3 Quarterly Results & Full-Year Outlook

LKQ announced Q3 revenue of $3.1B in their press release. LKQ reported Q3 EPS at $0.97, slightly beating the consensus. The Wholesale North American segment did better than expected, and organic parts and services revenues increased by 4.8% yearly. But that was not enough to offset declines from FX rates and divestitures, causing revenues to be 5.9% below Q3 last year.

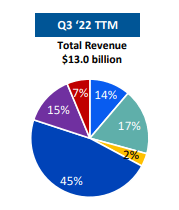

45% of total Q3 revenue came from recycled parts, while 17% came from new aftermarket parts, 15% from Specialty, which includes Marine, Power Sports, and E-Bikes, 14% from European Operations, 7% from Other, and 2% from Self Service pick your parts.

www.lkqcorp.com

Supply chains continue to be a problem, and management explained the currency headwind in Europe. LKQ’s sales declined to $3.1 billion in the third quarter, down 5.9% yearly. Revenues were mainly brought down by FX rates (690-basis point impact) and divestitures (210-basis point headwind). On a constant currency basis, the company’s sales increased by 1.0% yearly.

LKQ says aftermarket and recycled demand remains solid, given the aging of cars and limited new car sales. LKQ EBITDA margins by segment show that North American operations were 18.3%, Europe 10.2%, and Specialty 12.0% in 2021.

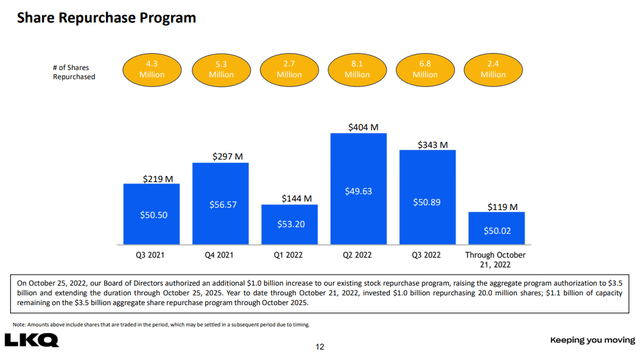

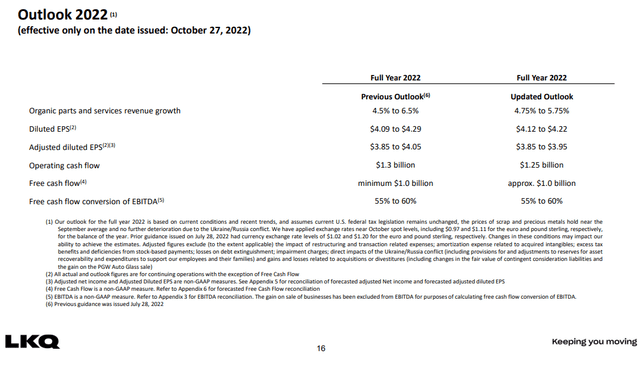

Management reduced 2022 adjusted EPS expectations. At the midpoint, guidance was lowered to $3.90 from $3.95. LKQ is expecting scrap and metal prices ($0.04), FX rates ($0.03), and taxes ($0.03) to have a downward impact on adjusted EPS to close out 2022. Better operating results and share repurchases will somewhat offset these items.

Balance Sheet Improvement and Share Buybacks

LKQ intends to sell several small, non-core businesses to simplify its operating model and improve margins. Proceeds can go towards debt reduction and be returned to shareholders via share repurchases and dividend payments.

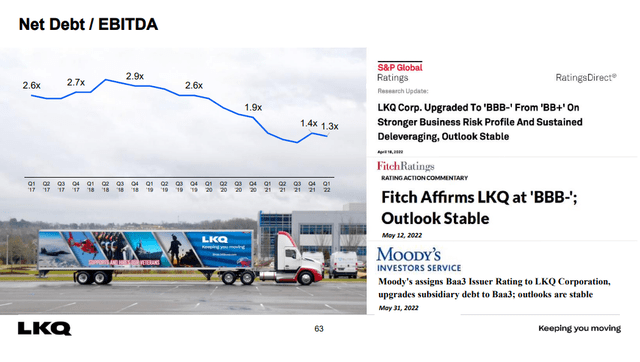

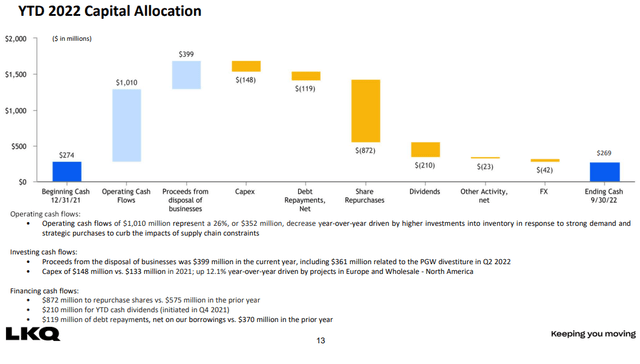

LKQ’s variable cost structure allows them to adjust as the current environment changes. Its $1B cost reduction plan will help. Free cash flow of about $1.0 billion is expected in 2022, down modestly from $1.07 billion in 2021 and $1.27 billion in 2020. Interest expense savings from its debt paydown and share repurchases will boost EPS.

www.lkqcorp.com

Management is also committed to repurchasing shares, evidenced by the current share repurchase program. LKQ repurchased $891 million of stock in the first nine months of 2022, $877 million in 2021, $117 million in 2020, and $292 million in 2019. On October 25, the company authorized a $1 billion increase to its share repurchase program.

www.lkqcorp.com

www.lkqcorp.com

www.lkqcorp.com

www.lkqcorp.com

Good Technical Entry Point

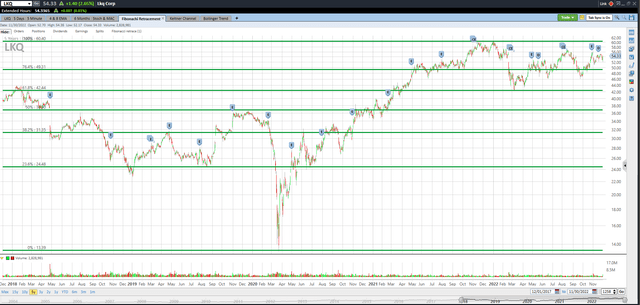

LKQ had a closing price of $54.33 as of November 30th. I’ve added the green Fibonacci lines, using the high and low of the past five years for LKQ. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. LKQ is above the 76.4% Fibonacci retracement level but could go lower. I think patient investors will be able to buy LKQ at or near $50 if they wait.

Schwab StreetSmart Edge

The three most accurate analysts have an average one-year price target of $66.17, indicating a 21.7% potential upside from the November 30th closing price of $54.33 if they are correct. Their ratings are all buys. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates or at least headed in the right direction. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

Trends in Earnings Per Share, P/E Ratio, and Operating Margin

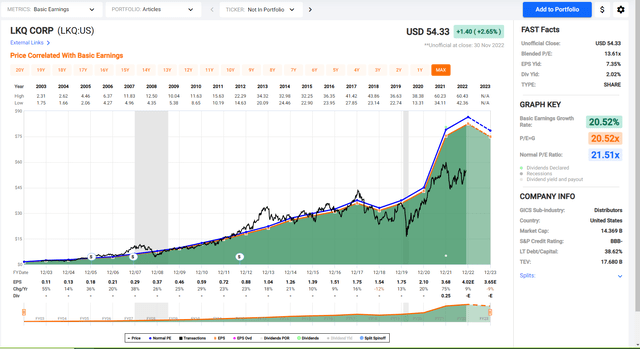

The black line shows LKQ’s stock price for the past twenty years. Look at the chart of numbers below the graph to see that LKQ earnings were $1.75 in 2019, $2.10 in 2020, and $3.68 in 2021, and they are expected to earn $4.02 in 2022 and $3.65 in 2023.

The P/E ratio for LKQ is currently at 13, but the average ratio over the past ten years is 20. I don’t think the P/E will rally back to 20 anytime soon. If LKQ earns $3.65 in 2023, the stock could trade at $55.11 if the market assigns only a 15.1 P/E ratio.

FastGraphs.com

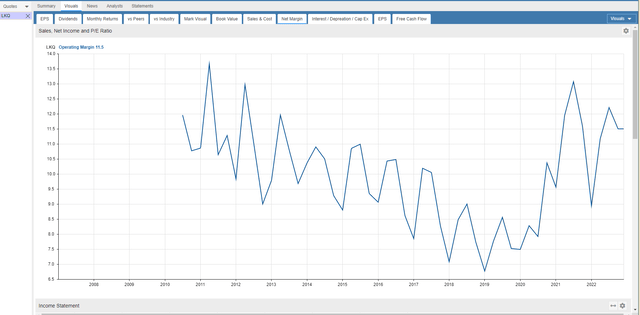

LKQ’s operating margin has shown improvement during the past few years.

StockRover.com

Sell Covered Calls

My answer to uncertainty is to sell covered calls on LKQ six months out. LKQ closed at $54.33 on November 30th, and I think patient investors will be able to buy LKQ at or near $50.00 in the coming weeks or months. The May $50.00 covered call can then be sold. One covered call requires 100 shares of stock to be purchased.

Takeaway

LKQ will see higher stock prices due to cost reductions from business integration and growing demand as more cars are on the road each year, and the average age is increasing. Wait and buy LKQ if it gets near $50.00 and then sell the May $50 covered call to boost your returns and lower your risk while collecting dividends.

Be the first to comment