Sundry Photography

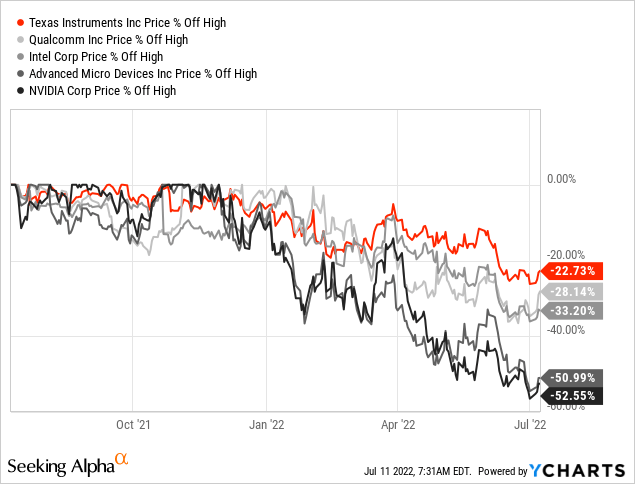

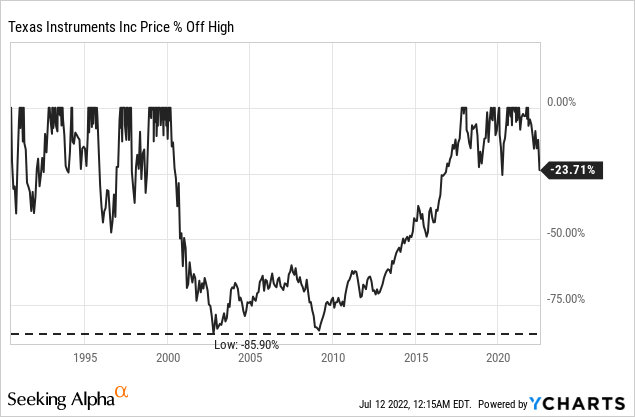

Since I covered Texas Instruments (NASDAQ:TXN) for the first time about a year ago[DS1] , the stock price constantly declined. However, it is interesting and worth pointing out that Texas Instruments is trading 23% below its all-time highs while many of its peers (other semiconductor companies) saw steeper declines during this correction we witnessed so far in 2022. Especially NVIDIA Corporation (NVDA) and Advanced Micro Devices (AMD) declined rather steep as both stocks lost about 50% of the previous value.

And since my last article was published, Texas Instruments could improve its business further (with the top and bottom line growing), while the share price was declining another 10%. The combination of a declining stock price and improving fundamentals is usually making a stock more interesting for investors – therefore, let’s analyze if Texas Instruments is a great investment at this point.

Results

When looking at the last quarterly and annual results, Texas Instruments could report extremely impressive growth rates. In fiscal 2021, Texas Instruments generated $18,344 million in revenue and compared to $14,461 million in fiscal 2020 this is an increase of 26.9% year-over-year. Operating profits increased from $5,894 million in fiscal 2020 to $8,960 million in fiscal 2021 and this resulted in 52.0% year-over-year growth. And finally, diluted earnings per share increased 38.4% year-over-year from $5.97 in fiscal 2020 to $8.26 in fiscal 2021.

And when looking at the first quarter of fiscal 2022, the strong growth rates continued. Revenue increased from $4,289 million in the same quarter last year to $4,905 million – resulting in 14.4% year-over-year growth. Operating profit also increased from $1,939 million in the same quarter last year to $2,563 million this quarter – resulting in 32.2% year-over-year growth. And finally, diluted earnings per share increased from $1.87 in Q1/21 to $2.35 in Q1/22 resulting in 25.7% YoY growth.

Cyclical Business and Recession

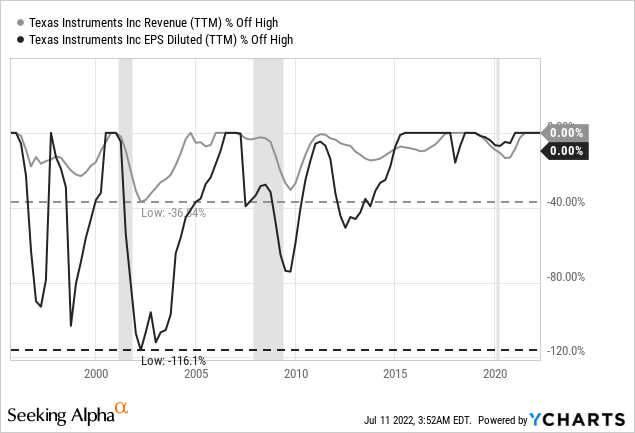

Texas Instrument is reporting impressive growth rates right now, but we should not forget or ignore that Texas Instruments is a cyclical business as the entire semiconductor industry is cyclical. The short lifespan of semiconductors leads to huge demand when better and faster products are developed, but these phases are followed by overproduction and declining demand.

For us as investors it is important not to get carried away by the high growth rates semiconductor companies can report. That statement is especially true as we must also consider a potential upcoming recession in the coming quarters. And when looking at the data from the past few recessions, we can see Texas Instruments being clearly affected by past recessions. Earnings per share as well as revenue declined rather steep in the recession in the early 2000s as well as the Great Financial Crisis.

But compared to many other businesses we also see steep declines which are not caused by a recession. And when combining the cyclical nature of the business with the potential for a steep recession, we should be very cautious about Texas Instruments in the coming years and expect steep declines for earnings per share as well as revenue.

Growth

When talking about growth in case of Texas Instruments, it gets a bit tricky. We should accept the possibility that we are at a cycle peak right now and might see lower revenue in the years to come. But despite the cyclical nature of the business, we still can expect long-term growth and despite short-to-mid-term cyclical waves, a company can still grow long-term with a solid pace. Texas Instrument is just lacking stability and consistency to a certain degree.

But during the last ten years (fiscal 2011 till fiscal 2021), Texas Instrument could increase earnings per share with a CAGR of 15.97% and when looking at longer timeframes (last forty years), Texas Instruments increased earnings per share with a CAGR of 9.64%.

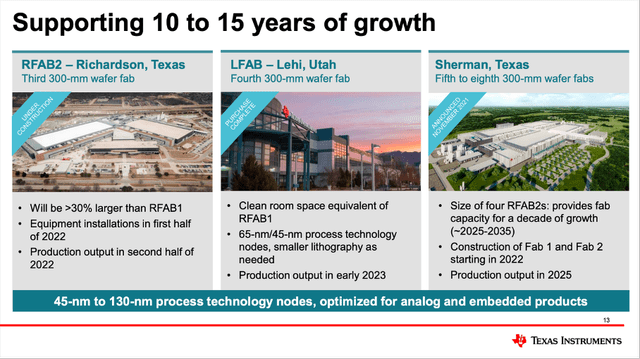

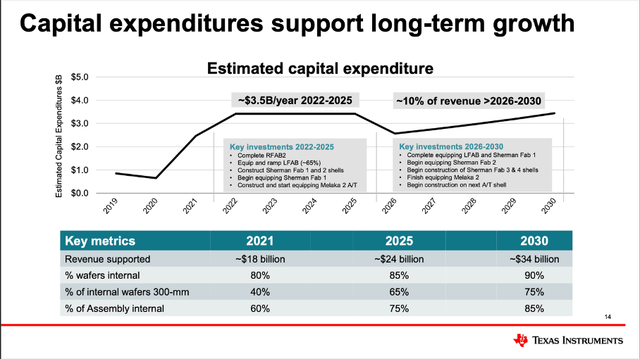

Texas Instruments Presentation

And despite any cyclicality, Texas Instruments is investing in the future and is building three additional production sites in Texas and Utah. These three new wafer fabrication plants should support about 10 to 15 years of growth for Texas Instruments.

Dividend and Share Buybacks

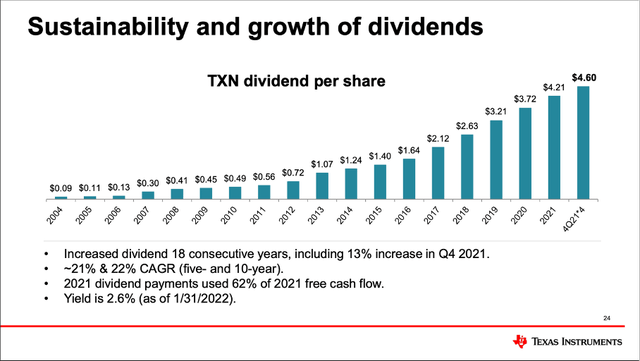

Compared to many other semiconductor companies, Texas Instruments is very interesting for its dividend as the company is a reliable dividend payer and that is rather a rarity in the industry. Texas Instruments has increased its dividend for 16 years in a row and in the last five years the dividend increased with a CAGR of 18.91%. The company is paying a quarterly dividend of $1.15 resulting in a dividend yield of 3% right now and when taking the current dividend and compare it to the TTM EPS of $8.86, we get an acceptable payout ratio of 52%.

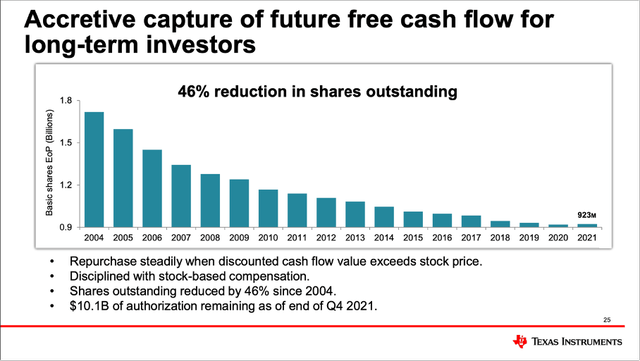

Texas Instruments Presentation

Texas Instruments is also focusing on share buybacks and claiming it reduced the number of outstanding shares by 46% since 2004. However, in the recent past, Texas Instruments spent less money on share buybacks as it used to in previous years. In fiscal 2021, Texas Instruments spent only $527 million on share buybacks – compared to amounts between $2.5 billion and $3 billion in previous years. Considering the rather high stock price in 2021 this was probably a smart move and as the stock price is declining, Texas Instruments also increased share buybacks again. In the first quarter of fiscal 2022 it spent $589 million – more than in the previous four quarters combined.

Texas Instruments Presentation

And with about $600 million spent on share repurchases in the first quarter of fiscal 2022, about $9.5 billion of share repurchase authorization should be remaining and with current stock prices it is enough to repurchase about 7% of the company’s total outstanding shares.

Intrinsic Value Calculation

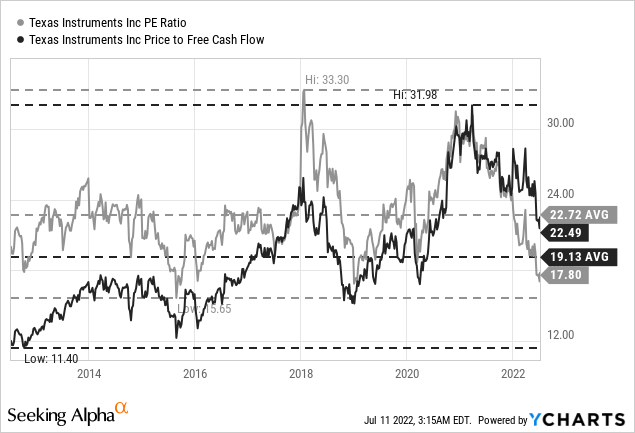

I already indicated in the section above, that Texas Instruments is now more reasonable valued than it was in 2021. This is already becoming obvious when looking at the price-earnings ratio. Right now, Texas Instruments is trading for 18 times earnings, which is clearly below the 10-year average of 22.72 and actually one of the cheaper P/E ratios of the last ten years. When looking at the price-free-cash-flow ratio the picture is a little different. The P/FCF also declined in the last few months, but the stock is still trading for 22.5 times free cash flow, which is above the 10-year average of 19.13. When looking at these simple valuation metrics we can at least make a case for Texas Instruments being fairly valued.

And there is a reason for the P/FCF ratio being a little higher right now. In the last few quarters, Texas Instruments increased its capital expenditures quite a lot and the business will continue to increase its capital expenditures in the years to come – and this is impacting free cash flow. When looking at the trailing twelve months numbers, capital expenditures increased from $796 million one year ago to $2,597 million right now. And management is expecting capital expenditures to be around $3.5 billion for the next few years until fiscal 2025 before it will be around 10% of revenue for the following years. Between fiscal 2012 and fiscal 2020 Texas Instruments had to spend 12.6% of cash from operations on capital expenditures – in fiscal 2021 it was 28.1%.

Texas Instruments Presentation

When trying to calculate an intrinsic value by using a discount cash flow calculation, we make the following assumptions. As basis we take $9,050 million in cash from operations in the last four quarters. For fiscal 2023 we assume 30% decline due to a potential recession followed by a recovery (30% growth in fiscal 2024 and 15% in fiscal 2025). And for the years till fiscal 2031 we assume 10% growth. From these numbers we subtract the expected capital expenditures, which are $3.5 billion for the years between fiscal 2022 and fiscal 2025 as well as 20% of cash from operations in the years between fiscal 2026 and fiscal 2031 (as mentioned above, capital expenditures were only 12.6% of cash from operations in the years 2012 till 2020 and therefore 20% seems like a realistic assumption). For perpetuity, we assume 6% growth (due to the economic moat Texas Instruments most likely has) and this will lead to an intrinsic value of $179.23 (assuming 10% discount rate and 934 million outstanding shares).

Texas Instruments could be seen as slightly undervalued right now, but we must take into account the possibility of a steeper recession and earnings per share declining more than “just” 30%.

A Warning

In 2021, I published several articles that included a section I usually called “Lessons from history”. It was a warning not to get too complacent and, in the summer of 2022, we already know these warnings were more than justified. And while Intel Corporation (INTC) was one of the companies we could learn from, Texas Instruments is actually another stock fitting that pattern.

If you invested in Texas Instruments in 2000 at the peak of the Dotcom bubble it would have taken almost 20 years for you to get your original investment back (not including dividends). Following 2000, Texas Instruments’ stock declined for several years and lost 85% of its previous value. And to be clear, I am not expecting a similar steep decline for Texas Instruments again, but it should be a warning. And Texas Instruments declining to $130 (the highs before the COVID-19 crash) or $90 (the low during the COVID-19 crash as well as the peak during the Dotcom bubble in 2000) is more than just a possibility. Declining to $90 would reflect a 55% decline from the previous all-time high and would still be a more moderate decline than in the last two major recessions (Texas Instruments declined 86% following the Dotcom bubble and 65% during the Great Financial Crisis).

While fundamentals play an important role in long-term investing and investment decisions in individual companies should be made mostly based on fundamentals, we should not ignore psychology and sentiment – both can have a huge effect on short-to-mid-term stock price movements.

Conclusion

Texas Instruments is neither extremely cheap nor extremely overvalued and I would still rate the stock as a hold. It could trade slightly below its intrinsic value, but there is also potential for lower stock prices in the coming quarters. While I would not argue that Texas Instruments must trade for a much lower stock price from a fundamental point of view, the combination of declining earnings per share in the next few quarters and sentiment turning negative (resulting in a much lower valuation multiple) could lead to a much lower stock price.

Be the first to comment