Nastassia Samal/iStock via Getty Images

By Karen Veraa

As widely anticipated, the Federal Reserve raised the Fed Funds rate by 0.25% to 0.25%-0.50% during the March Federal Open Market Committee (FOMC) meeting, its first interest rate hike since December 2018. The Federal Reserve has a dual mandate; keeping prices stable (i.e. managing inflation) and keeping the economy running at full employment. The central bank increased the Fed Funds rate to try and stay consistent with these goals:

- Stable inflation: Higher interest rates have historically helped curb high inflation.

- Full employment: Many jobs have been created as the economy continues to recover from the impacts of the global pandemic, affording the Fed leeway to raise interest rates to a level they believe won’t hurt economic activity and job creation.

In addition to the Fed Funds rate increasing, longer-term rates have increased as the market anticipates the path of future rate hikes. Interest rate increases can have a significant impact on bond investments, since bond prices fall when interest rates rise. However, bonds play a crucial role in portfolios as potential diversifiers and income generators.

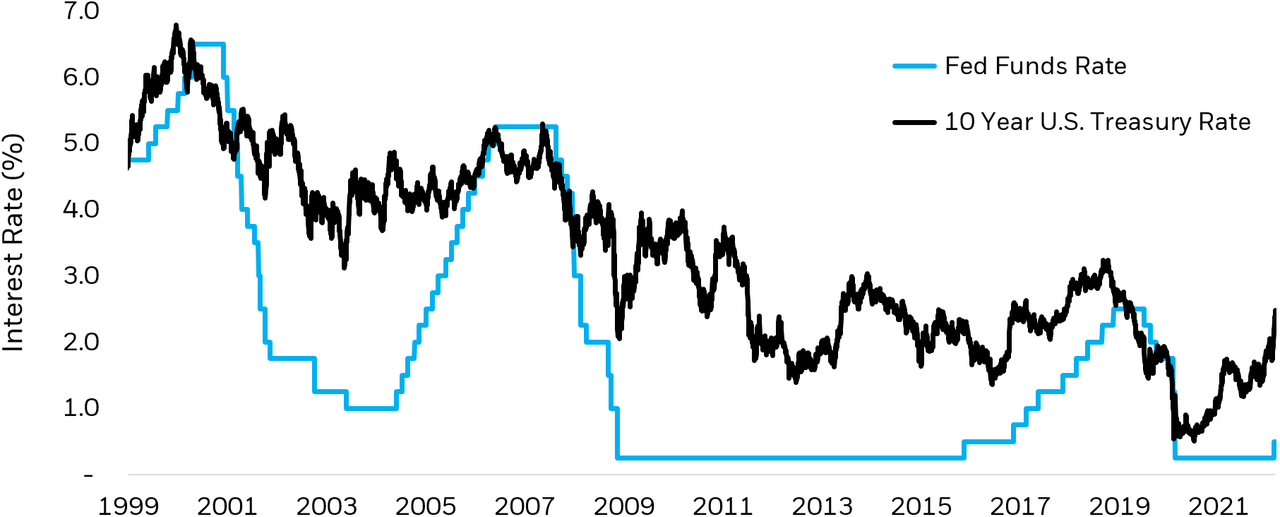

Fed funds rate vs 10-year U.S. Treasury rate

Bloomberg. As of 03/25/2022. The 10-Year Treasury index is represented by the Bloomberg 10-20 Yr U.S. Treasury Index. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bond ETFs are a low-cost way to help mitigate interest rate risk in your portfolio. Investors may want to consider the ETFs listed below to hedge against rising interest rates and complement or replace existing bond holdings.

Interest Rate Hedged ETFs: iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH) and iShares Interest Rate Hedged High Yield Bond ETF (HYGH) provide a cost effective way to seek to mitigate interest rate risk through a fund of funds structure that utilizes interest rate swaps, which reduce exposure to interest rate risk while maintaining credit exposure.

Floating Rate Note ETFs: iShares Floating Rate Bond ETF (FLOT) and iShares Treasury Floating Rate Bond ETF (TFLO) provide exposure to U.S. floating rate bonds and U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates. The floating rate notes in FLOT and TFLO tend to have lower duration than fixed securities due to the frequent interest rate resets.

Short Maturity Fixed Rate ETFs: iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) and iShares Core 1-5 Year USD Bond ETF (ISTB) hold fixed rate bonds with 1-5 years to maturity profiles, which currently provides reduced duration relative to broader maturity indices. IGSB invests in short-term U.S. investment grade corporate bonds, while ISTB invests in multi-sector short-term core bonds. In addition to taxable fixed income, investors can also seek to shorten duration of municipal bond portfolios with iShares Short-Term National Municipal Bond ETF (SUB) and BlackRock Short Maturity Municipal Bond ETF (MEAR).

Rising rates can weigh on bond returns. By allocating to interest rate hedging, floating rate, and shorter duration exposures, investors can help insulate their bond investments against rising rates.

© 2022 BlackRock, Inc. All rights reserved.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

There is no guarantee that interest rate risk will be reduced or eliminated within the Fund.

The Fund’s use of derivatives may reduce the Fund’s returns and/or increase volatility and subject the Fund to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. The Fund could suffer losses related to its derivative positions because of a possible lack of liquidity in the secondary market and as a result of unanticipated market movements, which losses are potentially unlimited. There can be no assurance that the Fund’s hedging transactions will be effective.

Investment in a fund of funds is subject to the risks and expenses of the underlying funds.

There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to federal or state income taxes or the Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable.

Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund’s income may decline when interest rates fall because most of the debt instruments held by the Fund will have floating or variable rates.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

Buying and selling shares of ETFs may result in brokerage commissions.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0322U/S-2101304

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment