Xiaolu Chu

Reiterating our most recent coverage analyzing Tesla’s valuation from an economic perspective, the Tesla stock (NASDAQ:TSLA) remains far from its year-to-date lows observed in the May-June period, reflecting its continued resilience against the broader market selloff which has gained pace in recent weeks amid worsening market jitters on elevated recession risks. The stock, though having suffered losses of more than 20% this year, continues to outperform the broader market, etching out gains of close to 17% in the three months through September while key benchmarks including the S&P 500 and Nasdaq 100 proceeded towards their third consecutive quarter of losses for the first time since 2019, nearing a two-year low. Even stocks that had started off the year alongside Tesla with lofty valuations supported by robust fundamentals – including names like Nvidia (NVDA) which led its peer group’s prices by wide margins, as well as the FAANG cohort (ex-Apple AAPL) – have rapidly succumbed to market turmoil in recent months.

But with no immediate catalysts to help lift the markets, and a potential injection of further complexity to mounting macro uncertainties in the near term, Tesla’s third quarter delivery miss could very well be that first hint of weakness to finally chip away at the stock’s lofty valuation. Paired with an anticipation for near-term margin reduction stemming from early-stage production ramp-up costs at new facilities, as well as rising input costs related to logistics, labour, and raw materials, Tesla is likely proceeding towards our earlier expectations that the spread between its returns and costs that has largely supported its valuation premium thus far is facing imminent erosion. While Tesla remains one of the few names within its peer group and the broader market that has yet to buckle amid rapidly contracting valuation multiples this year, the lack of catalysts within the immediate term foreshadows that the stock’s resilience might not be able to hold much longer.

Understanding Tesla’s 3Q22 Delivery Miss

Tesla produced 365,923 vehicles (+54% y/y; +42% q/q) in the third quarter and delivered 343,830 vehicles (+42% y/y; +35% q/q) worldwide over the same period. The results beat consensus estimates on productions of 359,853 vehicles by close to 2%, but fell shy of estimates on deliveries of 357,938 vehicles by almost 4%.

The outperformance demonstrated on the productions front continues to underscore Tesla’s manufacturing prowess while industry peers continue to reel from the fluid situation over protracted supply chain constraints – especially considering its most efficient factory, Giga Shanghai, was intermittently out of commission over the July-August period for pre-scheduled upgrades. The results also marked Tesla’s third consecutive quarter this year to have delivered less than it produce, implying a gradual build-up of backlogged inventory due to the failure of logistics capacity to catch up to Tesla’s rate of supply and consumer demand. Specifically, Tesla pointed to the shift in its logistics strategy for its third quarter delivery miss, citing “an increase in cars in transit at the end of the quarter” as opposed to historical trends of “skewed deliveries” near period end:

Historically, our delivery volumes have skewed towards the end of each quarter due to regional batch building of cars. As our production volumes continue to grow, it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks. In Q3, we began transitioning to a more even regional mix of vehicle builds each week, which led to an increase in cars in transit at the end of the quarter. These cars have been ordered and will be delivered to customers upon arrival at their destination.

Source: Tesla 3Q22 Vehicle Production and Deliveries Press Release

The latest development brings to light that while Tesla continues to outperform peers on securing sufficient raw materials and labour to boost vehicle volumes rolling off its production lines, getting the units into the hands of customers remain a challenge. The allusion to elevated costs during “peak logistics weeks” also corroborates our thesis that the stellar cost-returns spread buoying Tesla’s valuation premium is starting to give amid rising inflationary pressures stemming from protracted supply chain bottlenecks.

Yet, pricing gains are expected to alleviate some of the anticipated margin pressures ahead for Tesla. Recall that production volumes remain a function of supply availability across the auto industry this year. And the same goes for Tesla, as demand continues to outpace supply by wide margins – even after multiple price hikes this year. As such, the company’s production target of 1.5 million vehicles this year as guided by CEO Elon Musk during Tesla’s first quarter earnings call is critical to safeguarding its generous auto sales (ex-credit sales) margins.

Having produced 929,910 vehicles and delivered 908,573 vehicles on a year-to-date basis, Tesla is still about 570,000 vehicles out from the annual volume target of 1.5 million vehicles. This implies a weekly production run-rate of about 43,400 vehicles in the three months through December, which compares to its third quarter weekly production run-rate of about 27,820 vehicles.

Although the endeavour appears a far stretch, it is not entirely out of reach considering the added capacity in Giga Shanghai that would increase Model Y productions to 14,000 units per week and Model 3 productions to 7,700 units a week. Continued production ramp-up at Giga Berlin and Giga Texas is also expected to place a favourable impact on fourth quarter volumes – during the second quarter earnings call, Tesla disclosed that Giga Texas has reached a weekly production run-rate of 1,000 vehicles, while Giga Berlin has recently reached the 2,000-vehicle-per-week milestone. The ability to produce 1.5 million vehicles by the end of the year is further corroborated by consensus estimates that Tesla can produce more than 158,000 vehicles on a monthly basis based on the record volume catch-up observed in June, though the guidance leaves little room for error, such as sporadic COVID disruptions to operations on the production line.

The problem now turns back to whether these numbers can be converted into deliveries, and accordingly, revenues. And this is the critical link that is now at risk, considering the logistics impact experienced during the third quarter. Achieving productions of 1.5 million vehicles does not help maintaining reported margins much unless it hits the income statement, which GAAP-based accounting requires delivery for.

So What’s the Problem?

As mentioned in the earlier section, Tesla’s valuation remains elevated relative to its peers as well as the broader market, and we suspect it will get an imminent downward adjustment as market-wide valuation corrections persist in response to tightening macro conditions. Tesla’s third quarter delivery risk could be the first hint of weakness to break the stock, as it implies challenges to the company’s logistics capabilities, the critical last leg that bridges productions to pricing gains needed for compensating near-term inflationary impacts on profit margins. The delivery miss also comes at a time when market jitters are gaining momentum in response to the Fed’s unwavering commitment to an aggressive monetary policy tightening agenda for reining-in inflation, which amps up the likelihood for more market pains within the foreseeable future.

The robust investment demand observed for Tesla from funds – which we had previously pointed to as a potential risk to our near-term short thesis on the stock – is likely also starting to see early signs of retreat. In our most recent macro analysis, trillions of dollars worth of pensions are likely at risk as related funds look to liquidate massive positions in high growth products like equities to cover collateral on their liability-driven investments as interest rates continue to surge, adding further complexity to the dire market outlook in the near-term.

Looking ahead, the key near-term watch will be on whether Tesla’s industry-leading margins are sustainable amid protracted industry challenges – and we think the picture is looking increasingly grim. On one hand, in addition to heightened input costs, we know production costs will be slightly elevated in the third and current quarters considering early-stage ramp-up at Giga Berlin and Giga Texas, as well as early-stage production-line testing and ramp-up at Giga Shanghai following its expansion. And on the other hand, Tesla is also grappling with slowed conversion of produced volumes into revenues due to logistic bottlenecks, adding further pressure on margins that should have been helped by pricing gains, especially with continued record-breaking output volumes on the more profitable Model 3/Y vehicles.

What is the Implication on Tesla’s Near-Term Valuation?

There are few to no immediate cases that will support a sustained uptrend for the stock in the near term despite Tesla’s industry-leading fundamental performance still due to the lack of immediate catalysts big enough to overcome faltering economic conditions and waning market sentiment.

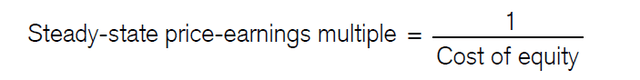

Circling back to our previous analysis, which bridges Tesla’s lofty valuation today with economics, we have attempted to derive the stock’s steady-state valuation to gauge the extent of its potential downward adjustment in response to the near-term macro challenges. Recall that the steady-state value represents the value of the firm when “NOPAT (net operating profit after tax) is sustainable indefinitely and incremental investments will neither add, nor subtract, value”. The steady-state value can be derived by multiple methods, and one of which is the “steady-stated P/E multiple”, which is denoted by 1 divided by cost of equity:

Steady-State P/E Multiple Computation (Credit Suisse)

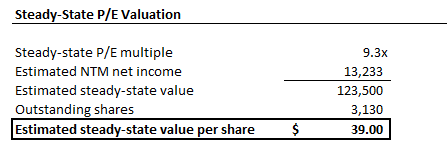

Drawing on our most recent fundamental and valuation analysis performed on the Tesla stock, adjusted for its actual third quarter delivery results, as well as the near-term macro impacts to returns on capital and costs of capital, we have determined a steady-state P/E multiple of 9x based on the company’s estimated cost of equity of about 11%. This forward P/E multiple would draw Tesla’s lofty valuation closer to those currently observed across the legacy auto OEM peer group, which counts Ford (F) and GM (GM) as key constituents. Under this scenario, by applying a 9x forward P/E multiple to Tesla’s forecast net income of about $13 billion over the next 12 months, the stock would yield an estimated steady-state value of $39 apiece. But given Tesla’s premium to peers in terms of manufacturing efficiency and industry-leading margins, which should not be discounted, we view this as an extreme bear case that likely will not materialize even in the face of near-term macro headwinds.

Tesla Steady-State P/E Valuation (Author)

Now, to better reflect where Tesla would be if its valuation was to be brought back down to earth, we turn to the Gordon Growth model, which we had discussed in our previous analysis as another typical representation used in determining a firm’s steady-state value. In the Gordon Growth model, we have applied a 3.8% perpetual growth rate, which is consistent with the blended long-term economic growth expected across Tesla’s core operating regions, including the U.S., Europe, and China. Recall the relationship between the estimated perpetual growth rate used in the Gordon Growth model and forecast GDP:

The perpetual growth rate is typically determined by using GDP as a key benchmark, adjusted for maturity of the industry as well as other company-specific factors such as market leadership and/or market share. Companies operating in industries that are higher growth in nature are typically valued at a perpetual growth rate closer to or more than GDP, given their greater contributions to economic growth.

Source: “Shorting Tesla: Bridging the Lofty Valuation to Economics“

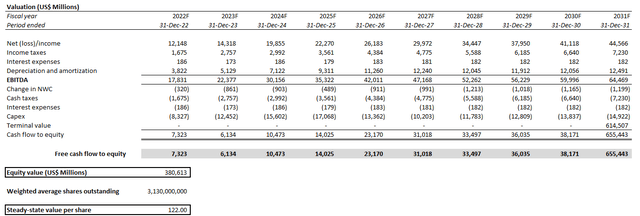

Applying a 3.8% perpetual growth rate in the Gordon Growth model results in a forecast terminal value of $614.5 billion for Tesla. Plopping this back into our discounted cash flow valuation analysis, which draws on our most recent fundamental forecast for the company, adjusted for actual third quarter deliveries as well as near-term macro impacts on Tesla’s margins and capital costs, the steady-state value for the stock is estimated at $122 apiece.

Tesla Steady-State Valuation (Author)

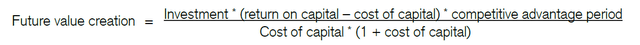

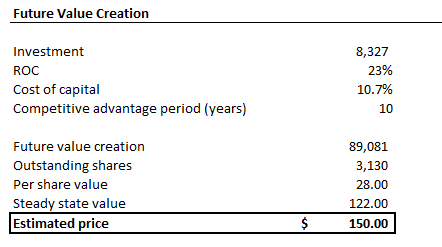

And now, we turn to computing the estimated future value creation leg of Tesla’s valuation – i.e. its projected valuation premium that takes into consideration the spread between its return on capital and cost of capital, as well as its anticipated competitive advantage period within the burgeoning EV industry:

Future Value Creation Computation (Credit Suisse)

Note that we predict Tesla’s cost-return spread to narrow amid contracting economic conditions, not collapse entirely to zero or enter a negative zone, considering demand still well exceeds supply and its margin profile remains positive with a generous buffer even if it slims in the near-term due to the inflationary environment. The key inputs we have used in determining the future value creation leg of Tesla’s valuation is as follows:

- Investment: approximately $8.3 billion, consistent with the historical capex spend as a percentage of revenue, as well as Tesla’s forward growth initiatives (e.g. continued production ramp-up at new and existing facilities; ongoing Supercharger build-out; etc.)

- Return on capital: 20%-range derived based on LTM net income and Tesla’s capital structure

- Cost of capital: 11%, consistent with Tesla’s capital structure and risk profile

- Competitive advantage period: forecast at 10 years, consistent with the discrete forecast period in our valuation and fundamental analysis previously performed

The computation yields a future value creation premium of about $28 apiece for Tesla. Adding that back to the projected steady-state value of about $122 apiece computed in the earlier section, Tesla’s valuation could potentially be downward adjusted to as much as $150 as near-term macro headwinds start to erode the stock’s resilience observed in 1H22. Based on the stock’s last traded share price of $265.25 on September 30, it is looking at a potential downward adjustment of as much as 43% over coming months in a reasonable bear case that takes into account the near-term macro headwinds outside of Tesla’s immediate control.

Tesla Future Value Creation Premium (Author)

Tesla_-_Forecasted_Financial_Information.pdf

Risks to the Bear Thesis

As discussed in our previous coverage, our bear thesis against Tesla is primarily reflective of the anticipated impact of near-term macroeconomic weakness, which we believe has not been appropriately priced into the stock yet considering its elevated valuation premium still. While Tesla’s long-term outlook remains favourable in many aspects (e.g. market leadership; competitive advantage in procuring long-term supplies; high growth, high margins; etc.) when compared to industry peers, we believe its valuation will be subject to an imminent downward adjustment in the near-term due to softening market dynamics. Yet, the near-term short thesis is not without risks, especially considering Tesla’s lofty valuation that has been admittedly hard to grasp for many.

As mentioned in the earlier section, while our preceding analysis had identified two risks to the near-term short thesis on Tesla – namely, 1) expectations for returns-generating growth, and 2) robust investment demand – the latter pertaining to funds-driven investment demand has likely weakened in recent days. Referencing our latest macro analysis on what has been unraveling at pension funds in recent weeks:

As the U.S. economy unravelled this year amid aggressive rate hikes, surging inflation, and looming recession risks, the country’s corporate pension plans – similar to those in the UK – are also facing margin calls. The portfolio of pension funds, worth more than $1.8 trillion in the U.S., is reported to have “posted tens of millions of dollars in collateral over the course of this year as bond prices fell”.

And with more aggressive rate hikes on the Fed’s agenda in the near term until there is concrete evidence that the peak of inflation is well behind us, trillions of dollars’ worth of Americans’ retirement plans are at risk, adding further complexity to the market turmoil ahead.

Source: “Lehman 2.0 Has The Fed Cornered: Equities Are At Risk“

In summary, pension funds have been reeling across major economies over past weeks due to its heavy exposure to liability-driven investments (“LDI”) that are prone to value erosion upon surging interest rates. As a result, related funds have had to liquidate positions in high growth assets – such as equities like the Tesla stock, which has benefited meaningfully from funds-driven demand – to post collateral on their LDIs. As such, we believe funds-driven demand will continue to weaken, relative to support shown in 1H22 which has likely contributed to the resilience of Tesla’s market valuation.

Now, addressing the initial risk to our short thesis – namely, that Tesla’s growth remains “virtuous” by generating positive returns on related investments – remains largely possible. As discussed in the earlier section, if Tesla’s profit margins remain on track for continued recovery from the low-to-mid-20% range during 1H22 due to new facility ramp-up costs, back to the high-20% range in 2H22, it could very well compensate for the anticipated macro-driven cost-returns erosion that we point to as the core support of our near-term short thesis on the stock.

The Beginning of Tesla’s Delayed Retreat

Although Tesla’s production numbers remain robust, the delivery miss – which Tesla has punted to strategic adjustments to its logistics – could mark the first shortfall of more to come amid mounting economic uncertainties. Lower delivery volumes mean less revenue recorded in the quarter to absorb anticipated cost increases stemming from inflation and/or early-stage ramp-up costs across Tesla’s production facilities worldwide.

If Tesla’s auto sales (ex-credit sales) gross margin retreats beyond current consensus estimates in the high 20%-range, the stock becomes one step closer to having its valuation sent next on the chopping block. Yet, if the figure meets consensus expectations, then the stock will potentially get another lifeline, though a downward correction is imminent given broader market risks at hand that are beyond Tesla’s control, such as the potential unravelling of funds that have played a substantial role in sustaining demand for the EV titan’s shares.

Although Tesla remains one of the best in automaking history in terms of growth and manufacturing efficiency, which has aided its industry-leading fundamental performance, the lofty premium that has been rewarded to the stock is now likely at risk of a downward adjustment, as it faces fierce macro headwinds and external challenges in the near-term that are beyond its control. While we remain optimistic that Tesla will make a favourable long-term investment given its industry leadership, we await better entry opportunities over coming months as markets respond to further macro tightening, which will likely bring substantial volatility to the stock.

Be the first to comment