gorodenkoff

It is quite possible that biotechnology equities have already bottomed. In May and June, several biotechs reached prices at or around their 2020 pandemic lows. Since then, many have been breaking out, and the industry is substantially outperforming the broader market. The SPDR S&P Biotech ETF (NYSEARCA:XBI) appears to be a reasonable way to broadly allocate into the industry here.

A growing number of equities appear to be round tripping their strong performances in 2020 and 2021. This is a continuing phenomenon. Biotech companies were among the strongest performers and 2020, and also one of the earliest industries to peak. In the case of XBI, it peaked in early 2021, and subsequently spent the next 5-6 quarters in a sustained decline. It seems that decline stopped in Q2 of 2022.

XBI monthly candlestick chart (Finviz)

Over the last few weeks, biotech companies have made an impressive move off of their bottom. XBI appears as though it is likely to retest the $90s in the near term.

XBI weekly candlestick chart (Finviz)

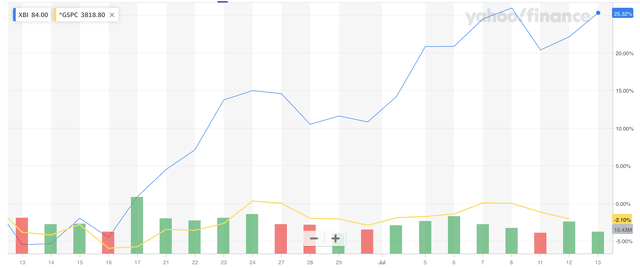

This has been a strong relative move versus the broader market. Over the last month, XBI is up around 25 percent, while the broader market is down around two percent. Further, the vast majority of days were positive. So far in July, XBI only had one red trading day.

XBI versus the S&P 500 (Yahoo! Finance)

I believe the biotech industry became substantially undervalued last quarter, and that this is just the start of a new season of outperformance. Beyond mere valuation, it appears likely that larger pharmaceutical companies will show up and acquire small prospective companies, as well as their technology.

There has already been a start to such M&A activity. For example, in June, Bristol Myers Squibb (BMY) recently announced that it would acquire Turning Point Therapeutics (NASDAQ: TPTX), a precision oncology company, for $76 per share. Similarly, in May, Pfizer (PFE) agreed to acquire Biohaven (BHVN), maker of the migraine drug Nurtec, for $148.50 per share. Also in May, GSK (GSK) agreed to acquire Affinivax, a clinical-stage biopharmaceutical company, for a $2.1 billion upfront payment and up to $1.2 billion in potential development milestones.

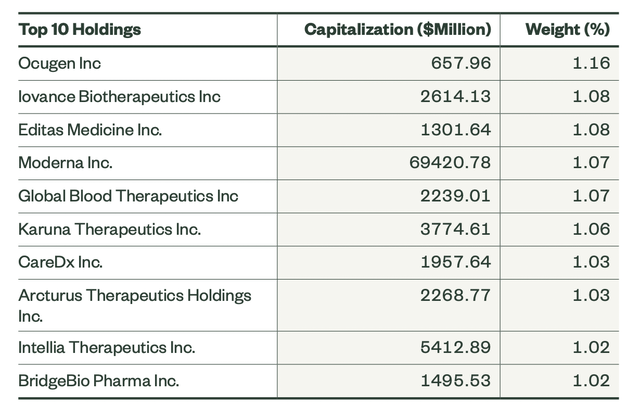

XBI is a modified equal weighted ETF with about 157 holdings, though that number may change due to issues such as being acquired, among others. No company usually makes up more than two percent of the fund. Below are the current top 10 holdings.

XBI top 10 holdings (State Street XBI fact sheet)

XBI’s equal weighting makes it less susceptible to individual equity movements, whether to the upside or downside. Also, not being market weighted makes the fund considerably less correlated to the broader market, as well as the broader pharmaceutical industry and health care sector.

Conclusion

I believe XBI’s recent momentum is likely to continue through this quarter, and possibly continue for an extended duration. It appears as though there may be some resistance at around $90 per share, but also that there is strong support in the low $80s and high $70s.

XBI has substantially outperformed the broader market over the last month. The ETF appeared to reach a capitulatory bottom last quarter, when it touched low valuations it last realized in the spring of 2020. Since making that apparent bottom, XBI’s strength is a sign of investor accumulation, as well as the heating up of M&A activity within the industry. I expect that both the trends of increased biotech pricing and increased acquisition activity are likely to continue in the near term.

Be the first to comment