Thinkhubstudio

Investment thesis

Logitech International S.A. (NASDAQ:LOGI) stock has lost more than 66% of its value since its all-time high in June 2021, and the downtrend seems to be persistent until today. Although the company has recently lowered its outlook and is facing some near-term headwinds, its business strategy based on multiple secular growth vectors is solid and offers great opportunities for investors.

The company is launching many new products and significantly increasing its expenses in Research and Development, while also investing in promising and future-oriented technologies. The financial strength of the company continues to be a solid argument for investors who could profit from the company’s increased share-buyback program and a higher dividend. My updated conservative valuation model prices the shares at $91, with 87% upside potential, but investors should consider their investment horizon as in the short term the stock may still face some headwinds.

A quick look at the recent events

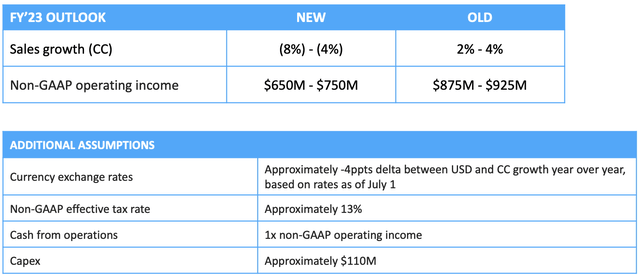

On July 26, 2022, Logitech announced its Q1 FY2023 results, reporting revenue of $1.16B down 12% Year-over-Year (YoY), gross profit margin fell to 40%, was nearly flat sequentially, but still within the long-term range between 39-44%. Operating income fell by 38% while quarterly EPS was reported 39% lower at $0.74 from $1.22 the prior year. The company could grow only in its Video Collaboration (VC) and its Keyboards and Combos business segments, with Pointing Devices flat in sales, while the other segments all recorded double-digit slowing revenue YoY.

Without surprise, the company is experiencing some near-term headwinds, as the inflationary environment, increased component costs, long-term logistic cost pressure and bottlenecks, slowing consumer confidence, and unfavorable currency movements are a toxic cocktail not only for Logitech but many technology companies worldwide. Investors also have to consider that the past years of reference were particularly profitable in the company’s history and that the company will likely not grow as fast as it did during the pandemic. The company is focusing on reducing its variable costs, with Sales and Marketing as well as General and Administrative expenses down respectively 10% and 9%, but increased its expenses in Research and Development by 9%. This signals its commitment, as the leader in its industry, to continue to provide highly innovative and qualitative products.

The company launched many new and innovative products, with the iconic G502 X line reinvented and upgraded with its latest LIGHTFORCE hybrid optical-mechanical switches, lighter materials, and high-precision gaming sensor, launched on August 30. The Logitech Chorus for Meta Platforms’ (META) Quest 2 was announced on August 17 and offers a full-immersive audio experience for Virtual Reality (VR) gamers. On July 26, Logitech G introduced the Aurora Collection featuring gaming headsets, keyboards, mice, and accessories specially designed for women gamers. Earlier on May 24, the company introduced a major update to its Master Series, by launching the MX Mechanical and MX Mechanical Mini, as well as the MX Master 3S mouse addressing advanced digital creators and the productivity customer segment.

A promising statement was made on August 2, when the company announced its partnership with Tencent (OTCPK:TCEHY, OTCPK:TCTZF) to release the Logitech G Cloud gaming handheld supporting multiple cloud gaming services such as NVIDIA’s (NVDA) GeForce NOW and Microsoft’s (MSFT) Xbox Cloud Gaming. While no official images or specifications have been released, recent leaks suggest that the handheld could run on Android with Google Play Store, featuring a large 6,000 mAh battery, with a 6.9 inch 1080p 320 DPI display, and be based on a Qualcomm Snapdragon 720G SoC, with 4GB RAM and supporting WiFi 5. The fact that the company may choose a mid-range chipset from 2020 and only 4GB of RAM, may hint that it is confident that this hardware will allow streaming the latest games from the supported gaming cloud services, while likely keeping the price of the handheld relatively low.

Teaming up with Tencent could mean that the company mainly focuses on the Chinese, Indian, and the Southeast Asian market for this product, which makes sense, as Asia Pacific was reportedly the only geographical segment that could achieve growth also in the last quarter, and Android games are a huge market. The pricing of this device will likely determine its success, as it has to be cheap enough to justify the expense of gaming on its smartphone and be able to penetrate the market over rival devices such as Valve’s Steam Deck priced at $399 but including a much more powerful Accelerated Processing Unit (APU) with Advanced Micro Devices’ (AMD) Zen 2 CPU and RDNA 2 GPU, or Nintendo’s (OTCPK:NTDOY, OTCPK:NTDOF) Switch priced at around $300.

What’s up next for Logitech?

The computer peripherals market is forecasted to grow by $50.37B at a 7.31% Compound Annual Growth Rate (CAGR) through 2026. While some competitors such as Corsair (CRSR) and Razer are mainly focusing on the gaming business segment Logitech is targeting many secular growth drivers and can significantly profit from actual trends, like the shift from products to systems in video collaboration, as spending from companies is still increasing and there may likely be an upgrade cycle in the near term, as the demand for state-of-the-art technology is coming not only from big companies but also from SME. The company launched this year its RightSight 2 AI technology that automatically moves and focuses the camera lens on the relevant meeting participant and continues to innovate in its Rightsense technologies to deliver the easiest and most natural experience in video meetings.

Logitech recently participated in two seed investment rounds in two Swiss companies Imverse and Metaphysiks. The first is focusing on developing software for live 3D holograms and real-time 3D graphics with applications in many fields across education, entertainment, gaming, marketing and E-commerce, remote work and learning, social media, and teleconferencing. The second company is instead a pioneer in neuro-haptic skin with its MetaTouch technology that generates targeted sensations, feelings, and emotions in the brain through body stimulation. A possible application of this revolutionary technology was shown in a study where virtual legs and perceptions of floor texture were assimilated by complete paraplegic patients receiving tactile feedback.

Gartner predicts that 30% of organizations worldwide will have products and services ready for the metaverse by 2026. Logitech is not only profiting from the building of the Metaverse and its applications but will most likely be a major player in that space once that technology enters the adoption and expansion phases.

By 2026, 25% of people will spend at least one hour a day in the metaverse for work, shopping, education, social and/or entertainment.

Gartner press release February 7, 2022

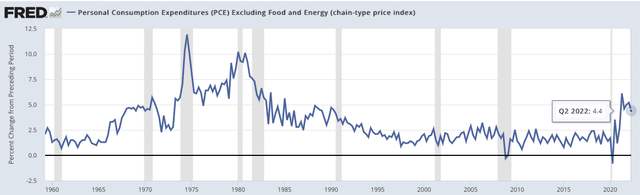

Despite a significant pullback in Q3 2021 and a recent weakening, the PCE index excluding food and energy for people living in the United States is still historically at high levels but could fall further if the economy slips into a recession. Although the gaming industry was losing steam in the last few quarters, the coming quarters are typically more robust in sales for Logitech, as consumer spending will be channeled away from traveling, towards products and services consumed at home.

Valuation

To determine the actual fair value for Logitech’s stock price, I rely on the following updated Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. The modelization is considering the recent FY 2023 outlook given by the management.

As forecasted by the Street consensus, the company is anticipated to generate 8.15% Free Cash Flow (FCF) CAGR over the coming 5 years, with substantially increased net profitability at 24.22% CAGR, while its revenue is forecasted to grow slower, at 9.51% CAGR but still at a higher pace than the computer peripherals market.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital. The perpetual growth rate has been set at an even much more conservative level.

Author

I compute my opinion in terms of likelihood of the three different scenarios, and I, therefore, consider the stock to be considerably undervalued with a weighted average price target with 87% upside potential at approximately $91. Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and likely value the company at a significantly higher price, but an acceleration of the inflation rate, increased cost of capital, or a greater deterioration of the company’s perspectives, could further reduce the fair value of the stock.

Risk discussion

The cash conversion cycle has considerably extended in the past quarter, reaching 101 days, increasing by 16 days from a quarter before, and even more than doubling on a YoY basis. Logitech has no liquidity problems, as the company is still sitting on $1.1B in cash and has no debt aside from a small position of $42M related to the capital lease, and I believe that this tendency will again balance itself in the upcoming more profitable quarters.

The high inventory levels of about $933M at the end of the last fiscal year, can further impact the company’s growth if a significant portion has to be written down or sold at a consistent discounted price, but the management seems to be quite confident in its strategy while keeping around 76% of inventory in finished goods. The CFO Nate Olmstead explained in the last earnings call, that the company is facing different product life cycles as compared to its past, with VC reporting a much steadier demand, and CEO Bracken Darrell noted that their products are much less subject to the risk of obsolescence compared to other companies in the technology industry.

Amazon (AMZN) accounted for 17% of Logitech’s gross sales in FY2022, up from respectively 13% and 14% the two years before. Two other individual customers, Ingram Micro and TD Synnex (SNX) accounted for respectively 15% and 14% of the revenue in FY2022. This sums up almost half of the sales in FY2022 generated by these three companies and indicates a relatively high customer concentration.

The Covid-19 pandemic has significantly impacted the whole industry in terms of workforce, increased air- and ship-freight costs, and supply-chain bottlenecks, causing shortages, delays, and increased pricing pressure. The ongoing war in Ukraine added inflationary pressure on rare earth and metals, and shortages of neon gas, an inevitable component in the manufacture of semiconductors. Although the company could manage some of those negative factors, extended geopolitical tensions like those building up in the South China Sea, around Taiwan, between China and the U.S., or an extended war in Europe that has a major macroeconomic impact on the most important economies in the EU, could significantly impact the company’s opportunities in the near term.

Market timing

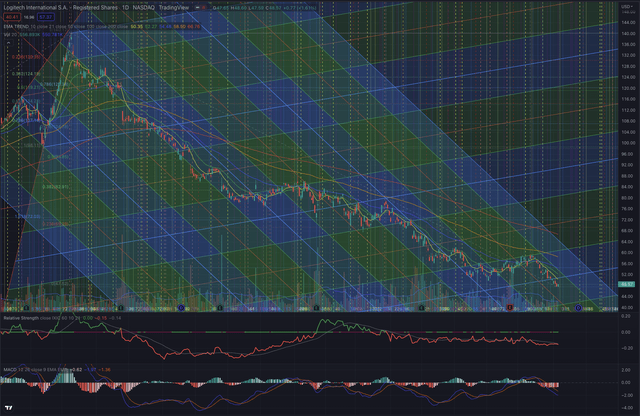

The stock reached its All-Time-High (ATH) at $140.17 on June 9, 2021, after a sustained rally since the Covid-19 pandemic low at $31.37 on March 16, 2020. The stock successively retraced 66% of its previous gains, by mostly underperforming the NASDAQ Composite, as many companies in the technology sector lost massively in value since the beginning of 2022. From a technical analysis point of view, the stock recently rebounded significantly at $71.60, close to a strong mid-term support level, by overcoming the most important short-term resistances and confirming its price level over the EMA50 and the EMA100 with increasing volume. An ideal setup for swing and momentum traders. The stock successively tested the EMA50 3 times, failing to build a lasting breakout, and is still in its long-term downtrend, way under its EMA200.

Technically the stock is not in a short-term buy situation, as the setup seems not favorable and continuous selling pressure seems to weigh on the stock. For long-term investors, this price level is instead surely interesting as my rather conservative valuation model shows significant upside potential and the stock price is back to pre-pandemic levels, while the company is in much better shape and with substantially higher sales and profitability.

Logitech can count on moderate institutional support among its shareholders with 47.10% of the outstanding shares owned by institutions, a relatively modest short interest of 6%, and about 14 days to cover. Increased interest by institutions could significantly support and improve the stock price, but for the moment, it seems that the buy-side is still weaker than the selling pressure, although the short interest has fallen from its peak in April 2022, when it reached 7.6%. The Street consensus given by 8 analysts prices the share on average at $65.20 with a buy rating, with the lowest estimation at $30.60 and the highest at $85. The Seeking Alpha Quant Rating is instead extremely bearish and qualifies the stock as a strong sell, with average D grades in terms of growth, momentum, and revisions, a B- grade in terms of Valuation, and a B+ grade for profitability. The substantial difference in the price targets given by the analysts is a sign of low visibility for properly valuing the company at this moment.

The bottom line

The company returned $121M to its shareholders through share repurchases in the last quarter, will increase the existing share buyback program by 50% to $1.5B as the total gross amount already purchased reaches $783M, and announced a proposed dividend increase by 10%, subject to approval at the upcoming annual general meeting on September 14th. When it’s true that the actual macroeconomic environment seems quite hostile for companies in the technology industry and especially those subject to consumer spending cycles, Logitech seems fundamentally significantly undervalued as the market is pondering more the short-term risks instead of the long-term opportunities.

From a short-term trading perspective, I don’t see a positive setup building right now and would wait until a sound base has formed and the stock breaks out of its downtrend and confirms its price over the EMA50. From a long-term investment perspective instead, my valuation model is showing a significant upside potential as the company seems to be massively undervalued in this depressed market environment. I therefore still value the company as a buy position, with a price target of $91 and 87% upside potential.

Be the first to comment